Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 08, 2025

Global PMI slips from 14-month high despite improved future growth expectations

The worldwide PMI surveys - produced by S&P Global in association with IFPSM for J.P.Morgan - signalled a slowing of business activity growth for the first time in five months in September. However, growth remained only modestly below the pre-pandemic trend rate.

The US regained its lead among the major developed economies in terms of output growth, and India once again led the emerging markets. But only the eurozone and mainland China reported faster growth rates among the major economies in September. Downturns meanwhile deepened in Canada, Brazil and Russia, while the UK came close to stalling.

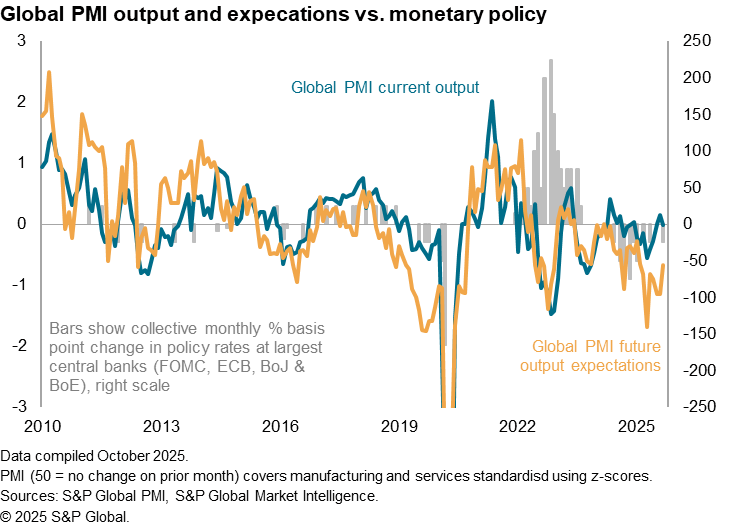

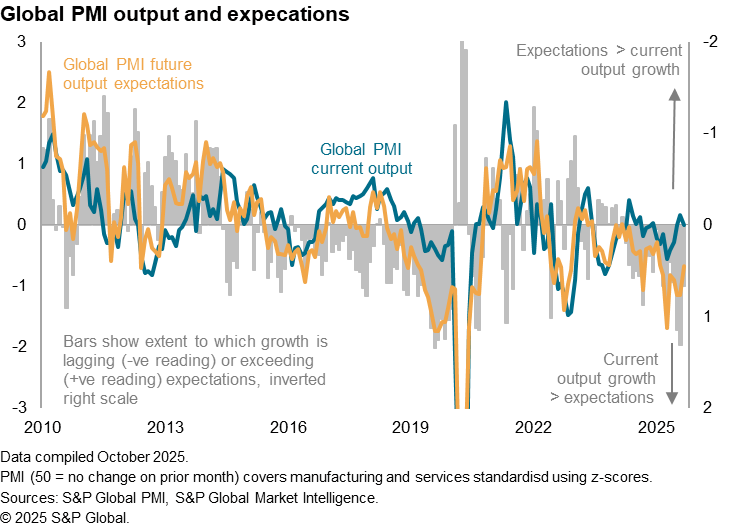

Future optimism meanwhile rose globally to a seven-month high, buoyed in part by a lower of interest rates by the US Federal Reserve and reduced concerns over global tariffs. Nevertheless, sentiment remains weak by historical standards, and the degree to which current output growth is running ahead of expectations poses downside risks to the growth outlook, hinting that the cooling of growth in September could represent a fading of temporary factors that supported the global economy over the summer.

Global PMI falls for first time in five months

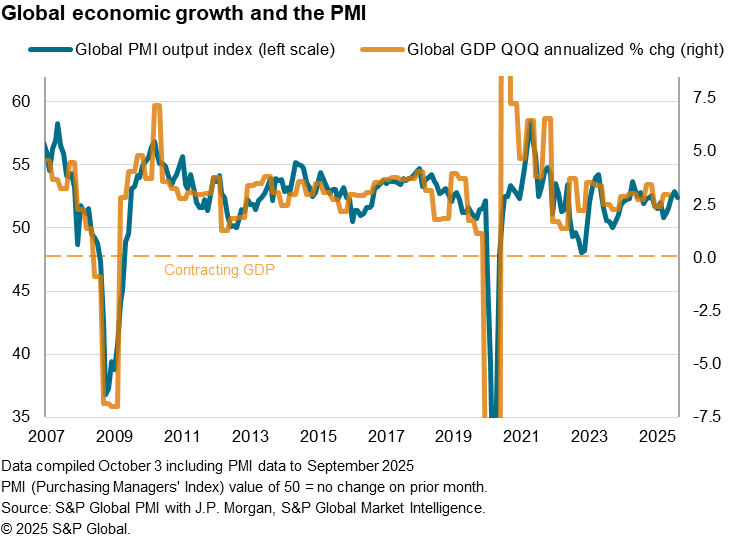

S&P Global Market Intelligence's PMI surveys indicated that worldwide business activity slowed for the first time in five months during September, though remained close to the survey's long-run trend. The J.P. Morgan Global Composite PMI Output Index, covering manufacturing and services in over 40 economies, fell from 52.9 in August to a three-month low of 52.4.

Despite the decline, the still-elevated level of the PMI rounded off the strongest calendar quarter since the second quarter of 2024. Historical comparisons indicate that the PMI is broadly consistent with the global economy growing at an annualized rate of 2.7% in September and 2.8% for the third quarter as a whole. This compares with the average GDP growth rate (3.1%) seen in the decade prior to the pandemic.

The survey data therefore suggest that growth has improved markedly compared to the low seen in April but has lost a little momentum in September.

Eurozone bucks developed market slowdown

Regionally, growth slowed across the major developed economies in September with the notable exception of the eurozone. Although reporting only weak growth still, the latter recorded its best performance for 16 months, thanks to a modest uptick in services growth and a sustained, albeit slower, recovery of its manufacturing economy. A strong upturn in Spain was accompanied by a burgeoning recovery in Germany and modest growth in Italy, though France acted as an increased drag on the eurozone in part due to heightened political instability.

The US meanwhile overtook Australia to regain its top spot among the biggest developed economies, regaining the lead it has enjoyed over much of the past year and a half. However, while both US manufacturers and service providers reported higher output, growth slowed in both cases to push the overall rate of expansion down to a three-month low.

Growth also cooled to a three-month low in Australia, reflecting weaker growth of both manufacturing and services, while a drop in manufacturing output offset robust services growth to pull Japan's overall growth to its lowest since May.

UK growth slumped, coming close to stalling, as a deepening factory downturn accompanied only sluggish services growth, but only Canada reported lower output, for a tenth straight month, with its downturn accelerating again to the steepest since June.

Mainland China bucks weaker emerging market picture

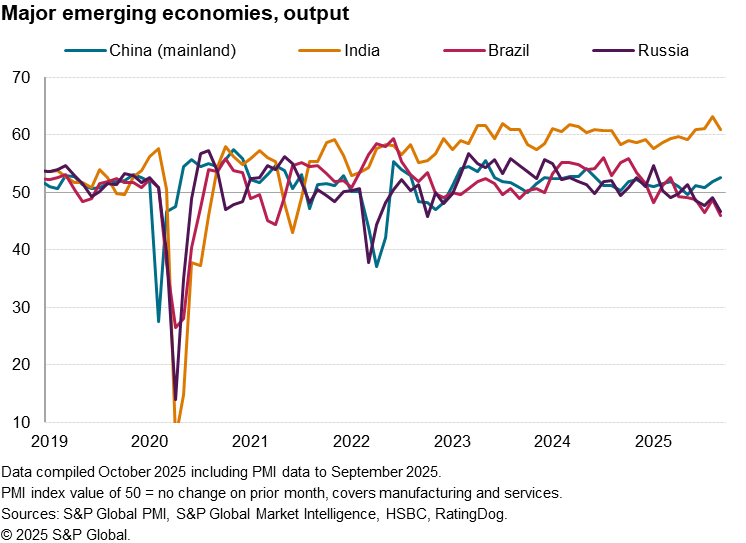

Looking at the four major emerging markets, India's lead narrowed as mainland China reported faster growth in September.

Output rose in mainland China at a rate not seen since June 2024, its recovery continuing to build from the brief decline reported back in May. Manufacturers reported the largest output gains for three months, while service sector companies reported the second-largest rise in activity for 16 months.

India nonetheless continued to outperform by a wide margin, despite growth slipping from August's 17-year high to a three-month low thanks to weaker expansions of output in both manufacturing and services.

In contrast, further signs of economic stress were again seen in both Russia and Brazil. Output in Brazil fell for a sixth successive month, dropping at the sharpest rate since April 2021 amid steepening falls in both goods and services. Barring the COVID-19 period, Brazil's decline was the steepest since January 2017.

Russia's decline was the sharpest for nearly three years as a steepening rate of loss of manufacturing production was joined by a renewed downturn in the service economy.

Lower US interest rates and reduced tariff worries help lift global business confidence

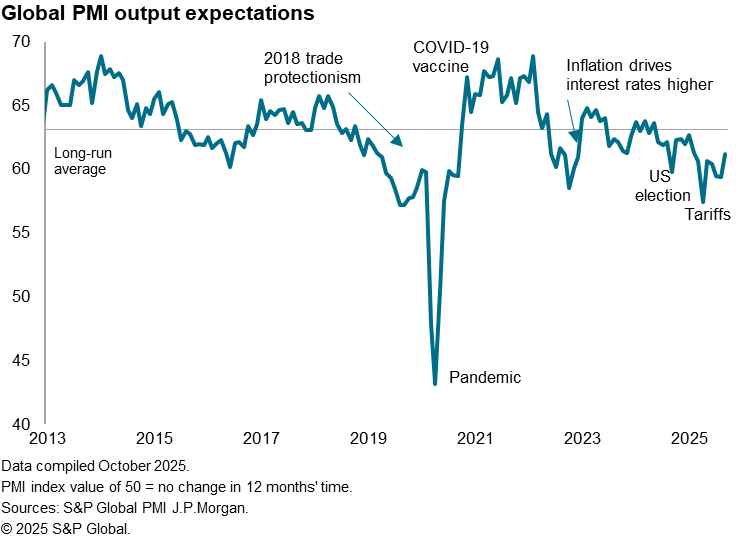

While business expectations about the year ahead recovered some ground in September, rising to the highest since February, expectations remained well below the long-run average. This primarily reflected ongoing widespread economic and political uncertainty, though such concerns have eased markedly compared to the situation seen back in April, when pessimism peaked in response to US tariff announcements.

Looking at how confidence has changed around the world, it is useful to analyse the PMI's future output index values relative to the respective long-run averages. This helps standardise business confidence between countries, as some economies typically see sentiment run higher than others, likely reflecting cultural divergences as well as stages of economic development.

These comparisons show that a lowering of US interest rates in September is reported to have helped lift optimism. Hence, among the major developed economies, business expectations rose especially sharply in the US in September.

However, sentiment about the year ahead also improved in mainland China, Japan, India, Canada and the eurozone, partly reflecting reduced concerns over the impact of US tariffs but slipped lower in the UK, Australia and Brazil. However, only in India and Russia is business confidence running above its long-run average.

Sentiment drag eases

Although business expectations about output in the year ahead rose globally to the highest for seven months, the fact it remained below its long run average is a concern in respect to posing downside risk to the growth outlook. In particular, current output growth is running well above levels that would normally be consistent with this degree of business optimism. This suggests that at least some of the recent upturn in growth has been based on temporary factors which companies assume will subside. These might include the front-running of tariffs and temporary lift to spending over the summer amid an uplift to asset - notably equity - prices (see our Global sector PMI commentary note, which highlights how the upturn has been driven primarily by tech and financial services).

The degree to which current output growth is exceeding expectations has in fact been among the highest recorded by the survey in recent months, albeit moderating in September largely on the back of a lowering of US interest rates. This gap will be therefore important to monitor in the coming months to assess the sustainability of economic growth.

Access the Global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-slips-from-14month-high-improved-future-Oct25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-slips-from-14month-high-improved-future-Oct25.html&text=Global+PMI+slips+from+14-month+high+despite+improved+future+growth+expectations+++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-slips-from-14month-high-improved-future-Oct25.html","enabled":true},{"name":"email","url":"?subject=Global PMI slips from 14-month high despite improved future growth expectations | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-slips-from-14month-high-improved-future-Oct25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+slips+from+14-month+high+despite+improved+future+growth+expectations+++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-slips-from-14month-high-improved-future-Oct25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}