Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 08, 2025

Global PMI signals robust expansion in November but confidence and hiring remain subdued

The worldwide PMI surveys signalled a sustained and robust upturn of worldwide business activity in November.

The US continued to lead the major developed economies, but faster output growth in the eurozone, Japan and Australia helped close the gap, contrasting with a steep decline in Canada and a near-stalling of growth in the UK.

While India continued to lead the emerging markets, its growth rate slowed alongside a weakened performance in mainland China.

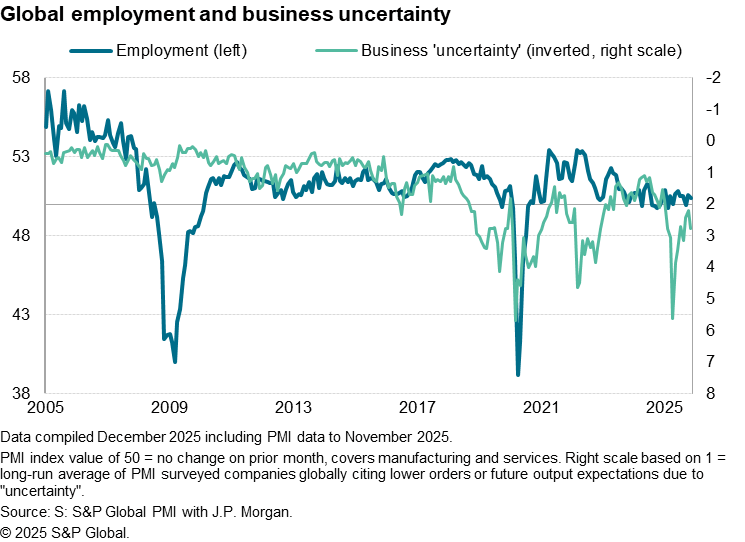

However, while current growth has returned to trend in recent months, business confidence with respect to future output remained very low, reflecting elevated levels of economic and political uncertainty. This low confidence meant global employment growth also remained subdued.

Solid fourth quarter global expansion

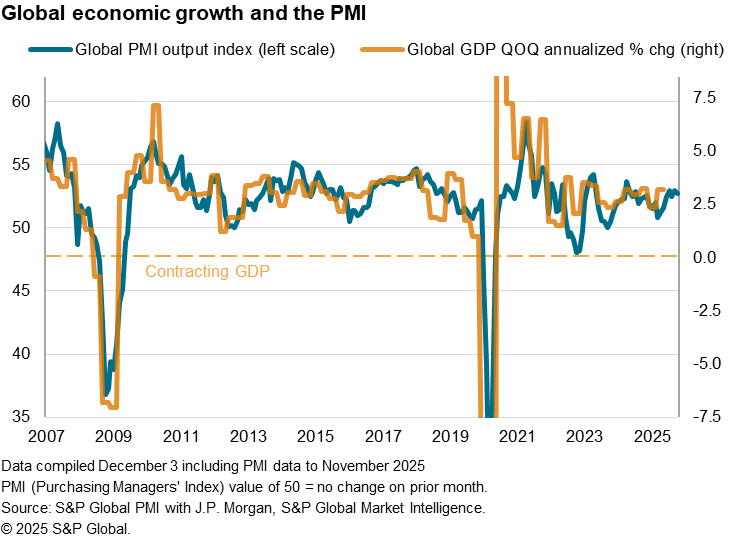

A further robust expansion of the global economy was indicated by S&P Global Market Intelligence's PMI surveys in November.

The J.P. Morgan Global Composite PMI Output Index, covering manufacturing and services in over 40 economies, edged down from 53.0 in October to 52.7, but still registered the third-strongest monthly expansion seen over the past 15 months.

Historical comparisons indicate that the latest PMI is broadly consistent with global GDP growing at an annualized rate of 3.0% so far in the fourth quarter. This compares with an average GDP growth rate of 3.1% seen in the decade prior to the pandemic.

The survey data therefore suggest that global economic growth has proved not just resilient but also robust in recent months, recovering well from the near-1½ year low seen back in April, when activity slowed in response to US tariff uncertainty, reviving back to a pace close to its long-term trend.

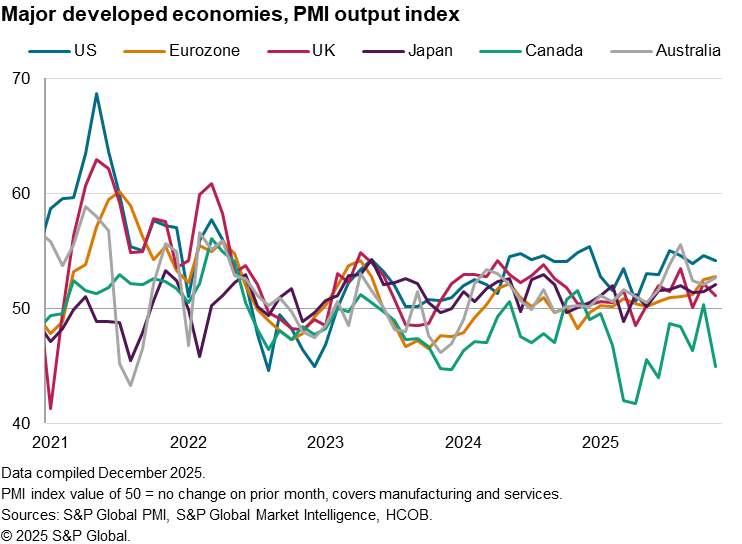

US leads developed world economic growth but eurozone and Japan close the gap

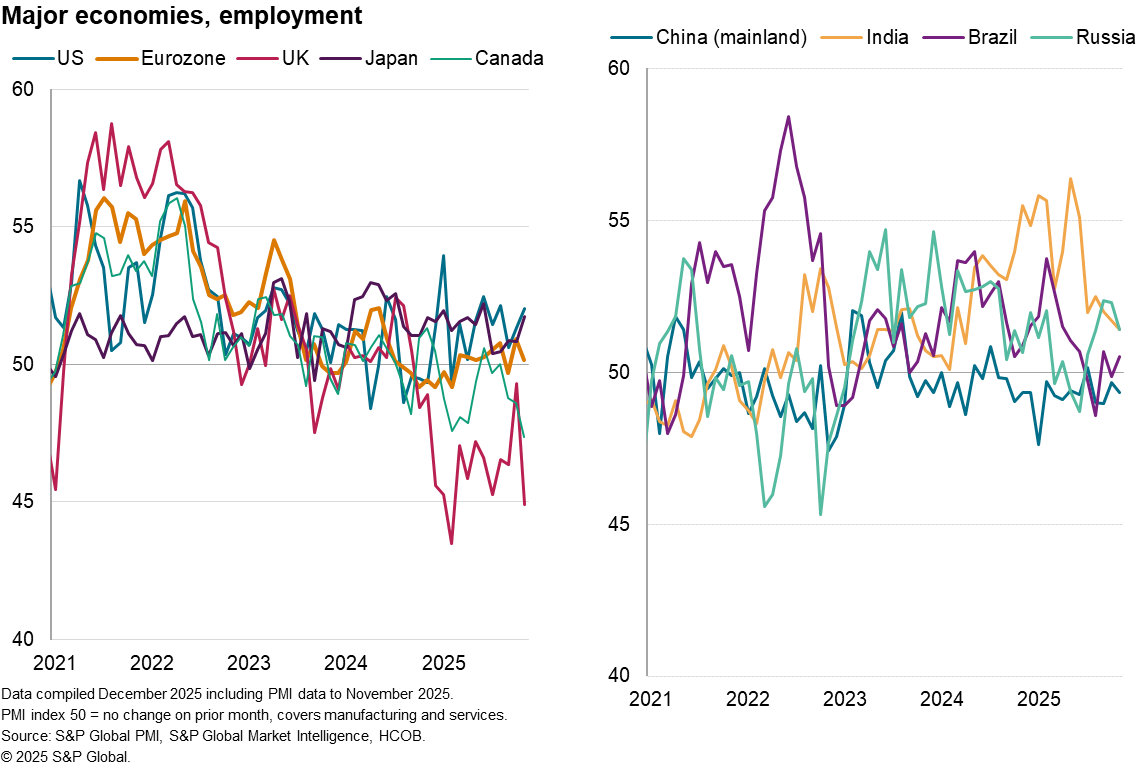

Growth across the developed economies continued to be led by the United States, despite its expansion cooling to register the second-weakest growth since June. A softer service sector upturn offset faster manufacturing growth.

The US expansion contrasted with a marked downturn in Canadian business activity, which slumped again after briefly stabilizing in October. An especially marked drop in services output was reported alongside a modest reduction in factory output.

Growth also slowed in the UK to register only a very mild pace of expansion. A meagre increase in services activity was accompanied by a near-stalled goods-producing sector. Construction output meanwhile fell rapidly.

In contrast, eurozone growth accelerated to the fastest since May 2023 as an improved service sector performance outweighed a near-stalling of manufacturing. Spain remained the region's star performer, though improved expansions were seen in both Germany and Italy, and France returned to growth for the first time since August 2024.

Australia's growth also ticked higher, albeit remaining below the highs seen mid-year, sustaining the longest growth spell seen over the past four years.

Growth in Japan likewise picked up pace, reaching the joint-highest for more than a year as a robust service sector performance was joined by a near-steadying of the manufacturing economy.

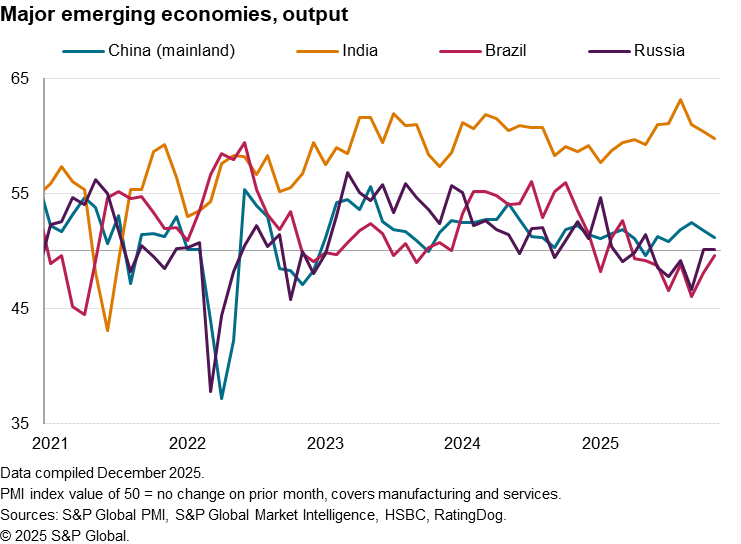

India leads emerging markets as growth slows in mainland China

While India again led the four 'BRIC' economies in terms of growth across both goods and services, its rate of expansion slowed to a six-month low. However, although India's manufacturing output growth slowed sharply to the lowest since February, the service sector picked up momentum.

Growth likewise slowed in mainland China, down to the weakest since July. A stalling of manufacturing output - despite improved exports - contrasted with the expansions seen over the prior three months, and service sector growth slipped to the lowest since June, thereby hinting at weaker domestic demand.

Only a marginal increase in output was meanwhile recorded in Russia for a second month, though this represents an improvement on the continual decline seen over the prior four months. Higher service sector output helped offset the steepest drop in Russian manufacturing output since April 2022.

That left Brazil as the only BRIC economy in decline, albeit with the downturn moderating to the weakest seen since output began falling in April. Although manufacturing output fell for a seventh straight month, a fractional rise in service sector output ended a seven-month spell of contraction.

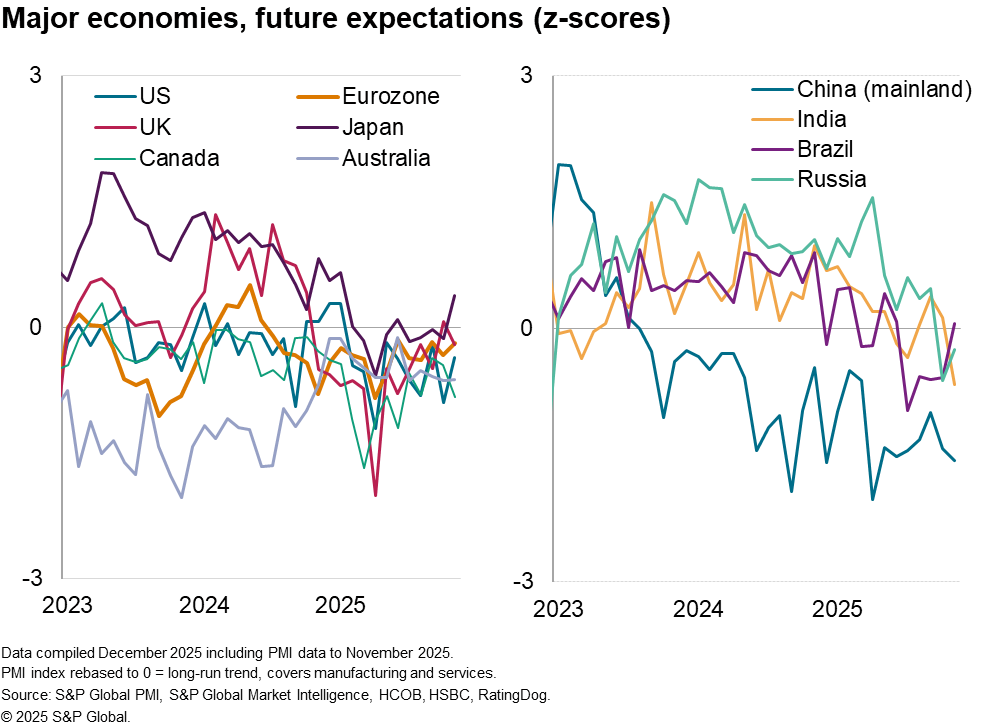

Global business growth expectations remain subdued

Although business expectations about the year ahead rose across both services and manufacturing in November, the level of sentiment remained very low by historical standards, having dropped markedly earlier in the year in response to the US tariff announcements.

Measured globally, confidence remains especially low among industrial services firms, though has picked up among basic material and consumer goods manufacturers amid some easing of tariff concerns. Confidence is highest among financial services, tech and healthcare companies.

Geographically, expectations are especially low relative to the survey long-run average in mainland China, and also fell sharply in India, but rose in Brazil.

Sentiment meanwhile remains weak by historical standards in the US despite picking up from October's recent low thanks in part to the ending of the government shutdown. Eurozone confidence hit a level that was among the highest seen for over a year, led by Spain and Italy, but the UK saw sentiment slip back below its long-run mean. That left Japan as the most optimistic of the major economies relative to long-run standards.

Elevated levels of uncertainty restrict hiring

Low business expectations about the year ahead, combined with an elevated degree of business uncertainty and sticky cost growth, contributed to a reluctance to hire among many firms globally. At 50.4, the Global PMI Employment Index signalled only a marginal net increase in private sector payroll numbers, continuing the weak global hiring trend that has been evident over much of the past two years.

Especially steep rates of job losses were reported in the UK and Canada. The latter saw the sharpest drop in employment since June 2020, while the UK's decline was the second-steepest since the early days of the pandemic. Eurozone job creation also came close to stalling. In all cases, hiring came under pressure from concerns over the economic outlook combined with sluggish sales and high costs.

In contrast, jobs growth lifted higher in both the US and Japan, linked partly to easing concerns over the impact of US trade policies.

Jobs growth meanwhile hit a 19-month low in India and payroll numbers were cut in mainland China.

Access the Global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-robust-expansion-in-november-confidence-dec25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-robust-expansion-in-november-confidence-dec25.html&text=Global+PMI+signals+robust+expansion+in+November+but+confidence+and+hiring+remain+subdued+++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-robust-expansion-in-november-confidence-dec25.html","enabled":true},{"name":"email","url":"?subject=Global PMI signals robust expansion in November but confidence and hiring remain subdued | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-robust-expansion-in-november-confidence-dec25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+signals+robust+expansion+in+November+but+confidence+and+hiring+remain+subdued+++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-robust-expansion-in-november-confidence-dec25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}