Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 08, 2025

PMI data highlight global economy’s ongoing reliance on rising financial services activity

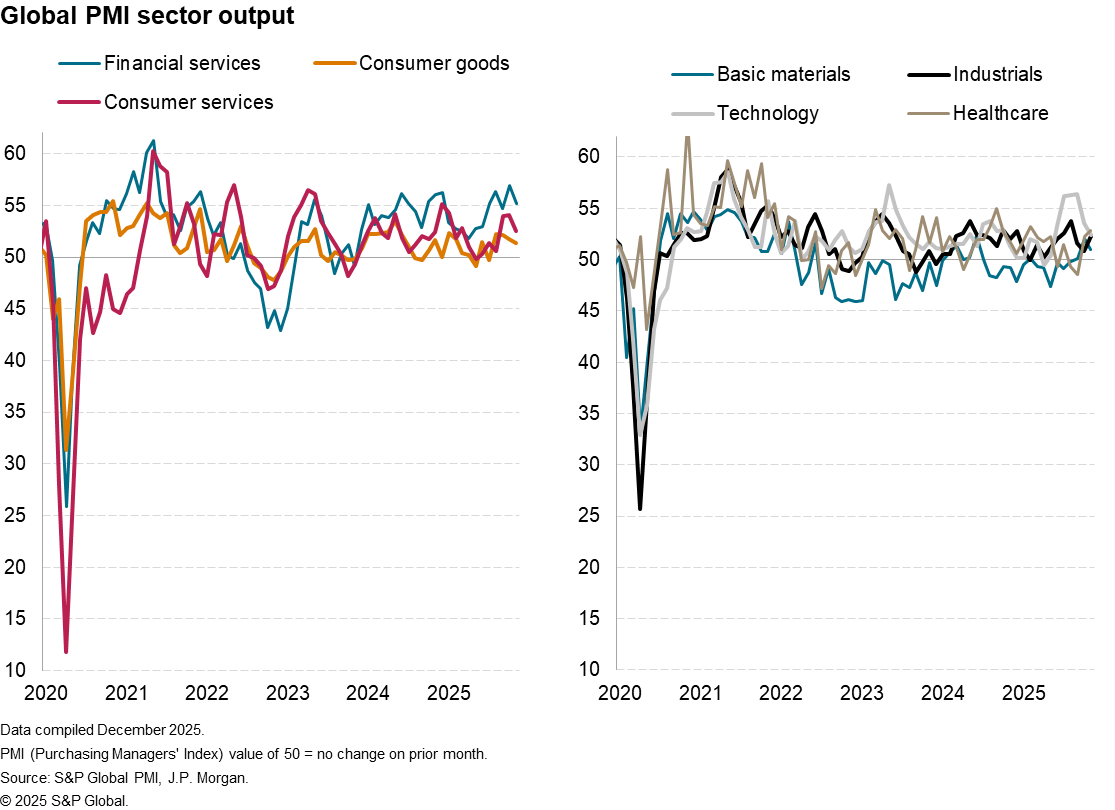

Global economic growth remained robust in November, according to PMI survey data, though growth was heavily reliant on a further strong expansion of financial services activity, in turn linked to supportive global financial conditions. In contrast, many other sectors remained mired in only modest or slowing growth, though notably only one sector - autos - reported falling output.

Robust global expansion

The worldwide PMI surveys produced by S&P Global in association with ISM and IFPSM for J.P.Morgan signalled a sustained and robust upturn of worldwide business activity in November. The pace of expansion cooled slightly compared to October but persisted at a rate broadly consistent with the pre-pandemic average.

As has generally been the case since the pandemic, the expansion continued to be led by the service sector, which saw the rate of business activity growth weaken slightly yet remain among the highest seen over the past 2½ years.

Manufacturing continued to support the expansion, albeit with factory output growth dipping slightly to a four-month low to register another only modest increase. However, despite remaining sluggish, the sustained growth represents one of the best spells of manufacturing expansion seen since mid-2024, albeit with marked - and notable - mixed regional performances.

Financial services drive growth

In more detail, by far the strongest expansion in November was recorded for financial services, which have been a key driver of the global economic recovery this year. However, healthcare, consumer services, tech and industrials also reported robust growth.

Only very modest growth was meanwhile recorded for basic material manufacturing and telecom services, and output of consumer goods slowed.

At the more detailed sector level, the top three sectors were all constituents of the financial services industry, with the global upturn led by 'other' (non-banking) financial services such as investment and pension funds, followed by insurance and banking.

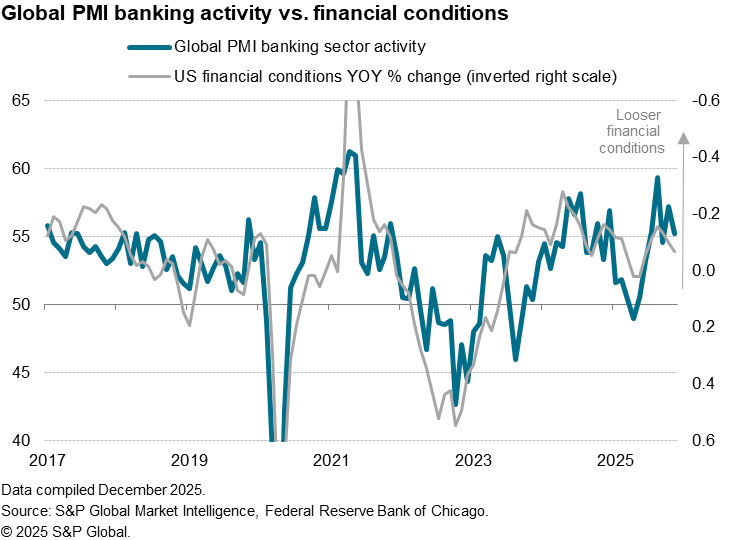

Financial services companies have cited supportive financial conditions, including lower interest rates and high asset prices, as having helped boost demand for financial services in recent months. However, there are some signs of this impetus fading, with growth in some financial conditions indicators having peaked and growth slowing accordingly in November within some sectors such as banking and insurance.

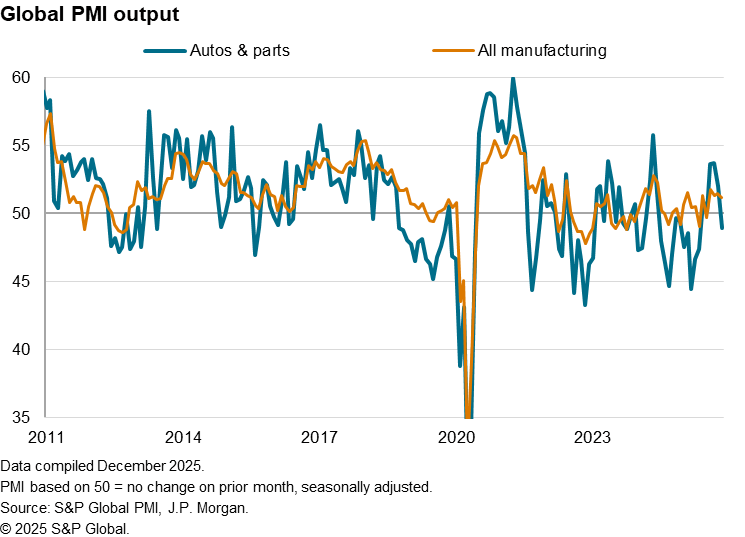

Autos report renewed downturn

The worst performer, and in fact the only sector reporting a fall in output in November, was automobiles and auto parts. November's fall in auto sector output was the first in six months, and was blamed in part on the fading impact of US tariff policies. Demand for vehicles had been buoyed over the summer as buyers sought to beat potential tariff price rises. November's decline therefore represents something of a return to the pre-tariff trend of falling production globally.

Access the Global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-highlight-global-reliance-financial-Dec25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-highlight-global-reliance-financial-Dec25.html&text=PMI+data+highlight+global+economy%e2%80%99s+ongoing+reliance+on+rising+financial+services+activity++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-highlight-global-reliance-financial-Dec25.html","enabled":true},{"name":"email","url":"?subject=PMI data highlight global economy’s ongoing reliance on rising financial services activity | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-highlight-global-reliance-financial-Dec25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+data+highlight+global+economy%e2%80%99s+ongoing+reliance+on+rising+financial+services+activity++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-highlight-global-reliance-financial-Dec25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}