Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 06, 2025

Global PMI falls to 14-month low in February as demand growth weakens

The worldwide PMI surveys - produced S&P Global in association with ISM and IFPSM for J.P.Morgan - recorded the slowest output growth for 14 months in February. Order book growth also dipped, with slower growth of backlogs of work hinting that global growth could weaken further in March.

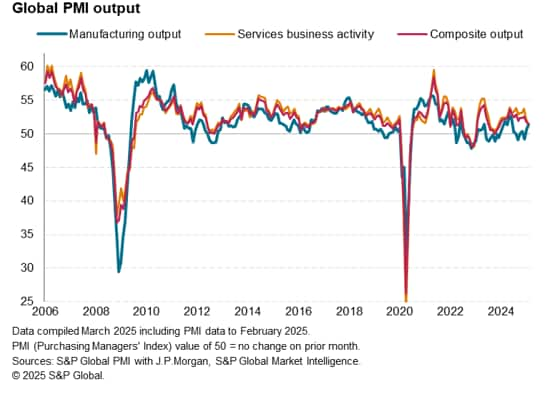

While the global services expansion hit its weakest for over a year amid heightened economic and geopolitical uncertainty, manufacturing output growth accelerated to provide a glimmer of good news. The latter nevertheless remained subdued and was fueled in part by the front-loading of output and orders ahead of tariffs.

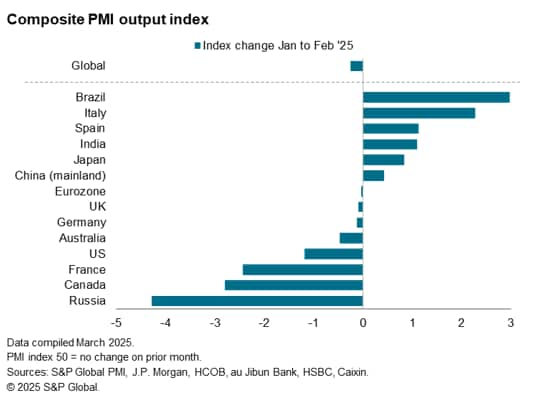

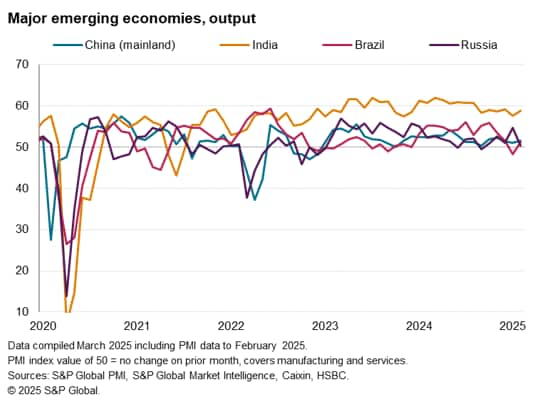

The US lost momentum to no longer be the star performer of the major developed economies, a title now passed to Japan. Growth remained largely stalled in Europe and Australia, while Canada's downturn deepened. India meanwhile far outpaced the other major emerging markets once again, with mainland China notably still reporting only modest growth momentum.

Global PMI at lowest since December 2023

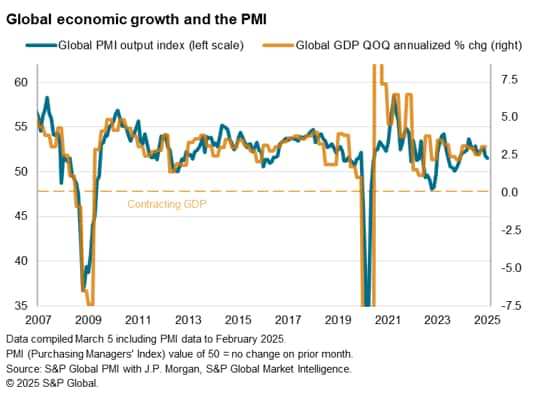

S&P Global Market Intelligence's PMI surveys indicated that global business activity expanded for a twenty-fifth successive month in February, but the rate of growth slowed for a second consecutive month to the weakest since December 2023.

The headline J.P. Morgan Global Composite PMI® Output Index, covering manufacturing and services in over 40 economies, fell from 51.8 in January to 51.5 in February.

At its current level, historical comparisons indicate that the PMI is broadly consistent with the global economy growing at an annualized rate of 2.2%. That compares with an average GDP growth rate of 3.1% in the decade prior to the pandemic and an estimated 3.0% rate in the fourth quarter of last year.

The gap in performance between the global services and manufacturing sectors effectively disappeared in February. While manufacturing growth hit the fastest for eight months, services growth waned to a 14-month low. Both rates of expansion were nonetheless only modest. There was also evidence that some of the manufacturing improvement was linked to the front-loading of production ahead of tariffs.

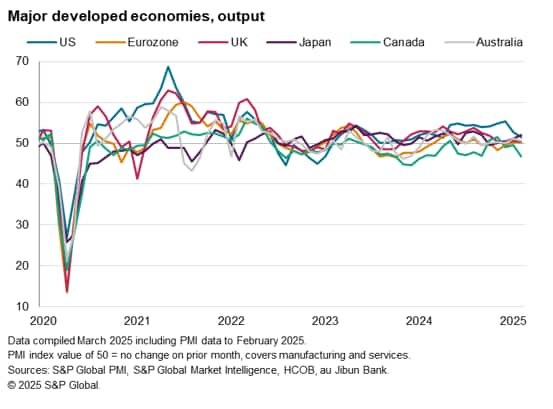

US loses steam to no longer outpace other developed economies, Canada's downturn deepens

Having outpaced the other major developed economies over the previous nine months, the US saw growth weaken to a 10-month low in February to now lag Japan, where growth hit a five-month high. Key to the US' weakening from a 32-month high seen late last year has been a marked slackening of growth in its service sector, which has offset improved factory output growth.

Europe meanwhile saw output levels largely unchanged compared to January, the PMIs pointing to near-stalled eurozone and UK economies as modest service sector gains were largely countered by falling factory output in both cases.

Australia likewise saw only a very modest output gain as, like Europe, falling factory output offset a slight service sector gain.

Worst performing was Canada, where output fell at an increased rate in February to register the sharpest contraction for just over a year amid marked drops in both manufacturing and service sector output.

India leads major emerging markets, other BRICs report only sluggish gains

India once again led the BRIC 'emerging' economies, as has been the case since July 2022, thanks to a further acceleration of growth. However, although activity in the service sector grew at the sharpest rate for six months, manufacturing output showed the smallest gain since December 2023.

The other major emerging markets only registered modest expansions, albeit with Brazil staging a broad-based recovery after both manufacturing and services output had fallen briefly in January. Companies again reported concerns over high inflation, a weak currency, and high interest rates.

Mainland China's economy showed signs of modest growth amid slightly improved - but still sluggish - performances across both manufacturing and services.

Russia's strong start to the year meanwhile lost momentum to register the weakest expansion recorded over the past five months and the worst performance of the BRICs.

Global order book growth weakens

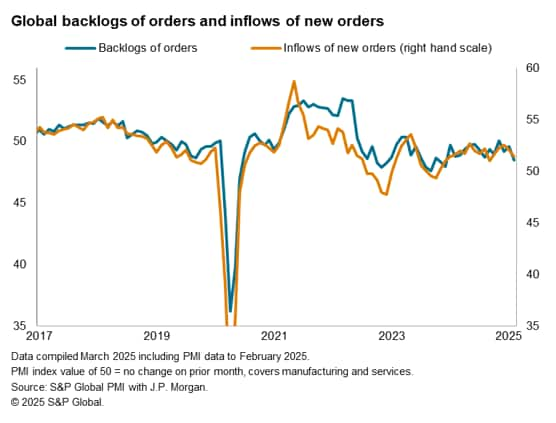

February also saw global new business growth ease to the slowest rate since last September, rising only very modestly to register the second-smallest gain for just over a year.

Trends were again mixed by sector: although a modest increase was recorded in the manufacturing sector (in fact the largest for nearly three years), service sector new business rose at the slowest rate since November 2023.

It remains uncertain just how much of the uplift in manufacturing output and orders seen so far this year represents the front-loading ahead of tariffs. However, worryingly, a further fall in backlogs of work at factories - a key indicator of workloads and capacity utilisation - hints at order books being depleted, notably in the US.

Although backlogs of work rose globally in the service sector, the rise here was the weakest for nearly one-and-a-half years. Measured overall, the latest rise in backlogs of work globally was the smallest recorded since December 2023.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-falls-to-14month-low-in-february-as-demand-growth-weakens-mar25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-falls-to-14month-low-in-february-as-demand-growth-weakens-mar25.html&text=Global+PMI+falls+to+14-month+low+in+February+as+demand+growth+weakens+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-falls-to-14month-low-in-february-as-demand-growth-weakens-mar25.html","enabled":true},{"name":"email","url":"?subject=Global PMI falls to 14-month low in February as demand growth weakens | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-falls-to-14month-low-in-february-as-demand-growth-weakens-mar25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+falls+to+14-month+low+in+February+as+demand+growth+weakens+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-falls-to-14month-low-in-february-as-demand-growth-weakens-mar25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}