Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 07, 2025

Global PMI at 17-month low as future expectation hit lowest since early pandemic months

The worldwide PMI surveys - produced S&P Global in association with ISM and IFPSM for J.P.Morgan - signalled deteriorating economic conditions in April, both in terms of current output and expected future growth.

Measured across goods and services, output rose at its slowest rate for nearly one-and-a-half years in April, with developed world growth notably coming close to stalling.

Business confidence meanwhile, indicated intensifying concern about prospects in the year ahead, with sentiment down worldwide to its lowest since the COVID-19 lockdowns of early 2020. There were few instances of improved sentiment, with especially steep falls seen in mainland China and the UK, as well as in the US and eurozone.

While tariffs and changing US policy announcements were again cited as the main cause of concern in relation to the business outlook, which in turn is set to hit global employment in the months ahead. A key worry is the degree to which sentiment has not only slumped in manufacturing but also in the service sector, reflecting a further spread of the economic malaise beyond goods production.

Global PMI at 17-month low in April

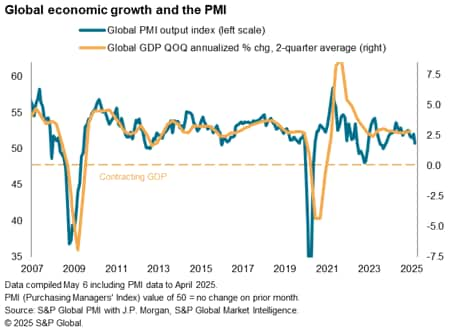

S&P Global Market Intelligence's PMI surveys indicated that global business activity expanded at the slowest rate for nearly one-and-a-half years in April.

The headline J.P. Morgan Global Composite PMI Output Index, covering manufacturing and services in over 40 economies, fell from 52.0 in March to 50.8 in April. Any reading above 50.0 indicates growth compared to the prior month, meaning the current PMI merely signals a weakened pace of expansion rather than falling output, but the latest reading was the lowest since November 2023.

At its current level, historical comparisons indicate that the PMI is broadly consistent with the global economy growing at an annualized rate of 1.7% in April. This compares with an average GDP growth rate of 3.1% in the decade prior to the pandemic and an estimated 3.0% rate in the past three years.

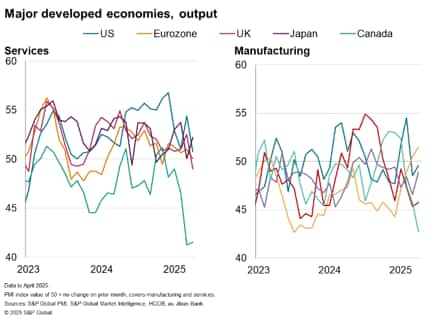

Developed world malaise intensifies

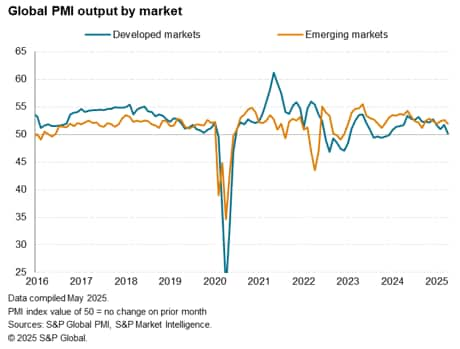

Developed markets were especially moribund in April, with growth near-stalling to register the worst expansion since the current upturn began at the start of 2024. However, growth in the emerging markets also dipped, dropping to a three-month low.

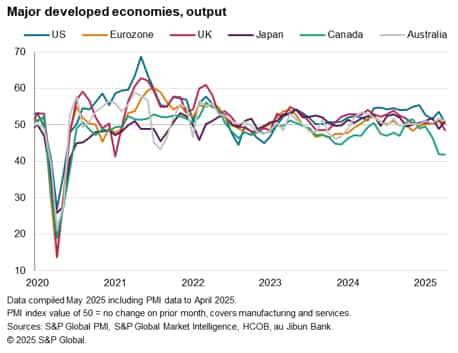

Among the major developed economies, by far the worst performance was seen in Canada, where companies widely blamed US tariffs and broader uncertainty emanating from US policy for the steepest downturn in business activity since the early pandemic lockdowns of June 2020. However, US policy changes were also reported as having dampened growth in the US in April to the lowest since September 2023.

While further modest gains were recorded in the eurozone, Japan and Australia, growth in all three cases was subdued to signal weak starts to the second quarter. UK business activity meanwhile fell into decline for the first time since October 2023, with companies blaming a combination sluggish domestic demand alongside a broader drag from US-derived economic uncertainty.

Service sector woes

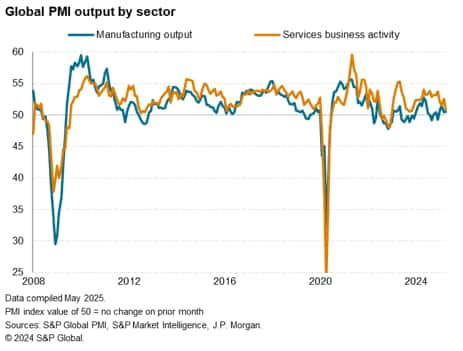

While much of the economic news flow has been in relation to tariffs on goods in recent weeks, it was notable that the main area of renewed weakness in April was the services economy. Services growth slowed globally to its worst since November 2023, fueled by the largest drop in worldwide exports of services since December 2022. Although manufacturing continued to register only modest growth, the rate of expansion in fact inched higher despite goods exports falling worldwide at a rate not seen since August 2023.

Regionally, the downturn in Canada remained especially broad based sectorally, with services growth coming under further marked pressure from the intensified economic uncertainty alongside slumping goods production. UK services activity also fell, down for the first time since October 2023, while eurozone services output was broadly flat and US services growth sank to a 17-month low. Japan was the only major developed economy to see an upturn in services growth, though even here the expansion came on the heels of stagnation in March.

In manufacturing, only the eurozone reported any output growth among the major developed economies in April, recording the strongest gain for just over three years (albeit the rise in part reflected the front-running of US tariffs). Especially steep manufacturing declines were meanwhile seen in Canada and the UK.

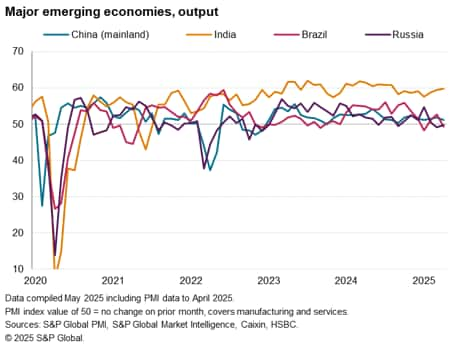

India leads emerging markets

Among the BRIC "emerging" economies, India continued to outperform by a wide margin, with output growth accelerating to the fastest since last June alongside a slight pick up in services.

In contrast, slight contractions were seen in both Brazil and Russia and growth slowed to a near-standstill in mainland China amid weakened performances in both manufacturing and services.

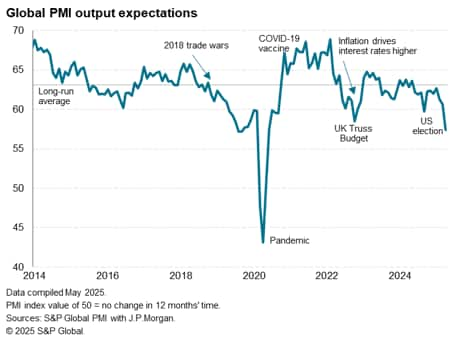

Global business confidence at lowest since May 2020

Looking ahead, the global PMI's future output expectations index points to downside risks for both output and employment in the months ahead. Expectations about output fell globally to their lowest since the pandemic lockdowns of early-2020 amid widespread concerns over the impact of US policy announcements on global economic growth, through both direct impacts on trade and manufacturing and on business and consumer spending via heightened uncertainty.

It was also noteworthy that business expectations deteriorated sharply across both manufacturing and services globally in April, underscoring how the trade uncertainty in relation to goods due to tariffs has also infected business sentiment in the services economy.

With business confidence about prospects typically highly correlated with hiring intentions, April's PMI data showed worldwide employment unchanged during the month, but the steep decline in output expectations suggest global employment could start falling soon, and potentially quite sharply, which would, in turn, likely feed through to lower household spending.

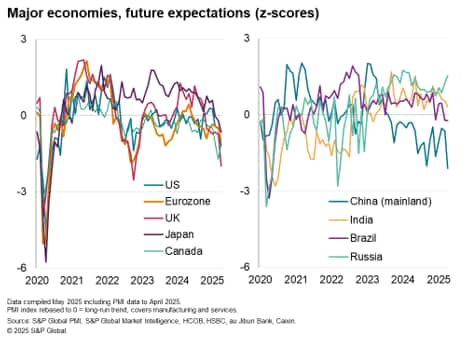

Among the major economies, improvements in business confidence were rare to spot. Hopes of improving US relations helped boost sentiment in Russia, while sentiment in Canada was buoyed by prospects of stronger political leadership, albeit the latter remained well below its long-run average. In Brazil, sentiment was unchanged, though merely at a four-year low.

But business confidence deteriorated elsewhere, and most markedly in the UK - where new employer taxes came into effect in April - and in mainland China - where US tariffs were hiked sharply. However, confidence notably also fell sharply in the US and eurozone, with even India not left unscathed by the rise in global economic uncertainty.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-at-17month-low-as-future-expectation-hit-lowest-since-early-pandemic-months-may25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-at-17month-low-as-future-expectation-hit-lowest-since-early-pandemic-months-may25.html&text=Global+PMI+at+17-month+low+as+future+expectation+hit+lowest+since+early+pandemic+months+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-at-17month-low-as-future-expectation-hit-lowest-since-early-pandemic-months-may25.html","enabled":true},{"name":"email","url":"?subject=Global PMI at 17-month low as future expectation hit lowest since early pandemic months | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-at-17month-low-as-future-expectation-hit-lowest-since-early-pandemic-months-may25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+at+17-month+low+as+future+expectation+hit+lowest+since+early+pandemic+months+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-at-17month-low-as-future-expectation-hit-lowest-since-early-pandemic-months-may25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}