Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 04, 2025

Global PMI at 14-month high in August, but future growth expectations fall further

The worldwide PMI surveys - produced S&P Global in association with ISM and IFPSM for J.P.Morgan - signalled a fourth successive month of accelerating business activity in August, taking growth to its highest since June 2024.

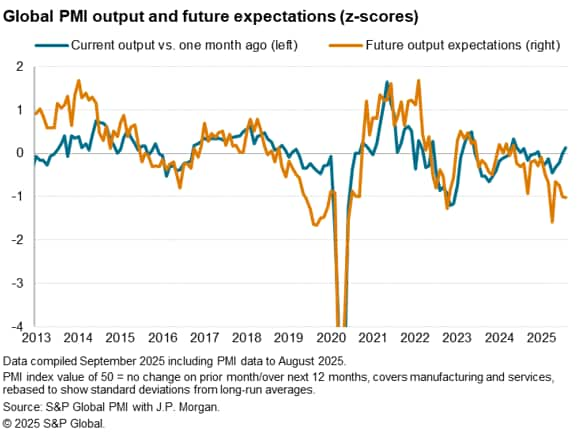

However, business confidence in prospects for the year ahead fell to one of the lowest levels seen since the pandemic, generally reflecting concerns over the impact of US policy changes, notably in relation to tariffs. The gap between current output and expected future output has consequently widened further globally in August, presenting increased downside risks to the sustainability of the recent upturn.

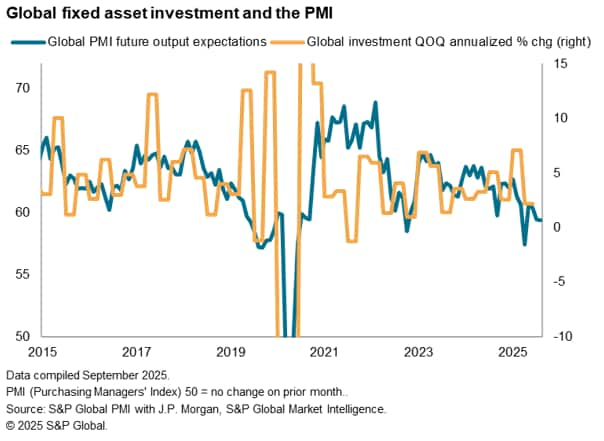

Low confidence not only stymied output and employment growth globally in August but also indicates potentially weak business investment growth in the near-term.

Regionally, while the US outperformed other major developed economies (bar only Australia), it not only saw current growth weaken in August, but it also saw business confidence dip, contrasting with slightly improved sentiment in the rest of the World on average. As such, the data hint at potentially greater downside risk to US growth resilience than in the rest of the World.

Global PMI highest since June 2024

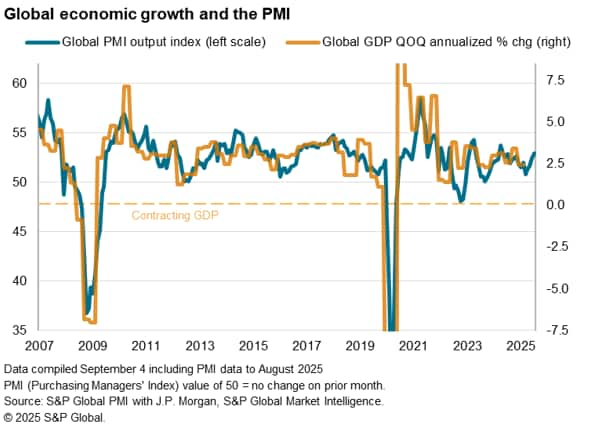

S&P Global Market Intelligence's PMI surveys indicated that worldwide business activity expanded at an increased pace for a fourth successive month in August, the rate of growth accelerating to the fastest since June of last year.

The rate of growth in August has been exceeded only once over the past 27 months, with the J.P. Morgan Global Composite PMI Output Index, covering manufacturing and services in over 40 economies, up from 52.5 in July to 52.9.

At its current level, historical comparisons indicate that the PMI is broadly consistent with the global economy growing at an annualized rate of 3.0%. This is broadly in line with the average GDP growth rate (3.1%) seen in the decade prior to the pandemic.

Jobs growth restrained by uncertainty

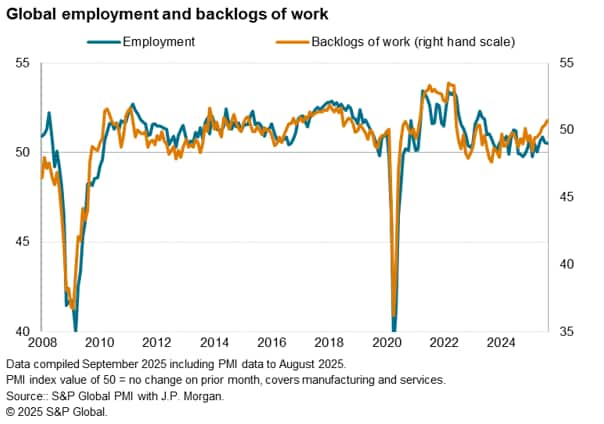

New orders growth also picked up globally to the highest seen so far this year, albeit subdued by another decline in global exports of goods and services. The influx of new orders nonetheless helped drive a third month of rising backlogs of work worldwide, which rose to the greatest extent since May 2022.

Higher backlogs of work in turn helped encourage firms globally to take on additional staff for a fourth month in a row. However, the rate of job creation remained only modest, and lower than would be consistent with current backlogs growth, according to historical comparisons.

While investment in technology (AI) and skill shortages could help explain some of the gap between order books and employment, survey responses indicated a broad reluctance to take on additional staff due to heightened concerns over the business outlook.

Business confidence near post-pandemic low

Business expectations about growth in the year ahead slipped globally to the lowest since the early months of the pandemic barring only October 2022 (when the UK's Budget crisis exacerbated wider concerns over global geopolitical tensions and rising interest rates) and April of this year (after new US tariffs were announced).

As seen in recent months, companies generally blamed geopolitical uncertainty and US trade protectionism as the most common causes of reduced confidence.

Not only does low business confidence pose downside risks to growth and employment in the months ahead, but optimism is also typically closely correlated with business investment. Hence the low business expectations index readings from the global PMI hint at a potential near stalling of worldwide capex spending.

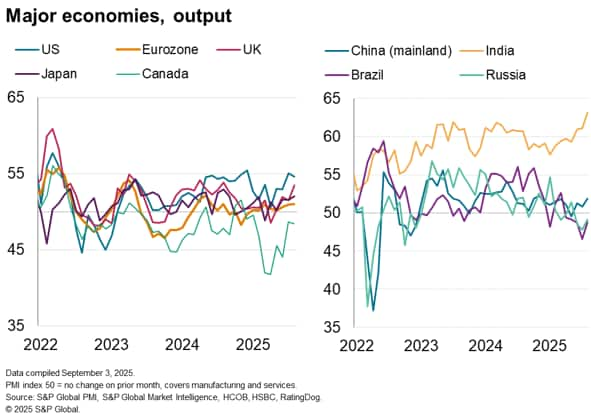

US outperformance wanes

Regionally, while India continued to report the strongest expansion of the world's largest economies, the US continued to outperform the major developed economies, though by a diminished margin. Slower US growth in August contrasted with faster expansions in the UK and Japan as well as a further marginal uptick in the eurozone. Growth meanwhile lifted higher in mainland China and downturns moderated in both Russia and Brazil.

So, while US growth moderated in August, the rest of the World reported the strongest collective output gain for 15 months.

Confidence drop led by US

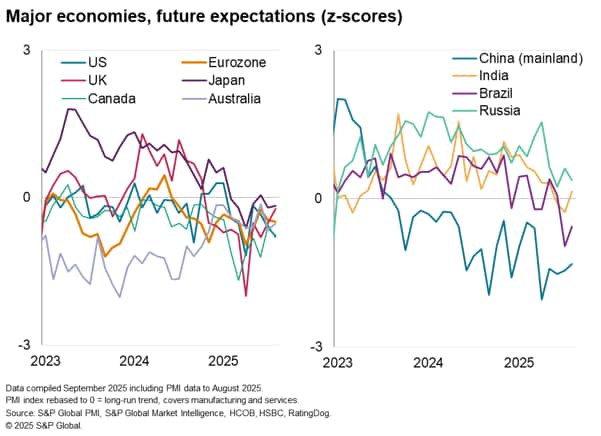

Looking at how confidence has changed around the world, it is useful to analyse the PMI's future output index values relative to the respective long-run averages. This helps standardise business confidence between countries, as some economies typically see sentiment run higher than others, likely reflecting cultural divergences as well as stages of economic development.

These comparisons show that, among the major developed economies, business expectations about the year ahead are lowest relative to long-run averages in the US and Canada, both of which saw sentiment deteriorate further in August. Relatively weak, and deteriorating, sentiment was also seen in the eurozone. In contrast, sentiment picked up in Australia, Japan and the UK, albeit in all cases remaining below long-run averages.

In the four largest emerging markets, sentiment improved across the board bar Russia, though remained especially weak (by both historical and international comparisons) in mainland China and, to a lesser extent, Brazil.

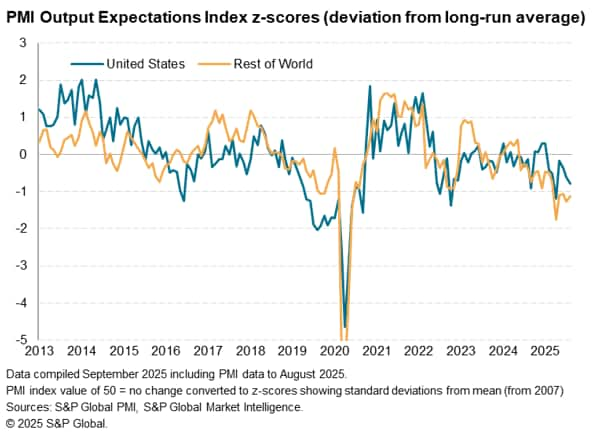

The data therefore indicated that a drop in optimism in the US contrasted with a small uplift in business expectations on average elsewhere, to therefore close the gap in confidence between the US and the rest of the World to its lowest since March, just prior to the higher rate tariff announcements from the US administration.

Digging deeper into the reasons provided by companies for changes in business expectations, the surveys point to growing unease among US firms regarding the negative impact of US tariffs and other policies, whereas responses from firms in other countries in general indicated that growth concerns stemming from US policy changes have moderated from a peak in April, alleviated in part by domestic factors and improving financial conditions.

Access the Global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-at-14month-high-in-august-but-future-growth-expectations-fall-further-Sep25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-at-14month-high-in-august-but-future-growth-expectations-fall-further-Sep25.html&text=Global+PMI+at+14-month+high+in+August%2c+but+future+growth+expectations+fall+further+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-at-14month-high-in-august-but-future-growth-expectations-fall-further-Sep25.html","enabled":true},{"name":"email","url":"?subject=Global PMI at 14-month high in August, but future growth expectations fall further | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-at-14month-high-in-august-but-future-growth-expectations-fall-further-Sep25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+at+14-month+high+in+August%2c+but+future+growth+expectations+fall+further+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-at-14month-high-in-august-but-future-growth-expectations-fall-further-Sep25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}