Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 09, 2025

Global labour market risks tilt to the downside as business confidence plunges

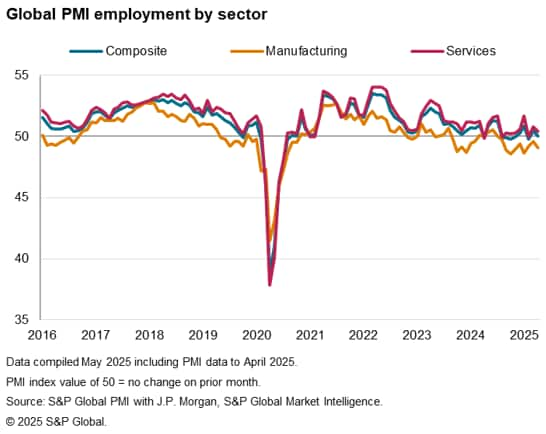

Global PMI data indicated that worldwide employment was unchanged in April, but it also hinted at downside risks to labour market conditions in the coming months as business confidence sank to its lowest in nearly five years.

Job cuts in manufacturing were offset by a slight increase in service sector staffing levels, with this pattern observed across emerging and developed markets alike. One country that has already seen a notable deterioration in labour market conditions is the UK, where businesses have scaled back headcounts markedly in recent months amid sharply rising labour costs.

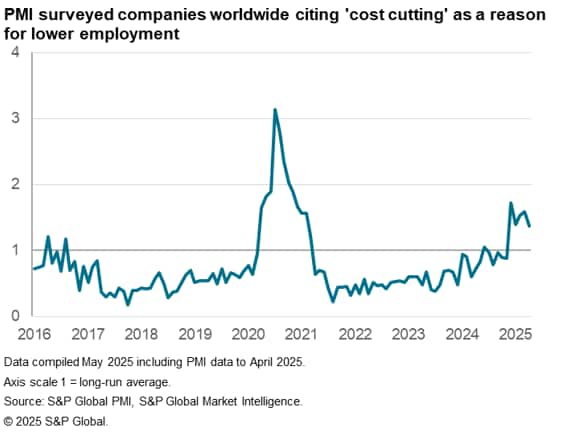

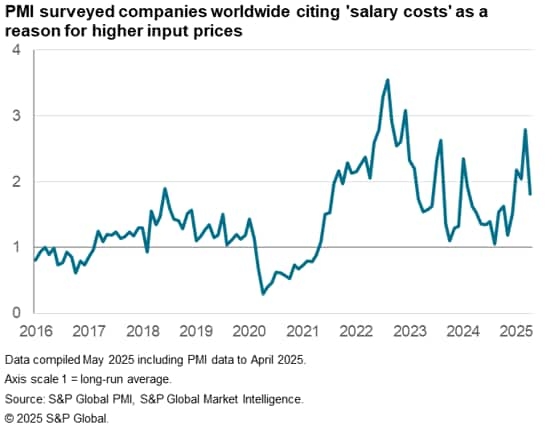

Recent PMI panel comment tracker data highlight that firms worldwide have been turning to staff retrenchment as a way to cut costs. Salary pressures are still running well above historical norms, but April data point to wage growth starting to slow.

Global employment stagnates as outlook deteriorates

April saw global employment stagnate, following a slight increase in workforce numbers in March. The J.P. Morgan Global PMI Employment Index, covering manufacturing and services in over 40 economies, registered in line with the 50.0 no-change threshold, down from March's 50.5. This followed slight decreases in employment in five of the previous seven months.

Taking the trend seen so far this year, 2025 is on course to see the Global PMI Employment Index record its lowest annual average in more than two decades excluding only the first year of the COVID-19 pandemic (2020) and the worst years of the Global Financial Crisis (2008-09).

Moreover, labour market risks appear tilted to the downside, with PMI data showing global business confidence plunging to its lowest since the pandemic lockdowns of early 2020. The historical relationship between employment and business expectations hint at labour market conditions taking a turn for the worse in the coming months, with the possibility of notable job losses unless confidence rebounds considerably from its current low level.

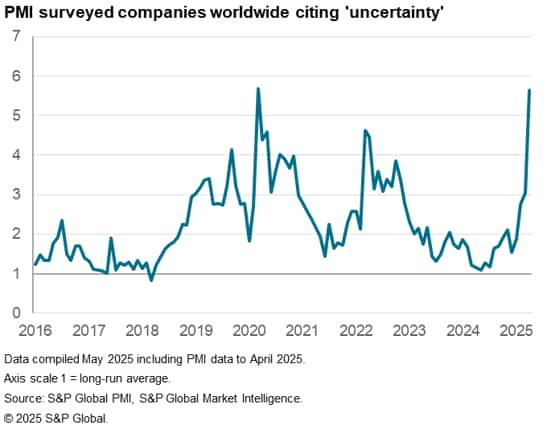

The drop in sentiment towards output over the next 12 months coincided with a spike in business uncertainty in April. Latest PMI Panel Comment Tracker (PCT) data - which utilise qualitative evidence provided by survey participants worldwide - showed reports of 'uncertainty' reaching more than five-and-a-half times the long-run average and their highest overall in more than five years, registering just shy of the all-time record set in March 2020.

Factory job cuts counter service sector hiring

The unchanged level of global employment in April masked contrasting trends at the sector level.

Workforce numbers fell across the global manufacturing sector for the ninth month running and at the quickest rate since January. The sustained decline in factory staffing levels was consistent with signs of a lack of pressure on business capacity, as evidenced by a solid and accelerated decline in backlogs of work in the goods-producing sector at the beginning of the second quarter.

Staff retrenchment at manufacturers in April was counterbalanced by ongoing hiring among firms in the relatively larger services economy, who continued to take on additional workers in line with further - albeit slower - growth in new business. The pace of service sector job creation eased compared with March, however, resulting in only a marginal rise in employment that was well below the long-run average.

UK sees steepest jobs decline

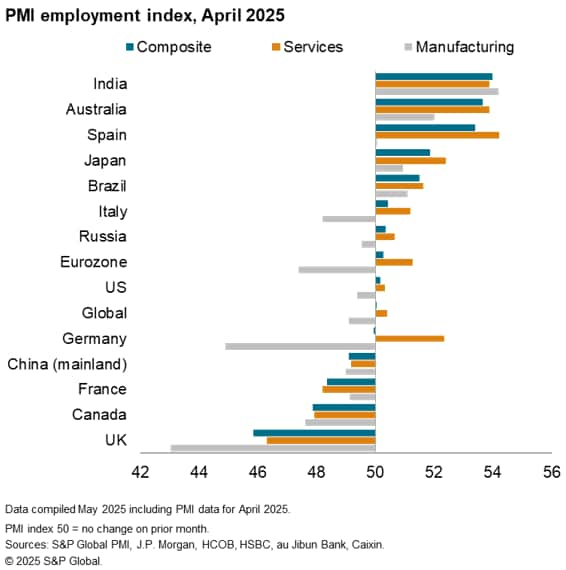

The pattern of job shedding in manufacturing being offset by services sector recruitment was seen across both emerging markets and developed markets in April, with overall employment levels broadly stable in each case.

At the national level, it was a similar story for both the US and Germany. US factory employment levels were down for the first time in six months, while the pace of job creation in services was noticeable slower than in March to leave overall employment only fractionally higher on the month. For the eurozone's largest economy, on the other hand, there was some positive momentum, as a slowdown in manufacturing staff retrenchment to the weakest in ten months coincided with the quickest rise in services employment since May last year. Overall employment in Germany broadly stabilised as a result, after falling in the previous ten months.

There were some pockets of broad-based employment growth in April, including in Brazil, India and Japan. By contrast, Canada, France, mainland China and the UK each saw employment decrease across both manufacturing and services.

In the case of the UK, job cuts have been recorded in each month since October last year, when the government announced plans to raise National Insurance contributions and minimum wages from April 2025. Employment fell markedly in the UK at the start of the second quarter, the drop in payroll numbers exceeding that of all other major economies surveyed by the PMI and led by a particularly steep drop in manufacturing employment that was also the fastest among the economies covered by PMI data.

Firms looking to control labour costs

A backdrop of heightened business uncertainty, combined with still-strong wage pressures, has in recent months led to an increased number of firms reducing employment as a means of cutting costs. In fact, the incidence of businesses worldwide citing 'cost cutting' (or similar) as a reason for lower employment has been running at its highest in more than 20 years, outside of the Global Financial Crisis and the early stages of the pandemic.

There are tentative signs that loosening labour market conditions and weaker employment prospects are starting to weigh on wage growth, however. Although worldwide reports of salary costs driving up input prices were around twice the long-run average in April, this represented a marked reduction from around three times the long-run average the month before.

Access the global PMI press releases.

Phil Smith | Economics Associate Director

Tel: +44 149

1461009

phill.smith@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-labour-market-risks-tilt-to-the-downside-as-business-confidence-plunges-may25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-labour-market-risks-tilt-to-the-downside-as-business-confidence-plunges-may25.html&text=Global+labour+market+risks+tilt+to+the+downside+as+business+confidence+plunges+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-labour-market-risks-tilt-to-the-downside-as-business-confidence-plunges-may25.html","enabled":true},{"name":"email","url":"?subject=Global labour market risks tilt to the downside as business confidence plunges | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-labour-market-risks-tilt-to-the-downside-as-business-confidence-plunges-may25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+labour+market+risks+tilt+to+the+downside+as+business+confidence+plunges+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-labour-market-risks-tilt-to-the-downside-as-business-confidence-plunges-may25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}