Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 06, 2025

Global disinflation trend offset by spike in US prices

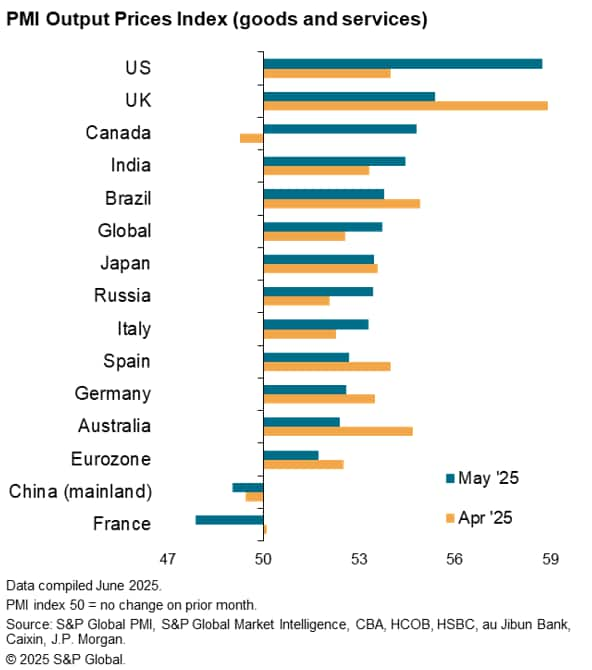

The worldwide PMI surveys - produced by S&P Global in association with ISM and IFPSM for J.P.Morgan - showed global selling price inflation accelerating in May. However, the increase reflected markedly higher US prices, as well as higher prices in Canada, which overshadowed weaker price pressures on average in the rest of the world. Notably, we estimate that the rise in US prices signalled by the PMI is consistent with consumer price inflation in the US running well above the central bank's target, contrasting with below-target inflation signal in the eurozone and with inflation moving toward target in the UK.

The rise in US prices was broad-based, and widely blamed on tariffs having pushed up prices for a wide variety of both goods and services, as well as higher interest rates relative to other economies, which drove up the cost of financial services in the US.

Global PMI signals rising price pressure

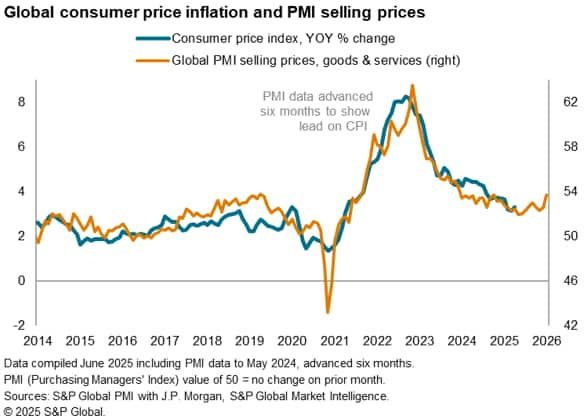

S&P Global Market Intelligence's PMI surveys indicated that global selling price inflation accelerated to a 14-month high in May. The headline J.P. Morgan Global Composite PMI® Prices Charged Index, covering prices levied for goods and services in over 40 economies, rose from 52.6 in April to 53.7 in May, its highest since March 2024.

Historical comparisons indicate that the PMI Prices Charged Index for May is broadly consistent with global consumer price inflation rising to 4% in the coming months, up from the 3.3% rate currently being indicated by official data in April.

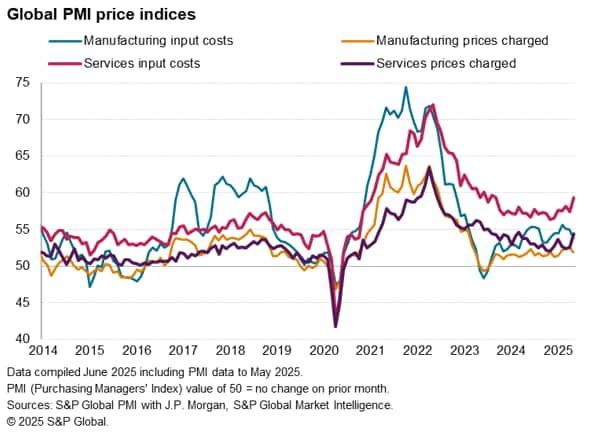

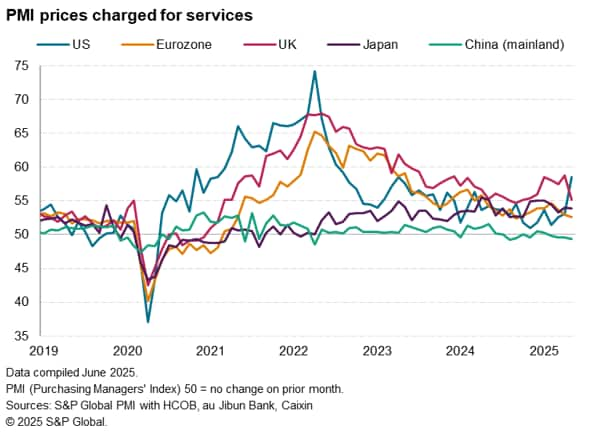

By sector, the increase in global inflation signalled by the PMI was driven by the services economy. Average prices charged for services rose globally at the fastest rate for 14 months, fueled by the largest monthly increase in service sector input costs recorded since August 2023.

In contrast, average prices charged for goods rose globally at the slowest rate for four months in May, with input costs in manufacturing rising at the weakest rate for eight months.

Services-driven global price growth

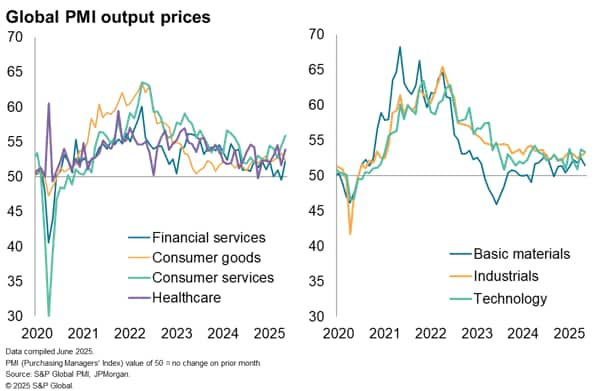

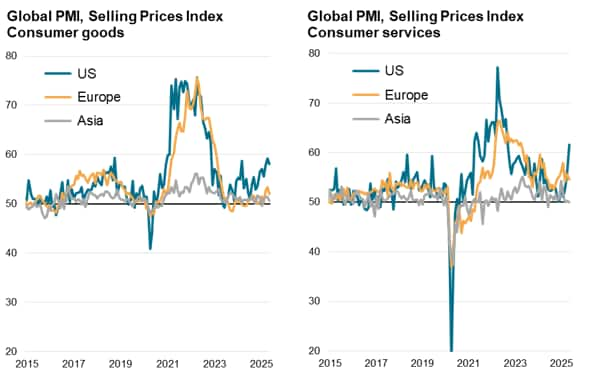

Drilling down deeper into the global prices charged data, the steepest price growth (and most marked uplift in price pressures) in May emanated from consumer services, where inflation rose to a 14-month high. However, a notable upturn in price pressures was also recorded for financial services, after prices had fallen marginally in April, while the rate of increase in prices charged for industrial goods and services edged up to a four-month high.

In contrast, prices charged for consumer goods, basic materials and technology goods and services globally all rose at reduced rates in May.

US bucks trend of lower inflation

The services-driven global price increase may seem surprising at first glance, given recent tariff developments. But this broad global price picture masks marked variations in inflation trends regionally, which reveals the tariff impact.

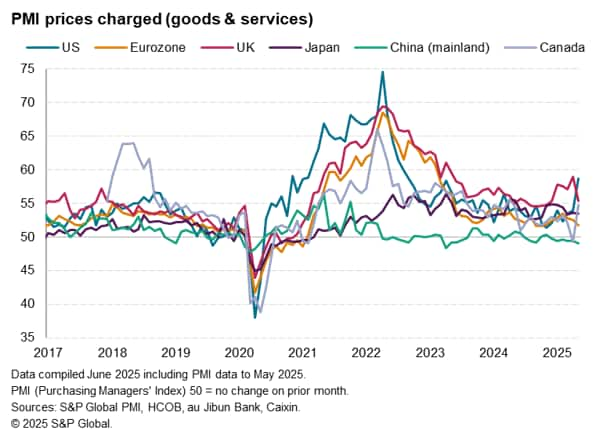

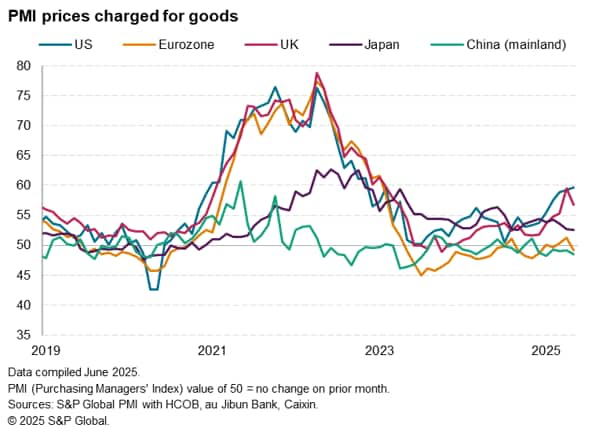

Looking at the world's largest economies, US prices jumped to the greatest extent since September 2022, and prices rose in Canada at the steepest rate since April 2024. But prices pressures moderated in the eurozone, Japan, UK and mainland China. The latter even saw prices fall at the fastest rate since April 2023. Prices charged inflation in the eurozone was the weakest since October 2024, while in Japan, it was the second-lowest seen in the past eight months. While UK price pressures remained elevated, thanks in part to recent payroll tax changes, May saw the rate of increase moderate sharply to a five-month low.

Consequently, the upturn in US inflation to a 32-month high contrasted with a cooling of inflation in the rest of the world to the joint-lowest since February 2021.

Comparisons with official data

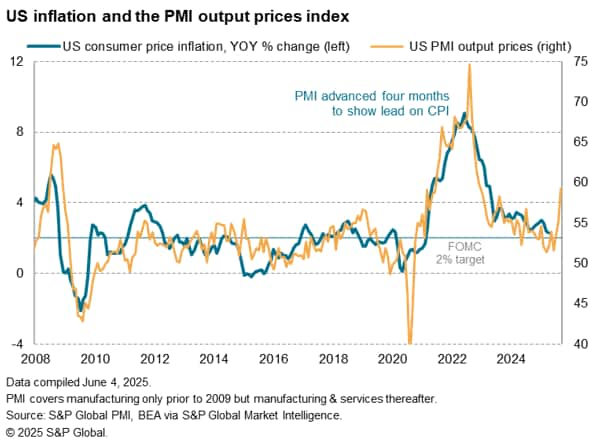

The PMI Prices Charged Index for the US has now risen to a level which is historically comparable with consumer price inflation rising to almost 5%.

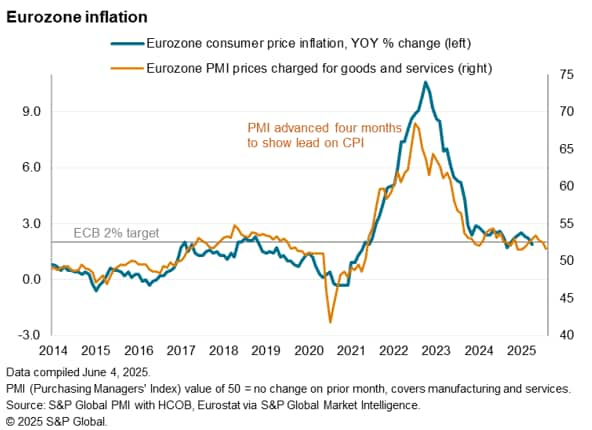

In contrast, the equivalent PMI Prices Charged Index for the eurozone has again dipped into territory consistent with below-target (2%) inflation, where it has been in four of the past nine months.

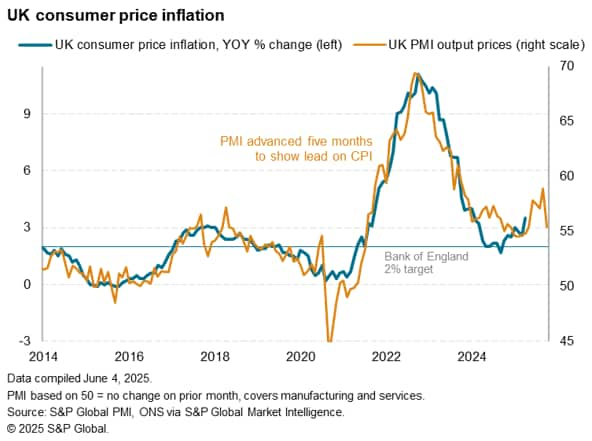

In the UK, the PMI Prices Charged Index has merely fallen to a level comparable with 3% consumer price inflation, though that represents an improvement on the more elevated rates signaled in prior months, which had reflected the passing-on of higher payroll tax and salary increases linked to government policy changes announced late last year.

US inflation rises across the board

Looking deeper into sector price trends across the largest economies, while prices charged for US goods rose at the fastest rate since November 2022, goods prices fell in both the eurozone and mainland China, and inflation rates moderated in both Japan and the UK.

For services, US services inflation hit the highest since August 2022, but rates cooled elsewhere and prices charges for services even continued to fall in mainland China.

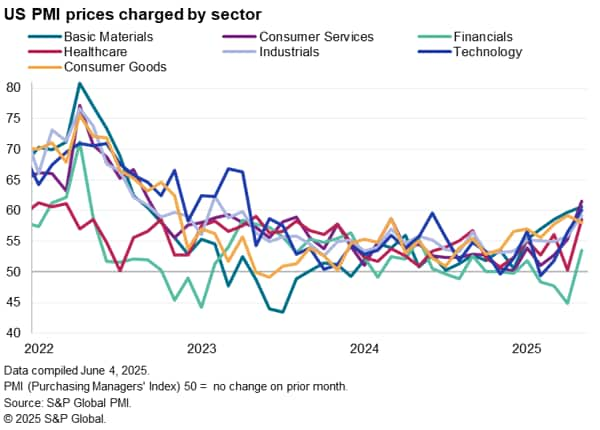

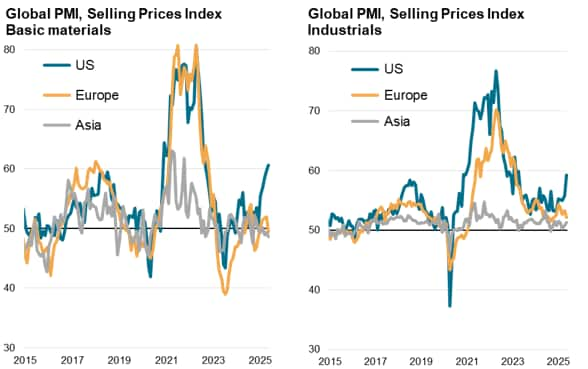

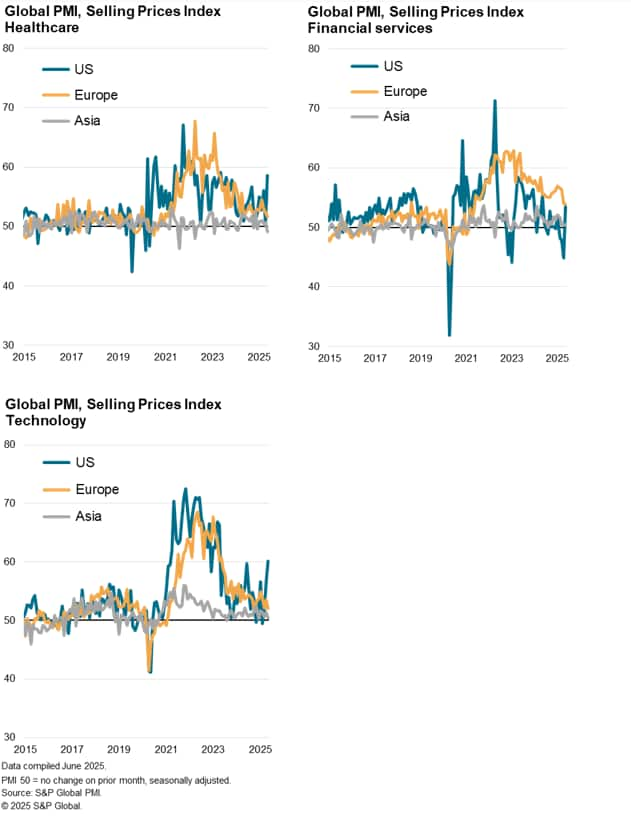

Stronger US price growth was also broad-based across the main product sectors covered by the manufacturing and services PMI surveys, with some notable multi-year highs. Only consumer goods reported slower, though still elevated, inflation.

Tariffs and interest rates drive price differentials

The steepest price growth in the US was reported for consumer services, where May's rise was the sharpest since September 2022, in marked contrast to overall weaker output price inflation rates for consumer services in Europe and Asia. Especially strong selling price inflation rates were also reported in the US for consumer goods, technology, industrials, healthcare and basic materials, the latter notably contrasting with falling basic materials prices in Europe and Asia.

In many cases, the higher rates of US inflation were attributed directly to tariffs or to tariff-related supply issues, including shortages of items. In contrast, companies in Europe and Asia at times noted lower cost supplies had been diverted from US markets.

One further key area of price differential was financial services. While charges levied by US financial companies rose in May at the fastest rate for a year, in part linked to higher interest rates, prices levied in Europe rose at the slowest pace for four years amid lower interest rates. Financial services prices were meanwhile largely unchanged in Asia.

Access the latest global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-disinflation-trend-offset-by-spike-in-us-prices-jun25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-disinflation-trend-offset-by-spike-in-us-prices-jun25.html&text=Global+disinflation+trend+offset+by+spike+in+US+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-disinflation-trend-offset-by-spike-in-us-prices-jun25.html","enabled":true},{"name":"email","url":"?subject=Global disinflation trend offset by spike in US prices | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-disinflation-trend-offset-by-spike-in-us-prices-jun25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+disinflation+trend+offset+by+spike+in+US+prices+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-disinflation-trend-offset-by-spike-in-us-prices-jun25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}