Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 24, 2020

Flash US PMI signals steepest output slump for a decade amid coronavirus outbreak

- Flash composite PMI™ slides to new low of 40.5 in March as business reports increased impact from coronavirus outbreak

- Service sector sees quickest drops in output and orders but manufacturing also reports steepest downturn for over a decade

- Business sentiment slumps to new survey low, causing largest staff layoffs since 2009

- Prices fall at steepest rate in over ten years

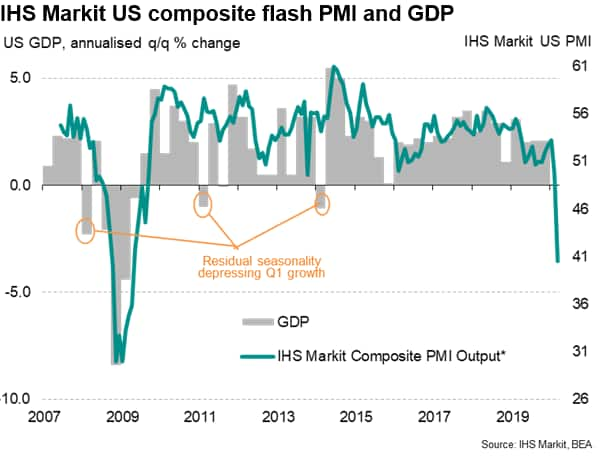

US companies reported the steepest downturn since 2009 in March as measures to limit the COVID-19 outbreak hit businesses across the country. Adjusted for seasonal factors, the IHS Markit Flash Composite PMI Output Index posted 40.5 in March, down from 49.6 in February, to signal a second successive contraction in output and the steepest slump recorded since comparable survey data were available in October 2009.

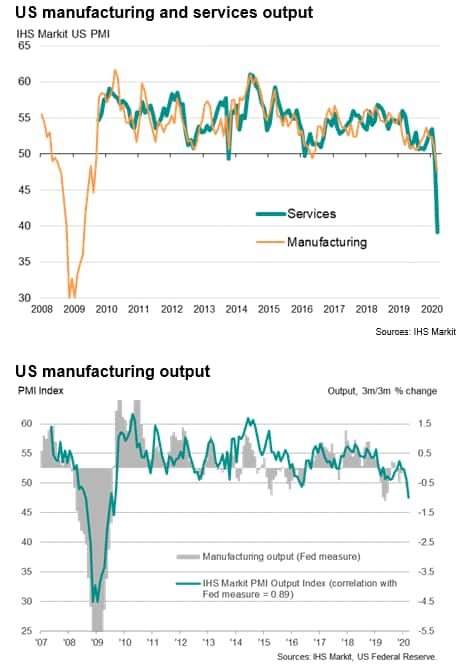

Widespread falls in activity were reported across the manufacturing and service sectors, though the service sector has been especially badly affected. Consumer-facing industries such as restaurants, bars and hotels appear to be bearing the brunt of the social distancing measures, while travel and tourism has been decimated amid government restrictions on international travel. Overall, the downturn in service sector activity was by far the largest since data on this sector were first collected in 2009.

Although manufacturing reported a weaker downturn by comparison to services, the collapse in output was none the less still the most severe recorded since 2009.

Companies also reported the first contraction of new business since data collection began. The marked decrease in new orders reportedly stemmed from sharp falls in client demand following the outbreak of COVID-19. Lower customer demand was also reflected in falling new export orders, with key export partners shutting down or limiting the size of orders. Manufacturers and service providers both noted a drop in total new business, with service providers in particular registering a robust contraction.

In addition to worsening demand, manufacturers also reported production to have been constrained by ongoing supply chain issues, with average delivery times lengthening to an extent rarely seen over the past decade.

Looking ahead, companies reported the sharpest fall in backlogs of work ever recorded by the surveys, hinting strongly that operating capacity will be scaled back further in coming months.

Not surprisingly, companies' expectations regarding business activity over the coming year also slumped markedly to a level that was by far the lowest ever recorded by the survey. Firms generally expressed concerns regarding the longevity of shutdowns and the ongoing impact of the coronavirus outbreak.

The downturn in demand and gloomier prospects meant jobs were slashed at a pace not witnessed since the global financial crisis in 2009, as firms either closed or ran at reduced capacity amid widespread cost-cutting. Similar marked rates of decline were recorded for both service sector and manufacturing payrolls.

The March data also indicated a decrease in inflationary pressures, as both average input prices and output charges fell at private sector firms. The decline in selling prices was the fastest in the ten-and-a-half year series history, as manufacturers and service providers both cut prices to attract new clients. Plunging oil prices and wider commodity price falls helped bring down inflationary pressures, but companies also often reported lower payroll costs.

The survey underscores how the US is likely already in a recession that will inevitably deepen further. The March PMI is roughly indicative of GDP falling at an annualised rate approaching 5%, but the increasing number of virus-fighting lockdowns and closures mean the second quarter will likely see a far steeper rate of decline.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-steepest-output-slump-for-a-decade-amid-coronavirus-outbreak-March2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-steepest-output-slump-for-a-decade-amid-coronavirus-outbreak-March2020.html&text=Flash+US+PMI+signals+steepest+output+slump+for+a+decade+amid+coronavirus+outbreak+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-steepest-output-slump-for-a-decade-amid-coronavirus-outbreak-March2020.html","enabled":true},{"name":"email","url":"?subject=Flash US PMI signals steepest output slump for a decade amid coronavirus outbreak | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-steepest-output-slump-for-a-decade-amid-coronavirus-outbreak-March2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+US+PMI+signals+steepest+output+slump+for+a+decade+amid+coronavirus+outbreak+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-steepest-output-slump-for-a-decade-amid-coronavirus-outbreak-March2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}