Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 23, 2026

Flash PMI shows UK business growth at 21-month high in January as optimism builds

UK businesses kicked up a gear in January, showing encouraging resilience in the face of recent geopolitical tensions. Companies are reporting higher demand, both from home and export markets, which has driven output growth to the fastest since April 2024. Firms are also reporting the greatest optimism about the business outlook since before the 2024 Autumn Budget.

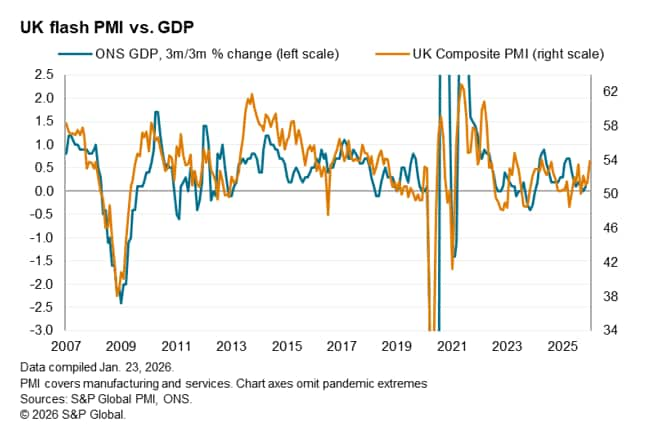

The January flash PMI is up to a level indicative of a robust quarterly GDP growth approaching 0.4%.

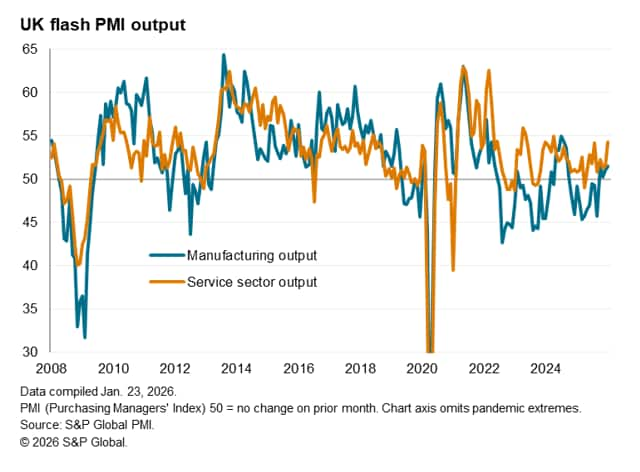

While growth continues to be driven by the service sector, and in particular financial services and tech, the manufacturing sector is also continuing to report a gathering recovery aided by resurgent demand, with goods exports notably rising for the first time in four years.

The good news was tempered, however, by the upturn in order books failing to stem a steep loss of jobs, which companies commonly blamed on the need to reduce high costs. These cost pressures were again often linked to government policies relating to higher National Insurance contributions and the Minimum Wage, and led to an especially steep further drop in hospitality jobs.

High staffing costs were also widely reported as a key cause of higher selling prices, hinting at an intensification of price pressures at a level above the Bank of England target.

Economy picks up speed

UK businesses are starting 2026 with the fastest output growth since April 2024.The PMI headline Composite PMI Output Index rose from 51.4 in December to 53.9, a 21-month high and one of the best readings since the 2022 rebound in business activity after the COVID-19 pandemic. The current PMI is broadly consistent with GDP growing at a near 0.4% quarterly rate in January, representing a marked improvement on the modest 0.1% gain signalled for the fourth quarter as a whole.

New orders growth also ticked higher, reaching the fastest since October 2024, boosted in part by the largest (albeit still modest) rise in exports since July 2024.

January's upturn was led by the service sector, where business activity growth jumped higher to reach the strongest since April 2024 amid improved inflows of new business. Financial services and tech companies again reported the strongest expansions.

However, the upturn also reflected a further improvement in manufacturing sector performance. Factory output rose for a fourth successive month in January, reviving after a near-year of continual decline, rising at the second-steepest rate since September 2024.

Even more encouraging for the goods-producing sector was a jump in new orders, which posted the largest monthly gain for nearly four years. New export orders for manufactured goods rose for the first time in four years, growing at a rate not seen since August 2021.

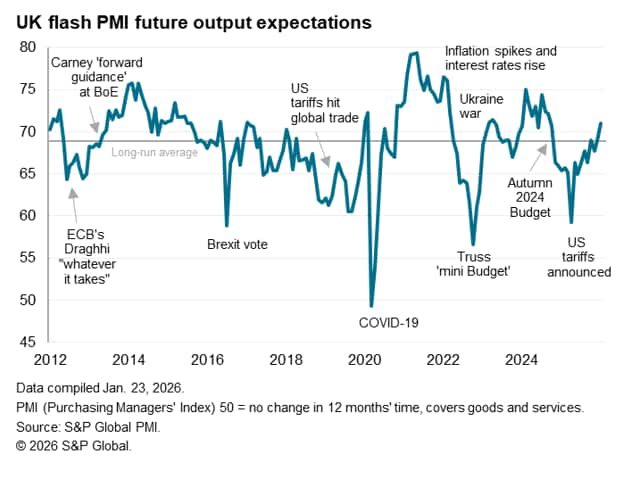

Greater optimism

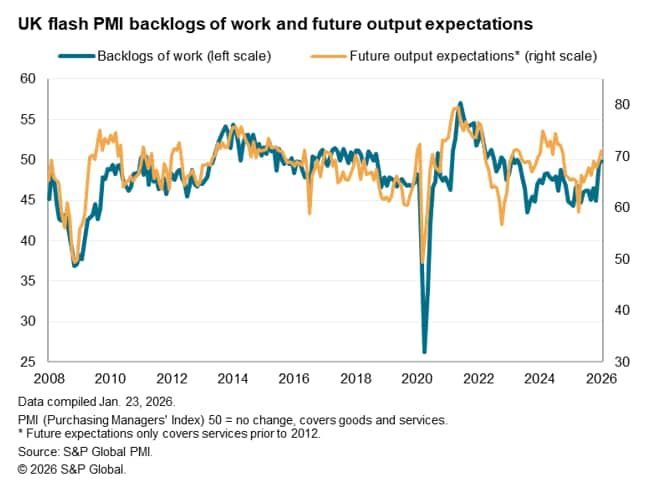

Higher activity levels and rising inflows of new business helped drive an improvement in business expectations about growth over the coming year to the highest since September 2024, after which the policies announced in that year's Autumn Budget dampened the business mood. Optimism regarding future output rose to its highest for over a year in both manufacturing and services.

The improving order book situation also helped stabilize firms' backlogs of work, which showed only a marginal decline for a second successive month in January. This contrasts with a period of steeply declining backlogs of work seen over the prior two years.

Ongoing job cuts

The revival of business optimism and upturn in order books failed to generate more jobs, however, with employment falling sharply again in January. Net job losses have now been recorded in each month since October 2024, following the employer tax rises and other increased staffing cost measures announced in the Autumn Budget of that year.

January's decline in jobs was again linked to these higher staff costs, albeit often reflecting the non-replacement of leavers rather than redundancies, and was one of the steepest reductions recorded over the past 16 months. Increased job losses were reported in both manufacturing and services, broadly indicative of around 30,000 jobs being lost in total during the month when compared with official employment statistics.

By far the steepest loss of jobs was reported in the hospitality sector, such as hotels and restaurants, though a net rise in jobs was reported in tech and financial service firms.

Inflation revives

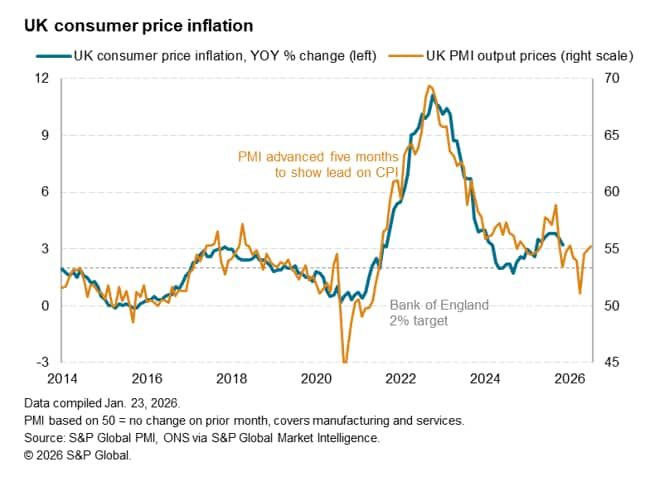

Beside the loss of jobs, a second negative from the January flash PMI survey came from the prices data. Average prices charged for goods and services rose at the fastest rate for five months, further suggesting that inflationary pressures have revived since sliding to a near-five-year low back in November. Although selling price inflation for goods remained only modest, service sector inflation picked up to a nine-month high, often blamed on higher staffing costs linked to Budget-related policies. Although average input price inflation held steady in January, it remained elevated and the highest since last May.

Comparisons with official inflation data suggest that the PMI survey's selling price gauge is broadly indicative of consumer price inflation running at around 3% into the second half of 2026, and therefore above the Bank of England's 2% target, albeit with some downside potential for inflation in the near-term.

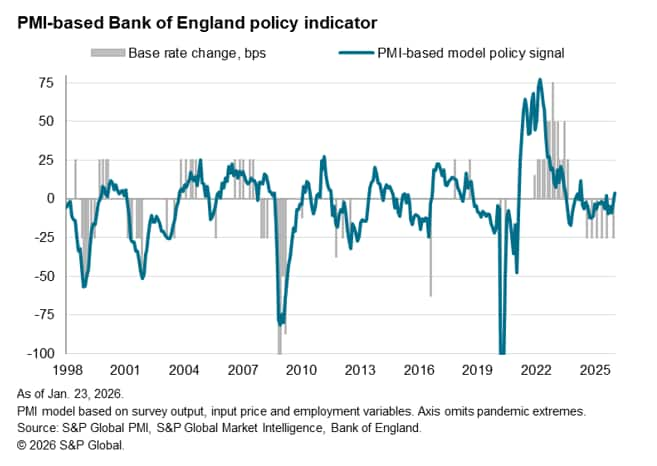

Rate cuts on hold

The flash PMI data for January follow a further cut to interest rates by the Bank of England's Monetary Policy Committee in December, which took the Bank Rate down to a three-year low of 3.75%. However, the stronger upturn in output and relatively elevated price pressures hint at rates being held steady in the short-term as policymakers assess the outlooks for prices and growth. One concern will be the ongoing drop in employment, which will add to calls for more stimulus from some rate setters and in our opinion leaves the door open to further rate cuts in 2026 if the inflation trend permits.

Read the press release here.

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-shows-uk-business-growth-at-21month-high-in-january-as-optimism-builds-jan26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-shows-uk-business-growth-at-21month-high-in-january-as-optimism-builds-jan26.html&text=Flash+PMI+shows+UK+business+growth+at+21-month+high+in+January+as+optimism+builds+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-shows-uk-business-growth-at-21month-high-in-january-as-optimism-builds-jan26.html","enabled":true},{"name":"email","url":"?subject=Flash PMI shows UK business growth at 21-month high in January as optimism builds | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-shows-uk-business-growth-at-21month-high-in-january-as-optimism-builds-jan26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+shows+UK+business+growth+at+21-month+high+in+January+as+optimism+builds+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-shows-uk-business-growth-at-21month-high-in-january-as-optimism-builds-jan26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}