Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 23, 2026

Japan’s inflationary pressures intensify alongside faster output growth

Japan's business activity expanded at a faster pace at the start of 2026, according to flash PMI data compiled by S&P Global. Private sector output rose at the quickest pace in nearly a year-and-a-half, reflecting resilient growth in January. This was underpinned by stronger demand growth, which was in turn driven by the first rise in manufacturing new orders since May 2023.

Japanese businesses responded to greater capacity pressures with additional hiring in January. That said, business optimism faded amid concerns over both domestic and external conditions. This was despite new export orders rising at the fastest pace in over four years.

Meanwhile, price pressures intensified, especially in the manufacturing sector amid the depreciation of the yen. The combination of accelerating growth and rising prices further builds the case for the Bank of Japan to tighten policy sooner rather than later, even as sentiment indicators continue to flash warning signs.

Japan's flash PMI fastest growth since August 2024

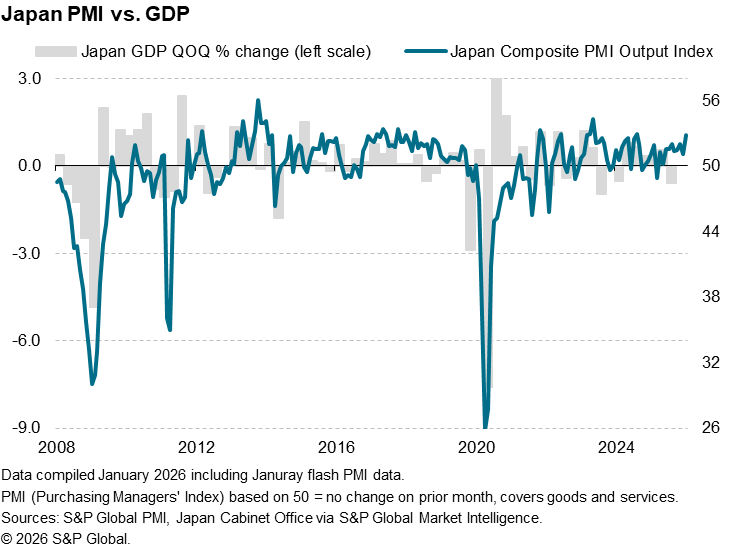

The S&P Global Flash Japan PMI Composite Output Index posted above the 50.0 neutral mark for the tenth straight month in January to signal another expansion in business activity. Moreover, the rate of growth was the fastest in nearly one-and-a-half years and solid overall. The acceleration in growth marks a departure from the more subdued expansions in private sector activity seen at the end of 2025, and demonstrates resilience in growth at the start of the year despite earlier concerns of a more protracted slowdown amid external geopolitical and trade uncertainties.

At current levels, the latest PMI reading is indicative of GDP growing at a quarterly rate of around 1.0% in January, which rests above the 0.2% average seen over the past decade. S&P Global Market Intelligence currently expect GDP growth to moderate to 0.9% in 2026, down from a forecast of 1.2% for 2025. As such, the latest PMI reading reinforces our latest growth forecast.

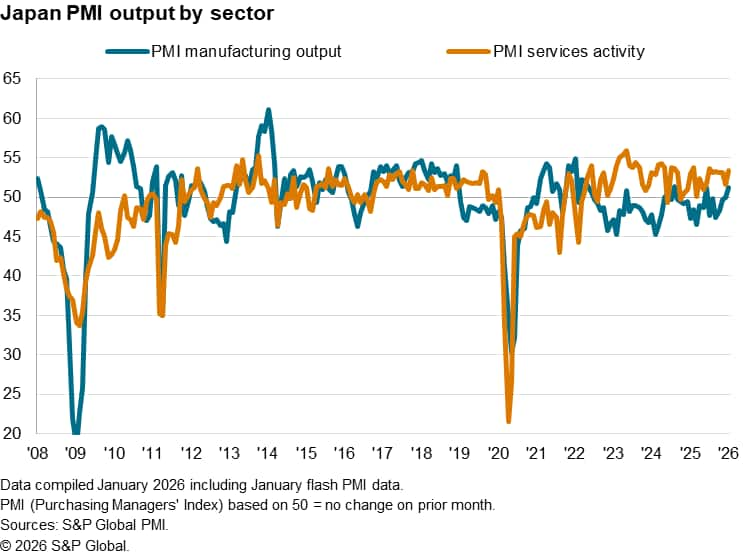

Services activity growth accelerates alongside a fresh rise in production

As well as accelerating, business activity growth became more broad-based in the opening month of the year, with manufacturing output rejoining services activity in expansion for the first time in seven months. Although modest, the rate of production growth was the joint-highest since August 2024, matched also by June 2025 (when goods output last rose).

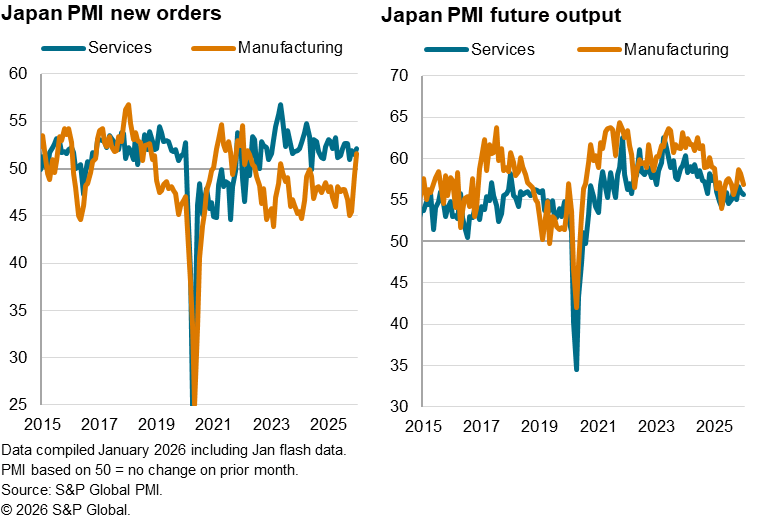

Details from the manufacturing survey showed that new product launches and better underlying demand conditions supported the first expansion in new sales in 32 months. Additionally, new orders from abroad for Japanese manufactured goods grew for the first time in nearly four years amid reports of higher new work inflows from the US, mainland China and other Asian markets.

Consequent of the surge in new orders, Japanese manufacturers lifted employment levels at the strongest pace in more than a decade. Despite the expansion in workforce numbers, the level of unfinished work in the manufacturing sector rose for the first time since the post-Covid supply constraint period around mid-2022, highlighting the pressure on capacity.

However, while both the PMI new orders and backlogs of work indices thereby point to continued manufacturing sector growth in the coming months, business sentiment among goods producers fell to a three-month low, adding some doubts to the sustainability of the manufacturing sector recovery.

Meanwhile, the service sector also saw improvement at the start of the first quarter with the strongest rise in activity in six months. The expansion in services activity was solid and backed by stronger demand at the start of the year. This similarly included foreign demand, which increased at the quickest pace in nine months despite ongoing external uncertainties.

In line with the trend for manufacturing, services new orders, backlogs of work and hiring trends pointed to the likelihood for growth to continue in the near-term. That said, a similar reduction in business confidence among service providers was also observed.

While some of the outlook jitters among Japanese firms may be attributed to potentially short-lived geopolitical uncertainties, concerns over the impact of rising costs, global economic uncertainty and domestic labour trends will need to be further monitored for any hints of a looming slowdown.

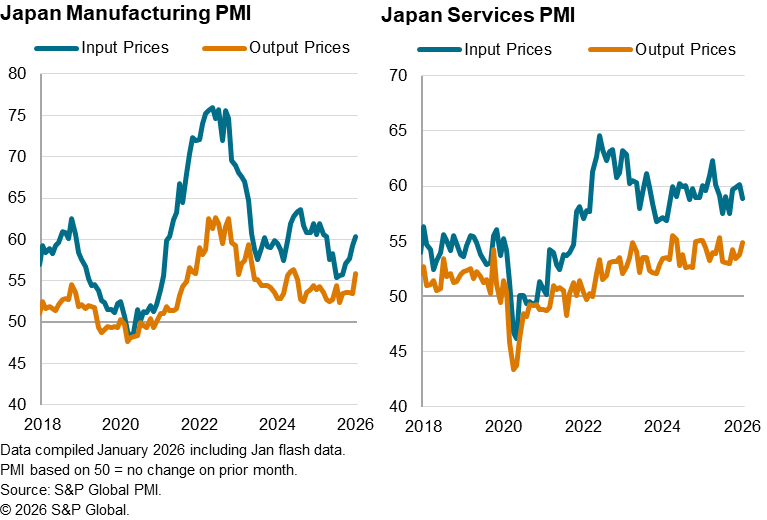

Charge inflation at 20-month high amid rising manufacturing price pressures

Turning to input prices, a divergence by sector can be seen at the start of the year. While the service sector saw input cost inflation ease from December, the opposite was true for goods producers.

Average input prices for the manufacturing sector increased at the fastest pace since last April. According to panellists, expenses rose due to higher raw materials (such as for metals), energy and supplier costs. This was further aggravated by a weaker domestic currency in January. As a result of the sharper rise in costs, and taking advantage of the period of demand growth, goods producers raised their selling prices at the quickest pace in six months. The rate of manufacturing output price inflation notably climbed to a level higher than services even as the latter also picked up at the start of the year, altogether bringing overall selling price inflation to a 20-month high.

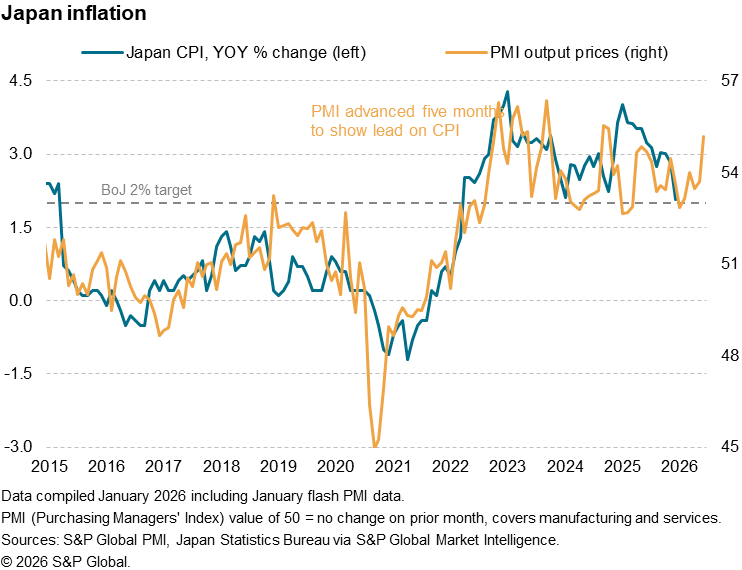

The latest rate of output price inflation was indicative of consumer price inflation rising above 3% going into 2026, which is above the Bank of Japan's (BOJ) 2% target.

Overall, the intensification of price pressures and improving growth conditions add to the likelihood of the Japanese central bank further tightening monetary policy, after last moving at the end of 2025. Broadly, the BOJ is expected to maintain a cautious approach, with the next policy rate hike potentially taking place as early as July according to S&P Global Market Intelligence's forecasters.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-inflationary-pressures-intensify-faster-output-Jan26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-inflationary-pressures-intensify-faster-output-Jan26.html&text=Japan%e2%80%99s+inflationary+pressures+intensify+alongside+faster+output+growth++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-inflationary-pressures-intensify-faster-output-Jan26.html","enabled":true},{"name":"email","url":"?subject=Japan’s inflationary pressures intensify alongside faster output growth | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-inflationary-pressures-intensify-faster-output-Jan26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan%e2%80%99s+inflationary+pressures+intensify+alongside+faster+output+growth++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-inflationary-pressures-intensify-faster-output-Jan26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}