Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 23, 2025

Flash eurozone PMI signals ongoing malaise despite brighter manufacturing news

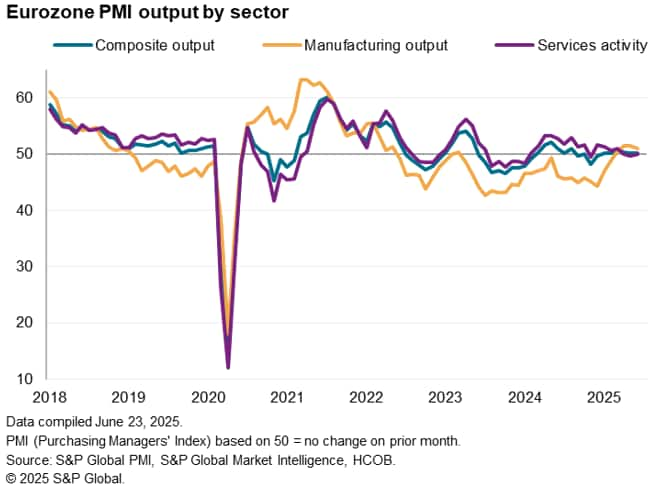

The flash PMI® survey data for June showed eurozone business activity continuing to grow at only a very modest rate, continuing the broad trend of near-stalled activity seen so far this year. However, there have been some brighter spots in recent months, notably signs of a steadying manufacturing economy after three years of steep decline, led in June by Germany.

While it remains unclear to what extent this reflects improving demand condition in the region or the front-running of US tariffs, there have been encouraging signs in relation to business confidence. Sentiment has improved markedly from a one-and-a-half year low in April, while inflation pressures also remain consistent with a further interest rate reduction, which should in turn help offset some of the dampening effect on demand from broader geopolitical concerns.

Eurozone business activity trending flat-ish

Eurozone business activity remained largely unchanged once again in June, according to provisional PMI survey data. The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, held steady at 50.2, registering only very modest growth by staying just above the 50.0 no-change mark. Each month so far this year has seen the PMI register modest growth at best for private sector output.

Service sector growth was unchanged in June after a small decline in May, while manufacturing output growth cooled slightly from the already-modest pace seen in May.

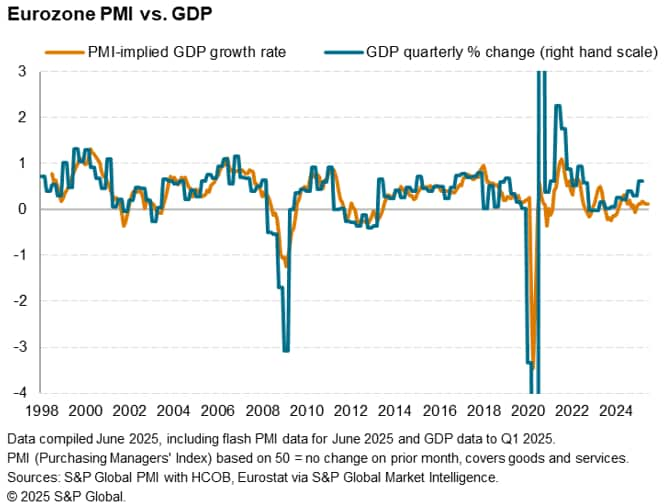

A simple statistical model indicates that PMI readings are consistent with eurozone GDP growing at a mere 0.1% quarterly rate in the second quarter.

While official GDP data pointed to a 0.6% rise in the first quarter, far stronger than the 0.1% gain signalled by the PMI over that period, we estimate that half of that gain was distorted by a huge (9.7%) surge in Ireland with an additional boost from the front loading of exports by traders ahead of US tariffs, which will likely reverse in the second quarter.

Broad based malaise hides pockets of encouragement

Within the eurozone, a marginal return to growth in Germany was offset by a slight, but steepening, downturn in France, as well as a cooling of growth elsewhere across the region to a disappointingly modest seven month low. In short, the malaise was broad-based across the region.

That said, there were some brighter spots behind the headline numbers. In particular, eurozone manufacturers reported a steadying of orders after 37 months of continual decline, helped by a near stabilisation of export sales. The uptick in the seasonally adjusted manufacturing New Export Orders Index was led by Germany, where goods exports rose to the greatest extent since February 2022, building on smaller gains in the prior two months.

While the steadying of eurozone manufacturing order books in recent months has contrasted markedly with the post-pandemic slump in demand signalled by the PMI in the prior three years, there are question marks over the sustainability of this improvement.

Fiscal spending vs. tariff front loading

Part of the steadying of eurozone production in recent months has been attributed by manufacturers to increased spending within the region (note that exports include intra-eurozone trade across national borders). This spending has in turn been linked in some cases to greater fiscal spending (and notably the removal of the German debt brake) as well as signs of greater political stability in the region, hence Germany having reported especially robust gains in terms of goods orders.

We also note that the new order to inventory ratio, which acts as a short-term leading indicator of manufacturing output, rose in June to its highest since September 2021.

However, anecdotal evidence also indicates that some of the recent improvement can also be attributed to the front-running of US tariffs, pending anticipated further tariff hikes due in July. This boost will likely prove short-lived.

Fully disentangling these two factors is not possible, meaning we will need to await further data to add clarity here, but there is certainly a suggestion that growth will weaken again once this tariff effect reverses and especially if higher rate tariffs are imposed.

Brighter outlook

More encouragingly, business expectations about output in the year ahead have picked up from April's one-and-a-half year low to now sit at their highest since January.

Sentiment improved in the services economy of the eurozone to its highest since February and, while manufacturing sentiment dipped compared to May, it remained the second highest recorded since February 2022. Sentiment also continued to revive among Germany manufacturers, to the highest since February 2022, albeit offset by reduced optimism elsewhere in the eurozone.

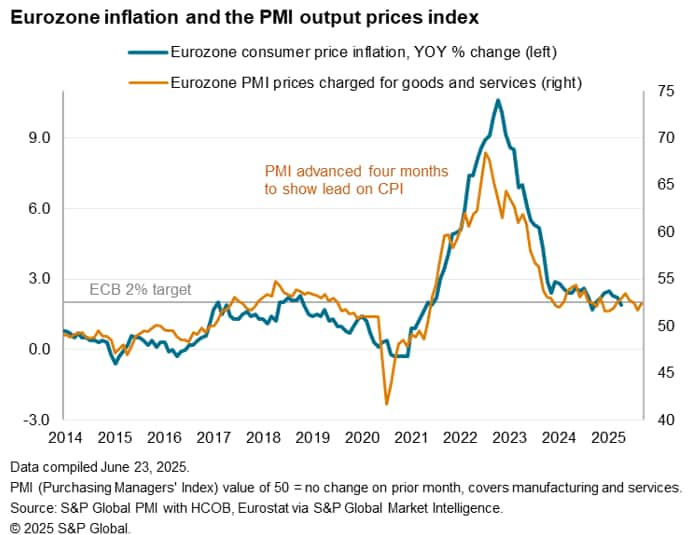

Lower inflation allows further rate cuts

While optimism has lifted compared to April's low in part due to reduced worries over US tariffs (albeit with concerns persisting as the pauses announced on higher rate tariffs are due to end in July), sentiment has also been lifted by lower borrowing costs. The ECB reduced interest rates further in early June on the back of growth worries but also in response to lower inflation, which remained muted in June according to the PMI.

Although June saw a small uptick in service sector selling price inflation, the rise was among the lowest seen since the pandemic. Goods prices meanwhile fell for a second successive month. The resulting overall rise in prices charged for goods services remains in line with the ECB's 2% inflation target, according to historical comparisons, after the headline inflation rate fell to 1.9% in May.

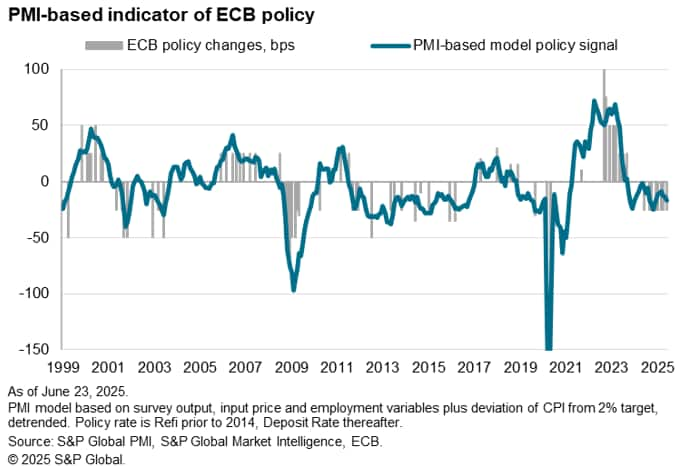

Policy loosening

A composite indicator, based on key PMI gauges and the extent to which inflation is deviating from the ECB's 2% target, has consequently slipped further into rate-cutting territory in June, reflecting the overall weakness of output growth, the cooler inflation picture, and a largely stalled labour market. June's flash PMI indicated only a marginal rise in eurozone employment for a fourth successive month after seven months of decline.

The ECB has now cut interest rates by 25 basis points eight times take the Deposit Rate to 2.00% from a peak of 4.00%. in the spring of 2024, and the weakness of the PMI means that another rate cut may be seen as we head into autumn.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-ongoing-malaise-despite-brighter-manufacturing-news-jun25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-ongoing-malaise-despite-brighter-manufacturing-news-jun25.html&text=Flash+eurozone+PMI+signals+ongoing+malaise+despite+brighter+manufacturing+news+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-ongoing-malaise-despite-brighter-manufacturing-news-jun25.html","enabled":true},{"name":"email","url":"?subject=Flash eurozone PMI signals ongoing malaise despite brighter manufacturing news | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-ongoing-malaise-despite-brighter-manufacturing-news-jun25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+eurozone+PMI+signals+ongoing+malaise+despite+brighter+manufacturing+news+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-ongoing-malaise-despite-brighter-manufacturing-news-jun25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}