Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 21, 2020

Flash Australia PMI signals deeper downturn amid adverse weather, coronavirus

- At 48.3 in February, Flash Australia PMI is lowest on record

- Orders fall for first time in nearly a year, led by survey-record decline in exports

- Business confidence weakens to four-month low

Australia's private sector business activity shrank in February as adverse weather conditions and the coronavirus outbreak took its toll, according to flash PMI data. Demand weakened, with new orders falling at a survey-record rate, led by reduced export volumes. Firms also cut back on employment.

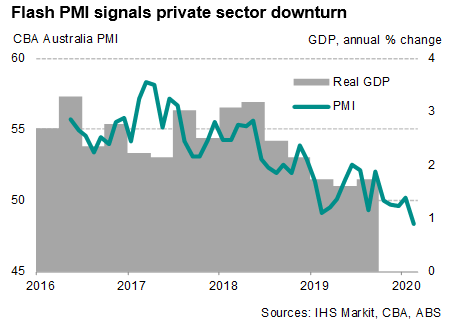

PMI sinks to record low

The Commonwealth Bank Australia Flash PMI, compiled by IHS Markit and covering both the manufacturing and service sectors, fell to 48.3 in February, down from 50.2 in January. As such, the flash estimate signalled the steepest contraction of business activity since data collection began in May 2016, indicating that the Australian economy is on track for a first quarter decline.

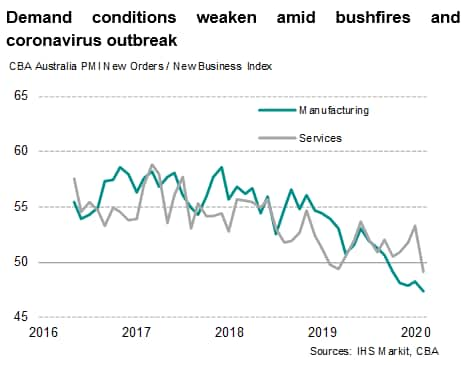

The survey data showed the downturn in business activity was broad-based, fuelled by ongoing weakness in manufacturing output and a renewed decline in services activity. Lower output was led by a softening of demand. While bushfires continued to disrupt economic activity, the outbreak of Covid-19 had reportedly also hurt sales. New business volumes of both manufacturing and service sectors declined, with goods orders and service sales falling respectively at the second-fastest and fastest rates on record.

The weak sales trend contributed to a freeing-up of operating capacity, as reflected by the first decline in backlogs of work for one-and-a-half years. The development of spare capacity in turn dampened hiring, with the survey indicating a reduction of overall private-sector employment.

Policy support

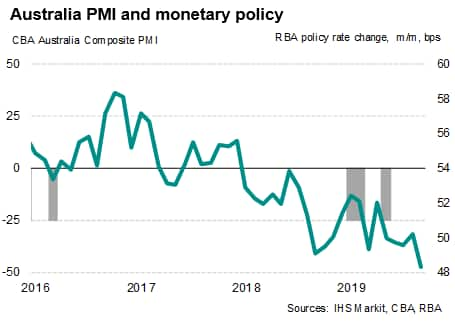

The deterioration of private sector business activity was accompanied by a weakening of business expectations, suggesting companies expect economic conditions to remain challenging in the months ahead. While still positive, the Future Output Index, a measure of confidence for the year ahead, continued to run below the series average, slipping to the lowest for four months during February.

Business confidence was primarily dented by worries over subdued demand conditions and the uncertainty surrounding the economic impact of the coronavirus outbreak, according to anecdotal evidence.

The deepening malaise in Australian private sector economy puts further pressure on policymakers to act amid recent stimulus packages announced by several Asian governments, including South Korea and Singapore. With monetary policy already very accommodative and the key policy rate edging closer to zero, there will likely be increasing calls for greater fiscal measures to support growth, especially if the economic impact of the coronavirus outbreak becomes deeper, more severe and widespread.

Bernard Aw, Principal Economist, IHS Markit

bernard.aw@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-australia-pmi-signals-deeper-downturn-amid-adverse-weather-coronavirus.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-australia-pmi-signals-deeper-downturn-amid-adverse-weather-coronavirus.html&text=Flash+Australia+PMI+signals+deeper+downturn+amid+adverse+weather%2c+coronavirus+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-australia-pmi-signals-deeper-downturn-amid-adverse-weather-coronavirus.html","enabled":true},{"name":"email","url":"?subject=Flash Australia PMI signals deeper downturn amid adverse weather, coronavirus | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-australia-pmi-signals-deeper-downturn-amid-adverse-weather-coronavirus.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+Australia+PMI+signals+deeper+downturn+amid+adverse+weather%2c+coronavirus+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-australia-pmi-signals-deeper-downturn-amid-adverse-weather-coronavirus.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}