Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 23, 2020

Eurozone rebound fizzles out as service sector reports renewed decline

- Flash Eurozone PMI signals stalling economy as rebound from COVID-19 fades

- Services contract, offsetting faster manufacturing expansion

- Germany leads upturn thanks to manufacturing surge, France and periphery slip back into decline

- Job losses ease but remain higher than at any time since early-2013

Business activity stalled across the eurozone in September, albeit with increasingly divergent trends by sector and country. Faster growth of manufacturing, led by Germany, was offset by a renewed downturn in the service sector, which was often linked to resurgent coronavirus disease 2019 (COVID-19) infection rates.

A net loss of jobs continued to be reported, though the rate of payroll reduction eased, notably in manufacturing, thanks in part to improved future expectations. Price pressures meanwhile moderated during the month.

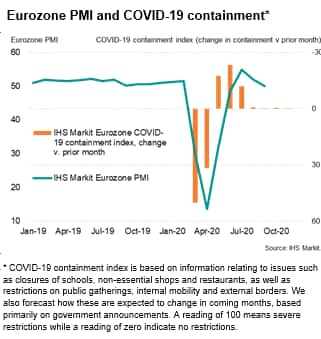

Business stalls

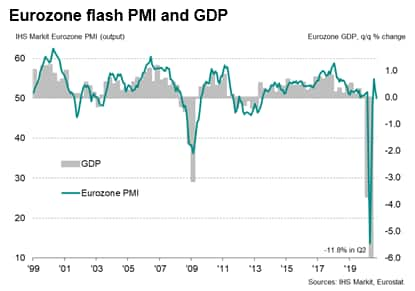

The flash IHS Markit Eurozone Composite PMI® fell for a second successive month in September, dropping from 51.9 in August to 50.1, indicating only a very marginal increase in business activity. Having rebounded sharply in July and, to a lesser extent, August from COVID-19 lockdowns during the second quarter, the PMI has since indicated a near stalling of the economy at the end of the third quarter as rising infection rates and ongoing social distancing measures curbed demand, notably for consumer-facing services.

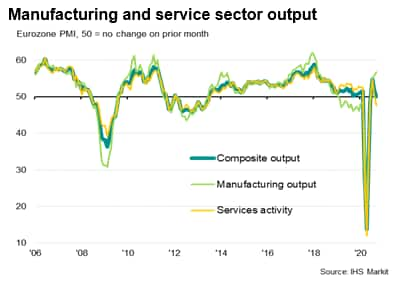

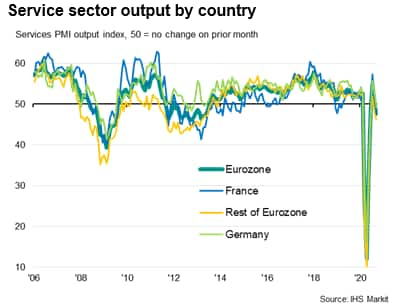

Manufacturing output growth accelerated in September to the fastest since February 2018, fueled by the largest rise in new orders seen over this period. But the service sector, having already almost stalled back in August, recorded the largest contraction of output since May, albeit with the rate of decline running far weaker than seen during the height of the pandemic.

Germany leads recovery

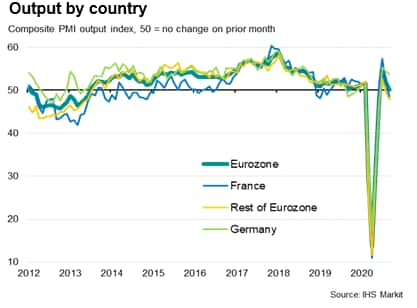

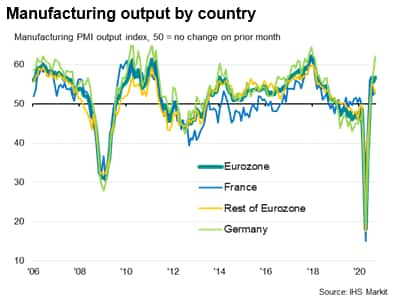

Germany continued to lead the recovery, though even here a strong surge in manufacturing output, which grew at the fastest rate since January 2018, was countered by a decline in services activity for the first time since June to cause the rate of expansion to slow for a second month running.

France meanwhile saw business activity deteriorate for the first time in four months as falling service sector output more than offset a modest rise in factory production.

Elsewhere, business activity fell for a second successive month after July's brief return to growth, with the pace of decline accelerating as an increased rate of contraction in services was accompanied by slower manufacturing output growth.

Job losses remain higher than at any time since 2013

Employment was meanwhile cut for a seventh successive month. Although the rate of job losses moderated further from April's record peak, the pace remained higher than at any time since June 2013 prior to the pandemic. An easing in manufacturing job cutting to the lowest since February contrasted with a slight increase in the rate of job losses in services, reflecting the divergent business activity trends between the two sectors. Reduced staff cuts in Germany and France were partly countered by greater job losses in the rest of the region.

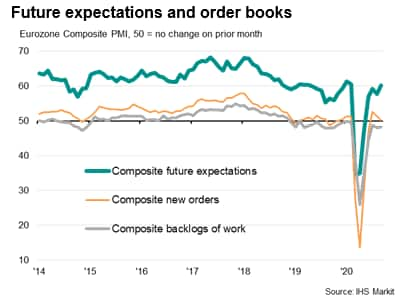

Backlogs of work fell at a slightly reduced rate, showing encouragingly robust growth in manufacturing but falling at an increased rate in services due to the latter's drop in inflows of new business. While the build-up of uncompleted work in manufacturing hints at growing capacity pressures in the factory sector, the service sector data point to the development of excess capacity.

Prices fall but costs rise

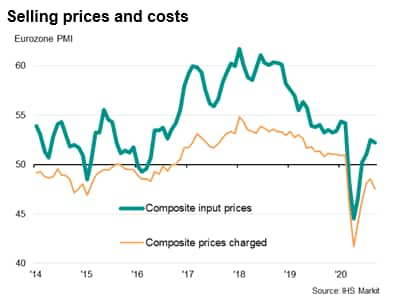

Average prices charged for goods and services meanwhile fell at the steepest rate since June, down on average for a seventh month running as firms increasingly reported the need to offer discounts to stimulate sales.

The drop in charges occurred despite costs rising again. Average input prices increased for a fourth consecutive month in September, albeit only modestly and at a slightly reduced rate compared to August. Falling manufacturing input prices, often linked to the appreciation of the euro, were offset by a further rise in services costs, in turn often blamed on higher virus protection costs.

The combination of falling selling prices and rising costs indicated the greatest squeeze on companies' margins since December 2018.

Covid-19 and the outlook

Looking ahead, business expectations about the coming 12 months hit the highest since February, improving in both manufacturing and services and across Germany, France and the rest of the euro area as a whole. But this optimism often rests on infection rates falling, which remains far from guaranteed for the coming months.

The main concern at present is therefore whether the weakness of the September data will intensify into the fourth quarter, and result in a slide back into recession after a frustratingly brief rebound in the third quarter.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-rebound-fizzles-out-as-service-sector-reports-renewed-decline-sep2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-rebound-fizzles-out-as-service-sector-reports-renewed-decline-sep2020.html&text=Eurozone+rebound+fizzles+out+as+service+sector+reports+renewed+decline+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-rebound-fizzles-out-as-service-sector-reports-renewed-decline-sep2020.html","enabled":true},{"name":"email","url":"?subject=Eurozone rebound fizzles out as service sector reports renewed decline | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-rebound-fizzles-out-as-service-sector-reports-renewed-decline-sep2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+rebound+fizzles+out+as+service+sector+reports+renewed+decline+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-rebound-fizzles-out-as-service-sector-reports-renewed-decline-sep2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}