Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 23, 2020

UK economic growth surge loses momentum at end of third quarter

- Flash UK composite PMI down from six-year high of 59.1 to 55.7, signals cooling rate of expansion

- Manufacturing and services both report slower expansions, latter hit by downturn in restaurants

- Jobs continue to be cut at rate not seen for ten years prior to the pandemic, though rate of decline eases

- Outlook darkened by rising COVID-19 infection rates and new restrictions

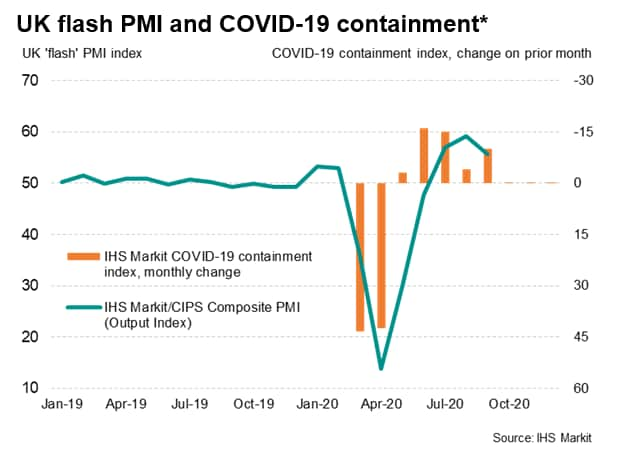

The UK economy lost some of its bounce in September, as the initial rebound from coronavirus disease 2019 (COVID-19) lockdowns showed signs of fading.

Output rebound loses momentum

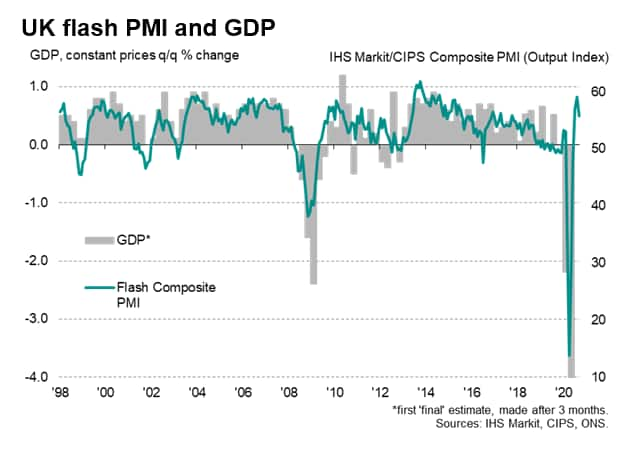

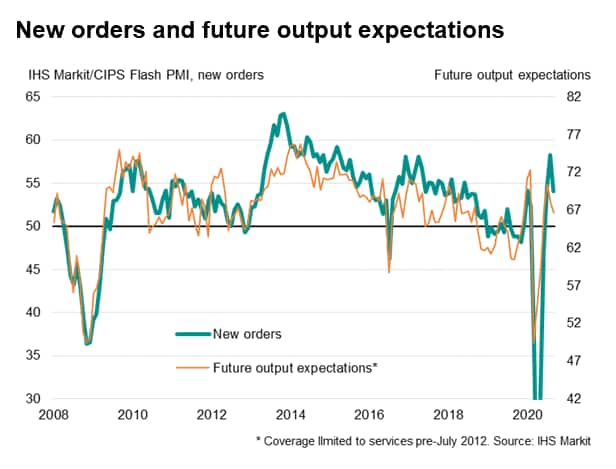

At 55.7 in September, the headline seasonally adjusted IHS Markit/ CIPS Flash UK Composite Output Index - which is based on approximately 85% of usual monthly replies - remained above the 50.0 no-change mark for the third consecutive month, to signal a sustained increase in private sector output. However, the latest reading was down from a 72-month high of 59.1 in August and the lowest since June, indicating a marked slowing in the rate of expansion. Prior to the pandemic, the 3.4-point drop in the index was the largest seen since 2016.

Where business activity growth was reported, survey respondents often commented on successfully adapting to the constraints imposed by the COVID-19 pandemic and a general boost from the reopening of the UK economy. A number of manufacturers noted that pent up customer demand, including a solid rise in exports, had encouraged them to expand production capacity.

That said, there were widespread reports that a lack of consumer confidence and persistent disruptions to business operations due to the pandemic had held back the recovery in September.

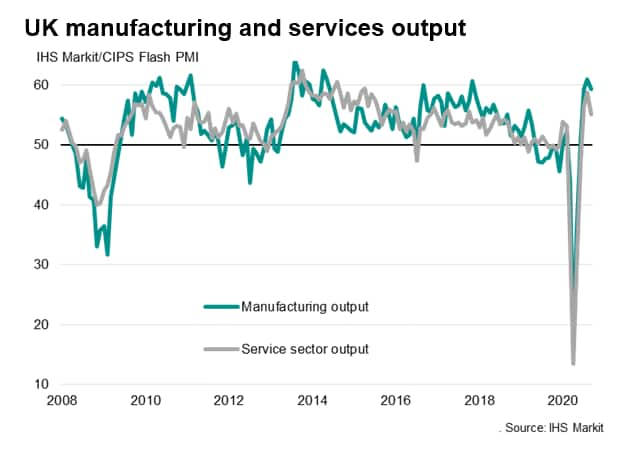

It was not surprising to see that the slowdown was especially evident in services, where the restaurant sector in particular saw demand fall sharply as the Eat Out to Help Out scheme was withdrawn. Demand for other consumer-facing services also stalled as companies struggled amid new measures introduced to fight rising infection rates and consumers often remained reluctant to spend.

Encouragingly, robust growth in manufacturing, business services and financial services offset the weakness in consumer-facing sectors, meaning the overall rate of expansion remained comfortably above the survey's long-run average, which adds to expectations that the third quarter will see a solid rebound in GDP from the collapse seen in the second quarter.

Jobs continue to be cut

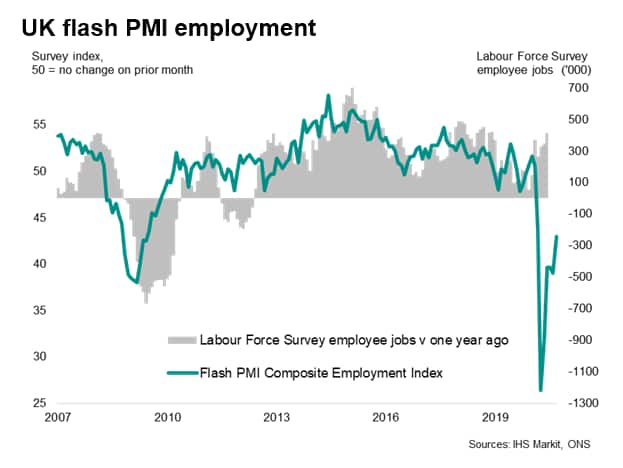

Worryingly, jobs continued to be cut at a fierce rate in September as firms sought to bring costs down amid weak demand, meaning unemployment is likely to soon start rising sharply from the current rate of 4.1%.

Although the latest reduction in headcounts was the least marked since March, the rate of job losses remained higher than at any time in the ten years prior to the pandemic.

Anecdotal evidence suggested that the forthcoming closure of the government's furlough scheme had accelerated decision-making on staffing levels, with firms typically commenting on redundancy measures alongside the recall of some employees. Job cuts remained much steeper in the service economy than the manufacturing sector.

Outlook

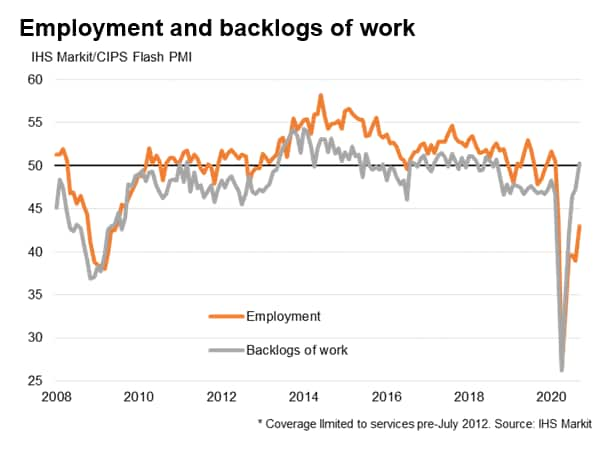

A steadying of backlogs of work after steep falls in prior months suggest that capacity and order books are now coming more into line, which would normally lead to a further easing in the need to cut jobs.

However, the indication from the survey that recovery momentum is quickly lost when policy support is withdrawn underscores our concern over the path of the labour market once the furlough scheme ends next month, and raises fears that growth could fade further as we head into the winter months, especially as lockdown measures are tightened further amid the recent rise in COVID-19 case numbers.

* COVID-19 containment index is based on information relating to issues such as closures of schools, non-essential shops and restaurants, as well as restrictions on public gatherings, internal mobility and external borders. We also forecast how these are expected to change in coming months, based primarily on government announcements. A reading of 100 means severe restrictions while a reading of zero indicate no restrictions.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economic-growth-surge-loses-momentum-at-end-of-third-quarter-Sep20.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economic-growth-surge-loses-momentum-at-end-of-third-quarter-Sep20.html&text=UK+economic+growth+surge+loses+momentum+at+end+of+third+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economic-growth-surge-loses-momentum-at-end-of-third-quarter-Sep20.html","enabled":true},{"name":"email","url":"?subject=UK economic growth surge loses momentum at end of third quarter | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economic-growth-surge-loses-momentum-at-end-of-third-quarter-Sep20.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economic+growth+surge+loses+momentum+at+end+of+third+quarter+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economic-growth-surge-loses-momentum-at-end-of-third-quarter-Sep20.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}