Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 17, 2020

IHS Markit European GDP Nowcasts: Eurozone growth to hit cyclical low in Q4 despite better-than-expected November data

Summary: 15th January 2020

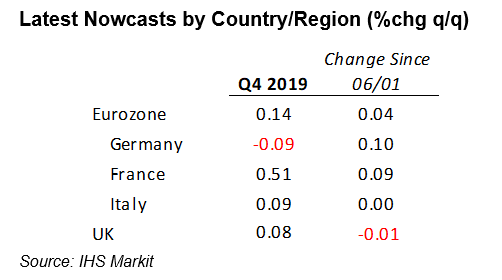

We have updated our fourth quarter nowcasts for the last time today following numerous official data releases in the past week or so. Overall, there has been little change in the message from our dynamic factor models for the eurozone and the UK, both of which look point to marginal growth of approximately 0.1% in the final quarter of 2019. Some firmer-than-expected data for Germany added 0.1 percentage points to the nowcast, but this remains in negative territory, while underlying conditions in France seemed to have picked up further since our last nowcast estimate.

Today saw Germany release its 2019 full-year GDP figures, showing a 0.6% year-on-year rise. Overall, this could imply that Germany has avoided contraction in the fourth quarter, although with no official data for December out yet, there still could be a downside surprise. Indeed, our fourth quarter nowcast for Germany suggests that underlying economic conditions did deteriorate in the three months to December. Our dynamic factor model projects a decline in GDP of -0.09%, an increase from -0.19% last time out owing to some stronger industrial and consumer spending numbers.

Over in France, robust manufacturing data for November was a key factor pushing the nowcast higher, with official industrial numbers alone almost adding 0.1 percentage points to our nowcast. Our model predicts a quarter-on-quarter expansion of 0.51% for Q4. Meanwhile, Italian growth looks set to make another sideways move, with the nowcast holding steady at 0.09% for the fourth quarter.

The main release for the UK since our last update was monthly GDP, which included industrial production and services output data. Rolling three-month GDP growth has been on a downward path since the third quarter, while PMI data show that underlying business conditions are clearly weakening. Our model estimates the UK economy grew by 0.08% in the fourth quarter, which is broadly unchanged since our last update.

Please note our next nowcast update on January 24th will be for the first quarter of 2020.

Next Nowcast Update: January 24th 2020

Joe Hayes, Economist, IHS Markit

Tel: +44 1491 461006

joseph.hayes@ihsmarkit.com

Paul Smith, Economics Director, IHS Markit

Tel: +44 1491 461038

paul.smith@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-growth-to-hit-cyclical-low-Jan20.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-growth-to-hit-cyclical-low-Jan20.html&text=S%26P+Global+European+GDP+Nowcasts%3a+Eurozone+growth+to+hit+cyclical+low+in+Q4+despite+better-than-expected+November+data+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-growth-to-hit-cyclical-low-Jan20.html","enabled":true},{"name":"email","url":"?subject=S&P Global European GDP Nowcasts: Eurozone growth to hit cyclical low in Q4 despite better-than-expected November data | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-growth-to-hit-cyclical-low-Jan20.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+European+GDP+Nowcasts%3a+Eurozone+growth+to+hit+cyclical+low+in+Q4+despite+better-than-expected+November+data+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-growth-to-hit-cyclical-low-Jan20.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}