Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 10, 2025

Emerging market confidence wanes despite a faster rise in output

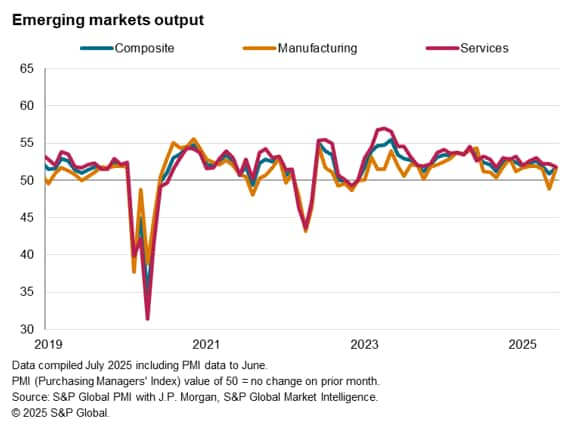

Emerging market growth accelerated in June, according to the latest PMI data. A renewed rise in manufacturing production, attributed partly to stock-building efforts ahead of the tariff deadline in July, helped to offset a slowdown in the pace of services activity growth.

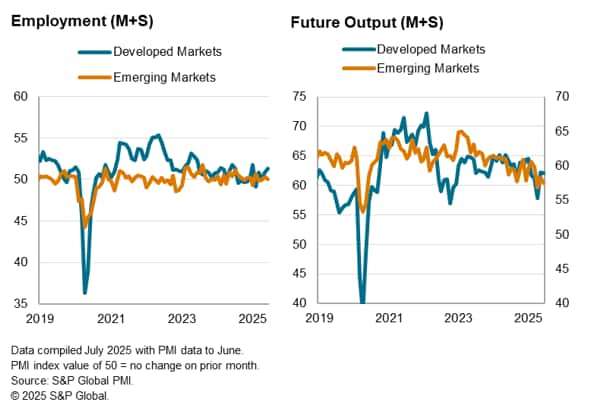

Meanwhile the Future Output Index reflected subdued optimism among emerging market businesses ahead of threatened tariff hikes, thereby indicating a more uncertain outlook following the June acceleration in output growth. Employment had also nearly stalled among emerging markets with little interest in hiring despite the uptick in the pace of business activity growth. Additionally, selling prices increased only marginally as cost pressures eased amid intense competition in June.

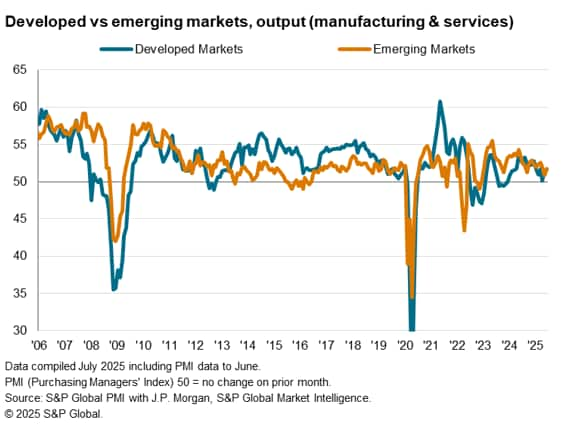

Emerging markets growth accelerates alongside developed economies

The PMI surveys compiled globally by S&P Global indicated that emerging markets continued to expand at the end of the second quarter. The GDP-weighted Emerging Market PMI Output Index posted 51.7 in June, up from 50.9 in May. This extended the period of expansion that commenced in January 2023. Despite picking up from May, the rate of expansion in June was below the average in the first five months of the year.

The improvement in growth pace was not exclusive to emerging markets as developed economies' output growth also accelerated during June. Overall, the latest data across both developed and emerging market was associated with another boost for manufacturers from the completion of orders ahead of the planned higher US tariffs deadline (July 9th) rather than being viewed as nascent signs of recovery. This had been evident on a global level with the manufacturing upturn driven partly by unusually high inventory building in the US amid tariff worries. Meanwhile services activity remained in expansion across both emerging and developed markets to aid in the overall rise in services activity, albeit with the rates of growth slowing since May.

Manufacturing rebound counters softening of services growth pace

By sector across the emerging markets, both manufacturing and service sectors recorded almost comparable rates of growth amid a convergence in conditions.

After posting the first fall in production in two-and-a-half years in May, emerging market manufacturing output returned to growth. The rate of expansion was modest but close to the rates of growth seen in the first four months of 2025. This was triggered by a renewed, though marginal, rise in new orders. Firms also worked through their existing orders, as evidenced by a third successive monthly reduction in the volume of outstanding orders as the completion of orders were rushed ahead of the looming tariffs deadline in early July.

A look into global sector data further emphasised the potential short-term nature of the latest boost to the goods producing sector, as the performance of the basic materials sector (crucial for economic development and typically linked to changes in economic cycles) remained subdued. In contrast, technology and industrials were the key manufacturing industries to record higher output in June with firms, especially in the US, accumulating inventories with risk of higher tariffs in the upcoming months.

Meanwhile, the emerging market service sector has started to appear less resilient in June as activity growth softened to the slowest pace in nine months. The rate at which services new business increased had also eased since May with exports falling for a second successive month - the longest stretch seen since August 2022.

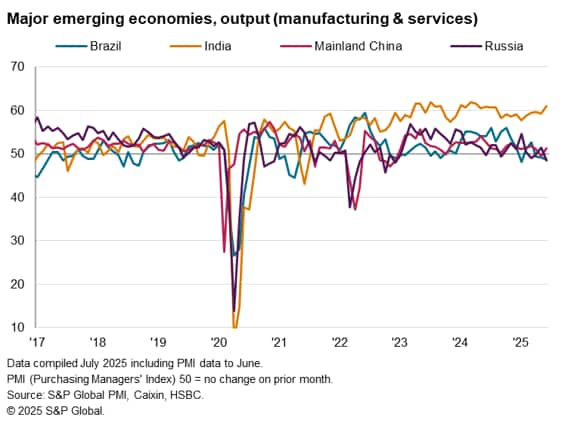

India leads growth by a wide margin while mainland China output rises modestly in June

The number of major 'BRIC' emerging market economies posting output expansions remained at two in June, albeit with mainland China replacing Russia with a modest rise in activity.

India continued to lead the emerging market expansion by a wide margin. The rate at which output rose was the fastest in 14 months, supported by quicker expansions in both the manufacturing and service sectors. Growth was particularly steep in the manufacturing sector, as export orders, especially from the US, surged.

Meanwhile, business activity growth renewed in mainland China following the first contraction in nearly two-and-a-half years back in May. This was mainly attributed to a renewed rise in manufacturing output while services activity growth slowed. The average pace of production growth in the second quarter notably paled in comparison to the first quarter of the year, even with the acceleration in growth rate to a one-year high in June.

On the other hand, a renewed fall in Russian private sector output was observed amidst a steep drop in manufacturing production and the first contraction in services activity since last June.

Finally, Brazil recorded a sharper downturn in June. The rate of deterioration was the strongest since January and characterised by quicker drops in both manufacturing output and services activity. A visible worsening of export demand contributed to the decline in manufacturing conditions in June.

Business confidence eases in June

While the acceleration in emerging market business activity growth was deemed to remain stock-building driven in June, alluding to the risk of a hangover into the second half of the year, the only sentiment-based PMI subindex, the Future Output Index, further told of uncertainty regarding growth in the coming months. Specifically, expectations regarding output in the next 12 months eased since May to signal that emerging market firms are among the least upbeat since the pandemic peak in early 2020. Confidence levels among service providers matched that of manufacturers, with the former being the joint-lowest in five years.

Concurrently, employment growth softened to a fractional level in June despite a quicker rise in output, reflecting apprehension regarding hiring. This was ahead of additional tariff updates observed at the start of July, which may well add to uncertainty for emerging markets in the months ahead.

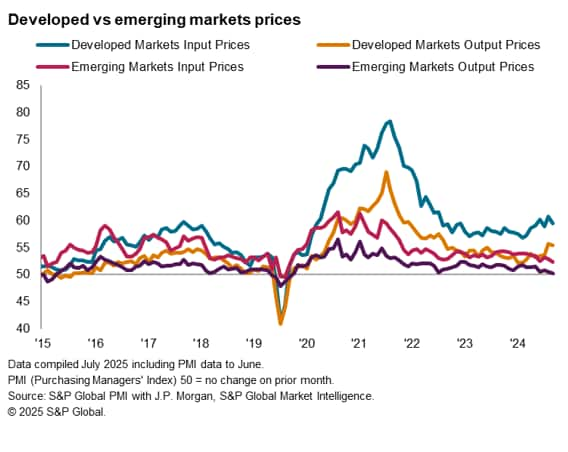

Softest rise in emerging market selling prices in nearly five years

Lastly, price pressures further eased across emerging markets in June, contrasting with US-buoyed price inflation for developed economies. The rates of input cost and output price inflation across emerging markets dipped to the lowest in 60 and 59 months respectively, signalling muted rise in prices. Anecdotal reasons revealed that the softening of inflationary pressures stemmed from a lack of demand pressure. In fact, average output prices in the emerging market manufacturing sector declined for a second consecutive month in June. Although marginal, the rate of discounting for goods was the most pronounced in nearly two years, further reflecting the intense competition among manufacturers.

Overall, the latest price trend again indicated a lack of inflationary pressures in the emerging market and thereby provide scope for regional central banks to further ease rates in view of risks of greater pressure on growth from trade policy uncertainty in the months ahead.

Access the global press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-confidence-wanes-despite-a-faster-rise-in-output-jul25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-confidence-wanes-despite-a-faster-rise-in-output-jul25.html&text=Emerging+market+confidence+wanes+despite+a+faster+rise+in+output+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-confidence-wanes-despite-a-faster-rise-in-output-jul25.html","enabled":true},{"name":"email","url":"?subject=Emerging market confidence wanes despite a faster rise in output | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-confidence-wanes-despite-a-faster-rise-in-output-jul25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+market+confidence+wanes+despite+a+faster+rise+in+output+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-confidence-wanes-despite-a-faster-rise-in-output-jul25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}