Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 01, 2018

Economic Preview - Week of 4 June 2018

- Services and composite PMI numbers updated worldwide

- Bank of England policy under scrutiny amid survey releases

- Policy meetings at reserve banks of India and Australia

Business survey data for May will provide indications of global and national economic trends midway through the second quarter, with UK data being watched especially closely for signs of a growth rebound. Meanwhile central bank meetings in Australia and India will form the main monetary policy focus.

Business surveys in focus

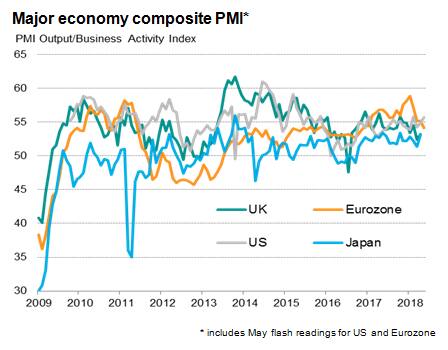

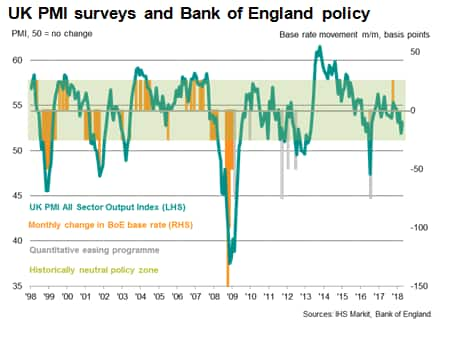

The release of service sector PMI data will add to insight from the sister manufacturing surveys, providing steers on second quarter growth for major economies including the US, eurozone, Japan and China. However, it's the UK surveys, which will also encompass the construction sector as well as the REC recruitment industry survey, that are perhaps the most eagerly awaited.

Bank of England governor Mark Carney has stressed that the central bank will be eyeing the survey data in the hope that an expected second quarter economic rebound will be confirmed. Anything less than a solid recovery in the surveys from weather-related weakness earlier in the year will reduce the chances of the Monetary Policy Committee voting to hike rates again as soon as August.

The headline worldwide PMI numbers will also be closely monitored by policymakers all over, amid recent signs that the global upturn has lost steam. A full overview of the latest global PMI data is available for download here.

Central bank meetings

The week also sees two notable central bank meetings, with investors eyeing both the Reserve Bank of Australia and Reserve Bank of India for indications of when interest rates will rise. India is widely expected to see a policy tightening in coming months, with August pencilled-in by many analysts.

In Australia, in contrast, the central bank has shown signs of becoming more cautious, meaning 2018 rate hike expectations have faded.

PMI data for both countries released during the week will provide extra guidance for policy, as will GDP numbers for Australia.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-4-june-2018.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-4-june-2018.html&text=Economic+Preview+-+Week+of+4+June+2018+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-4-june-2018.html","enabled":true},{"name":"email","url":"?subject=Economic Preview - Week of 4 June 2018 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-4-june-2018.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Economic+Preview+-+Week+of+4+June+2018+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-4-june-2018.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}