Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 24, 2025

Developed world output growth hits lowest since 2023 as confidence slumps, according to April flash PMI data

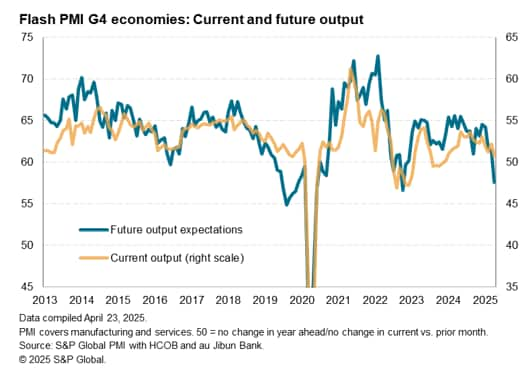

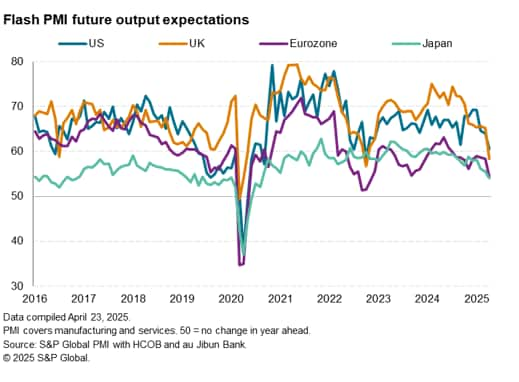

The flash PMI data compiled by S&P Global Market Intelligence indicated that business output among the G4 largest developed economies rose at the weakest rate since December 2023. Near-stagnant or falling output was recorded across all four major developed economies. The outlook also darkened as business optimism fell sharply, taking prospects to their lowest since late-2022, and the second-lowest since the pandemic, as companies cited growing concerns over the impact of geopolitical uncertainty and tariffs.

Price pressures meanwhile varied, with notable upturns for US manufacturing costs and UK selling prices, which will need to be monitored in case sticky inflation returns to limit scope for central banks to ease policy in the face of further growth weakness.

G4 output growth lowest since 2023

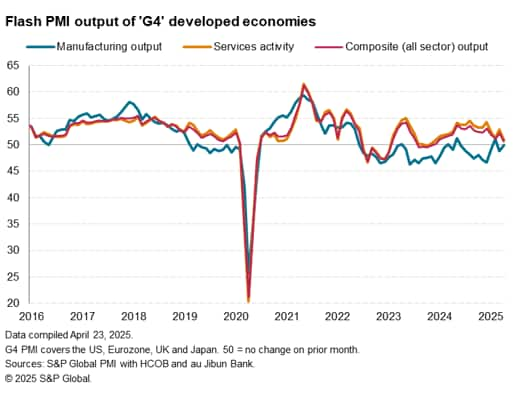

The Composite PMI Output Index from the G4 economies, a GDP-weighted gauge covering both goods and services, fell from 52.2 in March to 50.7 in April, according to the preliminary 'flash' reading. While the latest reading signalled an ongoing expansion of output, the rate of growth signalled was the weakest since December 2023.

Service sector activity expanded across the G4 collectively at the slowest rate since December 2023, growing only modestly. In contrast, G4 services activity had been growing at the sharpest rate for just over one and a half years at the end of 2024.

Manufacturing output across the G4 was meanwhile unchanged in April, sustaining a broadly flat growth picture that was evident across the first quarter on average. This flat picture in the year-to-date nevertheless represents an improvement on the marked decline of factory output seen throughout the second half of 2024.

The diverging trends across manufacturing and services can, however, in part be explained by the temporary front-running of tariffs in the goods-producing sector, as factories -notably in the US and eurozone - seek to build stock or ship items to customers before higher levies are potentially applied.

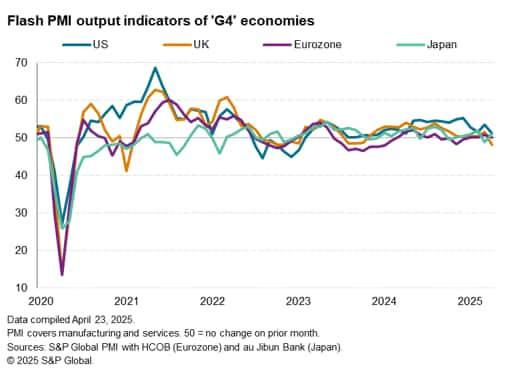

UK suffers worst performance among G4

The worst performance was seen in the UK, where output across both goods and services fell for the first time in one-and-a-half years. The decline was in fact the sharpest recorded since November 2022.

Growth meanwhile came close to stalling in the eurozone, with only a marginal rise in output recorded to register the weakest gain so far this year.

Modest growth was recorded in the US and Japan, though while the latter represented a slight bounce-back from a brief decline in March, the US expansion was notable in being the weakest recorded since December 2023.

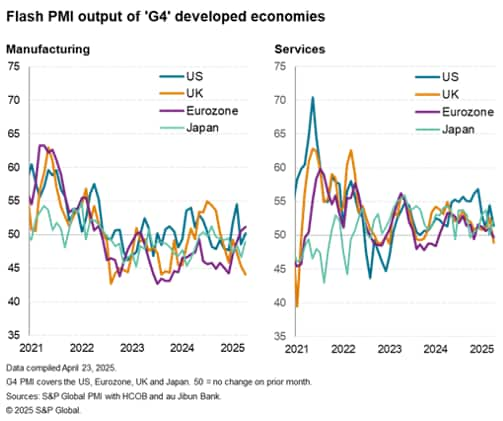

By sector, while the eurozone led the field in terms of manufacturing output, recording the fastest growth for just under three years, even here the rise was only very modest and in part linked to the front-running of US tariffs. Similarly, US production rose, but only fractionally. With Japanese factory output falling at a reduced rate, the UK stood apart in recording a steepening manufacturing decline, with output falling at a rate not seen since August 2022.

The UK also lagged the other G4 economies in terms of service sector output, recording the steepest decline since January 2023. However, service output also fell in the eurozone for the first time in five months, and US services output grew at the second-slowest rate seen over the past year, leaving only Japan reporting faster services growth.

Confidence slumps across the board

While trends in current output were somewhat mixed among the G4, there was a more common theme of deterioration in terms of future output expectations.

Measured across the G4 as a whole, business optimism about the year ahead sank to its lowest since October 2022, a time when central banks were aggressively hiking interest rates and the UK government (under Lizz Truss) faced a crisis of confidence.

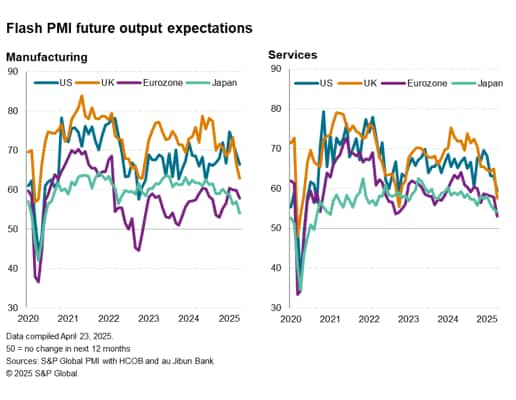

Output expectations fell in both manufacturing and services in all G4 economies, with a common thread of companies becoming increasingly concerned over economic outlooks both at home and globally, in turn widely linked to geopolitical uncertainty and recent US tariff and global protectionism announcements.

April saw sentiment slide especially sharply in the UK, down to its lowest since October 2022, followed by steep falls in the eurozone and US, down to their lowest since November 2022 and October 2022 respectively. While the monthly drop in confidence was more modest in Japan, the decline took optimism to its lowest since August 2020.

US and UK see upward price pressures

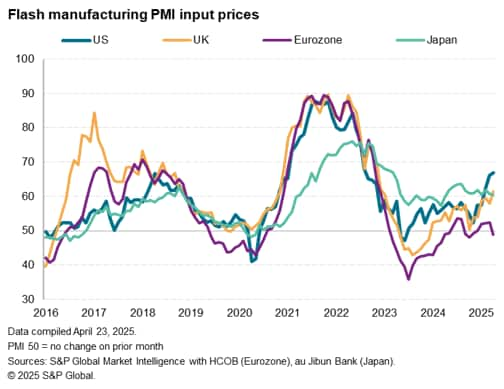

Tariff announcements were also linked to manufacturing input costs rising especially sharply again in the US, where the rate of inflation hit the highest since August 2022. In contrast, lower energy prices and supplier discounting led to a fall in manufacturing input costs in the eurozone and an easing in the rate of increase in Japan.

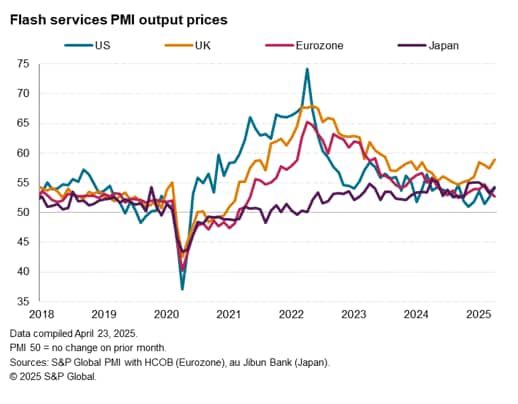

However, higher staffing costs (linked to recent government policy changes) were a key driver of higher costs in the UK across both goods and services, the latter leading to a worryingly steep rise in UK service sector selling prices, which rose at the sharpest pace since July 2023. More moderate selling price rates were seen for services in the other G4 economies, albeit edging higher in both the US and Japan.

Going forward, the future paths of these price gauges will likely prove important metrics to watch as central banks assess their scope to potentially support economic growth and labour markets. Caution may prevail as policymakers will be eager to not be caught out again by any stickiness of inflation.

Access the US, UK, Eurozone and Japan PMII press releases.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdeveloped-world-output-growth-hits-lowest-since-2023-as-confidence-slumps-april-flash-pmi-apr25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdeveloped-world-output-growth-hits-lowest-since-2023-as-confidence-slumps-april-flash-pmi-apr25.html&text=Developed+world+output+growth+hits+lowest+since+2023+as+confidence+slumps%2c+according+to+April+flash+PMI+data+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdeveloped-world-output-growth-hits-lowest-since-2023-as-confidence-slumps-april-flash-pmi-apr25.html","enabled":true},{"name":"email","url":"?subject=Developed world output growth hits lowest since 2023 as confidence slumps, according to April flash PMI data | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdeveloped-world-output-growth-hits-lowest-since-2023-as-confidence-slumps-april-flash-pmi-apr25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Developed+world+output+growth+hits+lowest+since+2023+as+confidence+slumps%2c+according+to+April+flash+PMI+data+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdeveloped-world-output-growth-hits-lowest-since-2023-as-confidence-slumps-april-flash-pmi-apr25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}