Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 04, 2019

Deepening economic downturn in September for Hong Kong SAR fuels business gloom

- IHS Markit Hong Kong Whole Economy PMI™ falls to second-lowest since early 2009

- Protests and trade wars continue to hurt demand

- Downturn is widespread across major sectors

- Business sentiment at new record low

The deterioration of the health of the Hong Kong SAR economy deepened in September, with the latest PMI survey indicating one of the steepest declines in business activity since the depths of the global financial crisis. Protracted political unrest and trade war tensions continued to hurt business sentiment, with firms' confidence sliding to a new survey low. The downturn also saw weakened price pressures as demand for goods and services slumped.

Third quarter recession

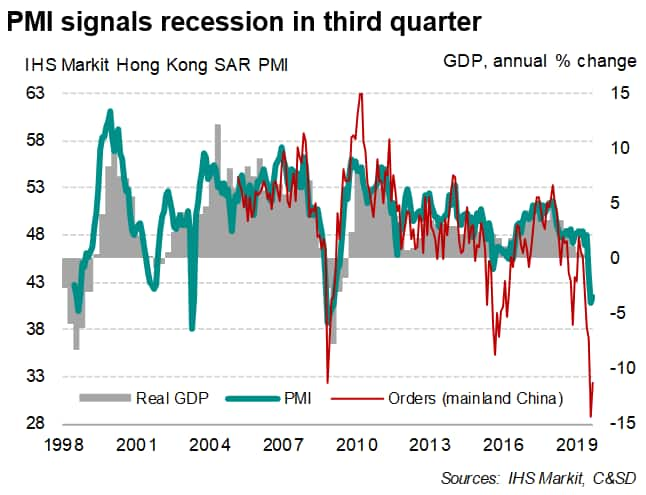

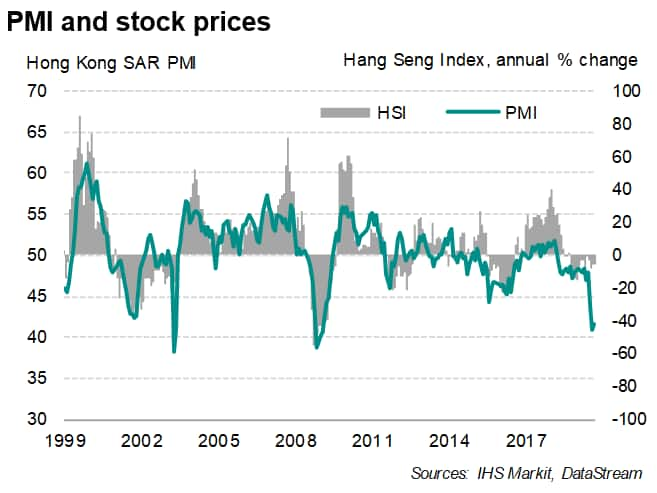

The IHS Markit Hong Kong SAR PMI™ rose slightly from 40.8 in August to 41.5 in September, indicating that business activity continued to contract at a sharp rate despite easing slightly from August, marking the second-largest deterioration in private sector conditions since February 2009.

September data finished off a third quarter in which business conditions deteriorated on average to the greatest extent since the first quarter of 2009. In over 20 years of data history there have only been two other occasions for which the PMI series has recorded a worse quarterly performance: the 1998 Asia Crisis and the 2008-09 Global Financial Crisis. Historical comparisons with GDP indicate that the PMI is broadly indicative of the economy contracting at an annual rate of over 3% in the third quarter.

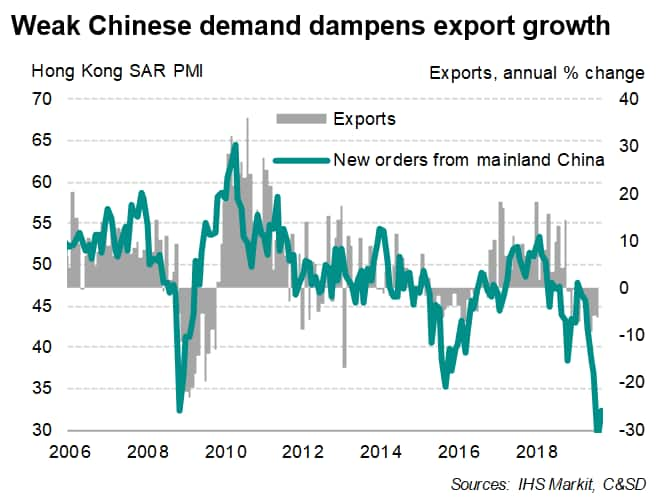

Inflows of new business fell sharply, seen at the second-fastest rate of decline in over a decade. New orders from mainland China (a survey indicator unique to the Hong Kong SAR PMI), which included tourism-related businesses, fell at the second-sharpest rate since data on this variable were first available in April 2005.

Anecdotal evidence suggest that tourism and retail sectors were particularly badly affected by political protests in the territory.

Looking further at the details of the survey, the downturn was widespread across four major sectors comprising the PMI survey. The fall in construction activity accelerated amid stalled projects, while a steepening decline was also seen in manufacturing output. Services business activity and wholesale and retail trade likewise remained stuck in deep downturns.

Business gloom

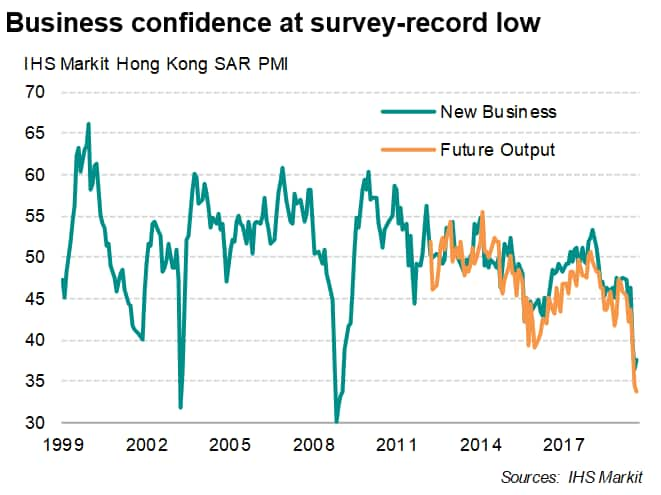

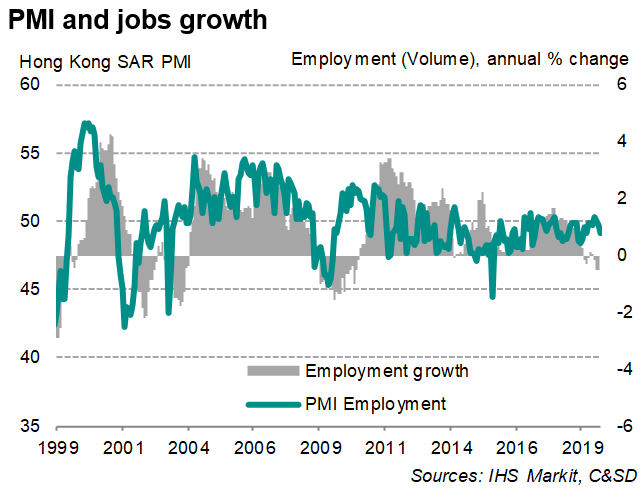

With no end in sight for the current economic malaise, September saw a worsening outlook among private sector firms. Businesses' expectations of their output in the year ahead sank to the lowest for seven-and-a-half years, reflecting escalating political unrest and US-China trade war tensions. The gloomy prognosis led firms to trim headcounts and cut back sharply on purchasing activity, the latter contributing to the steepest fall in stocks of purchases since the PMI series began in July 1998.

While an alleviation of the local political situation will surely lend support to economic activity, the global slowdown and widening trade conflicts suggest that Hong Kong economic growth is likely to remain under pressure.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdeepening-HK-downturn-in-sep-fuels-business-gloom-Oct19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdeepening-HK-downturn-in-sep-fuels-business-gloom-Oct19.html&text=Deepening+economic+downturn+in+September+for+Hong+Kong+SAR+fuels+business+gloom+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdeepening-HK-downturn-in-sep-fuels-business-gloom-Oct19.html","enabled":true},{"name":"email","url":"?subject=Deepening economic downturn in September for Hong Kong SAR fuels business gloom | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdeepening-HK-downturn-in-sep-fuels-business-gloom-Oct19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Deepening+economic+downturn+in+September+for+Hong+Kong+SAR+fuels+business+gloom+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdeepening-HK-downturn-in-sep-fuels-business-gloom-Oct19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}