Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 05, 2020

Daily Global Market Summary - November 5, 2020

Equity markets closed higher across all major global markets, with Europe's iTraxx and CDX-NA credit indices also higher across both IG and high yield. US government bonds were close to flat and European bonds closed mixed. The US dollar was weaker on the day, while oil, gold, and silver were all higher. As the world continued to wait for the final results for the US presidential election, today's US initial claims for unemployment insurance was almost unchanged versus last week and there were no major surprises from the FOMC meeting. In addition to the US election and continuous announcements of new COVID-19 restrictions, the markets will be focusing on tomorrow morning's US non-farm payroll report for October to gauge the speed of the recovery of jobs lost due to the first wave of the COVID-19 pandemic

Americas

- As of 9:32pm EST, NY Times reports Presidential candidate Joe Biden having won 253 electoral votes versus President Donald Trump's 214 (same tally as Wednesday night), with Nevada, Arizona, Georgia, North Carolina, Pennsylvania, and Alaska still undecided. (NY Times)

- Democrat Joe Biden strengthened his hold on the race for the

White House on Thursday, steadily chipping away at Donald Trump's

early lead in a pair of crucial swing states as the president's

campaign peppered the courts with legal complaints. (Bloomberg)

- Trump's lead in Georgia had dwindled to just 3,600 votes on Thursday evening, while his lead in Pennsylvania was down to 64,000, according to the Associated Press.

- In Nevada, Biden's lead widened to 11,400, from 7,600 at the start of the day.

- New tallies out of Arizona show Biden's lead has fallen to 46,257 votes ahead of Trump - a drop of 10,576 votes from the previous total.

- US equity markets closed higher for the fourth consecutive day; Russell 2000 +2.8%, Nasdaq +2.6%, and DJIA/S&P 500 +2.0%.

- 10yr US govt bonds closed flat/0.77% yield and 30yr bonds -1bp/1.53% yield.

- CDX-NAIG closed -4bps/54bps and CDX-NAHY -21bps/363bps.

- DXY US dollar index closed -0.8%/92.66.

- Gold closed +2.7%/$1,947 per ounce and silver +5.4%/$25.19 per ounce.

- Crude oil closed -0.9%/$38.79 per barrel.

- The U.S. became the first country to top 100,000 cases in one day, according to data compiled by Johns Hopkins University and Bloomberg. Illinois, Ohio, Michigan and Indiana were among states reporting record Covid-19 infections on Thursday. A Height Capital Markets analyst estimated that U.S. hospitals could reach capacity and trigger lockdowns before the Thanksgiving holiday if infections continue at the current pace. In Europe, France warned of a "violent" second wave and Greece imposed a three-week lockdown. (Bloomberg)

- The Federal Open Market Committee (FOMC) finished its two-day policy meeting this afternoon. The statement issued at the meeting's conclusion was similar to the one issued on 16 September, with minor updates to its assessments of recent inflation developments and financial conditions. The FOMC chose, as expected, to keep the target for the federal funds rate at a range of 0-0.25% and maintained forward guidance implying that the target will remain at that level for a few years, until achieving benchmarks for labor markets and inflation that were not revised. The chair's press conference began at 2:30 pm EST. He is likely to repeat calls for additional fiscal support for the economic recovery, prospects for which remain clouded with uncertainty over the outcome of elections for the US president and the US Senate. (IHS Markit Economists Ken Matheny and Kathleen Navin)

- Today's post-FOMC press briefing with Chair Powell offered insight on topics ranging from the pace of and risks to the recovery, need for additional fiscal stimulus, potential changes to the Fed's asset purchase program, and possible extensions of its emergency lending programs ("13-3"). With most 13-3 programs set to expire in December, we look for an announcement on this soon. During his prepared comments, the Chair announced that beginning in December, the FOMC will release the full set of materials for the Summary of Economic Projections, some of which do not currently become available until the release of the meeting minutes three weeks later. Overall, the Chair's remarks during today's press briefing were consistent with our current forecast and assumptions for monetary policy. (IHS Markit Economists Ken Matheny and Kathleen Navin)

- Seasonally adjusted (SA) initial claims for unemployment

insurance fell by 7,000 to 751,000 in the week ended 31 October.

Despite trending down, initial claims remain at historically high

levels—the high during the Great Recession was 665,000. The not

seasonally adjusted (NSA) tally of initial claims fell by 543 to

738,166. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 538,000 to 7,285,000 in the week ended 24 October. Prior to seasonal adjustment, continuing claims fell by 537,898 to 6,951,731. The insured unemployment rate in the week ended 24 October was down 0.3 percentage point to 5.0%.

- There were 362,883 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 31 October. In the week ended 17 October, continuing claims for PUA fell by 992,169 to 9,332,610.

- In the week ended 17 October, there were 3,961,060 claims for Pandemic Emergency Unemployment Compensation (PEUC) benefits.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 17 October, the unadjusted total fell by 1,152,854 to 21,508,662.

- US productivity (output per hour in the nonfarm business

sector) rose at a 4.9% annual rate in the third quarter following a

10.6% increase in the second quarter. Hours worked rose at a 36.8%

rate in the third quarter following a 42.9% decline, while

compensation per hour declined at a 4.4% rate after rising 20.0% in

the second quarter. (IHS Markit Economists Ken Matheny and Lawrence

Nelson)

- Data on productivity and costs have been severely impacted by fallout from the COVID-19 pandemic, so the implications of recent quarterly data for longer-run trends are unclear. Output and hours worked each fell sharply in the second quarter following smaller declines in the first quarter. Both rebounded sharply in the third quarter.

- However, hours fell further than output over the first two quarters and rebounded by less than output in the third quarter, resulting in a higher path for productivity. On balance over the first three quarters of the year, compensation per hour rose by even more than productivity, as employment in lower-wage sectors was more severely impacted than employment in higher-wage sectors.

- Unit labor costs rose at a 2.7% annual rate over the first three quarters of 2020.

- Looking ahead, we expect both productivity and compensation per hour to reverse portions of their recent increases as activity rises in lower-wage sectors. Unit labor costs are poised to trend higher.

- Productivity rose by less than we expected in the third quarter while compensation per hour declined by more than expected. Unit labor costs declined at an 8.9% pace in the third quarter, a slightly smaller decline than we had anticipated.

- US employers announced 80,666 planned layoffs in October,

according to Challenger, Gray & Christmas—down 32% from

September's 118,804. October's total is the lowest since February

but is still 60% higher than the number of cuts announced in

October 2019. (IHS Markit Economist Juan Turcios)

- October was the eighth month to report job-cut announcements specifically because of the COVID-19 pandemic, which totaled 7,803 for the month, behind other reasons including cost-cutting and restructuring. However, just as in the prior months of this pandemic, the number does not include furloughed workers.

- For the year to date (YTD), 2,162,928 job cuts have been announced, 320% higher than the same period in 2019. The current YTD total has already surpassed the record annual total of 1,956,876 announced job cuts in 2001, with two months remaining in the year (Challenger began tracking job-cut announcements in January 1993).

- Of the total job cuts announced so far this year, 1,099,726 were because of COVID-19, according to employers.

- According to Andrew Challenger, senior VP of Challenger, Gray & Christmas, "The lower numbers certainly indicate some companies impacted by shutdown orders were able to reopen and stave off cutting jobs. However, as case counts rise and more jurisdictions impose stricter enforcement, and stimulus money dries up with no coming legislation, uncertainty is likely guiding many company decisions on retaining workers."

- Unsurprisingly, the hardest-hit sector and recipient of the lion's share of the coronavirus-related cuts this year continues to be the entertainment/leisure sector, which encompasses bars, restaurants, hotels, and amusement parks. Year to date, companies in the entertainment/leisure sector have announced 845,954 cuts, a whopping 833,646 higher than during the same period in 2019. The entertainment/leisure sector announced 14,804 cuts in October, the highest number of announced cuts out of the 30 industries tracked by Challenger.

- Energy companies and transportation companies announced the second and third highest job cuts in October with 11,787 and 11,475, respectively.

- Rounding out the top five most adversely affected sectors year to date were retail (179,520 job cuts), transportation (159,674 job cuts), services (151,250), and automotive (86,169 job cuts).

- According to Challenger tracking, the number of hiring announcements in October was 255,198. In large part this reflected hiring plans by retailers in anticipation of the upcoming holiday season.

- A California judge on Thursday (Nov. 5) remanded FDA's approval of AquaBounty's genetically engineered salmon back to the agency to reconsider the potential environmental risks if the biotech fish escape and become established in the wild. The ruling from US District Judge Vince Chhabria requires FDA to update its environmental assessment under the National Environmental Policy Act (NEPA) and its Endangered Species Act (ESA) analysis. It is a blow to FDA but also unlikely to fully appease the plaintiffs who were keen to see the court strike down FDA's 2015 decision to allow AquaBounty to commercialize its GE salmon. Chhabria's decision is, however, clearly a win for AquaBounty, which warned of "devastating harms" to the company if FDA's approval were vacated. FDA approved AquaBounty's GE salmon in November 2015, declaring it as "safe and nutritious to eat" as conventional salmon after completing a new animal drug review under the Federal Food, Drug and Cosmetic Act (FDCA) that spanned more than 20 years. The agency's NEPA review found "no significant environmental impacts" associated with AquaBounty's plan to grow GE salmon at a hatchery on Canada's Prince Edward Island and a now-defunct facility in Panama. The salmon is the first - and only - GE animal FDA has approved for human consumption. The fish is an Atlantic salmon that contains a gene from a Chinook salmon and a DNA sequence from an ocean pout. The modification allows it to grow to market size in about half the time compared to a normal Atlantic salmon. A coalition of anti-biotech organizations and fishing groups filed their lawsuit in March 2016 in the US District Court for the Northern District of California, alleging the agency ran afoul of the FDCA, NEPA and the ESA. In December 2019 Chhabria tossed out the plaintiffs' challenge to FDA's authority under the FDCA to review and regulate biotech animals, but kept alive six claims related to its NEPA review and one claim the agency failed to comply with the ESA's consultation requirements. The judge also kept in play the plaintiffs' claim that FDA should have conducted an environmental review under the FDCA. Both sides filed for summary judgment earlier this year. (IHS Markit Food and Agricultural Policy's JR Pegg)

- Dana has announced that it is acquiring part of Modine Manufacturing's automotive segment business. Dana expects the acquisition to benefit its Power Technologies business unit. Dana is acquiring the business for the purchase price of USD1, although it will also assume certain financial liabilities. In the announcement, Dana chairman and CEO James Kamisickas said, "Dana's in-house engineering and manufacturing of thermal-management technologies is an important differentiator, and this acquisition is synergistic to our current portfolio, making it a natural fit for our Power Technologies business. In addition to strengthening relationships with core customers in Europe and Asia, it presents opportunities to leverage our scale to expand business with new mobility manufacturers and optimize the business to deliver significant value to our shareholders." Dana expects the new business to add about USD300 million in revenue and USD30 million in adjusted EBITDA, once the new unit is integrated. With the expanded thermal content and complementary manufacturing processes and supply chains, Dana expects this will increase the scale of its Power Technologies business by 30%, as well as accelerate Dana's electrification strategy. The acquisition is expected to strengthen relationships with new and existing light-vehicle manufacturers, as well as help Dana diversify its Power Technologies business footprint. In a statement on the deal, Modine Manufacturing said that the sale represents about 70% of the company's automotive business revenue. Dana expects the deal to be closed in the first half of 2021, and the business acquired will be consolidated in the Power Technologies segment. The acquisition will include eight major facilities with operations in China, Germany, Hungary, Italy, the Netherlands, and the United States, with the business serving global manufacturers. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Argentine light-vehicle registrations increased 14.6% year on

year (y/y) in October, according to the latest data from the

Automotive Dealers' Association of the Republic of Argentina

(Asociacion de Concesionarios de Automotores de la Republica

Argentina: ACARA). (IHS Markit AutoIntelligence's Tarun Thakur)

- The increase in sales due to a resumption of production at all plants, rapid rebuilding of inventories, and offers by vehicle dealers. Argentina was in total lockdown for a few days in May owing to the COVID-19 pandemic, but most plants reopened by 8 June, and by mid-July, all light-vehicle assembly plants were back on line. In the year to date (YTD; January to October), Argentina's light-vehicle sales declined 31.4% y/y.

- Argentina's light commercial vehicle (LCV) registrations increased 16.2% y/y in October, and passenger car sales were up 13.7% y/y. Argentina's light-vehicle market is still driven by passenger-car sales, which accounted for 65.5% of total light-vehicle registrations in October.

- However, this share was down from 66% in October 2019. Sport utility vehicle (SUV) sales increased 8.8% y/y in October. In October 2020, SUVs held a light-vehicle market share of 21.4%, compared with 22.5% in October 2019.

- Argentina's light-vehicle sales dropped 43.5% in 2019. IHS Markit projects a sharp 32.1% decline in Argentina's light-vehicle sales in 2020, followed by a 0.9% increase in 2021, which may be characterized as a step towards stability, since the projection for 2022 is 4.8% growth.

- As of now, we anticipate a quick recovery for Argentina, as any time the currency depreciates quickly an increase in exports and a quick recovery in light-vehicle sales follows. We will continue to monitor the market to evaluate if a revision to our 2021 outlook is needed, as when this phenomenon occurred previously, we saw a vacuum effect. The forecast is for a release of pent-up demand and growth in 2021 to 2027. Argentina is not forecast to see annual light-vehicle sales of over 500,000 units again until 2027.

Europe/Middle East/Africa

- European equity markets closed higher; Spain +2.1%, Germany +2.0%, Italy +1.9%, France +1.2%, and UK +0.4%.

- 10yr European govt bonds closed mixed; Italy -3bps, France/Spain flat, Germany +1bp, and UK +3bps.

- iTraxx-Europe closed -4bps/54bps and iTraxx-Xover -18bps/321bps.

- Brent crude closed -0.7%/$40.93 per barrel.

- As expected, the Bank of England (BoE) made no changes to

record-low interest rates but increased its wider support for the

economy in its November session. (IHS Markit Economist Raj Badiani)

- The BoE's Monetary Policy Committee (MPC) voted unanimously to maintain the Bank Rate at 0.1% at its meeting ended 4 November and did not hold a vote to impose negative rates.

- The MPC voted unanimously for the BoE to continue with its existing programmes of UK government bond and sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, maintaining the target for the total stock of these purchases at GBP745 billion (USD967.8 billion) by the latter stages of this year.

- As of 4 November, the total stock of the Asset Purchase Facility (APF) was GBP717 billion, representing a rise of GBP272 billion as part of the combined GBP300-billion programs of asset purchases announced on 19 March and 18 June. This consists of GBP262 billion of UK government bonds and GBP10 billion of sterling non-financial investment-grade corporate bonds.

- In addition, the MPC voted unanimously to purchase another GBP150 billion of government bonds to raise the total amount of quantitative easing (QE) from GBP745 billion to GBP895 billion over the course of 2021.

- The BOE's governor stated that the additional policy stimulus was to mitigate the "dramatic impact" of rising coronavirus disease 2019 (COVID-19) cases and the tougher lockdown restrictions across the United Kingdom.

- The inflation outlook is benign. The rate stood at a multi-year low of 0.5% in August and is set to remain below 1.0% until early 2021, below the BoE's 2% target. Lower inflation is due to the impact of lower energy prices and the temporary cut in VAT for the hospitality sector, holiday accommodation, and tourism attractions. However, inflation is expected to be "around 2% in two years' time" because of increasing domestic price pressures as spare capacity diminishes.

- The MPC's central projections assumes "an immediate but orderly move to a comprehensive free trade agreement (FTA) with the European Union on 1 January 2021". The EU-UK FTA could mirror the Comprehensive Economic and Trade Agreement (CETA) in place between Canada and the European Union, which removes most tariffs on goods and increases quotas. However, it fails to encourage trade in services, with trade in financial services not included.

- The BoE could decide to increase the target stock of purchased

UK government bonds for the fourth time during the COVID-19 virus

crisis. The triggers could be as follows:

- A second wave of infections spills into 2021, triggering an extended national lockdown. Indeed, the MPC continues to acknowledge that growth and inflation developments depend "on the evolution of the pandemic and measures taken to protect public health".

- The termination of the CJRS in March 2021 triggers a second wave of substantial job losses and a more elevated unemployment rate.

- The risk that the UK-EU trade talks could fail, with the UK having to resort to World Trade Organization (WTO) terms when trading with the EU from 1 January 2021. We believe that this could trigger a new recession in the UK in the first half of 2021, and we would anticipate a further expansion of the QE program.

- According to IHS Markit's October update, the economy is likely to contract by 11.0% in 2020. However, it appears that the UK is on course for a sharper contraction, probably by at least 12.0% in 2020.

- UK passenger car registrations slid by 1.6% y/y during October.

According to the Society of Motor Manufacturers and Traders (SMMT),

registrations fell to 140,945 units, from 143,251 units in October

2019. (IHS Markit AutoIntelligence's Ian Fletcher)

- Fleet registrations were the biggest drag, declining by 3.3% y/y to 77,249 units, while private registrations were flatter, growing by 0.4% y/y to 60,422 units.

- Registrations among business customers increased by 4.0% y/y to 3,274 units.

- Fuel-type data for October reflect the big swings in both consumer preference and technology availability. Gasoline (petrol)-engine passenger car registrations dropped by 21.3% y/y to 69,704 units during the month, and diesel registrations plummeted by 38.4% y/y to 20,941 units.

- The shift is partly explained by the fact that mild-hybrid electric vehicles (MHEV) are becoming more prevalent, with sales of diesel MHEVs increasing by 56.6% y/y to 6,129 units in October and registrations of gasoline MHEVs expanding by 545.8% y/y to 16,023 units.

- Other customers are making a more conscious move in the direction of alternative-powertrain technologies. Traditional hybrid registrations rose 39.0% y/y to 11,038 units, and plug-in hybrid electric vehicles (PHEVs) recorded an even bigger percentage increase, jumping 148.7% y/y to 7,775 units.

- Battery electric vehicle (BEV) registrations also rose by 195.2% y/y to 9,335 units. Nevertheless, the market share of these three vehicle types remained in single figures.

- The latest registrations data come on the same day that England enters a new, stricter lockdown. This follows the imposition of a "firebreak" lockdown in Wales since 23 October, which will remain in place until 9 November, and which has seen the closure of non-essential retailers including vehicle showrooms.

- The slide in October registrations, along with the steep declines earlier this year as a result of the COVID-19 virus-related lockdown, means that the market is now down 31% y/y in the year to date (YTD) at 1,384,601 units.

- Eurozone retail sales volumes dropped by 2.0% month on month

(m/m) in September, a larger fall than expected (the market

consensus was -1.0% m/m according to Reuters' survey). August's m/m

surge of 4.4% was revised marginally downwards to 4.2%. (IHS Markit

Economist Ken Wattret)

- The third quarter registered a record q/q increase in sales of 10.2% despite the latest drop, with the level of sales in September just over 1% higher than where it was in February prior to the COVID-19 virus-related collapse in March and April.

- However, the breakdown of September's figures showed weakness across the board. Sales of textiles, clothing, and footwear in particular plunged (-7.6% m/m) and remained around 11% below their February level.

- Mail order and internet sales, which have unsurprisingly outperformed during the pandemic, also dropped sharply in September (-5.5% m/m), although the level of sales remained almost 15% above where it was in February.

- Across other categories of spending, the picture remains mixed. Sales of audio and video equipment and household appliances were well above February's level (+7%), along with sales of computers, software, and telecoms (+2%), although both showed m/m declines in September.

- The third quarter's record increase in retail sales was boosted by exceptionally strong "carry-over" effects stemming from the very large gains from May to July as containment measures were eased and spending rebounded.

- The reverse effects points to a much weaker outcome in the fourth quarter, however, reflecting the resurgence in COVID-19 cases and related restrictions, with the eurozone headed for a double dip

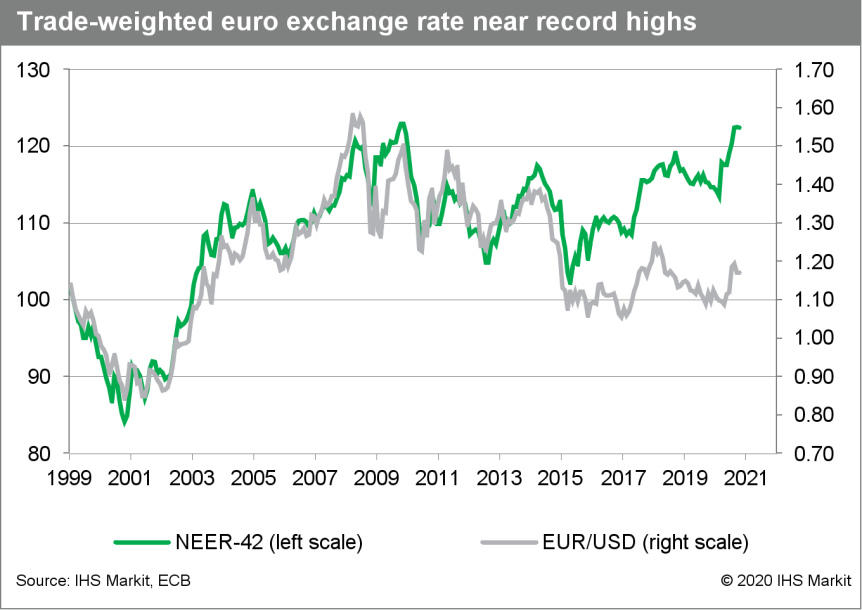

- Record low core inflation, deteriorating economic prospects,

and the elevation of the euro exchange rate have raised the

probability of a reduction in the European Central Bank's (ECB)'s

Deposit Facility Rate (DFR). (IHS Markit Economist Ken Wattret)

- The ECB has lowered its DFR below zero on five occasions, each time by 10 basis points (to the present level of -0.5%). However, only one of those five reductions has occurred since 2016, in September 2019 at the tail end of Mario Draghi's presidency.

- The significance of the latter change was that it was accompanied by the introduction of a two-tier system for reserve remuneration, in which part of commercial banks' holdings of excess liquidity at the ECB are exempt from the negative interest rate, thereby limiting its cost to banks (and avoiding potentially adverse effects on the cost and supply of loans).

- The introduction of this tiering process signaled that the ECB had not yet reached the lower bound for the DFR, keeping the option open for further (modest) reductions should the need arise for additional policy accommodation. This is reflected in the ECB's forward guidance, which states that the policy rates are expected to remain "at their present or lower levels", conditional on inflation prospects.

- The ECB's implied preferences regarding its various policy instruments are reflected in the DFR having hardly moved in over four years, while the ECB's asset purchase programs and long-term liquidity provision to banks have continued to drive huge balance-sheet expansion.

- Given the various factors highlighted above, we now conclude that a DFR cut of 10 basis points in December is likely, as part of a package of stimulus measures reflecting the material change in the outlook and the ECB's eagerness to demonstrate both that it is sensitive to these developments and that it has not run out of policy ammunition. We will incorporate this into our updated baseline forecast in mid-November.

- We recognize that the arguments are not all one way when it comes to the DFR and the ECB could concentrate on other policy instruments instead. The Pandemic Emergency Purchase Programme (PEPP) remains the ECB's preferred policy tool and we expect at least a EUR500-billion uplift in December, whether the DFR is lowered or not.

- There is also likely to be some reluctance within the ECB's Governing Council to take the DFR even further below zero, given the possible adverse side effects on the bank lending channel. We also acknowledge that a 10 basis-point rate cut will not make a radical difference to short-term growth and inflation prospects.

- However, it can still have a positive impact on monetary

conditions in the eurozone, by lowering expectations of the future

path of policy rates, leaning down in turn on longer-term interest

rates and at the margin, and households' and corporates' borrowing

costs.

- The German passenger car market posted a 3.6% y/y decline in

October to 274,303 units, according to the latest data from the

KBA. This brings the year-to-date (YTD) figure for the first three

quarters of the year to 2,316,134 units, a decline of 23.4% y/y.

(IHS Markit AutoIntelligence Tim Urquhart)

- The private market continued to show signs in October that it is responding to the twin government stimulus measures introduced at the beginning of July - a reduction in VAT from 19% to 16% and extended subsidies for electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs).

- Private registrations last month rose 6.8% y/y, to take an unusually high market share of 38.1%. However, any gains in private registrations were counteracted by declines in dealer, business, and fleet registrations, which fell by 9.1% y/y to take a 61.8% share of the market.

- In terms of the fuel split of passenger car sales, gasoline (petrol) cars took a 42.1% share of the market, although volumes fell by 29.8% y/y to 115,382 units, while diesel witnessed a big decline as well, taking a 26.0% of the market with volumes of 71,370 units.

- Pure battery electric vehicle (BEV) sales were up by 365.1% y/y to take an 8.4% share of the market, while hybrid sales were up by 138.5% y/y to 62,929 units to take a share of 22.9%. Of these 62,929 units, 24,859 were PHEVs, equating to an overall market share of 9.1% y/y.

- The October market in Germany probably reflected the uncertainty that is currently prevalent within society and among the country's economic and business institutions, as it becomes ever more apparent that there will not be a short-term fix to the COVID-19 virus pandemic.

- Another month-long lockdown was imposed on 28 October, although car dealerships are allowed to remain open if they follow strict procedures. However, the psychological impact of this second lockdown on consumer and business confidence remains to be seen.

- The significant reduction in business registrations in September suggests an increasingly cautious approach to pre-registering vehicles in order to manage inventory.

- German turbine engineering company Aerodyn Engineering has obtained a statement of feasibility from DNV GL for its variant super compact drive (SCD) technology nezzy2 floating wind turbine. The endorsement of safety, quality, and performance standards by DNV GL will allow Aerodyn to secure investments to embark on a full-scale test. The current model is a 1:10 model, and is being tested in the Bay of Greifswald off German. The nezzy2 is a dual downwind driven system that uses the same floating body, self-aligning and anchoring system as its predecessor SCDnezzy. The model has one central tower which branches into two leaning steel towers with the SCD turbines sitting at the tip, and secured by preloaded steel rods. Aerodyn has said that the 18 meter tall scale model was fitted with 180 sensors during the trial and measurements showed that the unit performed well under different wind and wave conditions, surviving a storm equivalent of a category four to five hurricane with waves reaching 30 meters high. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- French pure-play company in floating foundations for offshore wind, Ideol, has teamed up with Swedish concrete structures producer Bygging Uddemann (BYUM) to advance the serial production of Ideol's concrete floater design. The companies will work together in optimizing a gantry slipforming solution that will be easily implementable by all leading construction companies around the world. Ideol currently has its floating concrete foundation deployed as a demonstrating for a 2 MW Vestas V80 wind turbine at the EOLMED project. In September, it announced a strategic partnership with mooring cables and rope supplier Bridon Bekaert Ropes Group (BBRG) to develop and new synthetic mooring solution specifically for the floating offshore wind market. The product will focus on cost-reduction, capacity, and lead-time expectations to meet the growing demands of the floating offshore wind industry. (IHS Markit Upstream Costs and Technology's Melvin Leong)

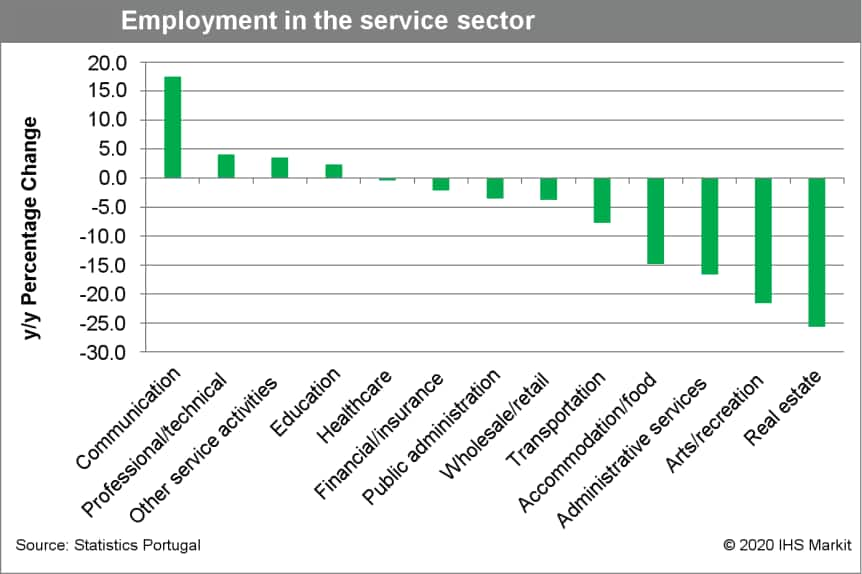

- Portugal's unemployment rate stood at 7.8% during the third

quarter, according to non-seasonally adjusted figures released by

Statistics Portugal. It rose by 1.7 percentage points compared with

the same period of 2019 and 2.2 percentage points compared with the

second quarter of the year. A rebound in the labor force was a key

factor driving the unemployment rate up. (IHS Markit Economist

Diego Iscaro)

- While the gradual reopening of the economy since May led to a 1.5% quarter-on-quarter (q/q) increase in employment, the number of jobs fell by 3.0% year on year (y/y). Employment in the manufacturing sector waned by 1.5% y/y during the third quarter, while employment in the services sector declined by a stronger 3.4% y/y. Within services, employment in the real estate and arts and recreation sectors fell strongly.

- The reopening of the economy also led to a large increase in the labor force on a q/q basis (+3.9%). However, the labor force during the third quarter was still 1.3% below its level a year earlier.

- The number of unemployed people jumped by 45.1% q/q, its strongest increase on record. Almost half of the unemployed population was formerly employed in the service sector, while a similar percentage had been seeking for a job for less than 12 months.

- Labor market conditions are expected to deteriorate further

during the fourth quarter, as the renewed tightening of

restrictions takes its toll on firms' hiring decisions.

- Denmark culled 17 million mink to prevent COVID-19 mutation causing renewed pandemic. The mutated strain has been transmitted to 12 people in Northern Jutland, where a large majority of Denmark's farms are located. Up to 17 million animals will be culled, in a move to ensure development of a vaccine against COVID-19 and efforts to control the disease will not be in vain. Danish prime minister Mette Frederiksen explained the Statens Serum Institut has found examples of the mutated COVID-19 virus in people showing reduced susceptibility to antibodies - meaning the strain poses the risk an upcoming vaccine will not work effectively. The first mink farms in Northern Jutland found to be infected with the COVID-19 virus were identified in mid-June. The virus has since spread to 207 farms across Jutland, as of November 4. Statens Serum has identified infection involving the mutated strain on 168 mink farms in the Northern Jutland region since August. Minister for food and fisheries Mogens Jensen said: "We are facing one of the biggest health crises the world has ever experienced. The Danish government and I are painfully aware of what this means for all the Danish mink farmers who are about to lose their livelihood and for some their entire life's work. But it is the right thing to do in a situation where the vaccine, which is currently the light at the end of a very dark tunnel, is in danger." The Danish government will provide an economic incentive of DKK20 ($3) for each mink if farmers cull all their animals within 10 days, or five days for farms with under 7,500 animals. (IHS Markit Food and Agricultural Policy's Sian Lazell)

- Valmet Automotive has announced that it is expanding battery pack production at its facility in Salo (Finland). According to a statement, construction work has already started and includes buildings for logistics and manufacturing functions. The installation of a new production line will also allow for a broader range of products. The work is expected to be completed by mid-2021. Valmet added that the expansion will require an increase in the number of employees from around 200 to more than 400 during 2021 and 2022. Production began at the battery pack site, run by Valmet Automotive's EV Systems business line, during 2019. However, strong demand for battery packs - underlining the growth in vehicle electrification - has led to the company undertaking further investment in this area. The company notes that it already has three contracts with unnamed businesses, and further manufacturing contracts are in the pipeline. In addition, the EV Systems business line also offers battery engineering and testing services. (IHS Markit AutoIntelligence's Ian Fletcher)

- According to a 'flash' GDP estimate for the third quarter by

Statistics Sweden (SCB), the Swedish economy grew by 4.3% quarter

on quarter (q/q) and declined by 3.5% year on year (y/y) on a

calendar-adjusted basis. (IHS Markit Economist Daniel Kral)

- This is almost fully in line with our forecast growth of 4.4% q/q and means that the Swedish economy recovered just over half of the lost output in the second quarter, when it contracted by 8.3% q/q.

- There is no breakdown available accompanying the release, but the SCB notes that the recovery in the third quarter was driven by a strong export performance, which is supported by monthly data.

- Although Sweden has suffered a much shallower downturn than the eurozone, their levels of output in the third quarter compared with pre-pandemic levels (the fourth quarter of 2019) are almost identical. The Swedish economy was 4.2% and the eurozone 4.3% smaller than pre-pandemic levels.

- Although Sweden's approach to containing the spread of the COVID-19 virus has differed from most European countries, relying on voluntary behavioral changes rather than a lockdown, the level of restrictions in Sweden throughout much of the third quarter was stricter than in many major West European economies, likely weighing down on parts of the services economy

- Turkey's merchandise trade deficit surged in the third quarter,

fueled by a 10.7% year-on-year (y/y) jump in merchandise imports.

Imports of gold had a particular impact on the trade deficit.

Regardless of the cause, the wider trade gap will add to the

country's current-account deficit, exacerbating external financing

concerns. (IHS Markit Economist Andrew Birch)

- In the third quarter of 2020, Turkey posted a merchandise trade deficit of USD13.9 billion, widening by more than USD6.6 billion compared with the same period of 2019. Overall for January-September 2020, the trade gap reached USD37.9 billion, up by nearly USD16.8 billion y/y.

- The spread of the COVID-19 virus globally severely undercut demand from key Turkish export markets. Shipments to the European Union - typically receiving over 40% of all Turkish exports - dropped by 14.3% y/y in the first three quarters of 2020, driving down overall exports by 10.9% y/y.

- Meanwhile, overall merchandise imports continued to grow in January-September, by 1.5% y/y. Surging gold imports inflated the overall import total, increasing by 132.4% y/y in the first nine months. This surge in gold demand was most likely due to a mixture of "in kind" trade (corresponding with an uptick in imports from Iraq), the central bank needing to replenish its gold reserves, and the population seeking to switch their savings into a safe haven.

- Without the gold imports, merchandise imports would have dropped by 30.7% y/y in the first nine months. However, in August-September, non-gold imports were growing again, by 4.5% y/y. Expansionary economic policies, the relaxation of social-distancing requirements, and expanding industrial activity all fueled a re-acceleration of import demand.

- The surge in the merchandise trade deficit - regardless of whether or not imports of gold were the contributing factor - raises external financing risks significantly. The concurrent rise in the current-account deficit, exacerbated by a severe drop-off in service exports, puts a heavy burden on foreign capital inflows for financing.

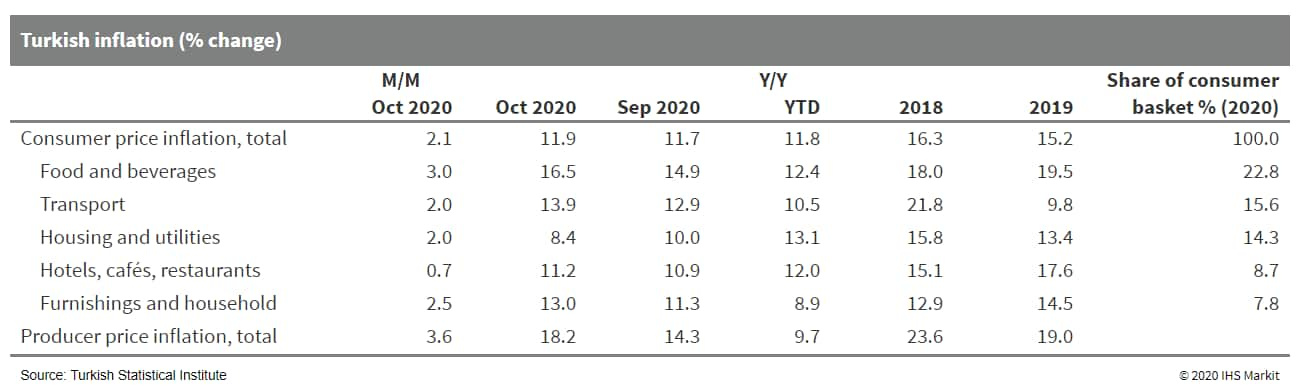

- Turkey's annual consumer price inflation remained elevated in

October, essentially unchanged since December 2019. The lira's

sharp depreciation since the end of July has contributed to upward

price pressures, with fresh losses since late October threatening

to push inflation higher in the final months of the year. (IHS

Markit Economist Andrew Birch)

- Annual consumer price inflation in October stood at 11.9%. Annual price growth accelerated slightly compared with the previous month, by 0.14 percentage point, but was generally where it has been since December 2019.

- Consumer prices grew by 2.1% month on month (m/m) in October. A seasonally influenced surge in clothing and footwear prices (up 6.8% m/m) contributed heavily to the headline increase in prices but, more generally, expansionary monetary policy and the sliding lira fueled inflationary pressures.

- Although the Central Bank of the Republic of Turkey (Türkiye Cumhuriyet Merkez Bankası: TCMB) has been tightening monetary policy through various "back-door" measures, it has failed to slow annual credit growth significantly, keeping demand pressures high.

- Meanwhile, the lira has been depreciating rapidly since the end of July, having depreciated by 23.7% against the US dollar to the end of October. The lira has tumbled particularly sharply since 22 October following the TCMB's decision to not raise its main policy rate, falling by more than 14% against the US dollar since that meeting. The sharp lira losses are contributing to upward pressure on the supply side.

- IHS Markit's current, end-2020 inflation forecast is 12.2%.

However, we had anticipated that the TCMB would raise interest

rates once again at its October meeting. With the central bank not

having taken action, the lira losses will be more severe than we

had previously anticipated, fuelling higher inflation. In our

November forecast revision, we project that the end-2020 rate is

likely to be closer to 13%. For 2021, we currently forecast

end-year inflation to fall to 10.2%, although that projection will

also rise.

- The Turkish lira fell to a record level of 8.52 against the US

dollar on 3 November. The currency has lost more than 40% of its

value this year against the US dollar. (IHS Markit Country Risk's

Firas Modad)

- Turkey is unlikely to default on debts, even as the government's foreign-currency reserves have now dropped to below zero when excluding swap operations. In late September, the US ambassador to Turkey announced that Turkey owes USD2.3 billion to healthcare companies and pharmaceutical companies. Healthcare companies operating in Turkey have not been paid for 16 months by public hospitals and 36 months by university hospitals. Similarly, Turkey faces difficulties in managing contingent liabilities from Public Private Partnerships (PPP), many of which include explicit minimum revenue guarantees as well as debt guarantees from the Turkish government. According to Turkish media, payments owed to contracts in PPP projects have been delayed by 6 months; and the total debt of the Directorate-General of Highways to construction companies reached TRY12 billion (USD1.52 billion). Turkey's foreign debt in foreign currency, which is due for payment within a year or less, amounted to USD123.7 billion dollars, while foreign reserves dropped to USD36 billion. The central bank had a USD50 billion net negative position in the swap market by September, up from net negative USD18 billion in December 2019. The net negative position in the swap market and commercial bank reserves required to be held at the central bank, and which do not belong the central bank. Turkey's low level of government debt was one of its strength in the economy. The government is likely to accelerate its borrowing, while the worsening foreign currency shortage increases the risk of non-payment to PPP contractors.

- A Biden presidency would lead to further deterioration in Turkey's financial position. A Biden presidency would likely better align with both the US foreign policy community's desires and congressional demands that the US take a tougher line against Turkey.

- Turkey is increasingly likely to impose capital controls by introducing transaction taxes and putting a limit to other similar transactions between Turkish banks and foreign counterparts. In May 2020, Turkey increased tariffs up to 20% on over 400 goods during the COVID-19 outbreak.

- President Erdogan is very unlikely to permit Turkey to go to the International Monetary Fund (IMF) in the near future, opting instead to raise foreign debt to buy time. Erdogan has repeatedly and publicly rejected the possibility of an official IMF program.

- The Azeri economy is heading for its worst downturn since the

late 1990s as both the oil and non-oil sectors continue to shrink,

while the military campaign over Nagorno Karabakh is set to

aggravate existing challenges. (IHS Markit Economist Lilit

Gevorgyan)

- The recent series of data released by Azerbaijan's state statistical committee show a further decline in Azeri economic activity in the third quarter. Real GDP contracted by 3.9% year on year (y/y) in January-September, following a 2.7% y/y fall in the first half of the year.

- Both the oil and non-energy sectors shrank in the three-month period. The all-important oil and gas sector fell by 6.4% y/y, while the non-energy sector declined by 2.4% y/y. Capital investment also fell markedly during January-September, by 3.8% y/y.

- The Azeri statistical service has also provided a breakdown of the contribution to value added. The top contributor was the industrial sector, making up 34.7% of total value added, followed by trade on 11.4%, agriculture on 7.6%, and transport on 7.4%. Industrial production declined by 4.5% y/y during the first nine months of the year.

- Although non-energy industrial sector output expanded by 10.8% y/y, the sector's contribution to overall production is limited and it was only partially able to offset the 6.1% y/y contraction in the oil and gas sector.

- The Azeri mining sector makes up 60% of total industrial output, whereas manufacturing comprises only 33.8%, therefore the sector's performance is determined by mainly external demand for Azeri energy exports.

- It is noteworthy that in September the industrial sector fell sharply by 15.7% y/y, the steepest fall in over a decade. This contrasts with declines of 10-11% y/y in April-May, at the height of the first wave of the COVID-19 virus pandemic.

- IHS Markit is planning a downward revision of its Azeri real GDP projections for 2020-21 in its November forecast round. The Azeri economy is now expected to see a much deeper fall of 5.9% in 2020 compared with 4.6% in our current baseline scenario. The rebound will also be weak in 2021, with real GDP expanding that year by only 2.0% (compared with 2.8%), mostly due to the statistical base effect.

- The Ministry of Transport and Communications (MoTC) has announced the signing of two memoranda of understanding (MoUs) with Nasser Bin Khaled & Sons Holding Co. and Q-Auto to provide free electric vehicle (EV) chargers in Doha (Qatar), reports the Qatar Tribune. Under the MoUs, the two companies will provide EV chargers for free and will perform periodic maintenance of the charging units. The location for installation of the charging units will be specified by the MoTC. The MoTC's director of the Technical Affairs Department, Sheikh Mohamed Al Thani, said, "The two MoUs come within the framework of putting into effect MoTC's Electric Vehicle Strategy developed in collaboration with the bodies concerned. The country continues reinforcing the participation of the private sector in government developmental projects and encouraging its partaking in mobility and transportation projects in such a way that helps enrich private sector companies' investment ideology, thus bolstering the localization of expertise and the technology in use." (IHS Markit AutoIntelligence's Tarun Thakur)

- Angolan private consumption is expected to decline by 4.3% in

2020 as inflationary pressures persist. Annual headline inflation

in Angola remained elevated in September and October, limiting

space for the central bank to cut interest rates further in the

near term to support small and medium-sized enterprises and raise

private consumption. (IHS Markit Economist Alisa Strobel)

- Although official data is currently not available as an aggregated number for annual average headline inflation in October, the figures available as of 4 November from Angola's central bank, the National Bank of Angola (Banco Nacional de Angola: BNA), suggest that price levels stood at 22.9%.

- September's annual headline inflation rate rose to 23.8%. Annual headline inflation reached the 20% mark back in April. In addition, April registered the highest increase on a month-on-month basis, at 2.1%, identical to the monthly price growth observed in January. Monthly headline inflation in September fell to 1.8%, down by 0.3 percentage point from the previous month.

- We maintain our view that interest rate hikes or further rate cuts by the BNA are unlikely in the near term amid expected continuous high inflationary pressures. IHS Markit expects Angola's annual average headline inflation rate to reach around 21.8% in 2020. Although softening moderately, inflationary pressures are expected to remain elevated in the near term, before tempering in 2022.

- The higher price levels in tandem with a weaker exchange rate of the kwanza, which is the result of oil price softness, are expected to continue to burden private-sector business growth, in particular, and IHS Markit expects private consumption to decline by 4.3% in 2020, before gradually recovering during the second half of 2021. This outlook remains under high risk, however, from the outcome and duration of a second wave of the COVID-19 pandemic globally.

- Given little scope to adjust interest rates, we have seen other prompt action by the Angolan government to support households and businesses in 2020 during the pandemic. These included exemptions from value-added tax (VAT) on goods imported as humanitarian aid and donations, but also VAT tax credits on imported capital goods and raw materials for producing essential consumption goods.

- Additional liquidity support to banks and a liquidity line to

buy government securities from non-financial corporations have also

been implemented to support business activity.

According to the Angolan National Institute of Statistics (INE), the unemployment rate during the third quarter of 2020 is estimated at 34%, 1.3 percentage point higher than in the second quarter and 3.9 percentage points higher than in the third quarter in 2019. To mitigate the negative impacts of the COVID-19 pandemic, the BNA announced in September plans to implement a deferral measure in the constitution of impairments for regulatory effect.

Asia-Pacific

- APAC equity markets closed higher across the region; Hong Kong +3.3%, South Korea +2.4%, India +1.8%, Japan +1.7%, and Australia/Mainland China +1.3%.

- Acrylonitrile butadiene styrene (ABS) consumption surged as a result of home quarantines imposed to curb the spread COVID-19, sending cash margins to unprecedent levels at above $500/mt and set to surpass $600/mt in 2021, said Daniel Siow, IHS Markit director for styrenics at the Eight Asia Petrochemical Conference on Nov. 5. The global economy plunged when COVID-19 blighted nations in early 2020 and a second wave is now emerging in major European countries and the U.S. This meant that cities were locked down once more and working or schooling from home become the norm until an effective vaccine can be discovered and large populations inoculated. This disruption to daily live turned out to be a boon for ABS, an engineering thermoplastic resin widely used in appliances and electronics, said Siow. The shift to home schools and offices meant that computers and peripherals such as monitors, mouses and keyboards are now essential products, and being cooped up at home has led to rising demand for television sets and refrigerators, he added. "Asian ABS producers, particularly those in mainland China, have benefitted from the surge in demand and several producers have already sold out their cargoes in recent months to meet orders from end product manufacturers," said Siow. China's refrigerator output for September was 9.36 million units, up 27% year-on-year and washing machine production reached 7.99 million units, up 11% year-on-year. Based on IHS Markit assessment, the pent-up demand for computers and home appliances may take a longer time to pan out as millions of people worldwide are expected to continue "flexible work arrangements or telecommuting," resulting in more demand for these products, he said. The Chinese automotive sector also rebounded strongly with September output rising to 2.46 million units, up 10.9% year-on-year and passenger vehicle increased 12.9% year-on-year to 2.57 million units. With world consumption of ABS at 9 million mt/year and concentrated mainly in Asia, it is critical that this region does not go through another massive COVID-19 lockdown, which will impede its road to recovery, he added. (IHS Markit Chemical Advisory's Sok Peng Chua)

- China attaining self-sufficiency in paraxylene (PX) meant that producers who traditionally export to the country will struggle to place their products amid falling demand, said Duncan Clark, IHS Markit vice-president for aromatics and fibers at the Eighth Asia Chemical Conference on 5 Nov. This will lead to a significant shakeup of the industry where significant capacity globally would have to shut as the PX-naphtha margin fell below $300/mt, he added. IHS Markit expects nameplate PX capacity to exceed domestic China demand by as early as 2023 and this could have a significant impact on the overall import requirements from other exporters around the world. Chinese PX imports peaked in 2018 at 16 million mt and are expected to decline to 8 million mt by about 2023. On paper, China should achieve self-sufficient by 2023 but poor production margins globally, associated with oversupply, will drive existing capacity within China to shut down so some PX imports will still be required but at a much lower level, Clark said. Historically, when the PX-naphtha margin fell below $300/mt, some aromatics units will close on a temporary basis as producers turn their focus to gasoline production instead. This typically rebalances the supply/demand and facilitates the recovery of the PX-naphtha spread to above $300/mt. However, recently the spreads are closer to $125-$140/mt and show little signs of improving, indicating that insufficient global capacity is shutting down relative to the new supply brought online in China and Brunei, said Clark. From 2021 to 2025, IHS Markit expects new Chinese PX demand to increase by about 9 million mt/year but this will be matched against more than 12 million mt/year of new capacity. As such, there will be a further reduction of global operating rates to around 69%, which on a nameplate basis is the lowest ever. (IHS Markit Chemical Advisory's Sok Peng Chua)

- Chinese automaker BYD has reported a sales increase of 16.1% year on year (y/y) to 47,731 units during October. Sales of BYD's new energy vehicles (NEVs), including battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), were 23,217 units in October, up 84.7% y/y. Meanwhile, sales of BYD's traditionally fueled vehicles fell by 14.2% y/y to 24,515 units last month. Passenger BEVs remained the top-selling category in the automaker's NEV line-up, reaching 14,919 units in October, up 96.6% y/y, while sales of its PHEVs rose 60.0% y/y to 7,126 units. In the year to date (YTD), BYD's total sales are down 16.0% y/y at 316,707 units, including 134,158 NEVs, down 34.6% y/y, and 182,549 traditionally fueled vehicles, up 6.3% y/y. BYD's sales continued to improve during October thanks to rising demand for its NEVs. The launch of the BYD Han EV, a flagship model in its Dynasty line-up, and China's efforts to boost NEV sales in rural areas helped boost BYD's NEV sales in October. In comparison, sales of its traditionally fueled vehicles contracted in October, although the automaker's traditional vehicle product line-up remains its main sales driver in the Chinese market. From January to October, sales of sport utility vehicles with conventional gasoline (petrol) engines, the best-selling vehicle type in BYD's line-up, increased 67.8% y/y to 133,733 units. (IHS Markit AutoIntelligence Abby Chun Tu)

- Mitsubishi Motors has posted a consolidated net loss of JPY209.8 billion (USD2 billion) during the first half of fiscal year (FY) 2020 (1 April-30 September), compared with a net profit of JPY2.598 billion in the first half of FY 2019, according to a company statement. Operating loss stood at JPY87.01 billion during first half of FY 2020 compared with a profit of JPY1.246 billion in the first half of FY 2019. Net sales for the period were down by 49% year on year (y/y) to JPY574.9 billion. Of this, Japanese sales stood at JPY179.8 billion and accounted for 31.2% of total sales during the period. Association of Southeast Asian Nations (ASEAN) sales accounted for 19.35%, while European sales accounted for 14.0% of total sales and North America contributed 11.4%. In terms of sales volume, the automaker sold 351,000 units globally in the first half of the FY compared with 592,000 units in the same period last year. Mitsubishi sold maximum volumes in Europe at 75,000 units during the period, followed by 71,000 units in ASEAN and 51,000 units in North America. According to IHS Markit light-vehicle sales data, Mitsubishi's light-vehicle sales are expected to decline by 30.5% y/y to 833,150 units in 2020 and will reach 890,400 units in 2021. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Andhra Pradesh's government is setting up 400 electric-vehicle (EV) charging stations across the state in the first phase of a plan to promote the adoption of EVs, according to a report by the Times of India. The government also plans to set up testing facilities for vehicles and components, and testing tracks for EVs, with an investment of INR2.5 billion (USD33.5 million). State Energy Secretary Srikant Nagulapalli said during a webinar on the 'Go Electric' campaign, organised by the Bureau of Energy Efficiency and AP State Energy Conservation Mission (APSECM), "We want to make more charging stations available to citizens in coming days. Installing charging stations will boost the confidence of users of electric vehicles and will also encourage companies to launch new electric vehicles." Several state governments in India have announced their own EV policy to encourage uptake of such vehicles and attract investment. A lack of charging infrastructure is one of the major impediments that hinders uptake of EVs and the latest initiatives will help to address this challenge. The Andhra Pradesh state government released an electric mobility policy in May 2018 to promote the use of EVs. Under the plan, the state government announced offer incentives to consumers, automakers, battery manufacturers, and charging infrastructure companies. The policy also offers full reimbursement of road tax and registration fees on sales of EVs until 2024. The state aims to have 1 million EVs on its roads in the next five years and has also set a target of attracting INR300 billion for EV manufacturing. (IHS Markit AutoIntelligence's Isha Sharma)

- Tamil Nadu state government in India has exempted electric vehicles (EVs) from payment of motor vehicle tax until the end of 2022, in a bid to promote their adoption. The move is part of the state's Electric Vehicle Policy 2019 unveiled last year. According to a report by The New India Express, the state government passed an order stating, "In exercise of powers conferred under Section 20 of Tamil Nadu Motor Vehicles Act, 1974 - and in supersession of Home Department notification of Part II Section 2 of Tamil Nadu Gazette Notification dated October 1, 2008 - the governor exempted the battery-operated vehicles, both transport and non-transport, from payment of Motor Vehicle Tax from 03 November 2020 to 31 December 2022." EVs are subject to a 4% road tax payment in the state. With the latest move, Tamil Nadu has become the second state in India to waive road tax on EVs, after Delhi. (IHS Markit AutoIntelligence's Isha Sharma)

- The IHS Markit Vietnam Manufacturing Purchasing Managers'

Index™ (PMI®) posted 51.8 in October, down marginally from 52.2 in

September but still signaling expansion in the manufacturing sector

and representing a substantial recovery from April's record low of

32.7. The latest survey showed improving operating conditions in

the consumer and intermediate goods sectors. However, investment

goods firms posted a deterioration, amid further declines in both

output and new orders. (IHS Markit Economist Rajiv Biswas)

- In October 2020, industrial production rose by 5.4% y/y, reflecting a substantial rebound in manufacturing output and export orders as lockdowns eased in major export markets. For the first ten months of 2020, industrial production rose by 2.7% y/y, reflecting a very resilient performance compared with many other Asian industrial economies which have faced sharp contraction in industrial output due to the pandemic and related lockdowns.

- According to Vietnam's General Statistics Office, exports in October are estimated to have risen by 9.9% y/y to USD 26.7 billion, while imports likely increased 10.1% y/y to USD 24.5 billion, resulting in a trade surplus of USD 2.2 billion for the month of October. Exports are estimated to have risen by 4.7% y/y for the first ten months of this year, while imports rose by 0.4%, resulting in a strong trade surplus for the first ten months of USD 18.7 billion.

- The US has been Vietnam's largest export market during 2020 year-to-date, with Vietnam's exports to the US up 24% y/y. Vietnam's trade surplus with the US during the first ten months of 2020 reached USD 50.7 billion, compared with a trade surplus of USD 55.8 billion for the full 2019 calendar year. Exports to China have also shown strong growth of 14% y/y during the same period. However, exports to the EU were down 3% y/y during the first ten months of 2020.

- A key factor that has driven the sustained strong growth of Vietnam since 2010 has been the rapid growth of electronics manufacturing. The importance of Vietnam's electronics industry has risen dramatically over the past decade, with the electronic industry's share of total GDP rising from around 5% in 2010 to around one- quarter of GDP by 2019, a key factor helping to drive rapid growth of both exports and GDP.

- With electronics now being Vietnam's most important export sector, the impact of global lockdowns due to the pandemic on the global electronics industry had been a major shock to the sector during the first half of 2020. Amid widespread global lockdown measures aimed at containing the spread of the pandemic, world demand for electronic goods slumped sharply in April and May.

- The Vietnamese economy is expected to rebound in 2021, with GDP growth expected to strengthen to a pace of 6.1% y/y. Over the medium-term economic outlook, a large number of positive growth drivers are creating favorable tailwinds, continuing to underpin the rapid growth of Vietnam's economy. This is expected to drive strong growth in Vietnam's total GDP as well as per capita GDP.

- Grab has announced that it has deployed more than 5,000 electric vehicles (EVs) in Indonesia this year. The EVs are in in the form of two-wheelers, e-scooters, and four-wheelers, reports Kompas.com. Ridzki Kramadibrata, president of Grab Indonesia, said, "We support the government's vision of reducing carbon emissions by 29 percent by 2030 through the initiative to launch and operate more than 5,000 electric-based vehicles. We have also worked with PLN to develop initiatives to build a motorized vehicle ecosystem." As the purchase prices of EVs are high, Grab employs a rental system and has partnered with companies Kymco, Selis, and others to procure leased vehicles. This year, Grab deployed Hyundai Ioniq EVs in Jakarta, as part of its pilot EV ride-hailing service, GrabCar Electric (see Indonesia: 29 January 2020: Grab pilots EV ride-hailing service in Jakarta). This pilot follows SoftBank's USD2-billion investment in Grab to establish a transport network based on EVs in Indonesia. This initiative is in line with the government's initiative to put 2 million electric cars on the road by 2025. Last year, Grab partnered with Hyundai, Astra Honda Motor (AHM), and Gesits to launch pilot EV ride-hailing services in Jakarta. Grab owns one of the largest fleets of EVs in Southeast Asia and launched a pilot in January 2019 involving 200 Hyundai Kona vehicles being operated on Singapore's roads. In 2018, Grab teamed up with energy utilities provider SP Group to power EVs with SP's fast-charging network. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-5-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-5-2020.html&text=Daily+Global+Market+Summary+-+November+5%2c+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-5-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - November 5, 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-5-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+November+5%2c+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-5-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}