Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 11, 2020

Daily Global Market Summary - November 11, 2020

European equity markets closed higher again, while APAC and US markets were mixed. Most benchmark European government bonds were higher except for gilts, while the US bond market was closed in observance of Veteran's Day. The US dollar and oil closed higher, while gold and silver were lower.

Americas

- US equity markets closed mixed; Nasdaq +2.0%, S&P 500 +0.8%, Russell 2000 flat, and DJIA -0.1%. The Russell 2000 closed at 1,736.94, which is 0.2% from its all-time high of 1,740.75 on August 31, 2018.

- US bond markets were closed in observance of Veteran's Day.

- DXY Us dollar index closed +0.3%/92.99.

- Gold closed -0.8%/$1,862 per ounce and silver -0.8%/$24.27 per ounce.

- Crude oil closed +0.2%/$41.45 per barrel.

- New York will order bars, restaurants and gyms closed at 10 p.m. and limit indoor gatherings to 10 people, Governor Andrew Cuomo said. New York reported 4,820 additional virus cases, the most since April. The rate of positive tests has climbed to 2.9%. The state has 1,628 people hospitalized for Covid, twice as many as a month ago. (Bloomberg)

- Ford will invest USD100 million in the Kansas City Assembly plant to support production of the e-Transit van, due to be revealed on 12 November, as well as USD150 million in the Van Dyke Transmission plant for e-motors and e-transaxles. The e-Transit will go into production in late 2021, ahead of the electric F-150 in 2022. The investment in the transmission plant will support both vehicles and retain 225 jobs, Ford notes. To support the e-Transit, Ford will add 150 jobs along with the USD100-million investment at Kansas City. Ford is also adding 200 permanent jobs to support electric F-150 production in Dearborn, in addition to the previously announced 300 jobs, and confirmed publicly that the Cuautitlan (Mexico) plant where the Mustang Mach-E is produced, will build a second electrified vehicle. The increase in jobs on the F-150 EV will increase Ford's production plans by 50%, based on what Ford says is strong early interest; Ford did not specify a production capacity target. Timing was not confirmed for the next electric vehicle (EV) in Cuautitlan, but Ford confirmed the new vehicle will share a similar electrified platform to the Mach-E. The overall investment of USD700 million is unchanged. As Ford and other automakers look to increase EV production and sales, it is requiring change to the manufacturing footprint. In Ford's case, the USD3.2 billion it has announced in recent months is part of a larger USD11.5-billion investment into electrification. IHS Markit also forecasts the next electrified vehicle will be a D-segment utility, and that ultimately there will be a version for Ford and a version for Lincoln. Production is forecast to begin in the second half of 2023. The risk with this manufacturing investment is that EV adoption may be slower than production capacity can be created, which could slow efforts for profitable EVs from launch. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Walmart will work with GM on a pilot program for autonomous vehicle (AV) grocery deliveries in Scottsdale, Arizona, beginning in early 2021. Walmart announced the program through a Medium blog post. Customers will be able to place an order from their local store and have it delivered by one of the Cruise AVs, which Walmart says it selected in part because the vehicles are based on the Bolt electric vehicle (EV) and enable zero-emission deliveries. In the statement, Walmart senior vice-president of customer product, Tom Ward, said, "You've seen us test drive with self-driving cars in the past, and we're continuing to learn a lot about how they can shape the future of retail. We're excited to add Cruise to our lineup of autonomous vehicle pilots as we continue to chart a whole new roadmap for retail." Cruise announced the pilot program via Twitter, saying, "Today, we're announcing our partnership with @Walmart, the world's largest grocery delivery company. Together, we will learn how autonomous vehicles can positively impact delivery experiences for customers in a way that's also sustainable for our planet." This is the first delivery pilot scheme for Cruise Automation, and Reuters quotes Cruise as saying in an email that it is "laser-focused on making this first pilot successful with Walmart." Walmart has also previously partnered with tech startups on pilot delivery programs, including both AVs and drones, as well as with Ford in the Miami, Florida, area. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Volvo Trucks North America has set a date of 3 December for the US and Canada sales launch of the VNR Electric truck; production will begin in early 2021, according to a company statement. The Class 8 truck will be built at Volvo's New River Valley manufacturing plant in Dublin, Virginia (United States), which received investment in 2019. Peter Voorhoeve, president of Volvo Trucks North America, noted that the VNR Electric's launch follows deployment in the Volvo Low Impact Green Heavy Transport Solutions (LIGHTS) project. "As part of the very successful Volvo LIGHTS project, which we started in 2019 in Southern California in collaboration with fourteen other pioneering organizations, we validated the viability and reliability of the Volvo VNR Electric in real-world operations and proved what it takes to create a holistic, end-to-end electromobility solution to drive true sustainability in the trucking industry. We are fully confident in bringing this new technology to the commercial market," the executive is quoted as saying. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Volkswagen (VW) of America has started construction of a previously announced battery lab, and has also appointed a new senior vice-president for brand marketing. The engineering center is located near the company's US plant in Chattanooga, Tennessee, where the ID.4 will be produced in 2022. VW will test and optimize Georgia-manufactured battery cells at the new lab, according to a company statement, as part of efforts to localize all aspects of vehicle development and production. The lab will include pressure and immersion testers, corrosion chambers, five explosion-rated climate chambers, and a custom, two-ton multi-axis shaker table. In a separate statement, the automaker announced the appointment of Kimberley Gardiner to lead marketing for VW of America. Gardiner replaces Saad Chelab, who left VW in May after less than a year in the job and after the appointment of Duncan Movassaghi as new executive vice-president of sales and marketing. Gardiner will report to Movassaghi. The addition of the battery lab in the US underscores VW's efforts to ensure localized electric vehicle (EV) production, in an effort to further its goal of ultimately offering all EVs. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Speaking to Automotive News, Rivian CEO RJ Scaringe outlined the company's service plans and confirmed that it is on track for a sales launch in the second quarter of 2021. Production of test vehicles has begun at the company's Normal, Illinois (United States) plant. Scaringe was interviewed for a podcast, and is quoted as saying that the company will have a combination of bricks-and-mortar service centers and mobile service vehicles, not unlike Tesla. Scaringe said, "We're launching a large number of service centers throughout the U.S., really in the next nine months, 41 service centers. In addition to those service centers, we're building a very robust network of mobile service [providers] that will come to you, your business or your home … What we deeply believe is that a significant majority of service operations necessary on a vehicle can be done remotely, can be done with our mobile service network, which from a customer's point of view simplifies things dramatically. They no longer have to think about dropping their vehicles off. Service just happens, when customers are at their house or at their office. We have not talked about it, but there is a massive amount of building that is happening behind the scenes within Rivian to set up the teams, infrastructure and the digital platforms, and of course all the physical assets to make that happen." The company will service Amazon delivery vans and R1T and R1S Rivian products through the same locations, and Scaringe also expects the Amazon products to help Rivian scale up its service for its own private consumer vehicle sales. Rivian is on track to launch its electric truck and sport utility vehicle solutions in 2021, although the company will quickly face competition from Ford and General Motors (GM), as well as Tesla. Although Tesla's service network is not as robust as GM's or Ford's at this point, the company has developed and continues to expand a service network using the same essential approach as Rivian. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Covetrus has posted an 11% year-on-year increase in sales in

the third quarter of fiscal 2020. The firm's revenues for the

quarter came to $1.13 billion. This performance builds on a strong

year so far for the company despite the coronavirus pandemic,

following a healthy Q2 and a robust first quarter. (IHS Markit

Animal Health's Daniel Willis)

- Third-quarter organic sales - adjusting for foreign exchange and M&A activity - climbed 12%. The company said the improved performance reflected companion animal market growth that returned to pre-COVID-19 levels across many of its geographies.

- Covetrus benefited from improved sales execution and market position in several key markets. The "continued positive trajectory" of the firm's prescription management business also supported Q3 growth.

- Covetrus' third-quarter revenues in North America totaled $618 million - translating to 14% growth. The company attributed the strong performance to healthy end-market demand and an improved market position. Meanwhile, prescription management sales in the region grew 43%.

- The firm saw sales grow in Europe by 5% to $403m. This was driven by "strong sales execution" and a recovery in market conditions following COVID-19-related disruptions in the second quarter. In Asia Pacific and emerging markets, Q3 revenues grew 15% to $108m.

- Selling, general and administrative expenses totaled $224m in the third quarter - up 6% on Q3 2019. Net loss for the quarter totaled $35m - a significant improvement on the loss of $959m reported in the comparative period of 2019. The company noted the primary driver of the year-on-year improvement was a $939m goodwill impairment charge recorded in the prior period.

- As of September 30, 2020, Covetrus had cash and cash equivalents of $335m, $1.14bn in term loan debt and no borrowings outstanding on its $300m revolving credit facility.

- Covetrus' fiscal 2020 guidance has also been lifted to an adjusted EBITDA of $213m to $218m. This is an increase from the firm's prior guidance range of $200m to $210m. This guidance assumes no significant additional supply chain disruption or economic impact related to COVID-19 in the second half of the year.

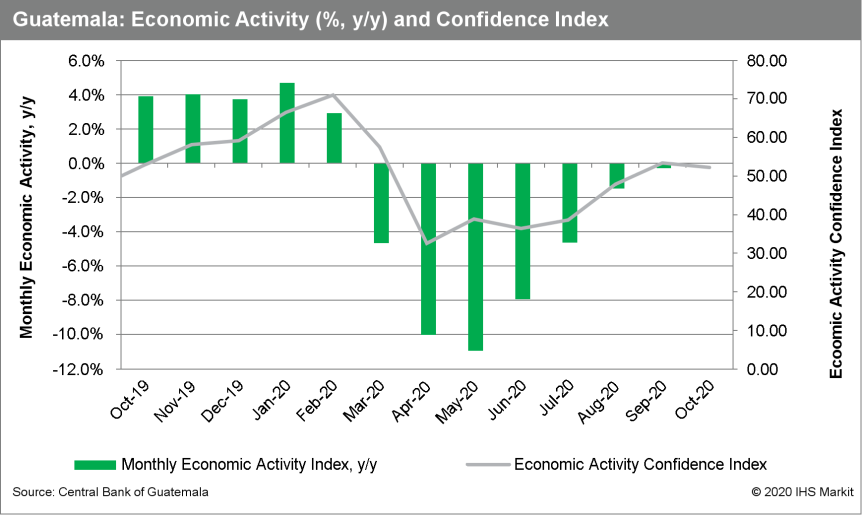

- After bottoming out in May and June, Guatemala's IMAE rebounded

by 6.1% m/m in July and 2.7% in August as the country reopened the

economy and lifted various social-distancing measures. Although

economic reopening has continued, the recovery of economic activity

has since slowed, declining by 0.5% m/m in September (and remaining

0.3% below September 2019 levels). (IHS Markit Economist Lindsay

Jagla)

- The sectors contributing most to this contraction were accommodation and food services, construction, sales and repair of auto vehicles, and transportation and storage. In contrast, the sectors that have seen continued improvements were the manufacturing industry, utility services, and agriculture.

- In line with slowing economic activity in September, Guatemala's economic activity confidence index declined by 2.14% m/m in October, indicating worsening expectations regarding the investment climate and the prospect of economic improvement in the next six months.

- On the upside, remittances to Guatemala have continued to rise significantly. In October, the amount of remittances sent to Guatemala achieved another monthly record, growing by 13.3% year on year.

- Guatemala's slowing economic activity in September bodes poorly

for the economy as a whole. The government has made it clear that

it will not pursue a second lockdown in favor of keeping the

economy running, but any upsurge in the number of coronavirus

disease COVID-19 cases would still put downward pressure on

economic activity as more workers contract the virus and consumers'

concerns prevent a return to normal activity.

Europe/Middle East/Africa

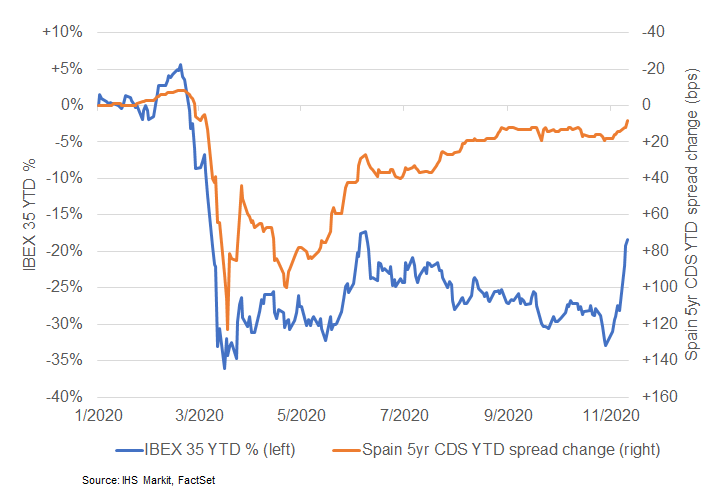

- European equity markets closed modestly higher across the region; UK +1.4%, Spain +1.1%, Italy +0.7%, France +0.5%, and Germany +0.4%. Spain's IBEX 35 closed today at its highest level since 8 March and is +20.8% month-to-date.

- Spain's 5yr CDS spread closed at 49bps today, which is its

tightest level since 5 March; tightening 10bps month-to-date. The

below chart shows the daily tear-to-date (YTD) change in Spain's

IBEX 35 equity index and Spain's 5yr CDS spreads (CDS on reversed

scale), with CDS spread only +8bps YTD and IBEX 35 -18% YTD as of

today's close.

- Most European govt bonds closed higher except for UK +1bp; Spain -4bps, Italy -3bps, and Germany/France -2bps.

- iTraxx-Europe closed flat/50bps and iTraxx-Xover +3bps/293bps.

- Brent crude closed +0.2%/$41.45 per barrel.

- The Rhine River at BASF's Ludwigshafen, Germany, site.

Germany's chemical industry association VCI (Frankfurt) says that

after setbacks in the first half of the year caused by COVID-19,

Germany's chemical-pharmaceutical industry rebounded in the third

quarter with a sequential increase of 1.9% in production and 2.8%

in sales. Producer prices also edged up 0.5% compared with the

previous quarter, and the number of employees in the industry

remained stable at about 464,000, VCI says. However, on a

year-on-year (YOY) basis the figures were below the levels of 2019.

(IHS Markit Chemical Advisory)

- Chemical-pharmaceutical production declined 1.7% YOY but compared with the previous quarter, chemical production alone went up 4.9% driven by higher demand, VCI says. Average capacity utilization rose sequentially, from 77.5% to 81.6%, so operating rates were back to almost normal in the third quarter, VCI says.

- Industry sales increased sequentially by 2.8%, to €43.8 billion ($51.6 billion), with sales to domestic and foreign customers going up by 3.5% and 2.5%, respectively, VCI says. It adds that there was positive development especially in business with European customers. Nevertheless, sales to foreign customers were 8% lower YOY, and sales overall were 7.5% down YOY.

- Germany-based chemical companies' selling prices were 2.6% lower YOY in the third quarter in line with weak oil prices and soft demand caused by COVID-19, VCI says. Crude prices went up by about 36% sequentially, but were almost 30% lower YOY, VCI says. The price of naphtha also increased sequentially by 50%, but remained 25% cheaper YOY.

- VCI notes that the global economic crisis is far from over and with a second wave of infections building up, the industry's optimism has been replaced by concern about the future, resulting in a deteriorated outlook for 2020. VCI continues to expect a production decline in the chemical-pharmaceutical industry of 3% for 2020. Prices are expected to be 2% lower, helping drive sales down 6% to €186.4 billion, VCI says.

- Germany's chemical-pharmaceutical industry faces a difficult fourth quarter, with COVID-19 threatening the industry's recovery, VCI says. "Business and society are required to reduce the risk of infection through effective measures and correct behavior. The federal government must prevent permanent economic damage," says Christian Kullmann, VCI president and chairman of Evonik Industries.

- Siemens Energy and Linde Engineering have entered into a strategic partnership to collaborate on decarbonization efforts in the petrochemical sector. The two companies will investigate, develop, and optimize technology and equipment packages to enhance the sustainability and performance of brownfield and greenfield petrochemical facilities. The companies will jointly conduct studies that explore how their technologies can be combined to facilitate the decarbonization of petrochemical plants through emissions reductions and increases in energy efficiency—for example, by optimizing the consumption of power and steam. Particular areas that will be evaluated include, but are not limited to, the use of Siemens Energy's products, including gas turbines, steam turbines, compressors, and generators with Linde Engineering's steam cracker technology and related processes for olefin production, purification, and separation. The companies will also explore how renewable technologies and energy storage can be leveraged to support customers' decarbonization initiatives. Other key performance areas that will be targeted for improvement include plant availability and uptime, maintenance, OPEX and CAPEX, and regulatory compliance. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

- Italy's COVID-19 mortality toll rose to 580 on 10 November, the

highest daily figure since 14 April, while total infections rose to

nearly one million. (IHS Markit Economist Raj Badiani)

- Prime Minister Giuseppe Conte wants to avoid a second national lockdown and is attempting varying levels of regional restrictions alongside a nationwide curfew to demand residents to stay indoors from 10pm to 5am to combat the second spike in infections.

- Italy has put a new tier system in place across its 20 regions to tackle the current spike in COVID-19 pandemic.

- The three tiers are red, orange, and yellow, with the COVID-19 restrictions varying according to tier.

- The classification is based on 21 criteria established by the Higher Health Institute (ISS), which has compiled various risk scenarios for the next few months and recommended strategies to deal with them. The ISS argues the government needs to consider how many people test positive but whether a region is able to handle a spike in COVID-19 infections, including capacity at local hospitals and how well contact tracing is working.

- The Ministry of Health will update the zones "at least weekly", according to the latest emergency decree signed on 3 November.

- We had anticipated more severe COVID-19 virus safety protocols to contain the latest spike in new infections. Therefore, we assumed that the recovery would slow dramatically in the latter stages of 2020.

- According to our October forecast, growth is set to slow to 0.6% q/q in the fourth quarter of 2020 and 1.0% q/q in the first three months of 2021. This represents a sharp slowdown after real GDP rose by a stronger than expected 16.1% quarter-on-quarter (q/q) in the third quarter.

- We now anticipate a tighter squeeze on economic activity in the latter stages of this year. The more severe regional lockdowns targeting hospitality, transport and the retail sectors likely to spark a renewed and sharp contraction in the final quarter.

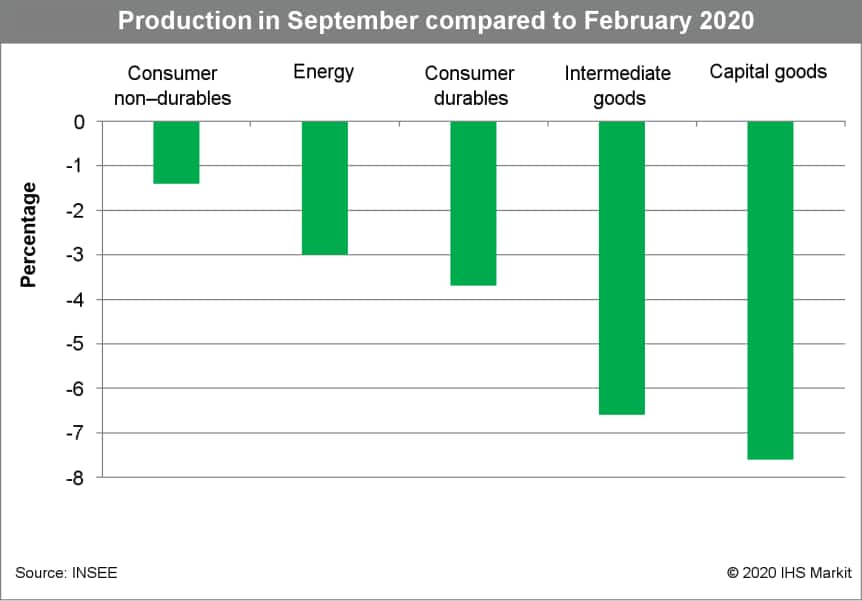

- French industrial production rose by 1.4% month on month (m/m)

in September, according to seasonally adjusted figures released by

the National Institute of Statistics and Economic Studies (Institut

national de la statistique et des études économiques: INSEE).

Production grew month on month (m/m) for the fifth consecutive

month. Moreover, the rate of pace of growth accelerated from 1.1%

m/m in August. (IHS Markit Economist Diego Iscaro)

- Nevertheless, industrial output fell by 6.0% year on year (y/y) in September and remained 5.1% below its pre-pandemic level.

- Manufacturing output grew by a stronger 2.2% m/m in September, following a rise of 0.8% m/m in August. Manufacturing production in September was still 5.5% below its level in February.

- Within manufacturing, production of transport equipment (+8.8% m/m) and computer and electronic products (+8.0% m/m) increased particularly strongly in September, despite remaining 12.1% and 5.7% below their levels in February, respectively. Production of pharmaceutical products also rose strongly (+12.1% m/m), standing 6.5% above its pre-pandemic level.

- The breakdown by main industrial groupings shows production of consumer non-durables (+3.6% m/m) and capital goods (+3.1% m/m) driving the m/m growth rate in September, while production of intermediate and consumer durables remained virtually stable. In all cases, production stood below February's level.

- While both manufacturing and services made a large contribution

to GDP growth during the third quarter, the reintroduction of tight

containment measures at a national level in November suggests that

activity in the service sector will decline sharply during the

fourth quarter.

- Lotus Cars is planning to make a planned crossover electric-only, reports Autocar. The enthusiast publication has said that it has learned that the vehicle, codenamed Lambda, will be based upon an adapted variant of Geely's recently announced Sustainable Experience Architecture . Among the tweaks are thought to be the use of lightweight materials. Autocar understands that the crossover will be offered with two powertrain options, one with around 600bhp and another with 750bhp, with greater torque. The article seems to suggest that these will both be of dual motor configuration. Lotus is also said to be aiming for a range of 360 miles or more. The article also notes that the new vehicle is planned to be built in China in 2022, in part as a way of boosting the brand's volumes. There has been talk of the prospect of a crossover or sport utility vehicle (SUV) joining the Lotus line-up for several years now, even before Zhejiang Geely Holdings took a majority stake in the business. While for some the prospect is at odds with Lotus' tradition of building lightweight vehicles, most notably sports cars, as has been proven in recent decades, its sports car strategy has been at odds with Lotus becoming a sustainable, profitable business. By moving i to this space, Lotus should be able to significantly increase its volumes as it broadens its customer base and targets becoming a "leading global luxury brand". The decision to use an upcoming Geely architecture for this vehicle will allow it to focus its attention on developing its own electric architecture for its more specialist models. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Windpark Fryslân wind farm construction is well underway as contractor Van Oord completes half the monopoles installation at the nearshore wind farm located in the Frisian part of Ijsselmeer Lake. The 89 monopoles were manufactured by EEW Group at its production site in Rostock, Germany, and delivered directly to the installation platform in Breezanddijk in 23 consignments. Foundation installation started in September 2020 and is scheduled to be completed by January 2021.Whilst the foundations are being installed, tower fabricator ASM Industries is begun work on the first 42 tower sections for the wind turbines at its facilities in Aveiro Port, Portugal. Work is expected to be completed before March 2021, where the start of the turbine installation work will begin. The main contractor Zuiderzeewind, a consortium of Van Oord and Siemens Gamesa Renewable Energy (SGRE), will undertake the entire scope of work from design, manufacturing, installation, procurement, and commissioning. Additionally, the contract also includes service operations for the facility for at least 16 years. Windpark Fryslân near shore wind farm will generate 382.7 MW of power when completed and will feature 89 Siemens Gamesa SWT-DD-130 wind turbines, with a capacity of 4.3 MW each. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- As part of its electrification strategy, Volvo Group has

announced that it is broadening its range of battery electric

trucks to include those in heavier weight categories. According to

a statement that coincided with the company's Capital Markets Day

last week, the company is currently running a test program of its

FH, FM and FMX using battery electric vehicle (BEV) powertrains.

(IHS Markit AutoIntelligence's Ian Fletcher)

- It will be able to offer this to European customers during 2021 for both regional transport and urban construction operations, while volume production is set to begin in 2022.

- The vehicle will be able to offer a gross combination weight of up to 44 tons and a range of up to 300km depending on configuration.

- In its statement, president of Volvo Trucks, Roger Alms said, "By rapidly increasing the number of heavy-duty electric trucks, we want to help our customers and transport buyers to achieve their ambitious sustainability goals. We're determined to continue driving our industry towards a sustainable future."

- The introduction of these heavy-duty BEVs is part of Volvo Group transitioning away from its traditional fossil-fuel powered vehicle range, which it plans to achieve by 2040, and it sees 35% of its sales being electric by 2030.

- The company has been investing heavily in the development and introduction of electrified variants of its vehicle range for over a decade, beginning with its bus range and offering hybrid, plug-in hybrid and eventually a full battery electric vehicle (BEV) offering. It started manufacturing medium-duty trucks in 2019, providing options in distribution and refuse roles.

- This comprised not only the Volvo FL Electric and FE Electric, but also the Renault Trucks D ZE and D Wide ZE. The BEV versions of the FH, FM and FMX will also come to market just after the Volvo Trucks VNR Electric in North America which has been designed for regional transportation, and also coincide with the launch of the Mack Trucks LR Electric which will also begin being built in 2021 for supply in urban refuse collection roles.

- Despite these targets, IHS Markit anticipates the growth of this technology to be quite slow in Europe. Indeed, despite other truck-makers also growing in this space such as Daimler Trucks, Paccar, Traton and CNH Industrial, our latest forecast shows that production of BEV trucks in the region will reach around 8,200 units by 2026. Nevertheless, these volumes should scale up as confidence in the technology for certain roles builds, the capabilities increase, and the charging infrastructure for such vehicles becomes more prevalent.

- Saudi Arabia's economy posted a comparably moderate decline in

the third quarter, taken the severe headwinds into account,

including low oil production, lockdown measures, and a tripling of

the VAT rate. (IHS Markit Economist Ralf Wiegert)

- Saudi Arabia's General Authority for Statistics announced in a "flash" estimate that real GDP declined by 4.2% year on year (y/y) in the third quarter following a 7.0% y/y drop in the second (non-adjusted). Compared to the previous quarter, GDP edged up by 1.2% seasonally adjusted.

- In the second quarter, the economy had declined by 4.9% compared to the first quarter as lockdown measures took effect, including closure of borders, schools, and restaurants. These lockdown measures prevailed during much of the third quarter as the Haji season was all but cancelled, and were partially lifted in September.

- Further details will be published with the full release of the GDP data for the third quarter, which is scheduled for 30 December 2020.

- The performance of the Saudi economy in the third quarter was clearly better than what we had expected. While we wait for the details, including the performance of the oil sector, and final demand, we will raise the outlook for the Saudi economy in the forthcoming November round of forecasts.

- Our current outlook expects GDP to decline by 8.1% in 2020 based on the observance of the Vienna oil supply quota, the impact of the severe lockdown measures, and other government austerity measures, including the implementation of the VAT rate increase to 15% in July. The new outlook will be published together with the global forecast for the fourth quarter on 17 November.

- Louis Dreyfus Company (LDC) has agreed to sell an indirect 45% equity stake to Abu Dhabi-based holding company ADQ, subject to regulatory approval. This follows rumors of a deal between the two entities two months ago. LDC has been trying to get out of the pure commodity markets for some time, due to their poor margins, and moving deeper into food processing. Its recent half-year results were encouraging, although they did declare the equity of the company at USD4.5 billion, down from USD4.8 billion in the previous year. Margarita Louis-Dreyfus, who assumed control of the group in 2009 after the death of her husband Robert, had been seeking an investor after borrowing substantial funds from Credit Suisse to buy out minority family shareholders. The transaction price was undisclosed but the two companies said a minimum of USD800 million will be invested in LDC. The deal includes a long-term supply agreement to sell agricultural commodities to the UAE. ADQ, established in 2018, said the investment in LDC would add to its food and agriculture portfolio after it agreed this year to acquire 50% of agribusiness group Al Dahra Holdings. In September, it announced the creation of Silal, a company to diversify food sources and increase the supply of locally-grown food. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- South African seasonally adjusted manufacturing production

increased by 3.7% month on month (m/m) during September, marginally

lower than the 6.3% m/m and 5.0% m/m expansions recorded during

July and August, respectively, according to the latest numbers by

Statistics South Africa (Stats SA). (IHS Markit Economist Thea

Fourie)

- The q/q growth rate accelerated to 32.9% during the third quarter of 2020, from a 29.1% q/q contraction during the second quarter, which was at the height of the COVID-19 virus-related lockdown measures implemented in South Africa.

- The rebound in manufacturing activity during the third quarter was broad based but the sectors showing the sharpest increases included textiles, clothing, leather, and footwear (up 76.8% q/q), glass and non-metallic mineral products (up 87.8% q/q), motor vehicles, parts and accessories, and other transport equipment (up 144.5% q/q), and furniture and other manufacturing (up 89.2% q/q).

- Annual growth in seasonally adjusted manufacturing production remained negative, averaging -1.6% during September following contractions of 11.5% y/y and 11.8% y/y in July and August, respectively.

- The rebound in South African manufacturing production during the third quarter was not unexpected and was in line with the slow reopening of the South African economy since May. South Africa moved to Level 1 COVID-19 virus-related lockdown status in August, opening its borders and allowing for international travel (besides business) to approved countries, more free movement within local borders, and the opening of schools and places of worship. COVID-19 cases remain contained in South Africa, with sporadic flare-ups in some provinces.

Asia-Pacific

- APAC equity markets closed mixed; Japan +1.8%, Australia +1.7%, South Korea +1.4%, Hong Kong -0.3%, and Mainland China -0.5%.

- Great Wall Motor sold 135,559 vehicles in October, up 17.86%

year on year (y/y). In the year to date (YTD), the automaker's

sales stand at 816,249 units, down 2.73% y/y. (IHS Markit

AutoIntelligence's Abby Chun Tu)

- Total deliveries of the automaker's Haval brand increased 13.32% y/y to 97,950 units in October, while sales of the WEY brand fell 12.43% y/y to 9,076 units.

- In the YTD, sales of the Haval brand have contracted by 10.66% y/y to 542,931 units, while sales of the WEY brand have fallen 26.0% y/y to 59,347 units.

- Sales of the automaker's pick-up trucks, including the Wingle and P-Series, totaled 20,405 units last month, up 27.53% y/y.

- In the YTD, sales of its pick-up trucks have surged 58.18% y/y to 180,756 units. Sales of the Ora electric vehicle (EV) brand came in at 8,011 units last month, compared with 1,774 units in October 2019.

- For the YTD, sales of the Ora brand have now reached 31,924 units, down 6.0% y/y.

- In October, the automaker sold 10,804 vehicles in overseas markets; in the YTD, a total of 52,262 vehicles have been sold outside China.

- Great Wall's sales continued to grow at a double-digit rate during October. The automaker's pick-up product line has already become a main driver of its growth. In the first 10 months of this year, deliveries of pick-up trucks accounted for 22% of its total sales. The launch of the Pao-series pick-up has extended its lead in China's pick-up segment by bringing to market a compelling model that appeals to private vehicle buyers.

- AnGes (Japan) plans to acquire genome-editing company Emendo Biotherapeutics (US) for USD250 million, AnGes said in a statement. As part of the acquisition, AnGes will acquire Emendo's genome-editing technology, which is based on OMNI nucleases and is applicable to a range of diseases that require allele-specific gene editing, AnGes's president Ei Yamada was quoted as saying. According to AnGes, the genome-editing therapeutic market is worth JPY900 billion (USD8.5 billion). Further financial details of the acquisition were not disclosed. The acquisition is expected to close on 15 December 2020. The acquisition builds on an initial investment of USD50 million in a 32% stake in Emendo Biotherapeutics that AnGes purchased in December 2019. The latest deal will enable AnGes to leverage synergies between Emendo's genomic-editing platform technology and the Japanese company's own gene therapy technologies to accelerate commercialization of gene therapies. AnGes's current gene-editing-based research and development portfolio includes treatment candidates targeting Mirage syndrome, retinitis pigmentosa, severe congenital neutropenia, epidermolysis bullosa simplex, and alpha-1 antitrypsin deficiency. AnGes plans to initially focus on advancing its ophthalmology-focused projects. (IHS Markit Life Sciences' Sophie Cairns)

- South Korean car-sharing platform SoCar plans to go public and is in the process of designing the initial public offering (IPO) outline, reports Pulse News Korea. The company is currently forming an underwriting team and has sent invitations to six brokerage houses - Mirae Asset Daewoo, Samsung Securities, Korea Investment & Securities, NH Investment Securities, KB Securities and Shinhan Financial Investment. The report said that SoCar will decide when and where to list the stock after establishing the team. SoCar is the largest car-sharing company in South Korea, with more than 12,000 vehicles and 4.5 million registered users. The company offers diverse services to cater the needs of customers, such as mid-to-long-term rental service SoCar Plan, car-sharing service SoCar Pairing and corporate vehicle service SoCar Business. Last month, the company secured KRW60 billion (USD52.2 million) funding at USD1-billion valuation, the country's first mobility startup to reach that mark. Many ride-hailing and car-sharing companies are planning to go public after seeing Lyft and Uber launching their own IPOs. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Sales of new vehicles, including passenger vehicles, light

commercial vehicles (LCVs), and medium and heavy commercial

vehicles (MHCVs), within the Association of Southeast Asian Nations

(ASEAN) region declined by 14.2% year on year (y/y) in September to

243,062 units, according to data released by the ASEAN Automotive

Federation (AAF). (IHS Markit AutoIntelligence's Jamal Amir)

- Thailand was the region's largest automotive market with sales of 77,907 units, up by 2.2% y/y, followed by Malaysia with 56,444 units, up by 26.4% y/y. Sales in Indonesia came in at 48,554 units, down by 47.9% y/y, while Vietnam recorded a 1.9% y/y decline in sales to 27,252 units and sales in the Philippines went down by 22.9% y/y to 24,523 units.

- Among the smaller markets, sales in Singapore declined by 11.7% y/y to 6,013 units in September, Brunei's sales surged by 30.4% y/y to 1,257 units, and Myanmar's sales declined by 39.0% y/y to 1,112 units.

- During January-September, sales in Thailand fell by 29.8% y/y to 534,765 units and in Indonesia they were down by 50.7% y/y to 372,046 units.

- Vehicle sales in Malaysia declined by 22.9% y/y to 341,489 units during the period, while in Vietnam they declined by 22.2% y/y to 179,155 units and in the Philippines by 44.6% y/y to 148,012 units.

- Singapore's year-to-date (YTD) sales went down by 44.4% y/y to 39,480 units, Myanmar's sales grew by 5.9% y/y to 15,145 units, and Brunei's sales increased by 11.6% y/y to 9,927 units.

- Overall, total vehicle sales in the ASEAN region stood at 1.64 million units during January-September, down by 35.7% y/y.

- Overall, the ASEAN new light-vehicle market is expected to fall by 31.8% y/y in 2020 to around 2.25 million units. We expect new vehicle demand in the region to recover from the fourth quarter or from early 2021 on the back of the government's stimulus package.

- Sembcorp Marine has resumed its production activities since the easing of the movement restriction and circuit breaker measures in July 2020. It is currently almost back to its full workforce (including sub-contractors) levels. However, low overall business activities and project execution delays led the company to continue incurring losses during the third quarter of 2020. On a brighter note, new orders visibility has improved with oil companies actively reviewing deferred projects following the gradual recovery of oil price. Sembcorp Marine is in discussions on the resumptions of delayed projects and is actively bidding for new projects, especially in the renewable energy and gas solutions sectors. Currently, Sembcorp Marine's backlog stood at USD1.3 billion (SGD1.8 billion), with USD242 million (SGD330 million) from the Repairs & Upgrades segment. During the third quarter of 2020, Sembcorp Marine delivered the jacket for the substation, the reactive compensation station and other substructure for the Hornsea 2 Offshore Wind Farm from its Batam yard. The company has rescheduled the delivery dates for most of its existing projects by between three to 12 months. Till date, it has not experienced any cancellations of existing projects. Sembcorp Marine expects to continue facing losses in the near term. It will continue to manage its finances carefully. With its strengthened liquidity position and balance sheet through the successful completion of its USD1.5 billion (SGD2.1 billion) recapitalization plan in the quarter, Sembcorp Marine will focus on executing its projects and securing new orders. (IHS Markit Upstream Costs and Technology's Jessica Goh)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-11-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-11-2020.html&text=Daily+Global+Market+Summary+-+November+11%2c+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-11-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - November 11, 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-11-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+November+11%2c+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-11-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}