Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 20, 2020

Daily Global Market Summary - 20 July 2020

Equity markets closed mixed across the globe, while the Nasdaq reached another record high. Benchmark government bonds, credit indices, municipal bonds, and Brent/WTI all closed higher on the day. Multiple positive early stage COVID-19 vaccine trials and emerging discussions of new government stimulus packages continues to create additional optimism in the markets.

Americas

- Most US equity markets closed higher, except for the Russell 2000 -0.4%; Nasdaq +2.5%, S&P 500 +0.8%, and DJIA flat. Nasdaq closed at a new record high of 10,767 today.

- 10yr US govt bonds closed -2bps/0.62% yield.

- CDX-NAIG closed -1bp/70bps and CDX-NAHY -10bps/462bps.

- Crude oil closed +0.8%/$40.92 per barrel.

- The IHS Markit AAA Municipal Analytics Curve (MAC) rallied 2bps

across the curve and yields have improved 8-10bps over the past

week:

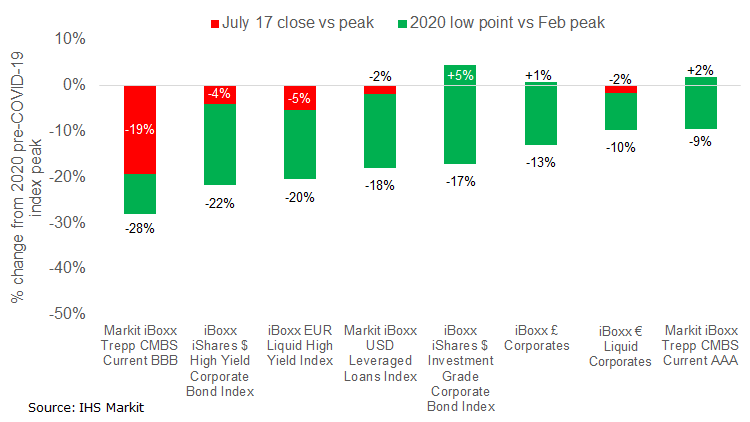

- The below chart shows the recovery across various fixed income

indices since the lows in March, with the IHS Markit iBoxx iShares

$ Investment Grade Corporate Bond Index, the iBoxx £ Corporate

Index, and the iBoxx Trepp CMBS Current AAA Index now higher than

February's peak levels. However, the iBoxx Trepp CMBS Current BBB

Index has recovered the least among the included indices, as it

remains 19% below its February peak.

- A coronavirus vaccine in development by the University of Oxford and AstraZeneca Plc showed promising results in early human testing. China's CanSino Biologics Inc. and a partnership of Pfizer Inc. and BioNTech SE also delivered positive trial updates, indicating progress in the pursuit to defeat the pathogen. (Bloomberg)

- In the week ended 4 July, US states reported 1,383,786 initial

claims of unemployment, a modest improvement compared with the

prior week as initial claims fell by 37,272. Claims fell in 30

states but there were sizable increases in several states led by

Texas, New Jersey, and Maryland. (IHS Markit Economist Alex

Minelli)

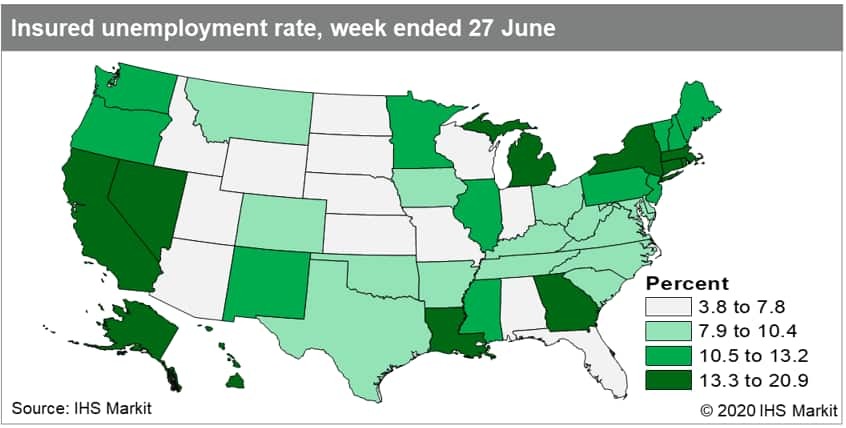

- Continuing claims of unemployment, which lag initial claims by one week, numbered 16,283,192 in the week ended 27 June. Declines occurred in 38 states as continuing claims fell by 920,842 (5.2%) from the previous week.

- The insured unemployment rate, equal to continuing claims divided by covered employment, fell by 0.6 percentage point to 11.3% as 36 states saw a decrease in the week ended 27 June.

- Continuing claims in the week ended 27 June numbered

16,283,192, down 920,842 from the week ended 20 June. Of the 38

states where continuing claims decreased, the largest declines were

in Florida (down 206,920), North Carolina (down 51,215),

Pennsylvania (down 48,857), Georgia (down 41,286), and Washington

(down 35,629). The large decrease in Florida was due to its

prolonged filing backlog and exacerbated by the biweekly system the

state reimplemented back in May.

- About one in four office employers intend to reduce their footprint by at least a fifth, and about 16% expect to move jobs out of the city, according to the Partnership for New York City, an influential group composed of corporate chief executives, which enlisted over a dozen consulting firms to work for free to conduct the study. Companies also expect only 10% of their employees to return to the office this summer and just 40% by year-end, according to the survey, which was conducted in May and released Monday. (Bloomberg)

- In a press release, Chevron Corporation announced the signing

of an agreement to acquire Noble Energy, Inc. in an all-stock

transaction valued at $14.4 billion. (IHS Markit Upstream Companies

and Transactions' Karan Bhagani)

- The transaction is expected to close in the fourth quarter of 2020. Under the deal, each Noble Energy shareholder will receive 0.1191 shares of Chevron for each Noble Energy share.

- The total equity offer value is $4.98 billion or $10.38 per share based on Chevron's closing price on 17 July 2020. The offer price is a 12% premium to the 10-day average closing price of Noble Energy.

- The total transaction value includes the assumption of Noble's 31 March 2020 working capital surplus of $562 million and $9.94 billion of long-term debt and liabilities.

- On closing, Noble Energy shareholders will own 3% of the combined company. The transaction will add 336,000 net acres across the DJ Basin, 92,000 net acres in the Permian Basin and 35,000 net acres in the Eagle Ford to Chevron's portfolio, the company said.

- DJ Basin assets produced around 150,000 boe/d (~70% liquids), Permian Basin around 65,000 boe/d (~80% liquids) and Eagle Ford assets produced 55,000 boe/d in 2019. Noble's key assets in other countries are as follows: Leviathan (39.6%) and Tamar (25%) fields in Israel, Alba field (33.75%), Block I (38%) and Block O (45% and operator) in Equatorial Guinea, Block 12 (35% and operator) in Cyprus and two exploration blocks (North Cleopatra and North Marina) in Egypt.

- Noble Energy's net proved reserves were 12.29 Tcfe (66% gas, 73% developed) at year-end 2019 and production averaged 233.8 MMcfe/d (54% oil and NGLs) during the first quarter of 2020.

- Celanese has agreed to sell its 45% share of Polyplastics to Daicel, its partner in the joint venture, for $1.575 billion in cash. Celanese says it will use the proceeds of the transaction, which is expected to close this year, for share repurchases and organic growth. Polyplastics will become a wholly owned subsidiary of Daicel, which says the deal is key to the restructuring of its plastics segment. Celanese and Daicel founded Polyplastics, a supplier, marketer, and manufacturer of engineered materials, in 1964. Major products include acetyl copolymer (also known as polyoxymethylene, or POM), liquid-crystal polymer (LCP), and polyphenylene sulfide (PPS).

- Ashland says it expects second-quarter sales to fall 10% year on year (YOY), to $574 million, with second-quarter adjusted earnings from continuing operations totaling $51 million, or 84 cents/share. "Strength in many consumer markets was offset by industrial weakness across the globe," Ashland says. "Our consumer business units performed particularly well as we experienced significantly stronger demand for pharmaceutical excipients, biofunctional ingredients, and additives for hand sanitizers," says Ashland chairman and CEO Guillermo Novo. "While our industrial businesses felt the impact of reduced global demand during April and May, the teams began to see signs of improving demand trends in June." Adjusted EBIDTA, however, grew 2% YOY during the quarter, to $143 million, due to cost-cutting measures. Ashland will report full second-quarter results on 28 July.

- Autonomous truck startup Plus.ai seeks USD60 million in latest funding, reports The Information. According to the report, Hong Kong-based investment and securities firm Guotai Junan International is expected to lead the funding, which will value Plus.ai in the range of USD600 million to USD1 billion. Plus.ai, which was founded in 2016, aims to make commercial freight transportation safer, more efficient, and less expensive for its customers. The company has raised USD200 million in funding over three rounds. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The US state of California's Department of Motor Vehicles (DMV) has issued a permit to AutoX to test its autonomous cars without a human backup driver, reports TechCrunch. The permit will allow the company to test its vehicle on designated streets near its headquarters in San Jose. The vehicle is approved to operate in fair weather conditions and light precipitation on streets with a speed limit of 45 mph. AutoX is the third company after Waymo and Nuro to receive a permit from the DMV for driverless testing. Currently, 62 companies, including Tesla, Ford, BMW, Nvidia, Volkswagen (VW), and General Motors (GM), have received permits from the DMV for testing their autonomous vehicles (AVs) on public roads with a safety driver on board. AutoX has recently partnered with Alibaba's mobility app operator AutoNavi to launch a robotaxi service in Shanghai's Jiading district. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- President Jair Bolsonaro on 15 July signed into law the

Sanitation Bill passed by Congress on 24 June. The new law will

permit the participation of the private sector in water provision

and sewage treatment, potentially opening up USD140 billion in new

investment opportunities. (IHS Markit Country Risk's Carlos

Caicedo)

- The law seeks to provide universal sanitation coverage by 2033, with estimated investments of USD8.8 billion a year, versus the current USD2.2 billion.

- The sanitation sector is the responsibility of local and regional state-owned companies, but they lack the resources to undertake large projects, offering major opportunities to private investors. Only 6% of sanitation firms in Brazil are privately owned, the rest are run by state-owned companies operating at state and city levels. However, most regions and municipalities are struggling with heavy fiscal deficits, with current expenditure requiring most of their budgets.

- The new framework improves regulatory clarity and strengthens legal certainty while promoting competition through compulsory bidding.

- Sanitation is likely to attract private investment in the next two years, but not at the rate suggested by the federal government, given the expected legal challenges by local authorities and resistance from some quarters in Congress. Companies already operating in the sector are likely to commit to new investment, but newcomers are more likely to wait for further clarity on the regulatory environment.

- Fitch Ratings on 16 July lifted its long-term foreign-currency issuer default rating (IDR) on Suriname to CC (75) from RD (85), driven by the completion of the consent solicitation to reschedule principal payments of the country's 2023 notes and amend terms of related accounts agreement. In Fitch's view, this event constitutes the execution and completion of a distressed debt restructuring, assessing that a broader restructuring is probable. The leading political party in the new government, the Progressive Reform Party (Vooruitstrvende Hervormde Partij: VHP), considers that debt restructuring is one way to improve government debt sustainability. On a similar argument, S&P Global Ratings (S&P) upgraded its long-term foreign-currency sovereign credit rating to CCC (65) from SD (80). The sovereign rating upgrade reflects Suriname's post-restructuring creditworthiness following bondholders' consent on 9 July to amend the terms of Suriname's USD125-million December 2023 bond. (IHS Markit Sovereign Risk's Claudia Wehbe)

Europe/Middle East/ Africa

- Most European equity markets closed higher except for UK -0.5%; Germany/Italy +1.0% and France/Spain +0.5%.

- 10yr European govt bonds closed higher across the region; Italy -9bps, Spain -5bps, and France/UK/Germany -2bps.

- iTraxx-Europe closed -3bps/59bps and iTraxx-Xover -22bps/345bps.

- Brent crude closed +0.3%/$43.28 per barrel.

- Finnish price growth stalled amid extremely weak pressures from

both demand and supply sides in the second quarter. Mainly due to

the latter's effects, some acceleration in inflation is expected in

the second half of 2020, but the outlook is shrouded with major

uncertainty. (IHS Markit Economist Venla Sipilä)

- Finland's consumer prices remained stable in June in annual comparison, after deflation rates of 0.3% and 0.2% year on year (y/y) in April and May, respectively, reports Statistics Finland. Compared with May, inflation was intensified in June mainly owing to the increased prices of long-distance passenger transport and wireless telephone services.

- The prices of cigarettes, long-distance transport services, and children's day care increased the most y/y in June. Annual inflation was mostly curbed by the falling costs of gasoline (petrol), hotel accommodation, diesel, and light fuel oil.

- Increased gasoline prices were instrumental in pushing month-on-month (m/m) inflation to 0.2% in June. Core inflation, which excludes the impact of food- and energy-price changes, stood at 0.3% in June.

- Using the European Union's Harmonized Index of Consumer Prices (HICP) inflation measure, Finnish prices remained unchanged y/y in June, following a deflation of 0.1% y/y in May. Preliminary results for the eurozone show HICP inflation at 0.3% y/y, following 0.1% in May.

- Finally, the HICP at Constant Taxes (HICP-CT) in June for Finland show a rate of -0.1% y/y, suggesting an impact of 0.1 percentage point from the changes in commodity tax rates on inflation.

- Spanish pharmaceutical company Grifols will invest approximately USD460 million in the acquisition of blood plasma processing facilities in Canada and the United States, according to a statement from the company. As part of an agreement with South Korean-based GC Pharma (Group), Grifols will buy a plasma fractionation facility and two purification facilities in Montreal, Canada, as well as 11 plasma collection centers in the United States. The Montreal-based facility will have a fractionation capacity of 1.5 million liters per year. The deal is subject to the necessary regulatory approvals and is expected to be completed before the end of 2020. The investment will strengthen the company's footprint in both Canada and the US. The acquisition of a fractionation plant in Montreal positions Grifols to become the only large-scale commercial manufacturer of plasma products in Canada once it secures the necessary approvals. (IHS Markit Life Sciences' Ewa Oliveira da Silva)

- Covid-19 has created a shift in global vanilla demand this year. World vanilla prices have drifted lower over the first half of this year on expected higher production. This is in line with IHS Markit's expectations back in December 2019, when it published its Global Outlook supplement. What was not anticipated though was that the world would be hit by a major pandemic in early 2020, resulting in thousands of deaths and causing major disruption to a multitude of sectors, including of course, agricultural commodities. The lockdown appears to have generated increased demand for vanilla at supermarket level in recent months, helping to offset a decline in offtake on the foodservice side of the industry. With Covid-19 forcing the closure of restaurants and other foodservice outlets and consumers in lockdown, vanilla has lost these key end use outlets. However, as a stay-at home treat, consumers have increased their purchases of products that contain vanilla. This includes the obvious examples of ice cream, yogurts and confectionery. It is open to debate whether this upturn in home consumption will fully make up for the shortfalls in foodservice offtake. The picture is further confused by the possible gradual reopening of restaurants, cafes and pubs etc in parts of Europe and other global destinations. IHS Markit still believes that a significant decline in prices is likely over the second half of this year. This could be by as much as 50% or more from prices prevailing in early June. A level around USD100/kg certainly looks possible by the end of this year as new crop supplies reach the market. It would be preferable if prices did not fall any lower than USD100/kg as anything below this level risks loss of interest among other origins, with Madagascar taking over control of the global market again. (IHS Markit Food and Agricultural Commodities' Julian Gale)

- In January-May, Slovenia's current-account deficit narrowed,

undermined by lost service exports. Meanwhile, external debt levels

rose as portfolio investments flowed into the country, attracted by

new public debt offerings. For 2020 as a whole, the current-account

surplus will be down and total external debt will be up. (IHS

Markit Economist Andrew Birch)

- In January-May 2020, Slovenia's current-account surplus narrowed as compared to a year earlier. The headline current-account surplus slipped in spite of a rising merchandise-trade surplus. While merchandise export losses were severe in the first five months of the year - equaling 14.2% year on year (y/y) - the drop-off of imports was even starker, at 16.5% y/y.

- Offsetting the rising trade surplus was a y/y deterioration of the services surplus. Lost tourism and transport service exports reduced the surplus, thus drawing down the headline current-account balance.

- As the global financial markets shifted to safe havens in the height of the pandemic, Slovenia benefited as a member of the eurozone, with a surge of net inflows of portfolio investment in April and May.

- Rising public debt securities attracted those portfolio investment inflows, driving up general government debt during the course of the first five months, by nearly EUR3.8 billion. This new public borrowing pushed up headline debt despite the still large current-account surplus.

- During a virtual meeting held over 22 June-10 July, the Zambian

government and the IMF held discussions on the necessary economic

policies needed to mitigate the fallout from the COVID-19 pandemic

on the country's overall economic activity, poverty levels, and

fiscal finances in the short to medium term. (IHS Markit Economist

Thea Fourie)

- The Zambian government has stated its intention to secure emergency financing under the IMF's Rapid Credit Facility. Zambia has also requested support under the G20's Debt Service Standstill Initiative (DSSI).

- "The social and macroeconomic impact of the COVID-19 shock, on top of a severe drought last year, will be heavy," the IMF warns. The IMF expects Zambia's economy to contract by 5.0% during 2020, while the number of people living in extreme poverty is expected to rise. In addition, fiscal pressures during 2020 have increased due to lower government revenue and rising spending needs.

Asia-Pacific

- APAC equity markets closed mixed; China +3.1%, India +1.1%, Japan +0.1%, South Korea/Hong Kong -0.1%, and Australia -0.5%.

- The Shanghai Composite closed 3.1% higher after China's regulators raised the limit on how much insurers can invest in equity assets to 45%, bringing fresh money into the stock market. (Seeking Alpha)

- China's public fiscal revenue grew 3.2% year on year (y/y) in

June, up 16.2 percentage points from May and the first expansion

time since the beginning of this year, according to release by the

Ministry of Finance (MOF) on 17 June. (IHS Markit Economist Yating

Xu)

- Tax revenue improved from contraction in the previous months to 9% y/y expansion as value-added tax declined at a slower pace with accelerating industrial production and corporate income tax rebounded due to half-year final settle.

- Consumption tax and import value-added tax and consumption tax returned to expansion, reflecting improvement in retails sales and unexpected recovery in imports.

- Non-tax revenue remained in 16.8% y/y contraction as state-owned enterprises' profit contribution declined amid the epidemic.

- Public fiscal spending declined 14.4% y/y in June, enlarging by 10.5 percentage points from May and the largest contraction since 2005.

- Local government spending fell 15.2% y/y, leading the headline decline. Spending on urban and rural community affairs was the main drag, falling 49% y/y, probably due to the flooding in southern China.

- Education, accounting for nearly 15% of total fiscal spending, declined 16% y/y.

- Moreover, health and social security spending registered double-digits decline as domestic pandemic eases. The positive side is that spending on culture and sports as well as transportation improved to expansion as economy gradually recovers. Debt interest payment growth accelerated to 23%.

- Government fund spending increased 43.7% y/y in June from 12% y/y in May, following nearly CNY1 trillion worth of local government bond issued in May.

- Land sales revenue rose by 5.2% in the first half, compared to the target set at 3% y/y, which could be financing source for local government spending.

- The fiscal revenue in the first half declined by 10.8% y/y with sharp contraction in the first quarter and sustained recovery in the second quarter.

- Fiscal spending declined by 5.8% y/y with urban and rural community affairs and energy conservation leading the contraction.

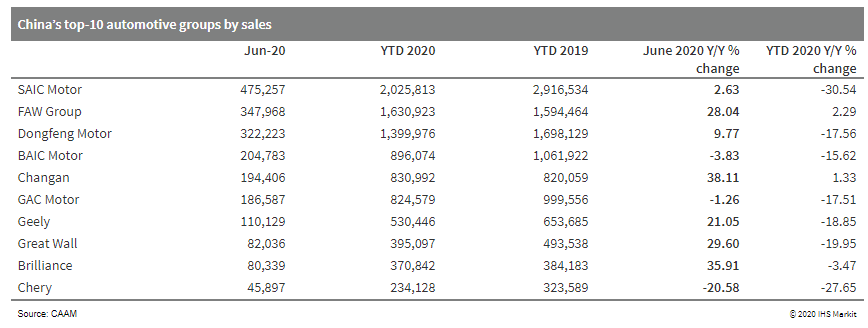

- Chinese new vehicle sales continued to gain traction in June as

the market recovers from the COVID-19 virus pandemic. New vehicle

sales on a wholesale basis rose by 11.6% year on year (y/y) to 2.30

million units last month, while production increased 22.5% y/y to

2.32 million units, according to data from the China Association of

Automobile Manufacturers. (IHS Markit AutoIntelligence's Abby Chun

Tu)

- Thanks to a rebound in new vehicle demand that began in April, new vehicle sales and production volumes in the year to date (YTD; January to June) are narrowing the gap with the same period last year. New vehicle sales volumes in the YTD have surpassed the 10-million mark despite a decline of 16.9% compared with the same period of 2019.

- In June, sales of passenger vehicles (PVs) continued to increase, posting moderate growth of 1.8% year on year (y/y) to 1.76 million units.

- Commercial vehicle (CV) sales surged 63.1% y/y to 536,000 units during June on the back of strong demand for light commercial vehicles. In the first half of 2020, sales of CVs have risen by 8.6% y/y to 2.38 million units, contributing largely to the rebound in new vehicle sales.

- The CAAM's data also indicates that Chinese brands lost market

share to foreign rivals in the first half of the year. The combined

PV sales of Chinese brands totaled 590,000 units, down 11.6% y/y,

in June. The market share of Chinese brands is estimated at 33.5%

in June, down 5 percentage points from June 2019. The data also

indicates the PV market share of Chinese brands has decreased to

the lowest level since the beginning of 2018.

- Chinese electric vehicle (EV) startup Xpeng Motors (Xpeng) has raised USD500 million in its latest funding round, reports Reuters citing a company statement. The investors joined the new round of funding include Aspex, Coatue, Hillhouse and Sequoia Capital China. The new funds raised will enable Xpeng to develop its intelligent vehicle technologies. The startup also plans to have around 200 showrooms in China by the end of this year. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Dongfeng Motor Group launched its premium electric vehicle (EV) brand on 17 July. The brand, whose name currently has been presented in Chinese characters only (an approximate English translation of which is 'Blueprint'), will have a new logo different from Dongfeng's main brand, Dongfeng. At the launch event for the brand, Dongfeng confirmed that the new brand's product line-up will be designed to tap the premium EV market. The brand and its product strategy is to be managed by a dedicated subsidiary of Dongfeng. The new subsidiary is to be led by Lu Fang, an automotive industry veteran who has experience in vehicle engineering and held various roles at FAW Group between 2006 and 2018 before joining Dongfeng. Dongfeng is looking to introduce nine models under the new brand, including sport utility vehicles (SUVs) and multi-purpose vehicles, with the first one hitting the market in 2021. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Japan's Ministry of Economy, Trade and Industry on 17 July announced JPY57.4 billion (USD536 million) in subsidies for 57 Japanese companies to invest in production in the country. Another 30 companies were allocated JPY12.6 billion in subsidies for investments in factories in Southeast Asia. Part of the fiscal 2020 supplementary budget, the government's JPY220-billion subsidy program aims to reduce reliance on manufacturing in China by encouraging companies to shift production to Japan or diversify output. The subsidies prioritize the production lines of high-added value products, such as auto parts, aviation parts, and electronics. The pharmaceutical industry is also prioritized to ensure the procurement of items such as personal protective equipment (PPE) during the COVID-19 virus pandemic. IHS Markit assesses that the government's subsidy program will likely be successful in reducing Japan's supply chain reliance on China over the coming year. A shift is already under way because of ongoing territorial disputes in the East China Sea, anti-Japanese demonstrations in China, and the deterioration in China-US relations, all of which have led Japan to review its reliance on Chinese supply chains. (IHS Markit Country Risk's Hannah Cotillon)

- Japan's trade balance turned to a deficit of JPY269 billion

(USD2.5 billion) in June from a surplus of JPY588 billion a year

earlier on a non-seasonally adjusted basis, but the seasonally

adjusted deficit narrowed by 27.6% from the previous month to

JPY424 billion. (IHS Markit Economist Harumi Taguchi)

- While the trade deficit reflected a continued large contraction of exports (26.2% year on year [y/y]) outpacing the decline for imports (14.4% y/y), the softer deficit relative to the month-earlier level was due to the first month-on-month (m/m) increase in exports (up 1.4%) in five months because of the reopening of economic activities in Japan's trade partners.

- Global containment measures continued to severely dampen Japan's exports of transport equipment, as a 41.1% y/y drop in exports of transport equipment accounted for 9.5 percentage points of the contraction of total exports.

- Decreases of exports of ordinary machinery, iron and steel, and chemical products were also major contributors to sluggish exports.

- By region, declines softened for exports to the US (down 46.6% y/y) and the European Union (down 28.4% y/y), but a faster decrease in exports to Asia (down 15.3% y/y) largely reflected a steeper contraction of exports to ASEAN markets (down 1.9% y/y).

- The fall in imports was due largely to weak prices of oil and other resources, as the decline in import volume softened to a 0.2% y/y drop from a 14.5% decrease in May.

- Imports of mineral fuel remained a major contributor (9.9 percentage points) to the contraction of total imports. Other major factors behind the steep decline included imports of autos (down 49.9% y/y), aircraft (down 78.5% y/y), and clothing and accessories (down 17.1% y/y), reflecting weak demand despite the lifting of Japan's state of emergency in late May.

- Hyundai and Korea Gas Corporation (KOGAS), a state-run natural gas company, have signed a memorandum of understanding (MoU) to form a joint venture (JV) to establish and operate integrated hydrogen charging stations, reports The Korea Herald. The integrated hydrogen charging stations will be able to carry out several functions such as hydrogen production, charging, selling, and fuel-cell power generation. The stations will produce hydrogen from natural gas supplied by KOGAS and also sell leftover hydrogen or use it to generate electricity. Hyundai is already part of the South Korean government-led special purpose company (SPC) to establish fuel-cell electric vehicle (FCEV) charging infrastructure in the country. The automaker along with KOGAS, Air Liquide Korea, and 10 other companies set up the Hydrogen Energy Network (HyNet) in March 2019 to build 100 hydrogen chargers across the country by 2022. (IHS Markit AutoIntelligence's Isha Sharma)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-july-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-july-2020.html&text=Daily+Global+Market+Summary+-+20+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-july-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 20 July 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-july-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+20+July+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-july-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}