Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 12, 2020

Daily Global Market Summary - 12 October 2020

Most APAC and all major US equity indices closed higher, while European markets closed mixed. The US bond market was closed for a market holiday and benchmark European government bonds were higher across the region, with longer maturity Italian bonds reaching new record low yields. iTraxx closed tighter across IG and high yield, while WTI/Brent were both lower on the day. The US dollar ended the day flat and both gold and silver were higher on the day.

Americas

- US equity markets closed higher today; Nasdaq +2.6%, S&P 500 +1.6%, DJIA +0.9%, and Russell 2000 +0.7%.

- Today's rally in the Nasdaq coincided with an increase in the CBOE NDX Volatility Index, which potentially indicates that the buying of option contracts is fueling a more significant share of the day's gains given that volatility typically decreases during rallies. A similar trend occurred during the Nasdaq rally in August and early-September. (Bloomberg)

- US bond markets were closed for a market holiday.

- DXY US dollar index closed flat/93.05.

- Gold closed +0.1%/$1,929 per ounce and silver +0.6%/$25.27 per ounce.

- Crude oil closed -2.9%/$39.43 per barrel.

- The first confirmed case of COVID-19 reinfection in the US has added to doubts about "herd immunity" from the virus, and worried experts because the patient became more seriously ill following the second infection. A 25-year old Nevada man tested positive for COVID-19, after developing moderate symptoms in April. He then suffered more severely two and a half months later, requiring emergency oxygen therapy. University of Nevada scientists found many more differences in the two genetic fingerprints of the viruses than could be explained by mutations during one long illness, confirming two separate infections. (FT)

- Tesla has requested approval to build battery cells as well as vehicles in Texas, according to media reports. Bloomberg reports that in a 188-page filing with the Texas Commission on Environmental Quality, Tesla indicated its battery intent. Bloomberg quotes the document as saying, "The facility is proposing to operate a cell-manufacturing unit to produce the battery packs that are installed in the vehicle." Bloomberg noted that Tesla's senior vice-president for powertrain and energy strategy, Drew Baglino, did not respond to requests for comment. Tesla announced the site selection of Austin (Texas) for its next US plant in July. At a recent Battery Day event, Tesla outlined plans for a new battery that will be cheaper and easier to produce, but also indicated the company will continue to source batteries from its current partners, although other than saying the new batteries are in the pilot production phase at the Fremont (California) plant, did not identify which plants will build them. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Plant- and cell-based meat advocates have teamed up again with Tofurky to challenge yet another state labeling law restricting the use of traditional terms on the labeling of alternative "meat" products. In a lawsuit filed on Oct. 7 on behalf of alternative meat producer Tofurky, the Good Food Institute (GFI) and the Animal Legal Defense Fund (ALDF) have challenged a sweeping labeling law in Louisiana, which prohibits the use of terms such as "meat," "sausage" or "burgers" on any products made from non-traditional sources, including plants, insects or cell based meat. The Louisiana statute, which went into effect Oct. 1, was enacted with wide support from the state's agriculture industry in June and had caught GFI's attention months ago, as it sought to impose broad restrictions on the use of common terms such as "meat," "rice" or "sugar" on the labels of non-traditional products. Under the statute, producers cannot use traditional terms such as "burgers," "hot dogs" and "rice" in products, such as "veggie burgers," "meatless hot dogs" or "cauliflower rice," even when the labels include a modifier to clarify the products were derived from non-traditional sources. Moreover, the statute established a fine of up to $500 per day, per product, for manufacturers who violate the restrictions. While Louisiana's ag industry has hailed the statute as a way to protect consumers from confusing labels, the new lawsuit claims it violates Tufurky's First Amendment right to truthful commercial speech. Filed with the U.S. District Court for the Middle District of Louisiana, on behalf of Hood River, Ore.- headquartered Tofurky manufacturer Turtle Island Foods, the complaint argues that the Louisiana law violates the company's First Amendment right to truthful commercial speech. The complaint also highlights the protectionist nature of the statute, noting that rather than based on evidence of confusion among consumers, the statute was enacted only to protect the state's traditional meat and cattle industry. (IHS Markit Food and Agricultural Policy's Margarita Raycheva)

- Arbiom has achieved successful operation of its fermentation technology for seven days without contamination or product quality issues. The company is aiming to move from batch production of its SylPro protein-rich feed ingredient to continuous commercial manufacturing. The start-up converts wood into protein for animal feed using biomass processing, fermentation technology and enhanced microorganism strains. Durham, North Carolina-based Arbiom said fermentation and downstream process stages "ran smoothly and continuously" during a demonstration version of its technology. The company produced over half a ton of SylPro - an alternative protein approved for use in the EU, Canada and the US. SylPro has an enhanced amino acid profile and high digestibility for use in animal feed. The amount of SylPro produced during the demonstration exceeded Arbiom's initial target. The firm worked with Bio Base Europe Pilot Plant (BBEPP). The demonstration as conducted at BBEPP's facility in Belgium. BBEPP is an independent facility that operates from a laboratory level to a multi-ton scale. It operates as service provider for process development, scale-up and custom manufacturing of bio-based products and processes. Arbiom continues to work on scaling up its technology with the help of BBEPP. The start-up has completed over 1,500 hours of process scale-up operations for SylPro. By the end of 2020, it expects to have run its bioconversion process continuously at the 15m3 scale (15,000 liters). Earlier this year, Arbiom secured successful results from a study evaluating SylPro for use in Nile tilapia feed. The firm has also gained positive results from trials testing SylPro as a feed ingredient for weanling pigs. (IHS Markit Animal Health's Joseph Harvey)

- The Central Reserve Bank of Peru (Banco Central de Reserva del

Perú: BCRP) opted to maintain the policy rate during its 7 October

meeting, citing below-target inflation and the continued need to

support access to credit. (IHS Markit Economist Jeremy Smith)

- October marks the sixth consecutive month at the 0.25% level after the BCRP cut its key policy rate by 100 basis points in April. Annual consumer price inflation ticked up to 1.8% in August from 1.7% in July, which remains below the 2% target rate but is within the bottom portion of the target range.

- During the session the BCRP also agreed to hold constant the overnight deposit rate at 0.15% and the rate on security/currency repo operations at 0.50%. These measures, along with the Reactiva Perú program, which provides businesses with access to credit, offer continued liquidity support for the economy.

- The Peruvian government guarantees commercial bank loans issued under the program at up to 95% of the principal amount. Private-sector credit and private-sector liquidity grew at annual rates of 14.4% and 25.8%, respectively, in August.

- The BCRP signaled its intention to maintain a strong expansionary stance for as long as the effects of the coronavirus disease 2019 (COVID-19)-virus pandemic continue to put downward pressure on inflation, even as preliminary indicators point to significant progress towards recovery for the Peruvian and global economies in the third quarter.

- In the short-to-medium term, Peru will continue to provide strong support to the private sector through the Reactiva program. Although the reference policy rate has held steady at 0.25% since April, average annual lending rates to small businesses fell from 22.19% in April to 3.29% in August.

- IHS Markit expects annual inflation for 2020 to remain below the 2.0% target rate because of weak domestic demand amid a harsh economic recession; we therefore currently expect the BCRP to keep its policy rate constant until late 2021.

- The media reports that JBS, the world's largest meatpacking

company, has set a target for zero deforestation and the

introduction of measures to track the history of all animals in its

supply chain by 2025 to ensure that no cattle originate from

illegally deforested land. In 2019 and 2020, forest fires destroyed

large areas of the Brazilian Amazon rainforest. In response,

non-governmental organizations (NGOs), foreign governments, and

companies have increasingly blamed deforestation on the expansion

of Brazil's agribusiness industry and perceived lack of

environmental controls. Amid a growing global focus on climate

change, environmental sustainability is becoming increasingly

important for international suppliers and consumers, with the

Brazilian Amazon a key focal point. Given this dynamic, companies

operating in Brazil face increasing pressure from exporters to

demonstrate efforts to ensure sustainability to avoid reputational

damage and the risk of consumer or investor boycotts. (IHS Markit

Country Risk's Ailsa Bryce and Carlos Caicedo)

- The growth and geographical expansion of cattle ranching and agribusiness in Brazil is increasingly encroaching on the Amazon rainforest. Numerous NGOs, including the World Wildlife Fund (WWF) have reported rising Amazon-based deforestation. WWF reported that 9,205 square kilometers were deforested between 1 August 2019 and 31 July 2020, a 33% increase on the same period in 2018-19.

- Threats of boycotts by international brands and global supermarket chains selling Brazilian products with potential links to deforestation are increasing pressure to ensure environmental sustainability. In May 2020, more than 40 supermarkets, including the United Kingdom's Sainsbury's, Tesco, Morrisons, and Marks & Spencer, signed an open letter demanding that the Brazilian Congress implement stricter regulations to prevent deforestation, without which they pledged to boycott Brazilian meat products.

- International condemnation of deforestation puts pressure on companies in other sectors to meet Environmental, Social, and Governance (ESG) requirements, with increased risk of blacklisting of Brazilian companies. In June 2020, 29 financial institutions, including Legal & General Investment Management, Sumitomo Mitsui Trust Asset Management, and Nordea Asset Management, delivered a letter to the Brazilian government stating that should deforestation continue, they would consider divesting their interests in Brazilian companies.

Europe/Middle East/Africa

- European equity markets closed mixed; Germany/France +0.7%, Italy +0.6%, Spain flat, and UK -0.3%.

- 10yr Italian govt bonds closed -4bps/0.68% yield and 30yr bonds -7bps/1.53% yield, which both broke through new all-time low yields today.

- 10yr European govt bonds closed higher across the region; Germany/France/Spain -2bps and UK -1bp.

- iTraxx-Europe closed -1bp/51bps and iTraxx-Xover -10bps/307bps.

- Brent crude closed -2.6%/$41.72 per barrel.

- EU farming association Copa-Cogeca has welcomed the European Parliament's support for the creation of a carbon-crediting scheme for farmers, which would pay food producers for the greenhouse gases they store in soils. Copa-Cogeca made the statement after MEPs voted their position on the new EU climate law, which the European Commission proposed in March to legally enshrine its Green Deal ambition of reaching net-zero greenhouse gas emissions by 2050. In amendment 144 to the draft Regulation, the MEPs state that the Commission should explore the feasibility of introducing carbon-crediting schemes, including for land use in agriculture, and present the results of this assessment by 30 June 2021. Pekka Pesonen, secretary-general of Copa-Cogeca, said this would be an "excellent opportunity" to boost the carbon sequestration potential of agricultural lands and increase farmers' income through a market-based approach. (IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- Mercedes-AMG is to drop its 'Hot-Vee' 4.0-litre V8 turbocharged powertrain from the next-generation C63 high-performance sedan and replace it with a hybrid 2.0-litre 4-cylinder turbocharged unit, reports Autocar. According to the report, the unit will be based closely on the M 139 engine, in the current Mercedes-AMG A45 S and which has the highest specific output of any current production model, at 421 bhp; however, the unit will have enhanced hybrid capability. This is an example of dramatic engine 'downsizing' on a performance vehicle, with the proposed new C63 having exactly half the capacity and number of cylinders as its direct predecessor. It will be the first time that Mercedes' performance variant in this segment has had four cylinders since the 1980s and the Mercedes 190E 2.3 16v. It is brave of Mercedes-AMG to go down this route on a high-performance D-segment sedan and coupé, as customers enjoyed the character of the 'Hot Vee' V8 - so-called because its turbos are packaged on top of the engine in between the cylinder banks - an integral part of the experience of the current C63 and also the AMG-GT, which it also powers. For example, BMW retained the turbocharged straight-six layout of the previous M3 and M4 on the just-launched new iterations. The new C63, which will utilize 48v technology to boost its power, is due to be launched in 2022. (IHS Markit AutoIntelligence's Tim Urquhart)

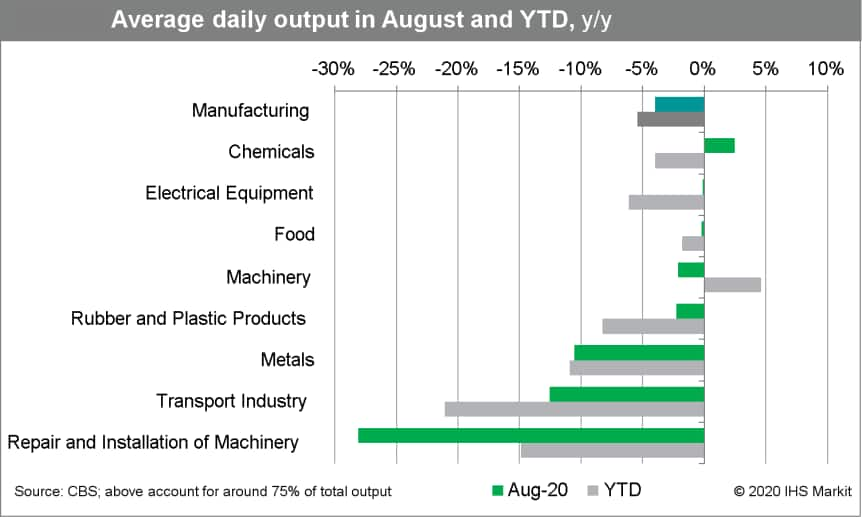

- In August, on a seasonally and working-day-adjusted basis,

Dutch manufacturing output was up by 0.7% month on month (m/m), a

significant deceleration from an increase of 4.0% m/m in July.

Output was down by 4.4% year on year (y/y) and also by 4.4%

compared with February, prior to the impact of the COVID-19 virus

pandemic. (IHS Markit Economist Daniel Kral)

- On a seasonally unadjusted basis, in July average daily output of the Dutch manufacturing sector was down by 4.0% y/y. On a three-month moving average basis, output was down by 6.4% y/y - an improvement from 9.1% in July.

- In July, most major sub-components were a drag in annual terms. The biggest drops were recorded in repair and installation of machinery, which was down by 28.1% y/y; transport, down by 12.6% y/y; and metals, down by 10.5% y/y.

- At 52.5 in September, the Dutch manufacturing purchasing managers' index remained largely unchanged from August. However, the output sub-index increased to 55.9 indicating a continued strong rebound in output in the short term.

- The latest output and survey data reinforce our baseline of a strong, but partial, bounce back in the third quarter after a record contraction in the previous quarter. The pace of the rebound is likely to fade over time.

- The Dutch export sector is highly dependent on European demand,

with 70% of goods exports going elsewhere in the European Union.

The continued recovery in Dutch manufacturing activity is heavily

dependent on European demand.

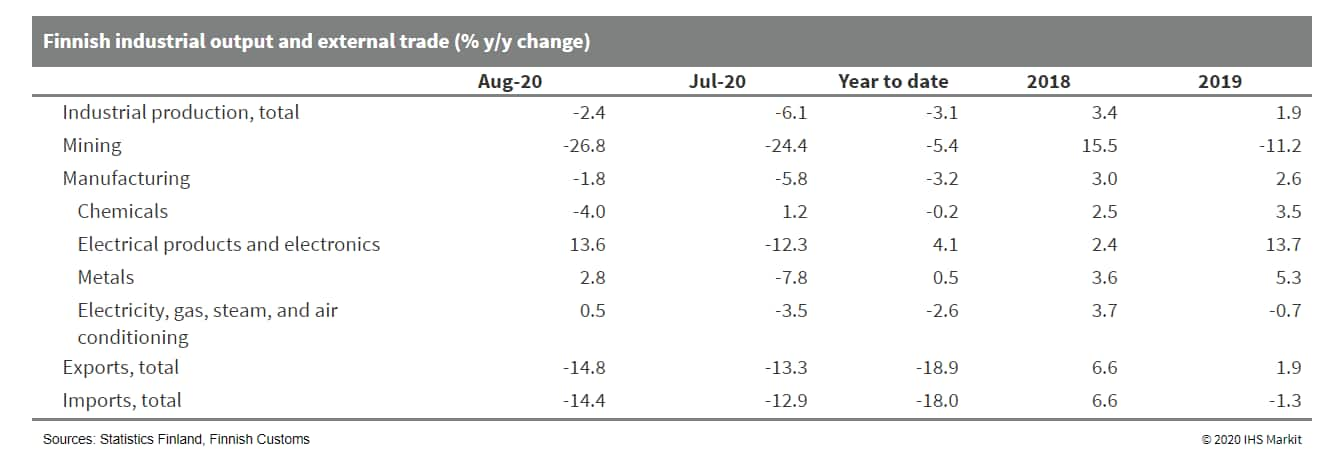

- According to Statistics Finland, working-day adjusted output

contracted by 2.4% year on year (y/y) in August, following a slide

of 6.1 y/y in July. This brought the cumulative fall in industrial

output in January-August to 3.1% y/y. Seasonally adjusted data show

growth of 2.0% from July in August. (IHS Markit Economist Venla

Sipilä)

- The manufacturing of electronics and metal output both returned to annual growth in August. Meanwhile, chemical-sector manufacturing contracted in August, while the mining sector continued its significant slide.

- Finnish Customs reports that the value of goods exports decreased by 14.8% y/y in August, and by 16.4% y/y in January-August. Imports fell by 14.4% y/y in August and by 12.3% y/y during the first eight months of the year.

- As a result, the trade balance in August showed a deficit of EUR245 million (USD290 million), which presents a narrowing of 7.2% y/y. However, the January-August gap of EUR2.4 billion marks more than triple of the shortfall in annual comparison

- The August fall in exports was broad-based, with oil processing, chemical, and mechanical forest industries and industrial machinery and equipment sectors all reporting sharp decreases. An aircraft delivery to the United States contributed EUR116 million to the value of exports of transport equipment, and without this, total exports in August would have decreased by 17.1% y/y (instead of 14.8% y/y).

- Exports to nearly all key trade partners decreased in August, with the notable exception of the US. In particular, exports to Russia fell by nearly 40% y/y and exports to China dwindled by around 26% y/y, while exports to Germany decreased by 5.2% y/y. EU exports on the whole decreased by 14.3% y/y and extra-EU exports by 15.4% y/y.

- The moderating pace of the industrial contraction well matches

our forecasts. Although the June collapse of 7.1% y/y seems to have

presented the bottom of this output cycle, the recovery's momentum

is weak and fragile, as the Finnish economy and its European trade

partners are coping with increasing cases of the COVID-19, which

brings uncertainty to the outlook.

- The autonomous vehicle operation technology entity formerly known as Zenuity has been renamed Zenseact. According to the company's website, the new name combines the words zen, sense and act, reflecting not only the abilities of its technology but also giving occupants an opportunity to relax. The decision to change the name comes in the wake of Volvo Cars and Veoneer announcing that they would split the Zenuity joint venture (JV) which they had previously established. Under this move which was completed on 1 July, Zenuity became a standalone independent company wholly owned by Volvo Cars which includes operations and staff in Gothenburg (Sweden) and Shanghai (China). Veoneer received intellectual property licenses and around 200 software engineers located in Germany, the US, and Sweden, as well as USD15 million in cash. The change of name is likely to be in order to signal the end of the earlier JV. Zenseact will focus on the development of autonomous technology for Volvo's next-generation SPA2 architecture, which will be first used on the XC90 sport utility vehicle (SUV) and is set to feature the 'Highway Pilot' technology, as well as building on and further developing what was previously Zenuity's software platform. (IHS Markit AutoIntelligence's Ian Fletcher)

- Both merchandise export and import contraction remain severe as

of August 2020, contributing with lost service revenues to a

contraction of overall trade activity in Croatia. With the sluggish

recovery of both European and Croatian economic activity, total

volume of trade will remain low throughout the remainder of 2020.

(IHS Markit Economist Andrew Birch)

- Detailed trade data show a more than 7% year-on-year (y/y) contraction in Croatian exports in January-July 2020 in nominal kuna terms. Preliminary data for August report a moderation in the fall of merchandise goods that month, to just 1.8% y/y, though the cumulative losses remained large, at 6.5% y/y.

- With a re-emergence of COVID-19 infections within Croatia, domestic demand has failed to drive imports back upwards. After contracting by 11.5% y/y through the first seven months of the year, imports fell by another 7.8% y/y in August. With losses still severe, imports were down by 11.1% y/y in January-August 2020.

- Tourism statistics through July paint a dismal picture for the export of services. In January-July, the number of foreign tourist arrivals was down by 68.8% y/y. After essentially evaporating in April and May, foreign tourist arrivals remained far below year-earlier levels in both June (down 86.4% y/y) and July (down 51.2% y/y).

- Lost merchandise exports is severely disrupting domestic industrial activity and, thus, overall economic prospects. With the sluggish recovery of the European production cycle, we do not anticipate any substantial improvement in either exports or industrial production in the final quarter of 2020.

Asia-Pacific

- Most APAC equity markets closed higher except for Japan -0.3%; Mainland China +2.6%, Hong Kong +2.2%, Australia/South Korea +0.5%, and India +0.2%.

- Japan's private machinery orders (excluding volatiles), a

leading indicator for capital expenditure (capex), notched up by

0.2% month on month (m/m) in August following a 6.3% m/m rise in

July. That said, private machinery orders remained weak, dropping

13.7% below the year-earlier level, gradually softened from a 25.3%

year-on-year (y/y) decrease in June. Seasonally adjusted figures by

industry groupings were rather sluggish, as manufacturing fell by

0.6% m/m and non-manufacturing (excluding volatiles) dropped by

6.9% m/m. (IHS Markit Economist Harumi Taguchi)

- The first m/m drop in orders from manufacturing in three months reflected declines in orders from chemical and chemical products, shipbuilding, iron and steel, and some other groupings, and these were largely offset by solid rises in orders from general-purpose and production machinery, non-ferrous metals, and other transport equipment. The weakness in orders from non-manufacturing was due mainly to drops in orders from finance and insurance.

- A solid improvement in orders from overseas (up 49.6% m/m) could drive industrial production and in turn support recovery of orders from manufacturing. However, recovery in orders from overseas is still patchy and the resurgence of COVID-19 infections in some countries could dampen further improvement. Substantial declines in corporate profits and continued sluggish cash flows could push out fixed investment.

- Baidu has announced the opening of its Apollo Go Robotaxi service at full scale to users in Beijing, reports Gasgoo. Customers will be able to take driverless taxi rides free of charge (without needing to pre-book) in pick-up spots in Beijing Economic Technological Development Area, Haidian District and Shunyi District. The free robotaxi service is available from 10 October until 6 November 2020. The service can be used via Baidu Maps or Apollo Go Apps. At the moment, Apollo Robotaxi allows two passengers aged between 18 and 60 with a safety driver on board. In September, Baidu opened the "Apollo Go Robotaxi" service to the public in Beijing. Initially, it deployed 40 robotaxis in a trial area with a total length of 700 km. Baidu is the first company to use robotaxis picking up passengers in Beijing. It has previously launched Apollo Go in Cangzhou (see China: 24 August 2020: Baidu launches public trial of robotaxis in Chinese city Cangzhou), and has been offering free robotaxi rides to the public in Changsha, a service that was previously limited to verified volunteers. (IHS Markit Automotive Mobility's Tarun Thakur)

- Great Wall Motor has recorded a 17.8% year-on-year (y/y)

increase in sales to 117,812 units during September. <span/>(IHS Markit

AutoIntelligence's Abby Chun Tu)

- The strong performance in September helped the automaker to narrow the gap further between its year-to-date (YTD) sales in 2020 and last year's volumes for the same period. Great Wall's combined sales volumes total 680,690 units in the YTD (January to September), down 6.0% y/y.

- Total deliveries of the automaker's Haval brand increased 5.14% y/y to 79,120 units in September, while sales of the WEY brand rose by 3.86% y/y to 9,037 units.

- Sales of the automaker's pick-up trucks, including the Wingle and P-series, were 22,885 units last month, up 67.29% y/y.

- Sales of the Ora electric vehicle (EV) brand were 6,619 units last month, compared with 1,877 units in September 2019.

- Great Wall's export volumes totaled 7,773 units in September. In the YTD, the automaker reports export volumes of 41,457 units.

- Great Wall's pick-up product line was the main contributor to its sales growth in September.

- General Motors (GM) delivered more than 771,400 vehicles in

China in the third quarter of the year, up 12% year on year (y/y).

The figure includes both imported vehicles and locally produced

models. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Among its brands, Buick delivered 252,000 vehicles in the third quarter, up 26% y/y.

- Cadillac deliveries increased 27.6% y/y to 65,200 units while Chevrolet delivered 77,500 vehicles, down 20% y/y.

- Baojun and Wuling, GM's two brands under the SAIC-GM-Wuling joint venture (JV) reported mixed results for the third quarter. Baojun deliveries fell by 18.6% y/y to 100,100 units while deliveries of Wuling increased 26.3% y/y to 276,600 units.

- GM's sales performance in the third quarter is in line with the overall passenger car market, which has been rising continuously since May.

- Strong consumer desire for new vehicles and a resilient Chinese economy despite the COVID-19 virus pandemic are underlying forces behind the rebound in passenger vehicle demand.

- Following its July 2020 announcement on its new MySE11-203 11 MW hybrid drive turbines, Mainland Chinese company MingYang Smart Energy has signed an agreement with certification body DNV GL to conduct tyoe certification for its new offshore wind turbine. MingYang has stated that the MySE11 is based on the similar compact design and dybrid drive of its predecessor product MySE5.5 MW turbine. The company has claimed that the light-weight and compact size will suit the fast-growing offshore wind market sector, and is setting its sights on the European market. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- The Reserve Bank of India's (RBI) newly appointed Monetary

Policy Committee (MPC) kept the key interest rates unchanged

following its October policy meeting, with the repo rate at 4.0%,

the reverse repo rate at 3.35%, and the marginal standing facility

rate and the bank rate at 4.25%. (IHS Markit Economist Hanna

Luchnikava-Schorsch)

- Despite inflation being above the RBI's tolerance band of 2-6% - which prevented the MPC from making a rate cut in October - it decided to continue with the accommodative stance "as long as necessary - at least during the current financial year and into the next financial year", while ensuring that inflation remains within the target range.

- The decision was unanimous among all six MPC members - including the three newly appointed external members, who are regarded as more dovish than their predecessors.

- In the RBI's assessment, the underlying factors behind the current elevated consumer price inflation - which stood at 6.7% in both July and August - are supply shocks related to the COVID-19 virus pandemic and the measures to combat it, which should dissipate once the economy gradually reopens and supply chains are restored.

- Despite keeping policy rates unchanged, the RBI announced other measures to lower banks' lending rates and provide sufficient liquidity for the economy and the government. Specifically, it pledged to double the size of open-market bond purchases to INR200 billion (USD2.7 billion) and to buy state government bonds as an exceptional measure (this is usually reserved for central government debt only).

- The latter is particularly important in light of the growing fiscal burden of India's state governments amid a sharp rise in healthcare spending and a goods and services tax (GST) revenue shortfall.

- To boost liquidity for other parts of the economy, the RBI raised the limit on banks' retail credit exposure and committed to providing INR1 trillion of targeted long-term funds (TLTRO) for banks to extend loans and invest in corporate bonds and commercial papers in specific sectors.

- The MPC also released its updated real GDP projections. It expects real GDP growth to contract 9.5% in the financial year ending March 2021 (FY 2021) and to rebound to growth of 20.6% in FY 2022.

- The RBI's October statement clearly indicates that it is ready to prioritize growth revival over inflation, which would require it to deploy further monetary stimulus as domestic demand gradually recovers. In 2020 alone, the RBI has cut the policy repo rate by 115 points, and it is now likely to cut rates again as early as its next meeting in December 2020 or the first quarter of 2021.

- The Delhi state government has waived road tax on electric vehicles (EVs) under its new EV Policy, reports the PTI. The transport department stated that the Lieutenant Governor of the national capital territory of Delhi, Anil Baijal, has exempted the tax levied on all EVs. This will be applicable on all EVs with immediate effect. "Another crucial step towards ensuring a pollution-free Delhi. This incentive-based policy will encourage large scale adoption of EVs, and bring us closer to fulfilling our dream of making Delhi the EV capital of India," Chief Minister Arvind Kejriwal tweeted. The state government also revealed its intention to waive the registration fee for EVs in the next few days. The Delhi state government rolled out a new three-year EV Policy in August with the aim of countering the rising level of air pollution, and in line with the Indian government's goal to encourage sales of environmentally friendly vehicles in the country. (IHS Markit AutoIntelligence's Isha Sharma)

- Groupe PSA is reportedly looking to launch a mass-market electric sport utility vehicle (SUV) model in the Indian passenger vehicle market in 2022, reports ETAuto. The model, codenamed eCC21, is expected to be priced around INR800,000 (USD10,959). Additionally, the company is looking to add a flexi-fuel small SUV that is compatible to run on a 1.2-litre gasoline (petrol) engine with ethanol blends starting from 27% to 100% on the biofuel, in the second half of 2021. Citroën India has confirmed its plans to launch its first model in India, the Citroën C5 Aircross SUV, during the first quarter of 2021. The model was previously expected to debut at the end of this year, but the plan was deferred owing to the ongoing challenging business environment due to the COVID-19 virus outbreak. (IHS Markit AutoIntelligence's Isha Sharma)

- South Korea's National Assembly became the country's first state organization to adopt a fuel-cell bus, and it will use it to help transport people within the parliament and from neighboring subway stations, reports the Yonhap News Agency. "We will initially operate the hydrogen [fuel-cell] bus two to four times a day as a shuttle bus for those who visit the National Assembly, along with other combustion engine buses," said an unnamed National Assembly official. The fuel-cell bus, manufactured by Hyundai, can travel up to 434 km on a single charge, and it takes about 13 minutes to fully charge the 180 kilowatt-hour battery installed in the bus. The National Assembly set up a hydrogen charging station inside the parliament in September last year. This latest development is in line with the South Korean government's wider aims to reduce greenhouse gas emissions, generate new growth momentum for its automotive industry, and reduce its heavy reliance on imported oil. Hydrogen fuel has a strong potential to revive sluggish manufacturing businesses, including small and medium-sized enterprises, which in turn will create new jobs. (IHS Markit AutoIntelligence's Jamal Amir)

- Hyundai will voluntarily recall around 77,000 units of the Kona Electric, manufactured between September 2017 and March 2020, globally over a potential battery fire risk, reports Yonhap News Agency. The recall comes after 13 fires have been reported involving the model since 2018. Hyundai has already decided to recall 25,564 units of the Kona Electric sold in the domestic market after the South Korean Ministry of Land, Infrastructure, and Transport (MOLIT) pointed out that a possible short circuit in the faulty battery cell system may start a fire in the affected vehicles. Hyundai's US unit reportedly filed its recall plan to the National Highway Traffic Safety Administration recently. It reportedly plans to recall more than 11,000 units of the Kona Electric in North America and more than 37,000 units in Europe, as well as 3,000 units sold in other countries. (IHS Markit AutoIntelligence's Jamal Amir)

- DSME has entered into a Memorandum of Understanding (MOU) with Kepco Engineering & Construction Company (Kepco E&C), a unit of Korea Electric Power Corporation, to jointly develop floating nuclear power plants. DSME will provide its shipbuilding knowledge and expertise while Kepco will provide its expertise in nuclear power plant design under the cooperation agreement. It is believed that the floating offshore nuclear plant will be equipped with the Bandi-60, a small modular nuclear reactor which Kepco has been developing since 2016. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Australia's draft federal budget has proposed several changes to so-called "super" (superannuation or pension) fund arrangements. Under the proposals, the Australian Prudential Regulation Authority (APRA) would undertake regular benchmark performance testing. Funds deemed to be underperforming would be obliged to notify their investors and would be prevented from taking on new members after two years of poor performance. Benchmarking procedures also would entail the creation of a new web platform to enable employees to review funds' fees and past performance before selection. The proposals additionally suggested so-called "stapling" of funds to employees to avoid the need for them to create a new pension account when moving employment. Finally, funds would be legally required to act in the best interests of their members and to disclose their outlays. The "stapling" feature is designed to reduce costs for pension savers. Treasurer Josh Frydenberg said in his budget speech that the savings could reach AUD450 million (USD324.5 million) annually, avoiding approximately six million accounts from being duplicated or becoming redundant. (IHS Markit Economist Brian Lawson)

- Keppel O&M has secured a contract worth approximately USD442 million (SGD600 million) from an undisclosed energy company for the EPC (engineering, procurement and construction) of a vessel for the offshore wind industry. No details of the vessel or expected delivery date were provided. Last year, Ørsted contracted Keppel O&M's wholly owned subsidiary Keppel FELS to build two 600 MW offshore wind farm substations for the Greater Changhua 1 and 2a OWFs (offshore wind farms) in Taiwan. Keppel FELS is also building two converter stations as part of the DolWin cluster servicing German OWFs. Further, Keppel O&M delivered and has a stake in Fred. Olsen Windcarrier's jackup installation vessel Blue Tern. (IHS Markit Upstream Costs and Technology's Jessica Goh)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-october-2020.html&text=Daily+Global+Market+Summary+-+12+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 12 October 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+12+October+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}