Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 10, 2020

Daily Global Market Summary – 10 December 2020

Most APAC equity markets closed lower, while European and US markets closed mixed. US government bonds closed higher and benchmark European bonds were mixed across the region. European iTraxx and CDX-HY credit indices closed modestly wider across IG and high yield. Brent and WTI both closed higher, with the former closing above $50 per barrel for the first time since early March. The US dollar and gold closed lower, while silver and copper were higher. Today's non-seasonally adjusted US initial claims for unemployment insurance rose to the highest level since early-August, further reinforcing the urgency for congress to pass some form of a stimulus bill before the New Year.

Americas

- US equity markets closed mixed; Russell 2000 +1.1%, Nasdaq +0.5%, S&P 500 -0.1%, and DJIA -0.2%.

- 10yr US govt bonds closed -3bps/0.91% yield and 30yr bonds -6bps/1.63% yield.

- CDX-NAIG closed +1bp/53bps and CDX-NAHY +2bp/302bps.

- DXY US dollar index closed -0.3%/90.82.

- Copper closed +2.0%/$3.58 per pound, which is the highest close since February 2013.

- Gold closed -0.1%/$1,837 per ounce and silver +0.4%/$24.09 per ounce.

- Crude oil closed +2.8%/$46.78 per barrel, which is the highest close since 4 March.

- The IHS Markit Materials Price Index (MPI) rose 5% last week,

its fourth consecutive increase and its largest one-week gain since

June. More significant, last week's move lifted the MPI to its

highest level since November 2014. (IHS Markit Pricing and

Purchasing's Michael Dall)

- Metal markets grabbed center stage for the week, with the steel-making raw materials sub-index jumping 7.1% and the nonferrous metals index rising 3.2%. Iron ore prices climbed to a seven-year high as major producer Vale announced lower production targets for 2021.

- Nonferrous metals were supported by across-the-board strength, with copper also hitting a seven-year high and aluminum breaching $2,000 per metric ton for the first time since 2018.

- Chemicals prices were another major contributor to last week's MPI gain, increasing 5.4%. The chemicals sub-index was boosted by strong price increases for US and European benzene.

- US supply chains have been challenged, sending prices higher in North America. In Europe, low levels of the Rhine River have constrained cargo traffic and tightened supply across the continent.

- Energy markets also showed comparative strength, with the MPI's energy sub-index rising 4.8%. Oil prices rose by almost 9% on news of a supply agreement between OPEC and Russia. Both parties agreed to increase supply by 500,000 barrels per day from January, significantly lower than previously agreed. This eased fear of oversupply and sent the price of Brent crude oil to a nine-month-high figure of $49.87.

- Markets have become energized by the continuing strength being exhibited by mainland China's economy and by hopes that multiple vaccines may be widely available in some regions during the first half of 2021.

- The likelihood of additional fiscal stimulus in the US also seems to have improved sentiment. On the supply side, continuing disruptions in supply chains are creating tight conditions and raising costs.

- This combination of demand and supply factors has created bullish conditions in commodity markets. How quickly supply bottlenecks are resolved and how badly a COVID-19 second wave impacts Europe and North America will determine how long the commodity price rally can be sustained.

- A Food and Drug Administration advisory panel recommended approval of the Covid-19 vaccine developed by Pfizer Inc. and BioNTech SE, clearing the way for the FDA to grant emergency authorization of the vaccine as early as Friday. In its vote to approve, the panel said the benefits of the vaccine outweigh the risks for people 16 years of age and older. (WSJ)

- Consumption of gasoline continued moving lower last week, according to the Energy Information Administration, and is considerably below the lower end of a normal range for this time of year. This is consistent with a marked deterioration in internal mobility and could be a sign of broader macroeconomic weakness heading into December. Meanwhile, passenger throughput at US airports, relative to year-ago levels, has been trending lower over the last week or so, according to the TSA. Recent readings appear to have broken below what had been a broadly firming trend, hinting at a broader re-weakening in the travel sector. (IHS Markit Economists Ben Herzon and Joel Prakken)

- Between past due rent, late fees and unpaid utility bills, Americans may collectively owe $70 billion by January, when the current federal eviction moratorium is set to expire. Estimates for the nation's total rent shortfall on Jan. 1 range in the tens of billions of dollars, potentially exceeding the amount of emergency rental assistance that Congress may or may not deliver over the next few weeks. If lawmakers fail to act, the New Year could trigger a long-feared disaster — an avalanche of evictions during the dead of winter, as the pandemic rages. (Bloomberg)

- Seasonally adjusted (SA) <span/>US initial claims for unemployment

insurance rose by 137,000 to 853,000 in the week ended 5 December,

its highest level since mid-September. The not seasonally adjusted

(NSA) tally of initial claims rose by 228,982 to 947,504, its

highest level since early August. Initial claims have risen for

three of the last four weeks, suggesting a flagging recovery in the

labor markets amid the resurgence of the virus that is forcing some

states into lockdown again. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, rose by 230,000 to 5,757,000 in the week ended 28 November. Prior to seasonal adjustment, continuing claims rose by 533,336 to 5,780,893, rising for the first time in 13 weeks. The insured unemployment rate in the week ended 28 November was up 0.1 percentage point to 3.9%.

- There were 427,609 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 5 December. In the week ended 21 November, continuing claims for PUA fell by 313,739 to 8,555,763.

- In the week ended 21 November, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 36,140 to 4,532,876.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 21 November, the unadjusted total fell by 1,120,049 to 19,043,429.

- The Government Accountability Office claimed that the Department of Labor's estimates of the number of individuals receiving benefits are flawed. The inaccuracies largely stem from inconsistent reporting from states, and although the Labor Department does not anticipate a change in its methodology for counting claims, it expects to add a clarifying statement in future weekly news releases.

- The consumer price index (CPI) rose 0.2% in November after no

change (0.0%) in October. During November, the CPI for energy

increased 0.4%, while the food index declined 0.1%. The core CPI,

which excludes the direct effects of movements in food and energy

prices, rose 0.2%. (IHS Markit Economists Ken Matheny and Juan

Turcios)

- The core CPI has partially recovered to its rising pre-pandemic trend following declines last spring when some components recorded sharp declines amid plummeting demand due to COVID-19. The core CPI fell 0.6% (not annualized) during the period from March to May, then rose 1.7% over the period from June to November. The 12-month change in the core CPI has recovered only a few tenths of the sharp decline it experienced last spring, when it fell from 2.4% (in February) to 1.2% (in May and June). As of November, the 12-month core CPI inflation rate was 1.6%, unchanged from October.

- In November, the CPI for shelter rose 0.1% for a fourth consecutive month. Rent inflation has eased this year as some landlords have agreed or been forced to accept lower rents. Rent of primary residence and owners' equivalent rent were each unchanged (0.0%) in November. Their 12-month rates of change have slowed substantially from 3.8% and 3.3% in February to 2.4% and 2.3% as of November, respectively. Rent inflation represents about 32% of the overall CPI and 40% of the core CPI.

- Prices for used cars and trucks decreased 1.3% in November, the second consecutive monthly decline. Used cars and trucks prices surged a cumulative 15.1% from June to September. As of November, the CPI for used cars and trucks prices was 12.2% higher than in February 2020. Prices for apparel (0.9%), household furnishings (0.9%), and transportation services (1.8%) rose during November.

- LeddarTech has collaborated with dSPACE to develop LiDAR sensors for autonomous vehicles (AVs). The companies will jointly provide simulation models and interfaces for testing and validating LiDAR sensors throughout the development process. This will enable OEMs and suppliers to incorporate their LiDAR innovations into ready-for-application solutions faster. The co-operation will also support LeddarTech to integrate dSPACE's sensor models into its development projects. Dr Christopher Wiegand, product manager at dSPACE, said, "This partnership will enable our customers to accurately and quickly perform validation tasks for lidar applications. Without reliable simulations, automated driving systems (SAE Levels 3-5) cannot be achieved." LeddarTech develops high-performance, low-cost LiDAR solutions for advanced driver assistance system (ADAS) and AV operation applications. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Cruise AV is beginning testing of autonomous vehicles (AVs) without a person behind the wheel in San Francisco, California, United States, according to media reports. The CEO of Cruise AV, Dan Ammann, said the company is deploying driverless AVs in a gradual process, growing both the scope of driverless operations as well as the number of driverless vehicles on the road and the area in which the vehicles operate, reports Automotive News. Cruise received approval from the US state of California to run vehicles without a backup driver in October. Cruise was one of five companies given approval to test in this way, with the others being AutoX, Waymo, Nuro, and Zoox. In China, AutoX began driverless testing in Shenzhen and Baidu in Beijing this month. Waymo has been allowing riders to book rides in driverless vehicles as well, although only in its Phoenix, Arizona, testing location. (IHS Markit AutoIntelligence's Stephanie Brinley)

- An explosion and fire at Optima Chemicals' manufacturing facility in Belle, West Virginia, Tuesday evening has left four injured, according to local news reports. Doug Cochran, general manager of the facility, says all process units have been taken offline. The Optima facility is located on a site owned by Chemours, which sold the assets to Optima, a toll and custom manufacturer of fine chemicals, in 2015. Belle Chemicals, which also has a production facility at the Chemours site, says it has also taken production offline. Belle, an affiliate of Cornerstone Chemical, acquired Chemours's methylamines business and associated assets in January 2020. The explosion, which reportedly threw debris as far as one mile, occurred at about 10 pm. It seems to have involved chlorinated dry bleach and methanol, and to have started on a barge, according to local authorities cited by the West Virginia Metro News. The fire was extinguished within two hours. Other producers with operations at the site include Lucite International and Kureha PGA. Kureha has been manufacturing polyglycolic acid (PGA) at Belle since 2011. Lucite produces higher methacrylates at Belle. (IHS Markit Chemical Advisory)

- According to Argentina's National Institute of Statistics and

Census (Instituto Nacional de Estadística y Censos: INDEC), the

country's industrial production decreased by 2.9% year on year

(y/y) in September. Seasonally adjusted data show a 2.5%

month-on-month (m/m) decline in October, compared with a 5.3% m/m

rise in September (revised figure). The cumulative change for the

first 10 months of 2020 is a decline of 9.9% y/y. (IHS Markit

Economist Paula Diosquez-Rice)

- The biggest annual decreases in October were in transport equipment, clothing and apparel, textiles, metal products, tobacco products, and oil refining, among others. On the other hand, a few sectors posted a year-on-year expansion in October: the rubber and plastics sector, the non-metal minerals sector, the machinery and equipment sector, and the general equipment sector.

- A qualitative industrial poll of companies conducted by INDEC shows that 30% of respondents estimate that demand will deteriorate in November 2020-January 2021, compared with the same period in 2019-20 (down from 38% in the previous month's survey). The percentage of respondents expecting demand to pick up rose to 31%, while 31% of respondents expect exports to fall during the period.

- Construction activity increased by 4.3% m/m in seasonally adjusted terms in October and decreased by 0.9% compared with October 2019 (the comparison base was quite depressed as construction activity dropped nearly 10% y/y in October 2019). Construction employment in the formal sector, registered, decreased by 23.9% y/y in October, while cumulative job losses in the sector stood at 23.9% in the first 10 months of the year. Approximately 23% of the construction firms that responded to the qualitative survey expect private-sector activity to shrink in the next three months, whereas 42% expect no change in activity.

- Brazil slashed its next orange forecast, making it the largest crop loss for over 30 years. Orange juice is likely to be in even shorter supply in 2021 than was first feared. The latest Fundecitrus forecast is for just 269 million boxes. The weather has been hotter and drier than the worst forecasts. El Niña was expected, but whereas the last such event happened in November, this time it hit in September and when only 30% of the crop has been harvested. Rainfall was 14% below average between May and August and 41% between September and November. For the whole period, the average rainfall in the citrus belt was just 337 millimeters, some 150mm below normal. Three regions in the citrus belt had reasonable rainfall but even that was below the historical average. Elsewhere, farmers even resorted to watering the trees from tankers. Harvesting is progressing slowly. In November, it had only reached 58% compared with 74% last year. The average fruit weight is put at 156 grams, 3g less than in the May forecast. The fruit drop has risen from 17.3% to over 21%, the worst figure since 2015. (IHS Markit Food and Agricultural Commodities' Neil Murray)

Europe/Middle East/Africa

- European equity markets closed mixed; Spain -0.6%, Germany/Italy -0.3%, France +0.1%, and UK +0.5%.

- 10yr European govt bonds closed mixed; UK -6bps, Italy -1bp, Germany flat, and Spain/France +1bp.

- iTraxx-Europe closed +1bp/48bps and iTraxx-Xover +10bps/250bps.

- Brent crude closed +2.8%/$50.25 per barrel, closing above $50 per barrel for the first time since 4 March.

- Limited monthly GDP gains from August to October confirm our

long-held assessment that the United Kingdom was never on course

for a strong "V-shaped" recovery. In addition, the outlook is

increasingly challenging, with the latest COVID-19 virus-related

developments suggesting that the economy endured a cliff-edge fall

in November. (IHS Markit Economist Raj Badiani)

- The Office for National Statistics (ONS) reports that the UK economy rose for the sixth successive month in October following a record fall of 19.5% month on month (m/m) in April, but the pace of recovery slowed for the fourth straight month.

- Specifically, real GDP grew by just 0.4% m/m in October, which followed m/m gains of 1.1% in September and 2.2% in July. Nevertheless, it remains 8.6% below the January level, which represents the pre-COVID-19 virus peak.

- This was broadly in line with our October estimate of a 0.3% m/m rise. In addition, it outperformed the 0% consensus forecast of economists polled by Reuters.

- In annual terms, the economy in October was 8.2% smaller than a year earlier.

- Meanwhile, the economy grew by 10.2% in the three months to October compared with the three months to July, down from growth of 15.5% in the three months to September. Nevertheless, GDP was still 8.6% smaller when compared with the August-October 2019 period.

- A breakdown by type of output reveals that the services sector increased by 0.2% m/m in October while remaining 8.6% lower than February 2020's level. The main narrative was accommodation and food service activities falling by 14.4% m/m in October because the sector faced stricter COVID-19 virus-related restrictions and an accompanying lack of demand.

- Meanwhile, many other parts of the services sector recorded moderate growth during October.

- The recovery in industrial production regained some momentum, rising by 1.3% m/m in October, after slowing notably in September and August. Manufacturing was the leading sector, up by 1.7% m/m, with 8 of the 13 manufacturing sub-sectors continuing to recover lost ground after experiencing large falls across March and April. The ONS reports that the manufacture of transport equipment grew by 5.4% m/m in October.

- Despite stronger growth in October, industrial production was still 4.4% lower than the level in February, with manufacturing trailing by 6.6%.

- The rolling three-month growth comparison reveals that output in the production sector grew by 7.6% in October. Again, the manufacturing sector was a strong performer, rising by 10.0%, with the manufacture of transport equipment leading the way.

- Supermarket sales have increased by 10% year-on-year in the month of November, with growth peaking at 13% in the week of 7 November as shoppers prepared for England's second national lockdown (5 November-1 December), data from market researchers Nielsen and Kantar shows. Consumers limited their supermarket trips, with visits down 12% compared with the same time last year. However, they spent, on average, 16% more each time they shopped. Sales of frozen food were up 19.7%, according to Nielsen. At the same time, Kantar highlighted that limited opportunities to drink in pubs and restaurants, as well as an early eye on festivities, pushed alcohol spend 33% higher than in the same four weeks last year. Two-fifths of that growth came from spirits, with sales of cream liqueurs - popular Christmas drinks - more than doubling compared with 2019. Online sales increased by 109% compared with the same period last year, with the online share of grocery spend exceeding 13%, compared with 7% in November 2019 and not far from the 14% peak seen in June of this year, according to Nielsen. November was the single largest month ever for the supermarkets, with GBP10.9 billion (USD14.6 billion) spent over four weeks. December's numbers are likely to surpass that again, and Kantar expects spend to be close to GBP12 billion in the month ahead, around GBP1.5 billion more than last year. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- Asset purchases and long-term loans to banks remain the favored

policy instruments, in line with prior signals. The European

Central Bank's (ECB) apparent reluctance to take its deposit

facility rate (DFR) further below zero could lead to further euro

appreciation. As expected, the ECB announced a "recalibration" of

various policy instruments following its policy meeting on 9-10

December. (IHS Markit Economist Ken Wattret)

- The envelope of the pandemic emergency purchase programme (PEPP) has been increased by EUR500 billion (USD606 billion) to a total of EUR1.850 trillion.

- The horizon for net purchases under the PEPP has been extended to at least the end of March 2022 and will continue until the ECB judges that the COVID-19 crisis phase is over.

- The reinvestment of principal payments from maturing securities under the PEPP has been extended until at least the end of 2023.

- Net purchases under the asset purchase programme (APP) will continue at a monthly pace of EUR20 billion for as long as necessary, to end shortly before the ECB starts to raise policy rates.

- The principal payments from maturing securities purchased under the APP will continue for an extended period past the date when the ECB starts raising interest rates.

- The third series of targeted longer-term refinancing operations (TLTRO III) has been recalibrated, with three additional operations to be conducted between June and December 2021.

- The total amount that counterparties will be entitled to borrow in TLTRO III operations will increase from 50% to 55% of their stock of eligible loans.

- The recalibrated TLTRO III borrowing conditions will only be made available to banks that achieve a new lending performance target.

- There will be four additional pandemic emergency longer-term refinancing operations (PELTROs) in 2021.

- The collateral easing measures adopted on 7 and 22 April 2020 will be extended to June 2022.

- The Eurosystem repo facility for central banks and all temporary swap and repo lines with non-eurozone central banks will be extended until March 2022.

- Regular lending operations will be conducted as fixed-rate tender procedures with full allotment for as long as necessary.

- Policy rates remain unchanged, although the ECB maintained its easing bias via forward guidance that states that they are expected to remain "at their present or lower levels" until inflation is seen to be robustly converging towards 2%.

- The ECB also signaled that it will "continue to monitor developments in the exchange rate" and "stands ready to adjust all of its instruments".

- It goes without saying that eurozone monetary policy will remain highly accommodative for a very long time. Indeed, the new staff projections imply that even by 2023, inflation will still be well below the ECB's objective of "below but close to 2%".

- French industrial production rose by 1.6% month on month (m/m)

in October, matching its increase in September, according to

seasonally adjusted figures released by the National Institute of

Statistics and Economic Studies (Institut national de la

statistique et des études économiques: INSEE). Production grew m/m

for the sixth consecutive month. (IHS Markit Economist Diego

Iscaro)

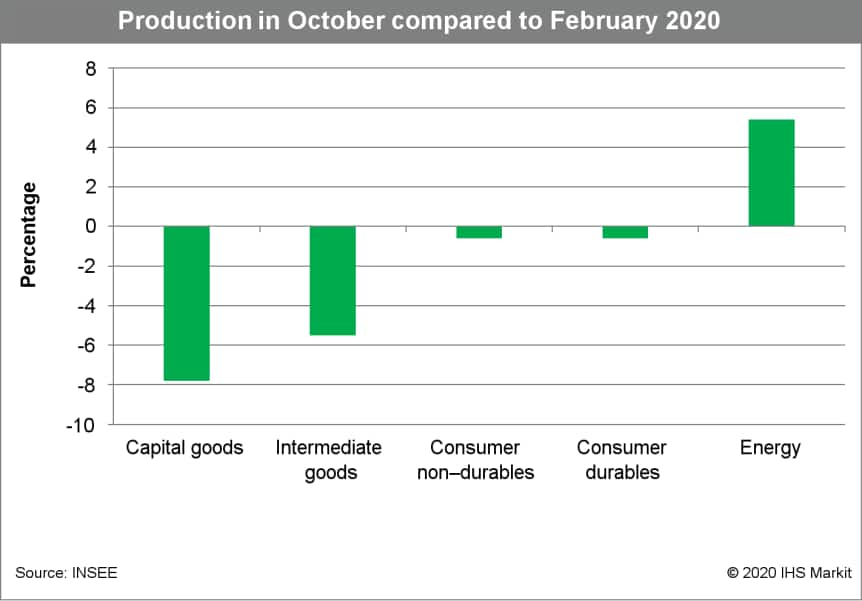

- Nevertheless, industrial output fell by 5.5% year on year (y/y) in October and remained 3.6% below its pre-COVID-19 virus pandemic level.

- Manufacturing output grew by a weaker 0.5% m/m in October, following a rise of 2.3% m/m in September. Manufacturing production in October was still 5.0% below its level in February.

- While energy production rebounded by a strong 7.9% m/m in October following a fall of 2.7% m/m in September, production of transport equipment and food/beverages products declined by 2.7% m/m and 0.3% m/m, respectively. Meanwhile, production of machinery and equipment goods increased for the second consecutive month, rising by 1.0% m/m following a 3.9% m/m rise in September.

- The breakdown by main industrial groupings shows production of energy (+8.6% m/m), consumer non-durables (+1.1% m/m), and intermediate goods (+0.9% m/m) driving the m/m growth rate in October, while production of capital goods and consumer durables fell by 0.4% m/m and 2.6% m/m, respectively. With the exception of energy, production was below February's level in all sectors (see Chart 1).

- October's increase in production raises the prospect of the industrial sector making a positive contribution to growth during the fourth quarter of 2020. Indeed, October's figures are likely to drive a modest upward revision of our GDP forecast for the period, which currently stands at -4.5% quarter on quarter (q/q).

- BASF says it has launched a circular-economy program, under which it aims to double its sales generated by solutions for the circular economy to €17.0 billion ($20.6 billion) by 2030, and process 250,000 metric tons of recycled and waste-based raw materials annually as of 2025, replacing fossil-based raw materials. The company says it is concentrating on three action areas to achieve its circular-economy targets: circular feedstocks, new material cycles, and new business models. In a circular economy, the aim is to avoid waste, reuse products, and recover resources, BASF says. As a result, the company's circular-economy program focuses on battery recycling, to develop processes that reduce carbon footprint; the development of additives to improve plastics recycling; chemical recycling that can turn plastic waste into feedstock for the chemical industry; and increasing the volume of renewable raw materials from sustainable sources in the company's production. (IHS Markit Chemical Advisory)

- The Netherlands' output increase in October demonstrates that

the dip in September was only an interruption to the recovery

ongoing since June, but it remains likely that the recent

resurgence of the COVID-19 virus across Europe will cause another

setback during November-December - even if containment measures

taken affect manufacturing much less than services. (IHS Markit

Economist Timo Klein)

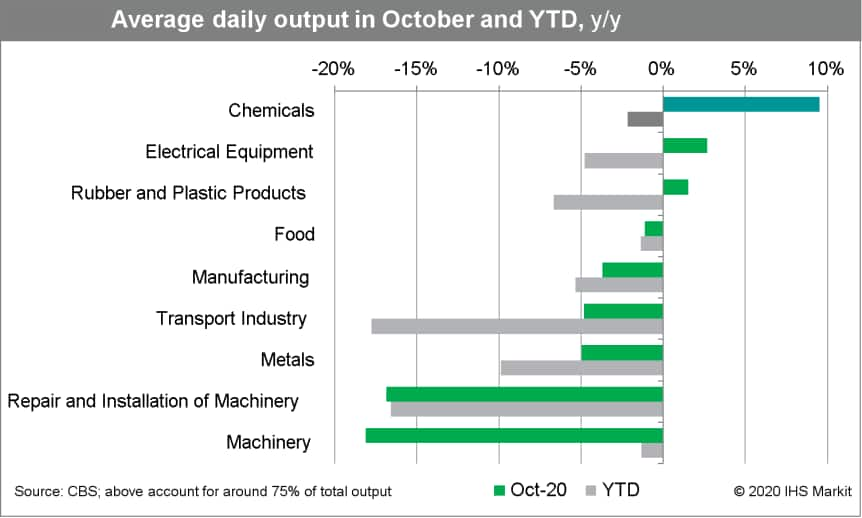

- In October, on a seasonally and working-day-adjusted basis, manufacturing output increased by 2.0% month on month (m/m), more than compensating for September's modest dip by 0.3% m/m (curtailed from -1.0% originally) and resuming the recovery observed since June. Output was down by 4.1% year on year (y/y) and by 2.4% compared with February, prior to the impact of the COVID-19 virus pandemic.

- On a seasonally unadjusted basis, average daily output of the Dutch manufacturing sector was down by 3.7% y/y in October, compared with -6.7% y/y in September. On a three-month moving average basis, output was down by 4.7% y/y.

- In October, most sub-components remained a drag in annual terms. The biggest drops were recorded for machinery, which was down by 18.1% y/y, followed by the repair and installation of machinery (-16.8%), metals (-4.9%), and transport (-4.8%). Chemicals were the chief positive offset, increasing by 9.5% y/y.

- The Dutch manufacturing purchasing managers' index, which had deteriorated by more than five points in October (the largest monthly drop over the last decade apart from April this year), managed to rebound from 50.6 to 51.3 in November. Being above 50, this indicates that mild expansion continues at the data edge.

- The latest output and survey data were unexpectedly positive, correcting for September's sudden and broad-based deterioration. Nevertheless, the second wave of COVID-19 cases across Europe during the fourth quarter renders further setbacks during November- December more likely than not. After all, the Dutch export sector and thus also manufacturing activity in the Netherlands are highly dependent on European demand, with 70% of goods exports going elsewhere in the European Union. The output index will not drop to anywhere near its April low, however.

- Volvo Group has announced that its investment arm is backing a business that is using technology to pool goods shipments and reduce unused trailer capacity. According to a company statement, Volvo Group Venture Capital AB is investing in Flock Freight, based in Solana Beach, California (United States), which uses algorithms to match multiple less-than-a-truckload shipments to reduce the handling of goods in terminals and hubs, and intended to boost quality and efficiency. On the announcement, Dan Tram, investment director of Volvo Group Venture Capital, said, "Flock Freight can provide the Volvo Group with further insights into optimizing road haulage. Together we can offer our operators and our operators' customers additional services." The company said that the transaction has no significant impact on Volvo Group's earnings or financial position. This is the latest announced investment to be made by Volvo Group Venture Capital recently. Last month, it announced an investment in Adnavem, an online marketplace for freight services. (IHS Markit AutoIntelligence's Ian Fletcher)

- Volvo Cars has announced that it is investing SEK700 million in its Skövde (Sweden) site to support the manufacture of electric motors. According to a statement, Skövde will only assemble the motors in the first stage of investment, and the company intends to bring the full manufacturing process in-house later on. The company added that this should take place by the middle of the decade. The latest investment will support the automaker's goal of making 50% of its global vehicle production fully electric by 2025, with the remainder set to be hybrids. This means that there will be a huge requirement for batteries, motors and systems that the company is looking to address. Having already set up a design and development facility for motors in Gothenburg (Sweden), it has now set up a similar function in Shanghai. (IHS Markit AutoIntelligence's Ian Fletcher)

- Valmet Automotive has announced that it is to expand its Uusikaupunki (Finland) facility to allow it to undertake battery assembly. According to a statement, this is in response to it being "nominated as a Tier-1 system supplier for a battery program by a leading, new customer from the automotive industry". It added that the agreement includes the assembly of the battery pack as well as the production of the cell modules. Production at this facility is set to go on stream in the second half of 2021. The Uusikaupunki facility is best known for its contract vehicle manufacturing operations; it currently builds Mercedes' A-Class and GLC. This will expand the company's battery assembly operations, which currently take place at its site in Salo (Finland) which started in November 2019, and Valmet has recently revealed that it will benefit from investment to expand output, which will be completed at around the same time as Uusikaupunki's operations. The decision to expand in this direction underlines how great the future demand for battery packs will be as OEMs are pushed towards greater electrification by legislation. IHS Markit forecasts that in 2021, European light vehicle production of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) combined will reach 2.137 million units and by 2025 this will hit 4.973 million units. (IHS Markit AutoIntelligence's Ian Fletcher)

- Lithuania is launching its first offshore wind project, setting aside EUR 7.5 million for tender preparations. The wind farm, to be located 29 kilometers from shore in the Baltic Sea in 39 meters water depth, is expected to have a capacity of 700 MW. The investment will go towards typical studies to be conducted such as environmental impact assessments, wind resource, and metocean surveys. The Lithuanian Energy Agency will lead the studies and surveys . A tender is currently underway for the preparation of a special plan for renewable energy development and will close on 21 December 2020. The selected company will have 18 months to complete its studies after which a tender will be launched in 2023. In September 2020, Lithuania's state-owned Ignitis Group selected Ocean Winds as a strategic partner for the development of offshore wind farm projects. Ocean Winds is a joint venture between Engie and EDPR. It is widely expected that the partners will jointly develop the wind farm, which is estimated to attract an investment of up to EUR 1.5 billion. (IHS Markit Upstream Costs and Technology's Melvin Leong)

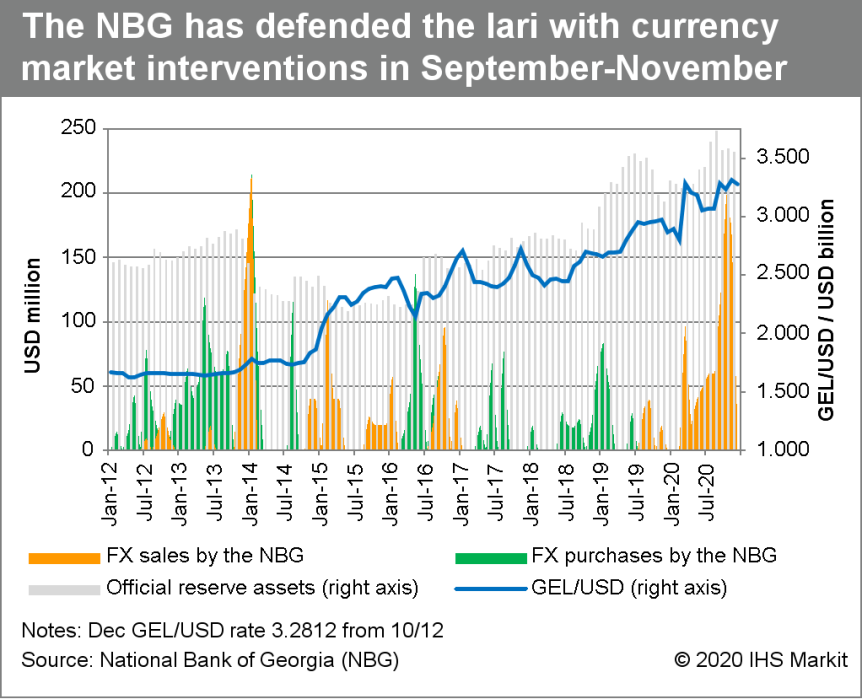

- The Monetary Policy Committee (MPC) of the National Bank of

Georgia (NBG) in its December monetary policy meeting decided to

keep the refinancing rate unchanged at 8.0%. The policy rate was

also kept stable in the September and October meetings, while both

the June and August meetings had resulted in rate cuts of 25 basis

points, following a more substantial 50-basis-point reduction in

April. (IHS Markit Economist Venla Sipilä)

- Consumer price inflation has recently showed a decelerating trend, while it has remained stable at 3.8% year on year (y/y) in September-November. According to the Georgian National Statistics Office (GeoStat), a gain of 6.0% y/y in prices of food and non-alcoholic beverages contributed 1.9 percentage points to annual inflation, while falling prices of transport services held back inflation.

- The NBG currently expects inflation to remain close to the target of 3% in the first half of 2021, with inflation pressures suppressed by weak aggregate demand. According to the latest Rapid Estimate of Economic growth from GeoStat, Georgian GDP in January-October contracted by 5.1% y/y, while shrinking by 3.9% y/y in October.

- Recovery in 2021 in GDP growth is expected to be driven by domestic demand. The MPC also took note of the upward impact on inflation from the 2020-21 fiscal stimulus related to pandemic relief, as well as supply-side pressures due to increased production costs in conditions of COVID-19 restrictions.

- The Bank noted the elevated level of uncertainty caused by the persisting global pandemic, and the tightened related restrictions globally during the second wave. In any case, for now, given the high degree of dollarization of the Georgian economy, the room for monetary easing is limited, in its opinion.

- The NBG also announced that as part of a COVID-19 relief program, the European Central Bank (ECB) and the NBG have agreed to launch an EUR100-million repo line to support liquidity in the Georgian financial system. This line is introduced under the framework of the Eurosystem repo facility for central banks (EUREP) and will be in place until the end of June 2021, with operational support provided by the German Bundesbank.

- The interest rate decision matches our forecast. Moreover, unsurprisingly, it seems that, while fully committed to its inflation-targeting policy and the flexible exchange rate framework, the MPC also is more mindful of exchange rate risks at present.

- We continue to see exchange rate volatility as an important indicator of risk of imported inflation, which is likely to be affecting inflation expectations. Indeed, the exchange rate of the lari ended November at GEL/USD3.316, having depreciated by 2.5% during the month, after appreciating by 1.7% in October and weakening by 7.1% during the second quarter. The NGB intervened by selling a total of USD174 million of foreign currency in the foreign exchange markets in November, following sales of USD200 million in October.

- Israel-based Meat-Tech 3D has agreed to acquire Peace of Meat - a Belgian producer of cultured avian products, for EUR15 million. Under the terms of the deal, Meat-Tech will pay half the total immediately, with the payment of the balance subject to Peace of Meat complying with preset technological milestones over a period of two years. Meat-Tech said it aims to leverage Peace of Meat's technologies to secure market entry while it develops an industrial process for cultivating and producing meat using 3D bioprinting technology. Peace of Meat has developed a way of cultivating animal fats from chicken and ducks, using stem-cell-based bioreactor. The technology's first expected application is in hybrid food products, combining plant-based protein with cultured animal fat, designed to provide meat analogues with qualities of "meatiness" (taste and texture) closer to that of conventional meat products. Meat-Tech estimates that the first hybrid products based on Peace of Meat technology could hit the market as early as 2022. Meat-Tech said the acquisition is consistent with its growth strategy, which aims to streamline development processes and penetrate cultured meat technology markets as quickly as possible. (IHS Markit Food and Agricultural Commodities' Max Green)

Asia-Pacific

- Most APAC equity markets closed lower; Australia -0.7%, Hong Kong -0.4%, India/South Korea -0.3%, Japan -0.2%, and Mainland China flat.

- Volkswagen (VW) is introducing a new sales model for electric vehicles (EVs) in China in which the dealers will not have to maintain inventory of models and prices would be fixed by the automaker, according to Reuters. The store, named "ID. Store X", will sell its ID. range of family cars and will be invested and run by selected dealers, who will get certain commission on sales. Customers can order vehicles at a fixed price directly through the company website, phone app or from authorized dealers. The new model will bring a concept of uniform pricing across dealers of VW's EV models as they will not be allowed to offer discounts from their own side as they can with the traditional sales model. The dealers would also benefit from not having to invest heavily upfront in maintaining inventories of different models. VW has been focusing on gaining foothold in the Chinese NEV market. In September, VW announced that the automaker along with its three local joint venture (JV) partners - FAW Group, SAIC Motor, and JAC Motor - plan to invest around EUR15 billion (USD18.1 billion) in electric mobility in China between 2020 and 2024. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The first monopile at the Yunlin offshore wind farm has been installed by Sapura Energy. This is Sapura's first construction project in the offshore wind sector and it is undertaking the work using its Sapura 3500 heavy lift vessel. The vessel will install 80 momopiles altogether. The Yunlin wind farm, located 8 kilometers off the west coast of Taiwan, reached financial close in May 2019. The wind farm consists of 80 Siemens Gamesa SG 8.0-167 DD wind turbines generating a total of 640 MW. Siemens Gamesa also signed a 15-year service agreement for the turbines. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Japan's current Business Survey Index (BSI) for large

enterprises rose by 9.6 points to 11.6 in the Business Outlook

Survey for the fourth quarter of 2020. The improvement largely

reflected a solid increase for manufacturing groupings, which

surged from 0.1 in the previous survey to 21.6. Business conditions

began to improve for a broad range of manufacturing industries.

(IHS Markit Economist Harumi Taguchi)

- While the BSI for medium-sized enterprises also began to improve (up 13 points to 5.5), the BSI for small enterprises remained in negative territory despite a 10.3-point improvement to -15.5, suggesting that current business conditions remained sluggish for most small enterprises. The future conditions BSI suggests that all enterprises expect business conditions to worsen and upward momentum to soften in the first quarter of 2021.

- The outlook for sales for all industries in fiscal year (FY) 2020 was revised down to a 7.5% year-on-year (y/y) drop from a 6.8% y/y decrease because of outlooks for a weak recovery. Ordinary profit outlooks were also revised down to a 24.3% y/y drop from a 23.2% y/y decline.

- Labor demand remains resilient, as a broad range of enterprises (particularly non-manufacturing industries) face labor shortages.

- Fixed investment plans for FY 2020 were revised down from a 6.8% y/y drop to a 7.6% y/y decrease. Although medium-sized and small non-manufacturing enterprises noted a lack of capacity in machinery and equipment, all size categories in manufacturing expect capacity utilization (machinery and equipment) to remain below sufficient levels over the short term.

- The third-quarter 2020 results suggest that the resumption of economic activity continued to improve for businesses in the fourth quarter. Upward momentum is likely to ease in the first half of 2021, reflecting concerns about the negative effect of the resurgence of COVID-19 in Japan and overseas as well as other persistent uncertainties.

- Although machinery orders show that capex is bottoming, weaker fixed investment plans suggest that sluggish outlooks of sales and profits could suppress a recovery of capex over the short term. While resilient labor demand could underpin consumer spending to some extent, sluggish sales and profit outlooks suggest weak wage increases over the short term.

- High-frequency data for South Korea show a mixture of slow

growth and flattening, consistent with a sluggish fourth quarter.

(IHS Markit Economist Dan Ryan)

- Exports rose again in November, although they are still down from the September rebound. Imports are still lagging because of sluggish domestic demand, thereby keeping the trade balance in large surplus.

- The current account balance, reflecting the merchandise surplus, remains large and positive. This net demand for the South Korean won is partly responsible for the recent strength of the currency.

- The recovery from the COVID-19 pandemic-induced recession has increased price volatility. Both the core CPI and the overall have fluctuated widely as of late, although the trend rate of inflation remains low.

- Producer prices remain on a downward trend. This mainly reflects productivity growth in the industrial sector, but also limited demand for consumer goods.

- There has been no noticeable change to interest rates. They are expected to remain low and relatively constant for many months to come.

- The won has strengthened sharply because of the large current-account surplus combined with limited net capital outflows. The Bank of Korea actually slowed the rate of appreciation by selling won and buying foreign currency, as seen by the rise in foreign reserves.

- Industrial production in October retreated slightly from the previous month's strong rebound. However, the index is now at a level consistent with the overall economy; therefore, growth should be slow in the near term.

- Retail sales have been volatile following the March nadir but on average appear to be levelling off near levels last seen at end-2019. These numbers, however, tend to overstate the level of total consumption - so that component of GDP remains weak.

- The number of unemployed increased by 80,000 people in October, taking the unemployment rate up to 4.2%. The job losses were widespread throughout the private sector.

- The number of employed also increased in October; therefore, the overall labor force continues to trend upwards. However, there are still about 200,000 discouraged workers who have dropped out of the labor force during the pandemic and have not yet rejoined.

- The latest data are consistent with expectations. Inflation remains low and monetary policy is expansionary, a situation that will continue through most of next year.

- The manufacturing and export sectors are still the main drivers of the economy, although these have been decelerating. Consumer spending has largely returned for merchandise purchases, but not for services.

- Mahindra & Mahindra (M&M) has announced in a filing to the Bombay Stock Exchange (BSE) that a shortage of microprocessors (semiconductors) used in electronic control units (ECUs) will negatively impact on its production and sales volume. M&M says that the shortage will affect operations in its Automotive division and in its wholly owned subsidiary, Mahindra Vehicle Manufacturers Limited (MVML), in the last quarter of fiscal year (FY) 2020/21. M&M stated in its filing, "The company is engaging closely with Bosch Limited and assessing likely production loss for the last quarter of FY 2020/21 on account of this supply disruption as also steps to be taken to minimize the impact of the same. However, estimation of exact likely reduction in production/sales volume of the company (Automotive division) and MVML for the last quarter is not ascertainable at this stage." The automaker confirmed that its operations in December will not be impacted due to the parts shortage. M&M's announcement comes a day after Bosch India said in a regulatory filing that it was witnessing a severe shortage of imported semiconductors, affecting its ability to deliver to the automotive industry in India. The auto-parts supplier stated, "Steep escalation of demand in consumer electronics industry driven by driven by safety and hygiene sentiments as well as the rise of 5G connectivity, led to a surge in global demand of semiconductors, a critical component in manufacturing of automotive electronics." The shortage in supply of critical parts could impact on other companies as well in the coming months as Bosch is a key supplier to several automakers in India. (IHS Markit AutoIntelligence's Isha Sharma)

- German aviation startup Volocopter will launch air taxi services in Singapore by 2023, reports Bloomberg. The startup, which is developing vertical-takeoff craft, will commence operations after completing flight trials, evaluation, and certification in partnership with the city-state. Volocopter said it will need to obtain the necessary approval from the Civil Aviation Authority of Singapore and the European Union Aviation Safety Agency as a prerequisite for the flights. The craft will initially carry a pilot and one passenger; after receiving approval for autonomous operations, the company may switch to carrying two passengers. Volocopter plans to set up a team of 50 pilots, engineers, and operations specialists to support the launch of its commercial operations in Singapore. Florian Reuter, CEO of Volocopter, said, "Singapore is renowned for its leading role in adapting and living new technologies. Local capabilities in battery research, material science and route validation for autonomous operations will be central to the project." Volocopter is an urban air mobility service provider and is backed by computer chip manufacturer Intel Corp. and automakers Daimler and Geely. In October 2019, Volocopter demonstrated a flight over Singapore's Marina Bay area. Although electric vertical take-off and landing (eVTOL) products are not yet close to commercial deployment, the appeal of this solution is growing. For instance, at the CES expo held earlier this year, Hyundai announced an air taxi partnership with Uber. Toyota has also invested in the fledgling industry of flying cars. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-december-2020.html&text=Daily+Global+Market+Summary+%e2%80%93+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-december-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary – December 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+%e2%80%93+December+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}