Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 06, 2020

Daily Global Market Summary - 6 November 2020

Most APAC equity markets closed higher, while European and US indices closed mixed. US government bonds sold off sharply on a better than expected US non-farm payroll report and benchmark European government bonds closed mixed. The US dollar and oil were lower on the day, while gold and silver were higher.

Americas

- NY Times reports Presidential candidate Joe Biden having won 253 electoral votes versus President Donald Trump's 214 (same tally since Wednesday night), with Nevada, Arizona, Georgia, North Carolina, Pennsylvania, and Alaska still undecided. (NY Times as of 6:43pm EST)

- Joe Biden was on the threshold of winning the White House with

narrow leads over President Donald Trump in several battleground

states, yet the final outcome remained stalled by the painstaking

work of counting ballots. (Bloomberg as of 5:49pm EST)

- Earlier Friday, the Democratic nominee overtook Trump to claim a slim advantage in Pennsylvania, where a victory would push him past the 270 Electoral College votes needed to win the presidency. He currently leads by almost 15,000 votes there, according to Associated Press, and the late-counted ballots are overwhelmingly in his favor.

- Biden also held close leads in Nevada and Georgia.

- US equity markets closed mixed; Russell 2000 -1.0%, DJIA -0.2%, and S&P 500/Nasdaq flat. S&P futures reacted positively to the better than expected US non-farm payroll report.

- 10yr US govt bonds closed +5bps/0.82% yield and 30yr bonds +8bps/1.61% yield, with both maturities selling-off sharply after the US non-farm payroll report.

- CDX-NAIG closed flat/53bps and CDX-NAHY +3bps/366bps, which is

-13bps and -55bps week-over-week, respectively. Spreads tightened

across IG and high yield after today's US non-farm payroll

report.

- DXY US dollar index closed -0.3%/92.24.

- Gold closed +0.3%/$1,952 per ounce and silver +1.9%/$25.66 per ounce.

- Crude oil closed -4.3%/$37.14 per barrel.

- US nonfarm payroll employment rose 638,000 in October and the

unemployment rate declined a full percentage point to 6.9%. The

headline increase in employment was restrained by a 268,000 decline

in government payrolls; private payrolls posted a solid gain of

906,000. (IHS Markit Economist Ben Herzon and Michael Konidaris)

- The decline in government payrolls in part reflected a 147,000 loss of temporary Census 2020 employment, as canvassing efforts were winding down in October.

- There was also a sharp decline in state and local employment that was centered on education services. This was mainly a seasonal issue, as a typical expansion of educational employment in October was muted by virtual learning.

- The sharp decline in state and local employment lowered our forecast of government consumption expenditures in the fourth quarter, as state and local employment is used as an indicator of real general government compensation of employees in the National Accounts.

- The average pace of payroll gains over the last few months has been robust, but the level of payroll employment remains about 10 million below the pre-pandemic (February) level.

- If payroll gains were to continue at the recent clip (say, 900,000 per month), it would take nearly one year to recover the February level of employment.

- However, given the diminution of fiscal support that has already occurred and that we expect to continue in coming months, it is likely that payroll gains will in fact slow, delaying into 2022 or 2023 the point at which payroll employment fully reverses the pandemic-driven declines.

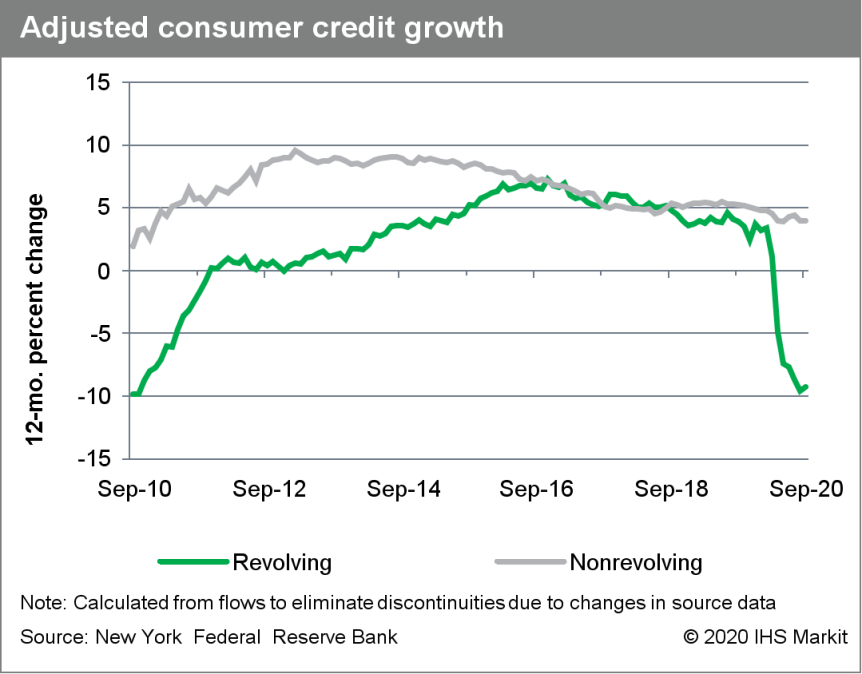

- Outstanding US nonmortgage consumer credit rose by $16 billion

to $4.16 trillion in September after a $7 billion decline in

August. (IHS Markit Economist David Deull)

- The 12-month change in outstanding consumer credit edged up 0.1 percentage point to 0.6%.

- Revolving (mostly credit card) consumer credit saw its first increase since February, growing $4 billion after a cumulative $114 billion decline during the prior six months. The 12-month growth rate of this category was -8.9%.

- Nonrevolving credit increased $12 billion in September, and its 12-month growth rate was unchanged at 3.9%. This category includes student and auto loans, and the growth of these types of obligations has remained stubbornly steady.

- The ratio of nonmortgage consumer credit to disposable personal income edged down 0.1 percentage point to 23.7%.

- During the COVID-19 episode thus far, reduced opportunities to

spend, less willingness to finance spending with debt, and fiscal

stimulus have combined to drive down the level of outstanding

revolving consumer credit. As fiscal stimulus wanes and

labor-market conditions slowly normalize, credit-card balances are

likely to continue creeping back up.

- GM's results in the third quarter proved stronger than the COVID-19-related impacts in the second quarter led most to expect. GM was profitable in the third quarter and is profitable in the YTD. With its wholesale deliveries down only slightly y/y in the third quarter, GM's revenues were flat and the company reported USD4.4 billion in income. In the YTD, GM also remains profitable, although its income is down nearly 36% y/y. GM's efforts in recent years to ensure a strong foundation as well as cost-saving measures helped the company withstand the effects of the second quarter and take advantage of market improvements in the third quarter. GM is holding to its strategy of reinvestment as well as maintaining a strong balance sheet, repaying much of the credit-facility debt incurred in the second quarter. The strong results in the third quarter also help ensure the company has funds to support plans to accelerate EV development and deployment. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Privately held truck-leasing company Pride Group Enterprises has announced that it has placed an order for 150 Tesla Semi trucks, with an option to increase the order to 500 units, according to media reports. Pride operates in the United States and Canada. Reportedly, in the company statement, Pride CEO Sam Johal said, "With support from one of our long-term financial partners, Hitachi Capital, we are very excited to bring this innovative product to our strong customer base, helping forge a new path in clean transportation. We believe electrification is the way of the future as we work together across multiple industries to reduce our carbon footprint. As well, we have the option to increase our order as we gauge customer acceptance of this new technology." Pride vice-president of operations Aman Johal reportedly said, "Our reservation with Tesla is the first of many, and we continue to work with all OEM partners and have more exciting projects in the works." Trucking Info reports that the company will determine the placement of the vehicles by considering which US states and Canadian provinces have a substantial electric commercial vehicle environment. The company has already invested in infrastructure for parking, charging, and maintenance at its locations. Although the Pride statement did not lay out any financial terms or the size of the deposit made under the deal, Tesla has previously said that prospective buyers would be required to place deposits of USD20,000 per truck. Reportedly, Walmart placed a deposit for 150 Semi trucks recently. The Semi truck will be produced at Tesla's new plant in Austin, Texas, construction of which began earlier this year, and Tesla has suggested that production at the plant will start in 2021. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Ride-hailing giant Uber has reported a net loss of USD1.1 billion in the third quarter of 2020. This loss is attributable to stock-based compensation expenses for employees and restructuring-related charges. The company's revenues shrank to USD3.13 billion in the third quarter, a decrease of 18% year on year (y/y). The fall in revenues was the result of a decline in the number of monthly active users across rides, bike shares, and food deliveries, reaching 78 million, down from 103 million a year earlier. Gross bookings, a number used to track customer demand, decreased 10% y/y to USD14.75 billion. Demand for Uber's core business, ride hailing, was battered by the coronavirus disease 2019 (COVID-19) virus pandemic, which resulted in a decline in its revenues of 53% y/y to USD1.37 billion in the third quarter. Meanwhile, revenues of its food delivery business, Uber Eats, rose 125% y/y to USD1.45 billion. Uber's freight revenue was USD288 million, up 32% y/y, in the third quarter. Uber CEO Dara Khosrowshahi said, "Despite an uneven pandemic response and broader economic uncertainty, our global scope, diversification, and the team's tireless execution delivered steadily improving results, with total company Gross Bookings down just 6% year-on-year in September." Uber's ride-hailing service gradually picked up again in May after the COVID-19 virus pandemic hit the business hardest in mid-April. Globally, Uber laid off 6,700 employees in two phases and has now reduced its workforce by 25% since the pandemic began. Uber says it still aims to be profitable on an adjusted basis before the end of 2021. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Ivey PMI saw little change in October at 54.5, suggesting a

continued but modest improvement in purchasing managers' spending

activity. The suppliers' delivery index saw the largest increase,

adding 4.1 points, to reach 44.8. (IHS Markit Economist Alexander

Minelli)

- Purchasing managers reported slower delivery times compared with the prior month as supply chains faced continued stress amid shifting business conditions in response to the COVID-19 pandemic.

- The price index grew steadily, up 2.7 points to 63.0, which was the second consecutive solid increase. The employment index rose 2.3 points to 56.1 as October's labor force survey results showed an 83,600 net employment increase.

- The inventories index inched up 1.4 points to 45.5, reversing its three-month decline, while purchasing managers' spending on inventories continued to fall in the month.

- While the Ivey PMI marginally improved, the IHS Markit manufacturing PMI was down slightly to 55.5 in October, still indicative of continued improvements in business conditions.

- The CFIB business barometer saw a five-month low as it dropped to 53.3, partly reflecting significantly increased business uncertainty regarding the resurgence of the COVID-19. As a result, fourth-quarter real GDP growth is expected to be mild after the expected surge in the third quarter.

- During the Canadian labor force survey week, regional

containment measures were in place to help stop the spread of the

COVID-19 virus. The 83,600 jump in net employment was double IHS

Markit expectations, but the small 0.1-percentage-point inch down

in the unemployment rate to 8.9% did match our forecast. (IHS

Markit Economist Arlene Kish)

- As restaurants, bars, and gyms were mostly affected, there was a hefty drop of 48,200 employment in accommodation and food services positions in the month, which were mostly concentrated in Quebec at a 41,600 drop.

- Ontario containment measures limited job losses in the industry to 8,600. The extension of Quebec's restrictions will dampen the industry's recovery, which is lagging all other industries.

- Currently, employment in accommodation and food services is 80.8% and hours worked within the industry is 76.2% of February's pre-pandemic level compared with total industry employment of 96.7% and total hours worked of 93.9%.

- The bulk of the gain was in full-time positions at 69,100. Self-employment increased for the first time in four months.

- Services-producing industry employment is just 3.2% below February's pre-pandemic peak and goods-producing industry employment is 3.9% lower.

- The labor force participation rate climbed to 65.2%, and the labor force is back to February's pre-pandemic level.

- Canada's second-wave containment measures, which seem to be targeted and temporary (for now), will further contribute to the labor market's uneven recovery.

- There are still only a handful of industries where employment levels have recovered from the pandemic, namely utilities, professional scientific and technical services, education, finance, and real estate. Joining this list in October is natural resources employment.

- Natural resources employment was the only major goods-producing industry employment gain in the month, with Alberta and British Columbia accounting for about 4,000 net employment increases each.

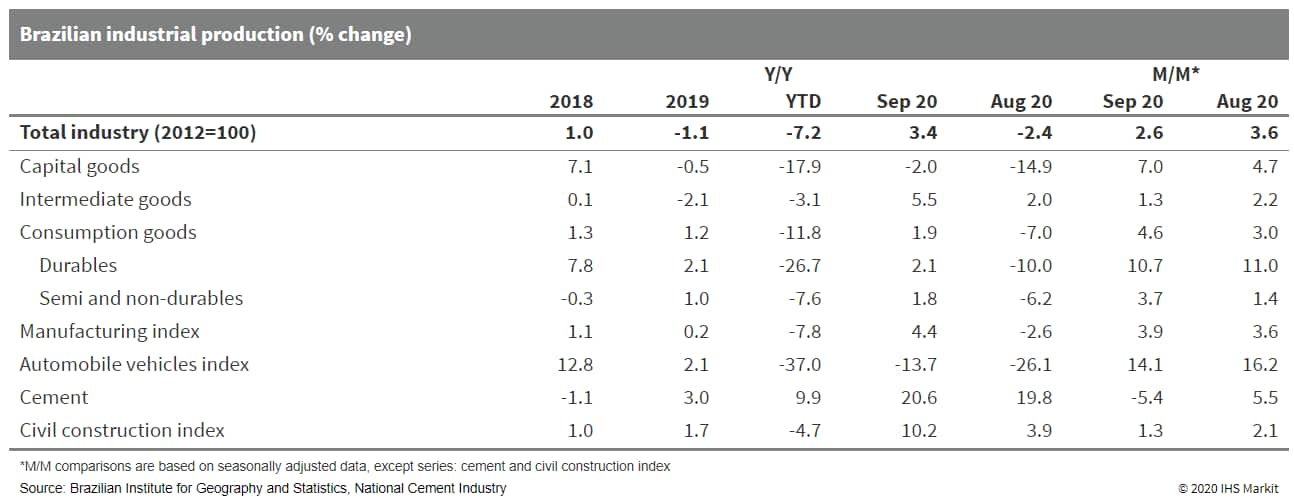

- Seasonally adjusted data show that Brazil's industrial

production (IP) expanded by 2.6% in September compared with August

(month on month, m/m); although this is a deceleration over the

previous four months, it takes the IP index above pre-pandemic

levels. (IHS Markit Economist Rafael Amiel)

- Although all subcategories expanded in September, production of durable consumer goods posted robust growth, driven by the automotive sector.

- Compared with September 2019, and using unadjusted data, IP grew by 3.4%. This extraordinary expansion is being fueled by fiscal stimulus and by pent-up demand (postponed purchases from previous months when lockdowns limited economic activity).

- A sector that has performed significantly well in recent months include electronics and appliances, especially computer equipment, where demand increased sizably because of the need to work from home because of the COVID-19-virus outbreak. The food and beverages industry has also benefited from stronger demand.

- There is ample room for recovery in the automotive and apparel sectors and there may still be some pent-up demand that may fuel growth in the next few months. In general, IHS Markit anticipates some growth in industry during the fourth quarter of 2020, although the deceleration pace should continue.

- The outlook for next year seems more challenging as government

support (specifically, direct transfers of money to households) is

set to end; public finances are in dire straits and businesses and

investors are waiting to see a commitment to fiscal prudence.

- Brazilian light-vehicle registrations declined 14.9% year on year (y/y) in October, according to initial data from the National Federation of Motor Vehicle Distributors (Federação Nacional da Distribuição de Veiculos Automotores: Fenabrave). Fenabrave reported registrations of 205,244 light vehicles last month, compared with 241,142 units in October 2019. Registrations of medium and heavy commercial vehicles (MHCVs) and buses decreased by 19.6% y/y last month, Fenabrave's data show. In October, 9,809 MHCVs were sold, compared with 12,198 units in the same month a year earlier. The best-selling automaker in the Brazilian light-vehicle market, Fiat Chrysler Automobiles (FCA), had a market share of 18.7% in October. Volkswagen (VW) and General Motors (GM) claimed second and third places with shares of 16.7% and 16.6% respectively. Fenabrave reported that the GM Onix was the best-selling passenger car in Brazil last month, with 12,203 units registered. The Fiat Strada pick-up was the best-selling commercial vehicle, with 10,068 units registered in October. While reporting their third-quarter earnings, separately, GM and FCA highlighted these two models as being significant for their respective performances in the region; however, both companies struggle to maintain profitability in South America. Alarico Assumpção Júnior, president of Fenabrave, is reported by regional media sources as stating that "the month of October is so far one that registers the record of the year, a year with the impact of the pandemic. Customers are more confident and making purchase decisions due to more credit offers." (IHS Markit AutoIntelligence's Stephanie Brinley)

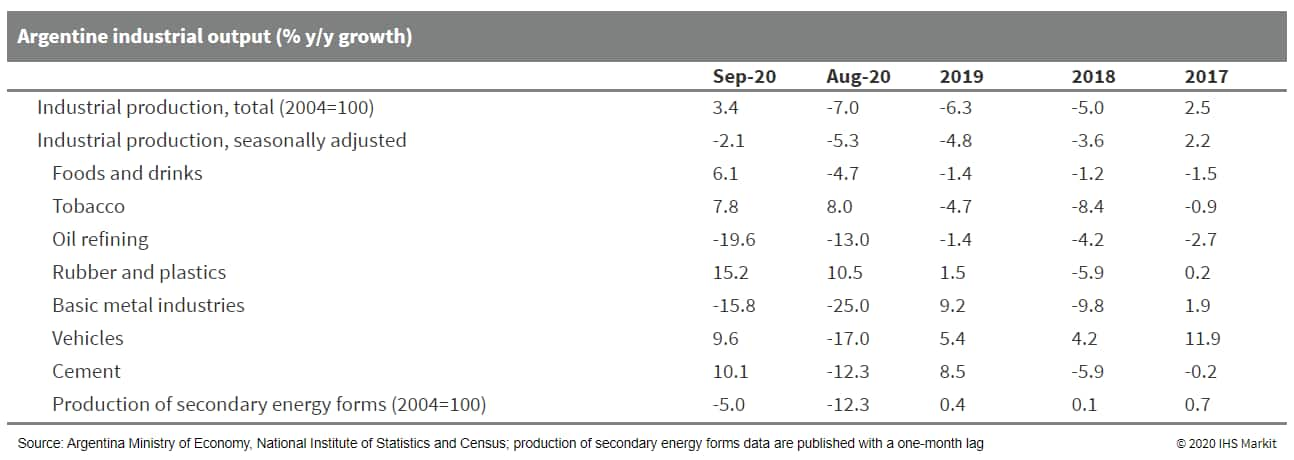

- Argentina's industrial production increased by 3.4% in

September 2020 compared with September 2019. The highly volatile

seasonally adjusted monthly index rose by 4.3% in September

compared with August, and more than half of the categories posted

annual expansions. (IHS Markit Economist Paula Diosquez-Rice)

- Argentina's industrial production rose by 3.4% year on year (y/y) in September, according to the National Institute of Statistics and Census (Instituto Nacional de Estadística y Censos: INDEC). Seasonally adjusted data show a 4.3% month-on-month (m/m) rise in September, compared with a 0.6% m/m decrease in August (revised figure). The cumulative change for the first nine months of 2020 is a decline of 10.8% y/y.

- The biggest annual decreases in September were in transport equipment, textiles, clothing and apparel, basic metals, and oil refining, among others. On the other hand, more sectors posted a y/y expansion in September - the food and beverages sector, the tobacco product sector, the chemicals sector, the machinery and equipment sector, and the general machinery and equipment sector.

- A qualitative industrial poll of companies conducted by INDEC shows that 38% of respondents estimate that demand will deteriorate in last quarter of 2020 compared with the same period in 2019 (down from 39% in the previous month's survey). The percentage of respondents expecting demand to pick up remained at 26%, while 34% of respondents expect exports to fall during the period.

- Construction activity increased by 3.9% m/m in seasonally adjusted terms in September and dropped by 3.9% compared with September 2019; construction employment in the formal sector, registered, decreased by 27.2% y/y in September, while cumulative job losses in the sector stood at 23.8% in the first nine months of the year. Approximately 22% of the construction firms that responded to the qualitative survey expect activity to shrink in the private sector in the next three months, whereas 54% expect no change in activity.

- Argentina's manufacturing's utilized capacity increased to

58.4% in August. The chemicals sector had the highest utilized

capacity at 71.1%, followed by non-metal minerals, oil refining,

and paper and cardboard. The sectors with the least utilized

capacity were the automotive industry, at 35.4%, and the textiles

industry, at 42.3%.

Europe/Middle East/Africa

- Most European equity markets closed lower; Spain -0.8%, Germany -0.7%, France -0.5%, Italy -0.3%, and UK +0.1%.

- 10yr European govt bonds closed lower except for Italy -1bp; UK +4bps, Germany +2bps, and Spain/France +1bp.

- iTraxx-Europe closed -1bp/53bps and iTraxx-Xover -6bps/314bps,

which is -12bps and -53bps week-over-week, respectively.

- Brent crude closed -3.6%/$39.45 per barrel.

- UK Chancellor of the Exchequer Rishi Sunak will extend the

Coronavirus Job Retention Scheme (CJRS; furlough) across the whole

of the United Kingdom to the end of March 2021. The scheme had

ended on 31 October before being extended throughout November in

response to the decision to place England on a national lockdown

during the month. (IHS Markit Economist Raj Badiani)

- This represents a major government U-turn after its recent "winter economic plan" proposed to replace the furlough scheme with a job support scheme to subsidize the wages of people working part time.

- Sunak confirmed that the extended furlough scheme will again pay up to 80% of an employee's wage up to GBP2,500 per month. The government will review the policy in January to determine whether it should adjust its support, probably to decide whether firms should make a contribution towards the cost of furloughed workers.

- The extended furlough scheme is available to all UK companies regardless of whether they are open or closed.

- The chancellor said his aim is "to give businesses security through the winter", and that "the security we are providing will protect millions of jobs".

- The UK Treasury did not provide the total cost of the extension, as it will depend on the take-up of the scheme. However, it suggests that 1 million workers on furlough will cost GBP1 billion a month, with the Bank of England (BoE) estimating that about 5 million workers are likely to be placed on the scheme.

- The CJRS cost GBP39.5 billion in April-September, implying that it is the Treasury's single most expensive COVID-19 virus support measure.

- Sunak also announced the "job retention bonus" of GBP1,000 per worker, intended to incentivize firms to re-employ furloughed workers who will be shelved in February 2021.

- Sunak will provide more support through the Self-Employment Income Support Scheme (SEISS), with the third grant covering November-January calculated at 80% of average trading profits, capped at GBP7,500. The increased generosity of the scheme will cost GBP1.4 billion per month, which cost GBP13 billion in April-September.

- There are some exclusions, which include the newly self-employed, those who earn from dividends, freelancers, and sole traders with trading profits in excess of GBP50,000.

- In addition, the government will provide an additional GBP2 billion to GBP16 billion for devolved administrations in Scotland, Wales, and Northern Ireland to protect their economies from tougher COVID-19 virus restrictions.

- The extension of the furlough scheme and more generous assistance to the self-employed to the end of March provide welcome support to the economy facing a renewed downturn in the final quarter of this year. In addition, the government is providing further guarantees to workers should the national lockdown extend beyond 2 December. Clearly, there is a significant risk that further lockdowns could be required in early 2021.

- Bentley has outlined its new Beyond100 strategy, which will see the company become an all-electric brand by 2030, according to a company press statement. Bentley also aims to be fully carbon neutral as an organization in terms of its production, logistics, and sales operations. Bentley says the plan is designed to take a holistic approach to "reinvent every aspect of its business to become an end-to-end carbon neutral organization as it embarks on its second century". As well as the headline target of a move to fully battery electric vehicle (BEV) products by 2030, prior to that the company will have its entire range consist either of BEVs or plug-in hybrid electric vehicles (PHEVs) by 2026. Commenting on the plan, Adrian Hallmark, Bentley's chairman and CEO, said, "Since 1919, Bentley has defined luxury grand touring. Being at the forefront of progress is part of our DNA - the original Bentley boys were pioneers and leaders. Now, as we look Beyond100, we will continue to lead by reinventing the company and becoming the world's benchmark luxury car business. Driving this change includes, and also goes beyond our products, delivering a paradigm shift throughout our business, with credibility, authenticity, and integrity. Within a decade, Bentley will transform from a 100 year old luxury car company to a new, sustainable, wholly ethical role model for luxury." This is a move that may at first glance look bold, but it is probably entirely necessary and logical in order to safeguard one of the world's most famous and storied ultra-premium brands. For the ultra-premium brands, the move to electrification is much easier to sell to its established customer base than it is for companies such as Ferrari, Lamborghini, and McLaren, which have established their brands by offering hugely dramatic, exciting, and dynamic hypercars, supercars, and GTs. (IHS Markit AutoIntelligence's Ian Fletcher)

- Light commercial vehicle (LCV) registrations in the United

Kingdom grew by 13.1% year on year (y/y) during October. According

to data published by the Society of Motor Manufacturers and Traders

(SMMT), registrations of LCVs with a gross vehicle weight of less

than 3.5 tons increased 13.3% year on year (y/y) to 28,753 units

during the month. (IHS Markit AutoIntelligence's Ian Fletcher)

- Sales in nearly all LCV categories improved. This included the popular category of vans with a GVW of 2.5-3.5 tons, which leapt by 26.8% y/y to 20,492 units.

- Registrations of vans with a GVW of 2.0-2.5 tons increased by 2.9% y/y to 4,482 units, while vans with a GVW of less than 2 tons posted a modest improvement of 1.6% y/y to 1,418 units.

- Registrations of pick-ups were down 31.8% y/y to 2,211 units, and registrations in the low-selling commercial 4x4 category slipped by 33.6% y/y to 150 units.

- As a result of the gain in registrations of LCVs with a GVW of less than 3.5 tons in October, registrations during the first 10 months of the year are now down by 24.1% y/y at 236,833 units.

- Registrations of the bigger rigid LCVs with a GVW of 3.5-6 tons also increased in October, by 27.7% y/y to 1,151 units. In the year to date (YTD), registrations in this segment are down 20.5% y/y at 5,482 units.

- Seasonally and calendar-adjusted German industrial production

excluding construction increased by 1.7% month on month (m/m) in

September, following a temporary halt to the recovery (began in

May) during August (0.2% m/m). The cumulative rebound during

May-September was 26.9%. Although this appears to almost recoup the

March-April plunge by 28.5%, differences in the base level - that

these percentages refer to - mean that production in September

remained more than 9% below February's pre-pandemic level and the

2019 average. (IHS Markit Economist Timo Klein)

- Total production including construction increased by 1.6% m/m in September, while construction output alone increased by 1.5% m/m after an upwardly revised 2.0% m/m in August (originally: -0.3%). The level of construction activity in September was thus about 1% above the average of the fourth quarter of 2019, whereas production excluding construction remained almost 8% lower.

- Unlike in August, differences among the three general types of manufacturing goods were limited in September, with consumer goods - led by non-durables - outperforming to some extent (see table below). A different split according to industrial branches shows that September's production was boosted the most by sectors that had experienced the largest setbacks in August, namely automotive (10.0% m/m), chemicals and pharmaceuticals (8.0%), and machinery and equipment (2.7%). Nevertheless, automobile production in September remained 15% below February's pre-pandemic level and 14% below that of the fourth quarter of 2019, keeping in mind that the latter was already 17.5% below the average car output in 2017, the last healthy year before sector-specific problems emerged.

- Meanwhile, manufacturing orders data were encouraging despite a headline increase of just 0.5% m/m in September, because volatile big-ticket orders posed a major restraint - the series excluding big-ticket items increased by 4.5% (see chart below). Thus, underlying orders were broadly back at January-February levels. The dampening impact of big-ticket items showed up in weak investment goods demand (-2.0% m/m), while intermediate and consumer goods orders posted robust increases. The split between domestic and foreign orders reveals a further recovery of the former - having suffered an interim setback in July and a consolidation of foreign demand after an extremely strong rebound during May-August (a cumulative increase by 64%, almost back to February's level). This correction stemmed entirely from non-eurozone demand (-6.0% m/m), whereas eurozone orders posted their fifth consecutive increase (2.7%).

- The orders breakdown by industrial branch shows that September's demand increased the most in the metal processing and automotive industries (by 9.1% m/m and 5.1% m/m, respectively), whereas the machine-building sector experienced a downward correction of -3.7% after its surge by 12.8% in August.

- Germany's industrial sector remained on a recovery path in September, and both September's orders and October's manufacturing PMI data suggest that this continued during October. The key sectors - automotive, chemicals and pharmaceuticals, metals, and machinery - still had considerable momentum in September. Nevertheless, it is important to remember that February's pre-pandemic level still has not been regained by a sizeable margin and that structural problems, in the automobile sector for instance, will persist in any case.

- The CEO of the Volkswagen (VW) Group has said that electrification across the automotive industry is an existential challenge to OEMs. In an interview with Bloomberg, Herbert Diess said there is no turning back on his company's strategy to spend EUR33 billion (USD39 billion) on launching 80 fully electric vehicles across the Group's brands by 2025. He said, "If you're not fast enough, you're not going to survive. In the long run, climate change will be the biggest challenge mankind is facing." As well as electrification, the industry is also facing huge challenges in terms of the shift to mobility and the digitization of the passenger car. Diess added, "This is the most important race and decisive point for our industry in [the] next five to 10 years. We think we can do it. We have software skills, and we are ramping up fast." Diess also acknowledged that the second COVID-19 virus-related lockdowns that are currently being implemented across Western Europe will be difficult to manage, but he pointed to the fact that VW has healthy advance order books, especially for its electrified cars. (IHS Markit AutoIntelligence's Tim Urquhart)

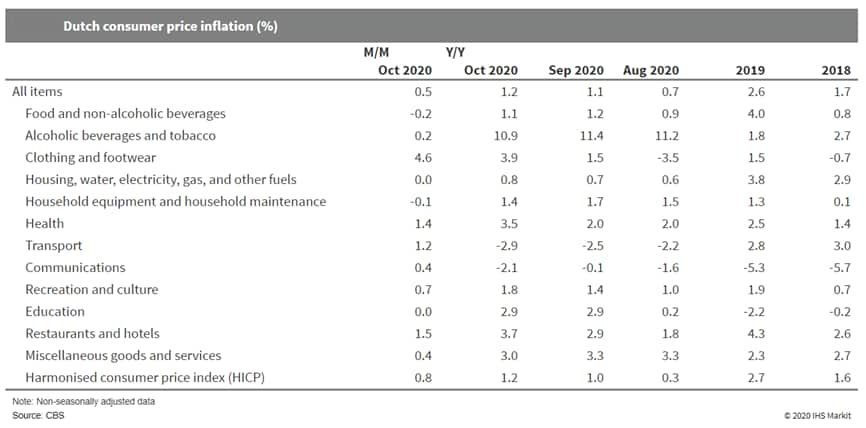

- Dutch consumer prices increased by 1.2% year on year (y/y) and

by 0.5% month on month (m/m) in October, according to the national

consumer price index (CPI) measure, and grew by 1.2% y/y and 0.8%

m/m according to the EU-harmonised measure. This followed a sharp

monthly fall in headline inflation during August. (IHS Markit

Economist Daniel Kral)

- A large positive contribution to October's headline inflation came from clothing and footwear prices, which increased by 4.6% m/m. This is because summer sales in 2020 lasted well into August, unlike in 2019, while autumn collections were introduced in September.

- The largest downward pressure came from food and non-alcoholic beverages, which dropped by 0.2% m/m. On an annual basis, the largest drag came from transport, down by 2.9% y/y.

- Statistics Netherlands (Centraal Bureau voor de Statistiek: CBS) notes that prices covering roughly 4% of the consumption basket, such as airlines or events, had to be estimated, owing to an insufficient number of recorded transactions.

- Core inflation increased to 1.9% y/y in October from 0.8% y/y

in August, even as core inflation in the eurozone remained at a

record low of 0.2% y/y. This means that the Dutch differential

versus the eurozone stood at 1.7 percentage points (pp), versus an

average of 0.3 pp over the last decade.

- Although new restrictions aimed at limiting the spread of the

COVID-19 virus will limit short-term growth, Slovakia's mass

testing program could bring relief. (IHS Markit Economist Sharon

Fisher)

- Excluding the automotive sector, real retail sales jumped by 5.8% year on year (y/y) in September, marking the third straight month of growth and the fastest rate in nearly two years. Seasonally adjusted sales rose by 1.3% month on month (m/m).

- Wholesale trade and restaurant services also posted continued y/y growth in September, while hotel services and automotive sales weakened, especially in the former's case. In m/m terms, declines were reported in hotel and restaurant services.

- Overall, the latest retail trade figures had positive implications for Slovakia's third-quarter GDP results. Private consumption fell by 4.2% y/y in the second quarter, and we estimate that the decline was considerably more modest in the third quarter.

- Norwegian food producer Orkla and frozen food giant Nomad Foods are among the groups interested in acquiring Croatian Fortenova Group frozen food units Ledo Plus, Ledo Citluk and Frikom. A Czech-Slovak consortium of Emma Capital and J&T Private Equity Group have also entered the fray, according to the local press. The three candidate buyers can now carry out due diligence at the companies put up for sale, after which they should submit binding bids. The operation is estimated at EUR600 million (USD704 million). Fortenova invited selected bidders to start due diligence at its frozen food units, which have already been offered for sale. The test confirmed a strong interest among potential investors. Its chief executive Fabris Perusko said this process should be completed by the end of this year. In September, the company received several non-binding offers for its frozen food business, in order to reduce its debts and strengthen other areas of the business. Fortenova was started in April 2019 when business operations from the bankrupt Agrokor were transferred through a settlement plan to the newly-established company. Since its creation, Fortenova has divested non-core operations to focus on more strategic divisions. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

Asia-Pacific

- APAC equity markets closed higher except for Mainland China -0.2%; India +1.3%, Japan +0.9%, Australia +0.8%, South Korea +0.1%, and Hong Kong +0.1%. Japan's Nikkei 225 closed at its highest level since 1991.

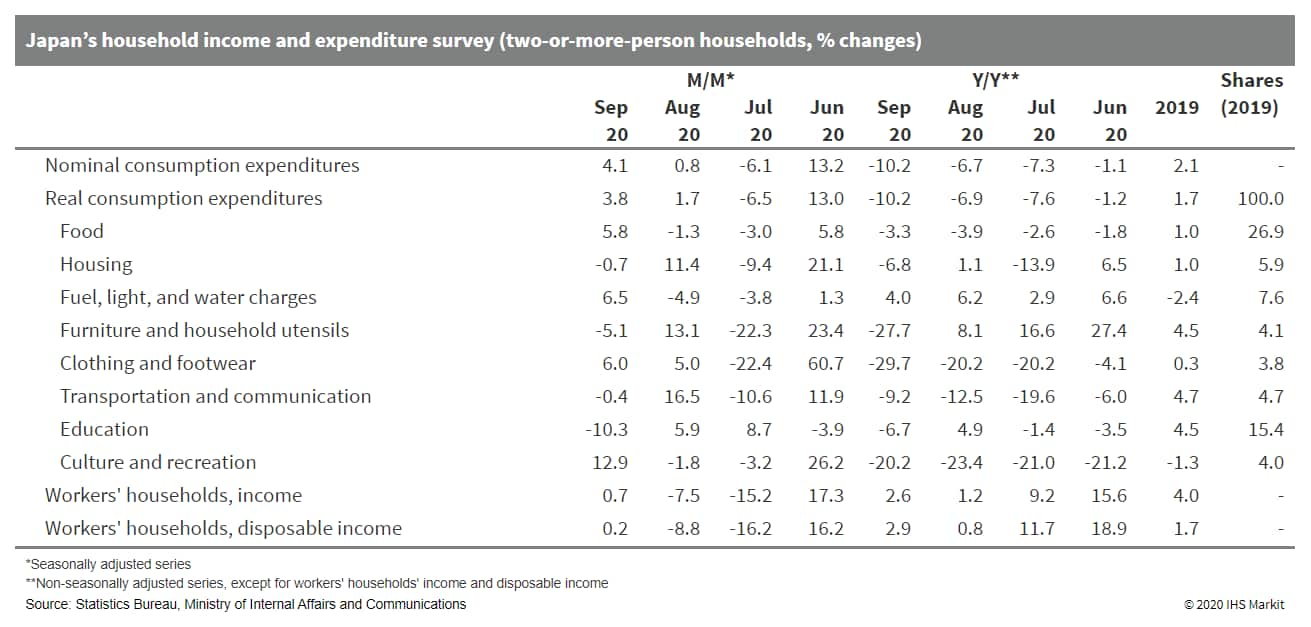

- Japan's real household expenditures rose by 3.8% month on month

(m/m) in September 2020 following a 1.7% m/m drop in the previous

month, although the year-on-year (y/y) contraction widened to 10.2%

as front-loaded demand ahead of the consumption tax increase in

October 2019 boosted spending in September 2019. The stronger m/m

increase largely reflected solid rises in spending on food, mainly

because of improved spending for eating-out, culture and recreation

(including domestic travel package tours and entrance fees of

amusement parks), and fuel, light, and water charges, as hot

weather boosted electricity charges. (IHS Markit Economist Harumi

Taguchi)

- However, real average monthly cash earnings continued to decline in September 2020 (down 0.9%), although the y/y contraction continued to narrow thanks largely to a milder decline in hours worked. Although household expenditure in personal services improved, regular working hours in accommodation/drinking/eating services and life-related services/amusement remained sluggish, declining 8.8% and 6.7%, respectively, while non-scheduled hours worked continued to decline in most industries. Weak recoveries in demand led to continued declines in the number of part-timers and a softer rise in part-timers' hourly cash earnings.

- The September results suggest that the government's travel subsidies and easing guidelines on public gatherings continued to support household spending. A recovery in private consumption is likely to be a major factor behind a rebound of real GDP growth in the third quarter of 2020 (which will be released on 16 November).

- While additional stimulus measures introduced from October and

improved consumer sentiment are likely to support upward momentum

in the coming months, sluggish cash earnings could weigh on a

recovery of personal consumption, particularly when government's

stimulus measures end. The recent resurgence of COVID-19 could make

consumers more cautious about going out.

- Toyota today (6 October) released its financial results for the

first half of fiscal year (FY) 2020/21 (April-September 2020). The

automaker's operating income plunged by 62.8% during the period to

JPY519.98 billion (USD5.00 billion) on net sales of JPY11.375

trillion, down by 25.9% year on year (y/y). (IHS Markit

AutoIntelligence's Nitin Budhiraja)

- Its net income declined by 46.7% y/y to JPY631.18 billion, while income attributable to equity holders of the company fell by 45.3% y/y to JPY629.36 billion.

- Toyota's consolidated vehicle sales in the first half of the FY were severely affected by the spread of the COVID-19 virus pandemic. The automaker reported consolidated sales of 3.086 million units during the period, marking a decrease of 33.7% from the same period last FY.

- Sales declined in Japan, North America, and Europe to 921,000 units (down by 19.2% y/y), 930,000 units (down by 35.7% y/y), and 395,000 units (down by 25.4% y/y), respectively.

- In Asia, Toyota's sales declined by 46.1% y/y to 456,000 units. Sales volumes contracted by 44.8% y/y to 384,000 units in other regions.

- The sharp deterioration in performance during the first half of the current FY largely reflected disruptions from the COVID-19 virus pandemic in the first quarter of the FY, which escalated in major automotive markets, especially North America and Europe.

- The COVID-19 virus pandemic dealt a major blow to Toyota's financial performance during the first quarter of the FY ended 30 June. The pandemic, and delayed factory reopening put consumers' purchase plans on hold.

- The automaker's operating profit during the first half of the FY suffered owing to a drop in sales volume and effects of foreign exchange rates, partially offset by cost-reduction efforts as well as a reduction in labor and depreciation costs.

- Research and development (R&D) expenses during the period were up by JPY20 billion during the first half of the FY. Toyota performed well in mainland China during the period and its sales there increased by 19% y/y to 992,000 units on the back of high demand for models such as the Corolla and Levin.

- For the full year 2020, IHS Markit expects sales of Toyota Group, which includes the Toyota, Daihatsu, Lexus, and Hino brands, to drop by 15.1% y/y to around 8.913 million units in the global market.

- Sales in the Greater China region are forecast to increase by 6.8% y/y to 1.976 million units in 2020 compared with 2019, as automotive sales in the region are less affected by the pandemic and the region's main growth engine, mainland China, is still expected to expand its economy during the pandemic.

- The Japan Automobile Importers Association (JAIA) has reported that imported vehicle sales in the country increased by 54.3% year on year (y/y) in October to 30,003 units. This figure includes the sales of foreign brands' imported vehicles, which increased by 32.9% y/y to 22,088 units, and Japanese brands' imported vehicles, which increased by 180.9% y/y to 7,915 units. By brand, Mercedes-Benz continued to lead the import market with a 14.9% share, with its sales up by 20.6% y/y to 4,468 units in October. Volkswagen followed in the rankings with sales of 2,880 units, up by 27.7% y/y, and a market share of 9.6%. BMW ranked third, with a market share of 10.1% and sales of 3,029 units, up by 11.4% y/y. Among the Japanese brands, Nissan sold 4,015 imported units last month, compared with 432 units in the same month last year. It was followed by Toyota with 2,257 units, up by 36.4% y/y. In the year to date (YTD), sales of imported vehicles in Japan are down by 13.5% y/y at 249,551 units. Imported vehicle sales in Japan advanced in October after several months of decline. The double-digit growth in sales of imported vehicles last month can mainly be attributed to last year's low base when the Japanese government implemented a rise in value-added tax in October 2019. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Tier IV, JapanTaxi, Sompo Japan Nipponkoa, KDDI, and Aisan Technology have collaborated to launch autonomous taxi trials using 5G networks in Tokyo (Japan). The companies will conduct tests on public roads around the metropolitan government office building in Shinjuku Ward with an aim of commercializing autonomous taxis after 2022. The pilot test will operate for four days to monitor safety, comfort, and punctuality of these autonomous taxis under remote monitoring and human monitoring modes. Tier IV will provide its open-source automatic driving operating system, Autoware; Aisan Technology will offer high-precision 3D maps; and KDDI will provide 5G communication networks to support autonomous taxi operations. JapanTaxi will be the service partner and Sompo Japan Nipponkoa will provide insurance services for the autonomous vehicles (AVs). Residents chosen through lottery can hail the autonomous taxi using a smartphone app, reports The Japan Times. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The China Association of Automobile Manufacturers (CAAM) on 5 November released an estimate of new vehicle sales in China in October, prior to its monthly briefing. According to the CAAM, new vehicle sales in China are expected to reach 2.544 million units in October, up 11.4% year on year (y/y) and down 0.8% month on month. Breaking down the figures by vehicle type, the CAAM expects passenger vehicle (PV) sales to grow 7.3% y/y during October and commercial vehicle (CV) sales to rise 27.5% y/y. In the year to date (YTD; January-October), new vehicle sales in China are estimated at around 19.66 million units, down 4.8% y/y. The CAAM expects PV sales to decrease 10.1% y/y and CV sales to grow 20.6% y/y in the YTD. IHS Markit expects more details to be released by the CAAM in the coming week. IHS Markit currently expects light-vehicle sales in mainland China to decline 6.8% to 23.1 million units in 2020, followed by a rebound of 5.9% y/y growth in 2021. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Nylon 6 and feedstock caprolactam are oversupplied but demand

growth is expected in the coming years, as such producers must be

disciplined in running their plants to stay afloat in the new slim

margin environment, said Anthony Tso, IHS Markit principal research

analyst at the Eighth Asia Chemical Conference on Nov. 6. (IHS

Markit Chemical Advisory's Sok Peng Chua)

- Reviewing the caprolactam situation in China, Tso pointed out that supply was ample in late 2019 prior to COVID-19. Operating rates stayed above 80% but inventories were at moderate levels of around 40,000 mt. Then the pandemic swept through the nation and run rates dipped to around 60% at its lowest point. However, the impact lasted only a month as the Chinese government quickly contained the spread of the disease and the economy rebounded. Producers ramped up run rates quickly even though demand was slow to follow, causing massive caprolactam build in the first quarter to more than 90,000 mt.

- Looking forward, IHS Markit expects growth and a more significant demand rebound for the global caprolactam industry. Global demand is forecast to be slightly above 6 million mt in 2021 but supply would rise even faster, especially in China, where new capacities are added despite the pandemic.

- In 2020 total nylon 6 demand is estimated to be at 5.6 million mt with 41% going to textile filament yarn and 39% going to engineering resin. The nylon 6 to caprolactam spread has been trending lower over the past few years after hitting a high of more than $500/mt in 2017.

- The spread has been declining since 2018 but margins were still slightly positive in 2018-19 and market participants expected a recovery in 2020 until COVID-19 struck. In Q2 2020, demand crashed and the spread plunged to as low as $180/mt.

- For the full year of 2020, IHS Markit is forecasting the spread to be around $250/mt and margins should rebound further towards the end of 2020 and in 2021. However, ample supply will keep nylon 6 chip cash cost recovery at bay as the market still appears long in the coming years.

- Although Indonesian economic activity contracted 3.49% year on

year (y/y) in real terms during the third quarter, this was an

improvement from the previous quarter's result. This marks

Indonesia's first recession since the Asia Crisis of the late

1990s; while IHS Markit does not expect the downturn this time to

be as deep, the recovery may still be several quarters off because

of the persistence of the coronavirus disease 2019 (COVID-19) virus

in Indonesia. (IHS Markit Economist Bree Neff)

- Government consumption spending for individual consumption that largely consists of social assistance benefits surged 16.7% y/y in real terms during the quarter, or the largest annual increase in seven years, according to data available from Statistics Indonesia.

- The government indicated in early October that nearly 74% of its social safety net spending as part of the national economic recovery stimulus package had been spent by 28 September, with much of that spending arising in the third quarter.

- Despite the successful ramping-up of social safety net spending, the government simultaneously reported that it had only spent 43.8% of the IDR695.2-trillion (USD48.5 billion) national economic recovery stimulus package through the end of September, with the government falling behind primarily on health-sector spending. The underperformance of the stimulus package spending raises questions if the government's stimulus measures will ever be fully realized, which is a worrisome prospect for a health sector in the middle of a pandemic.

- While government consumption activity ramped up significantly, private consumption spending was slower to recover during the third quarter. Both the monthly frequency real retail sales data from Bank Indonesia and the private consumption data from Statistics Indonesia indicate improved spending at retail shops, albeit a weak improvement. Non-restaurant food and beverages spending by households as recorded in the national accounts was essentially unchanged at -0.7% y/y, and spending at clothing retailers improved to -4.3% y/y in the third quarter from -5.1% y/y in the second quarter.

- Due to continued concerns for health and safety, consumer spending recorded double-digit contractions for a second consecutive quarter in the transportation and communication as well as restaurant and hotel categories, which were down 11.6% y/y and 10.9% y/y, respectively.

- Fixed investment spending remained in the doldrums as well during the third quarter. Machinery and equipment spending slumped further, contracting 21.0% y/y in the third quarter of 2020, or the worst result since the fourth quarter of 2009. Easing contractions for transportation investment and capital outlays for "other" equipment mitigated the effect of the slump in machinery and equipment spending, although both were still contracting around 15% y/y.

- The net export position remained favorable, in no small part due to the continued weakness in domestic demand that led to goods imports slumping 19% y/y in real terms during the quarter, while the ongoing COVID-19 virus pandemic kept services imports contracting at 40% y/y in real terms.

- Merchandise exports benefitted modestly from recovering external demand during the quarter with non-oil and gas related exports contracting a smaller 4.9% y/y in real terms, mitigating the effect of a 12.5% y/y contraction in oil and gas exports. Services exports remained down 52% y/y in the third quarter.

- Inflation remains feeble in October because of weak demand pressures

- At the start of the week, Statistics Indonesia reported inflation held firm at 1.4% during October, but there is some upward drift to food prices arising from the commencement of the rainy season. According to the statistical agency, higher prices for red chillies, onions, and cooking oil helped lift the food component of the Consumer Price Index (CPI) for October.

- Otherwise price pressures remain weak, with decreased prices for airline tickets and lower electricity tariffs helping to contain price pressures in the transportation and communication as well as housing and utilities components of the CPI. Core inflation eased further during October 2020 because of the broad-based weakness in demand, and at 1.7% y/y, is at a fresh record low for the series that dates back to the start of 2009.

- The result for Indonesia's third quarter was better than IHS Markit had expected, and that was because the ramping-up of government spending was stronger than had been anticipated after a very discouraging performance in the second quarter. Additionally, the reintroduction of large-scale social restrictions (known locally as "PSBB") in Jakarta in September did not drag on the recovery as much as feared. In response, we will upgrade Indonesia's real GDP growth forecast for 2020 from -3.3% to closer to the -2.3 to -2.5% range in our November forecast.

- The below Price Viewer chart shows November 2015 to present 5yr

CDS spreads for the Republic of Indonesia. The chart indicates that

2020 spreads peaked at 296bps on 23 March and are currently 26bps

wider than the lowest point of the year of 58.66 on 20

February.

- As per the Indian Finance Ministry, GST collections during Oct

2020 crossed INR 1 trillion (USD 14.4billion, USD/INR~73.25)

psychological mark for the first time since COVID 19 restrictions

dented economic activities in the country. Compared to the previous

year, GST collections in local currency were 10 percent higher y/y.

The eight core industries index compiled by the Ministry of

Commerce and Industry for September 2020 showed an annual increase

in production for domestic coal (up 21 percent y/y), electricity

(up 4 percent) as well as steel production (up 1 percent), pointing

recovering demand in the country. (IHS Markit Maritime &

Trade's Rahul Kapoor and Pranay Shukla)

- During September 2020, as per CEA data, total electricity generation stood at 110 TWh, up 5 percent y/y. In terms of fuel mix, there was an increase in electricity generation from coal (79 TWh, up 10 percent y/y) and renewables (11.4 TWh, up 5 percent), which compensated for the decline in generation from nuclear (3.8 TWh, down 6 percent), Hydro (19 TWh, down 9 percent). Generation from Gas based plants was flat at 4.4 TWh.

- Strong electricity generation enticed an increase in thermal coal imports; while increase in steel production allowed a surge in imports of metallurgical coal in the country.

- As per IHS Markit's Commodities at Sea, total coal arrivals

into India during October 2020 are calculated at 23.9mt (up 27

percent y/y).

- In terms of thermal and metallurgical coal imports stood at 17.6mt (up 15 percent y/y) and 6.3mt (up 80 percent y/y), respectively.

- On the back of rumored import restrictions at Chinese ports on Australian coal cargoes, there was a significant arrivals of both thermal as well as metallurgical coal of Australian origin into India.

- During Oct 2020, imports of Australian thermal and metallurgical coal into India stood at 1.2mt (versus 0.3mt in the previous year) and 5.2mt (versus 3mt), respectively.

- Cheap Australian cargoes attracted Indian buyers.

- There was also a 35 percent monthly increase in arrivals of Indonesian thermal coal in the country, but it was almost at previous year levels.

- Thermal coal into the Indian ports in terms of western, southern, and eastern coast of India during Oct 2020 calculated at 11.1mt (up 23 percent y/y), 4.1mt (down 23 percent), and 2.4mt (up 142 percent), respectively.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--6-november-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--6-november-2020.html&text=Daily+Global+Market+Summary+-+6+November+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--6-november-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 6 November 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--6-november-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+6+November+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--6-november-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}