Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 05, 2019

Corporate Bond Pricing Data, November 2019 Recap

US Treasury Movement

In this week's post, Michael Skorczynski from our IHS Markit Corporate Bond Pricing team has highlighted U.S. Treasury movement for November 2019, and delivered a review of the Investment Grade market sector and key up/down movers within the Investment Grade market. His observations are drawn from our Corporate Bond pricing data via the IHS Markit Price Viewer.

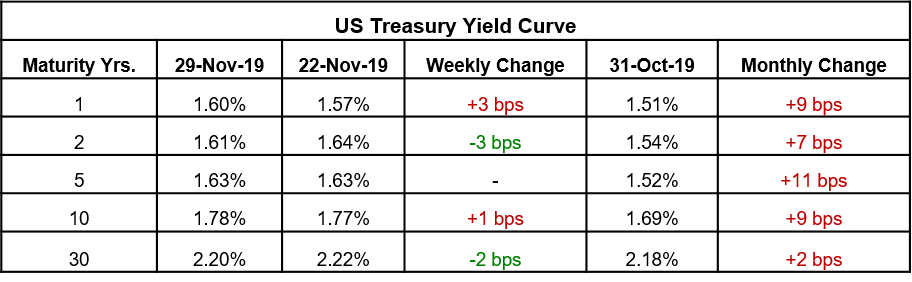

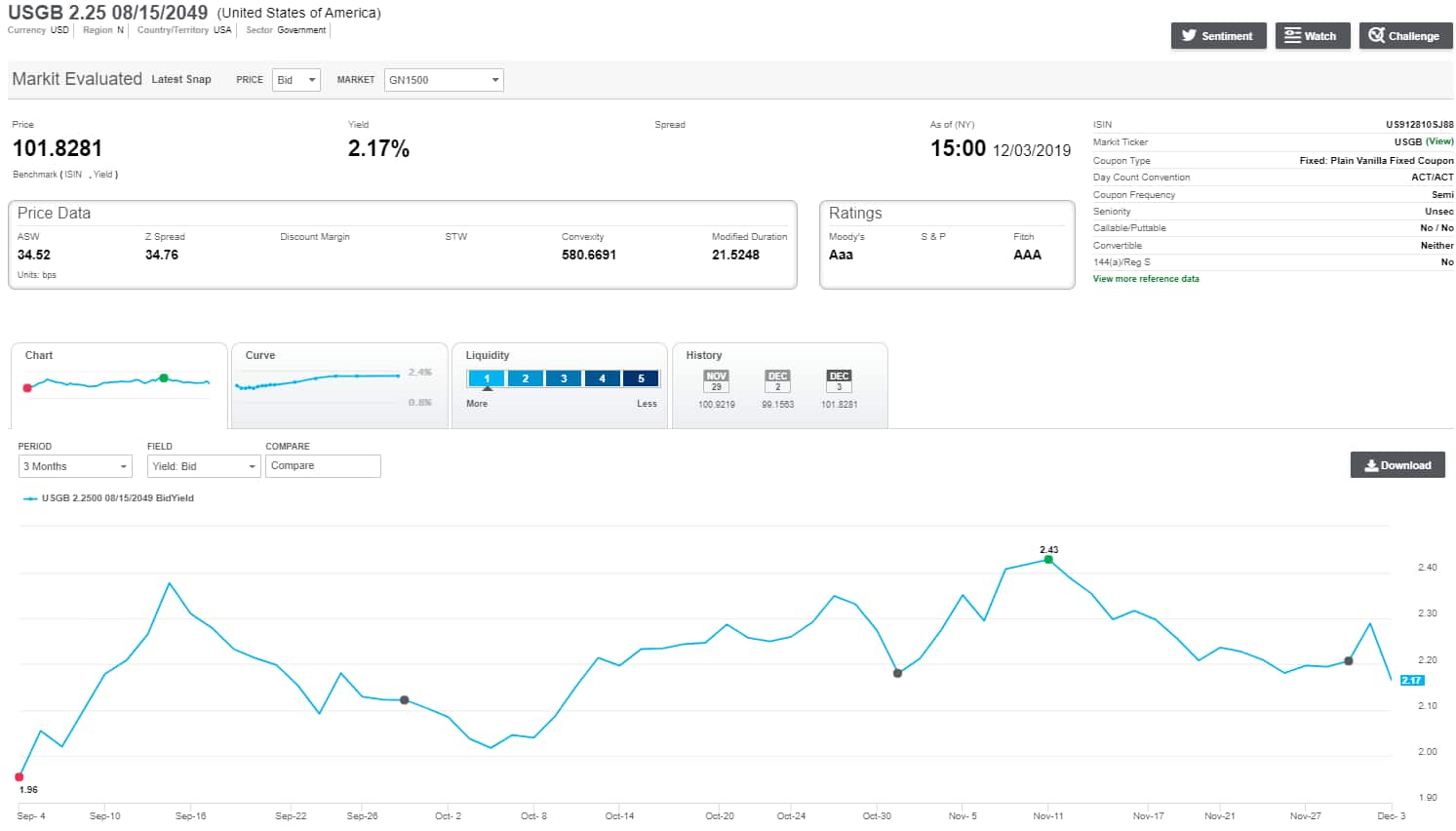

Over the month of November, the US Treasury curve widened. The table below summarizes weekly and monthly performance across the curve, followed by a snapshot of the 30 year's performance in more detail, sourced from our Price Viewer portal.

The 30-year yield started the month at 2.18%, then widened for the first two weeks of the month to 2.43% on November 11th. It then tightened for the rest of the month, finishing at 2.20%.

Investment Grade Market Review

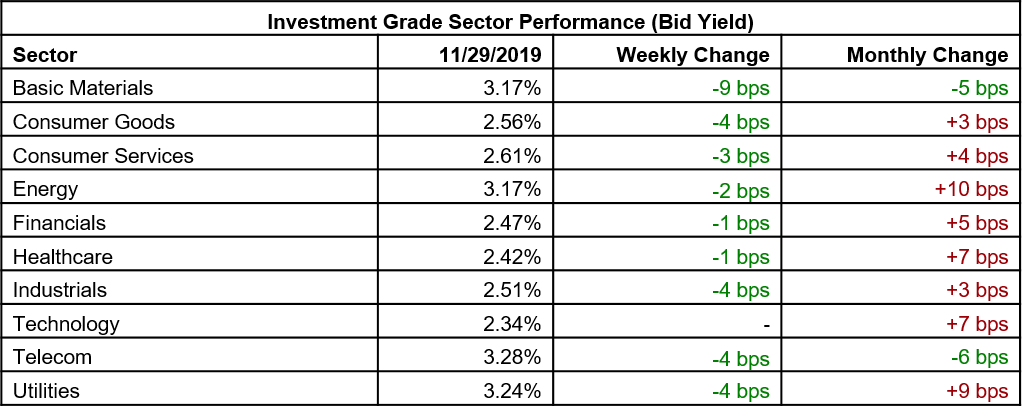

The table below summarizes weekly and monthly sector performance across the iShares iBoxx $ Investment Grade Corporate Bond ETF.

Top Moving Issuers within the Investment Grade Market

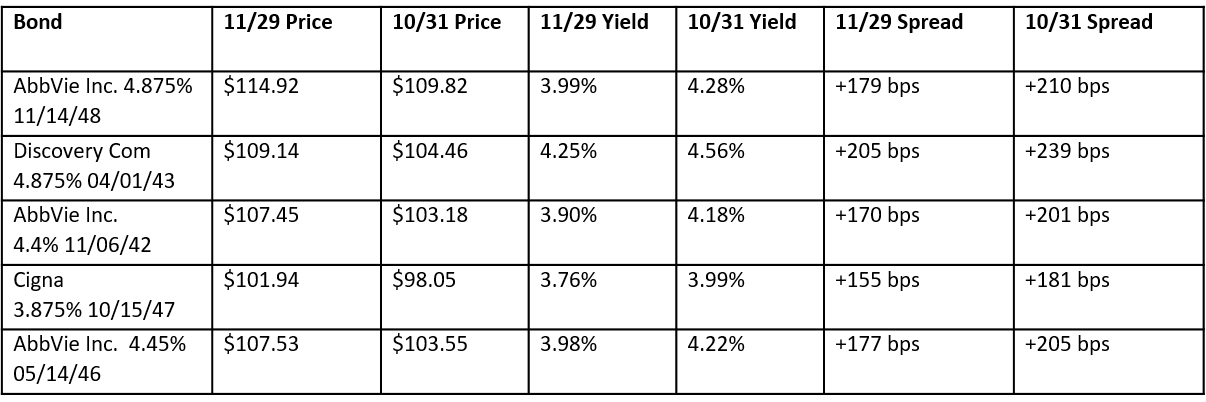

The best preforming IHS Markit iBoxx USD Investment Grade Index bonds in November are shown in the table below. AbbVie Inc., Discovery Communications, Inc., and Cigna Corporation all had the below bonds as well as their equity prices increase in value over the course of the month.

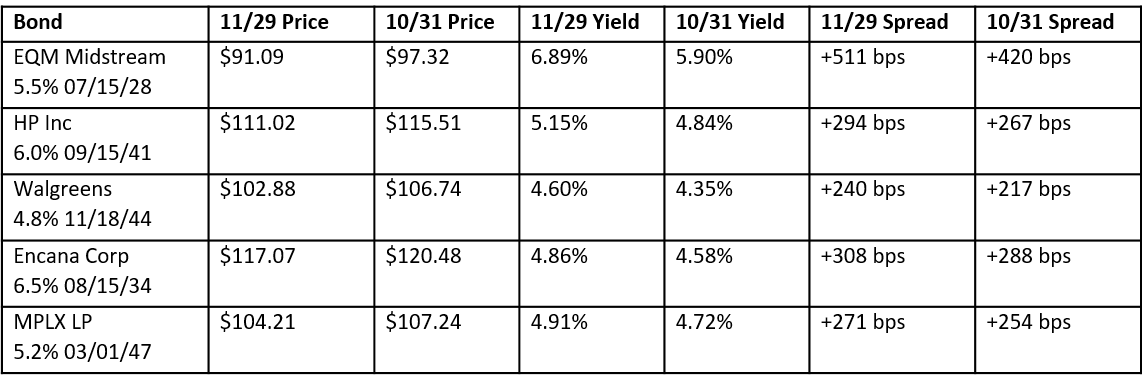

Below are the worst preforming IHS Markit iBoxx USD Investment Grade Index bonds of November.

EQM Midstream Partners, LP, Encana Corporation, and MPLX LP are energy firms which have had both their bond and equity prices decrease over the month of November.

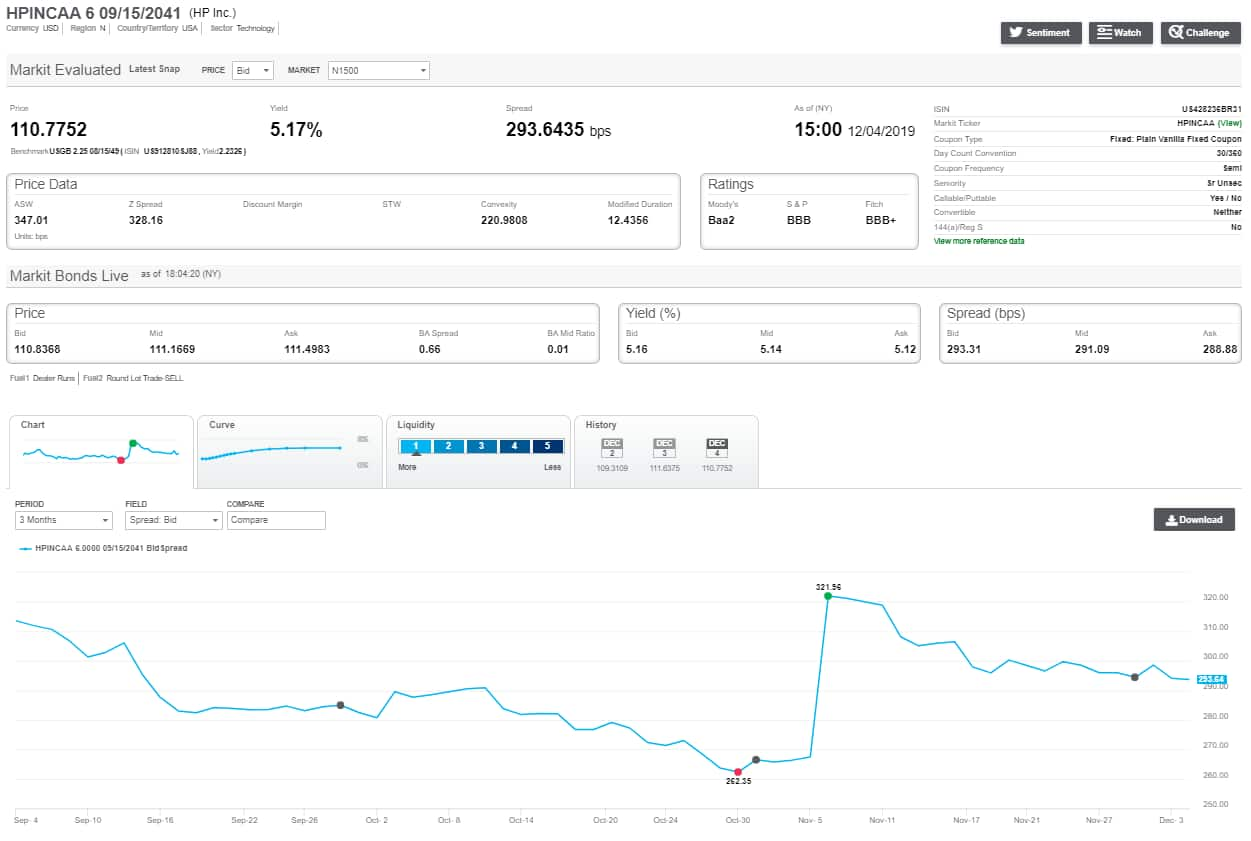

HP bonds widened out in early November due to a potential takeover by Xerox. Below is a screenshot which highlights the HP 6% '41 bond's credit spread widening on the news.

Walgreens bonds also widened out in early November on news of a potential deal that would take the company private.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcorporate-bond-pricing-data-november-2019-recap.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcorporate-bond-pricing-data-november-2019-recap.html&text=Corporate+Bond+Pricing+Data%2c+November+2019+Recap+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcorporate-bond-pricing-data-november-2019-recap.html","enabled":true},{"name":"email","url":"?subject=Corporate Bond Pricing Data, November 2019 Recap | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcorporate-bond-pricing-data-november-2019-recap.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Corporate+Bond+Pricing+Data%2c+November+2019+Recap+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcorporate-bond-pricing-data-november-2019-recap.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}