Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 15, 2019

Corporate Bond Pricing Recap for July 2019

US Treasury Movement

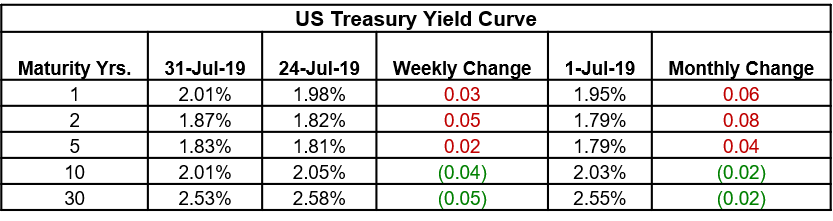

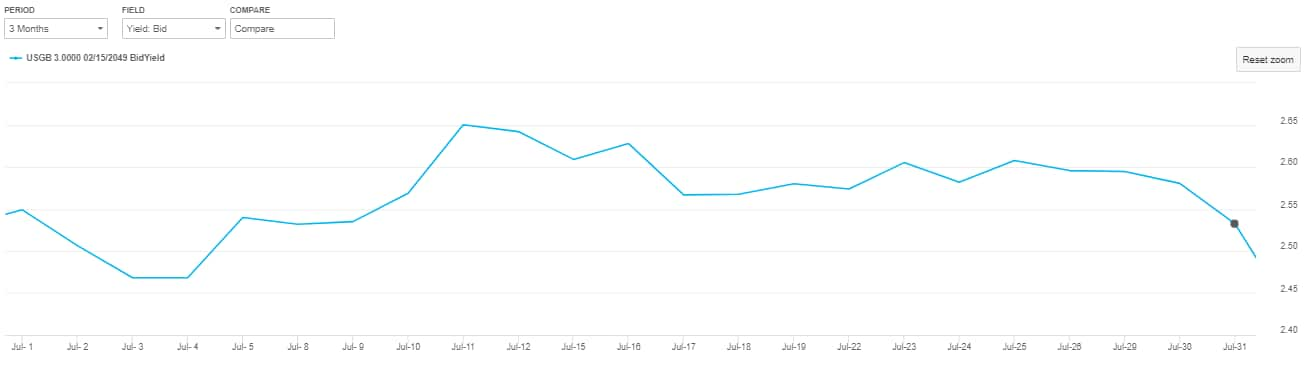

Over the month of July, the US Treasury curve has flattened with the short end widening and long end tightening. The table below summarizes weekly and monthly performance across the curve, followed by a snap of the 30 year's performance in more detail, sourced from our Price Viewer portal.

In July, the 30 year finished mostly unchanged at 2.53%, 2 bps

tighter than 2.55% where it started the month. At its highest, the

30 year yield touched 2.65% and dropped to 2.47% at its

lowest.

Investment Grade Market Review

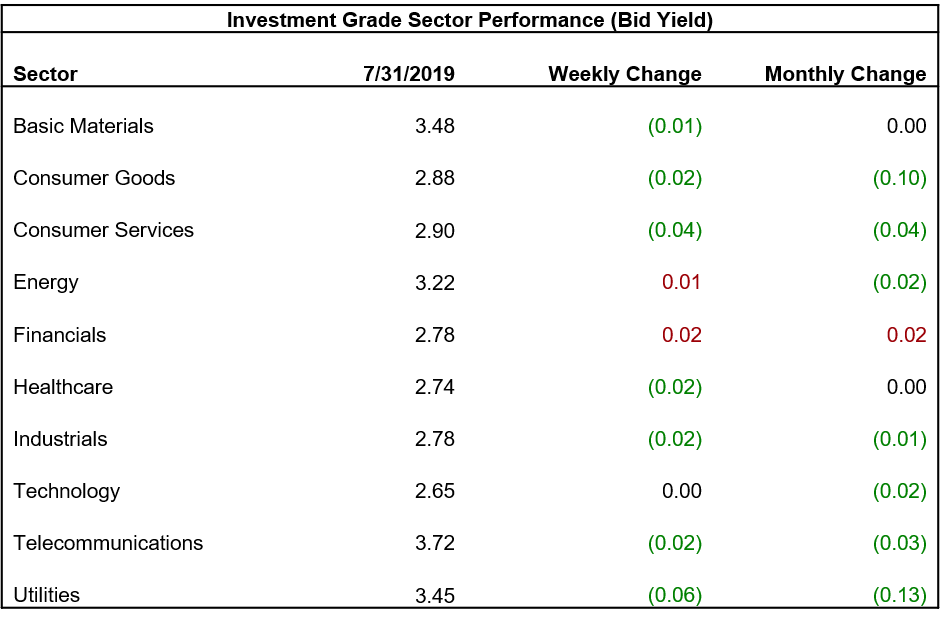

The table below summarizes weekly and monthly sector performance across the iShares iBoxx $ Investment Grade Corporate Bond ETF.

Top Movers (up/down) within the Investment Grade Market

July's best performing iShares iBoxx $ Investment Grade Corporate Bond:

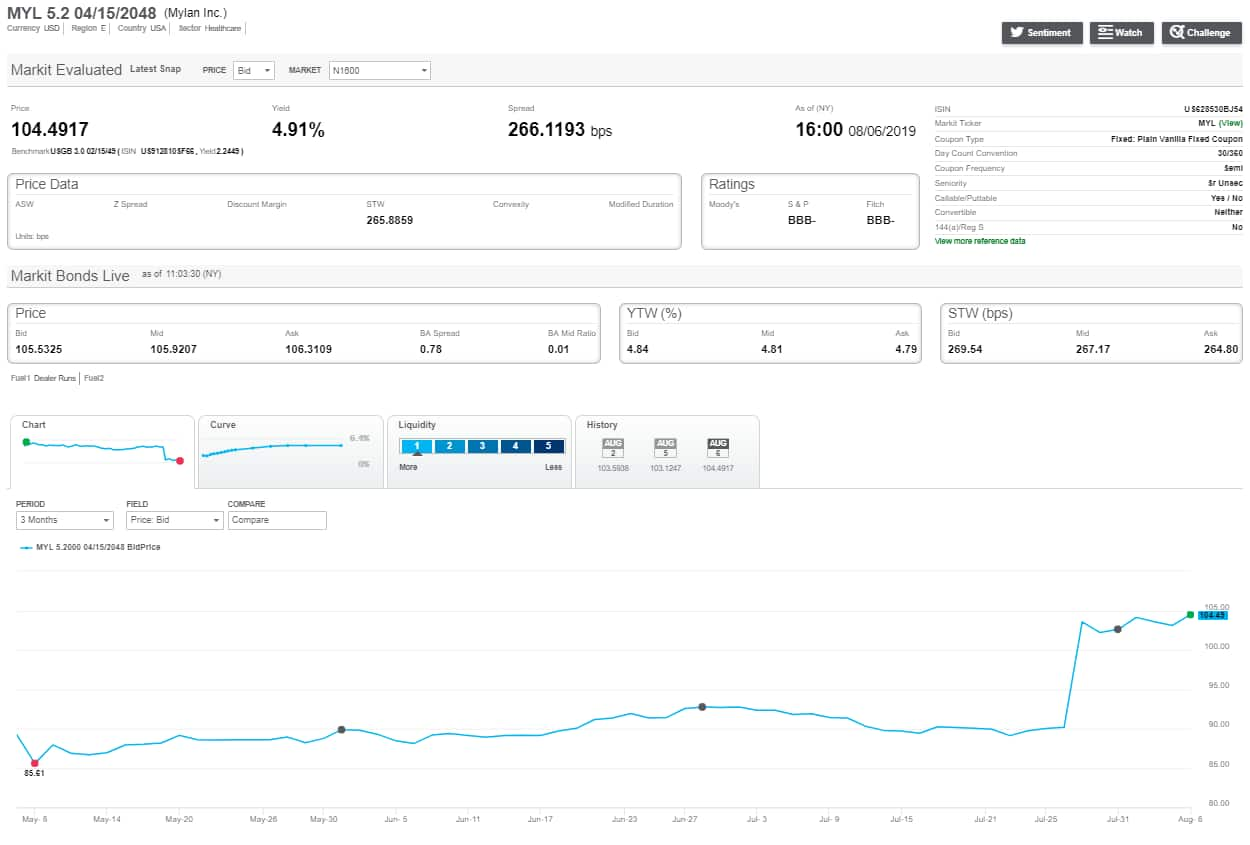

Mylan 5.2% 04/15/48 (US628530BJ54)

- This bond increased in price value by $10.01, from $92.57 to $102.58 (the bond continues to move upward in the month of August)

- This bond's credit spread tightened by 68 basis points, from +317 to +249

- In late July, Pfizer announced an agreement to combine Mylan and Upjohn (a division of Pfizer) causing tightening across all Mylan bonds

July's worst performing iShares iBoxx $ Investment Grade Corporate Bond:

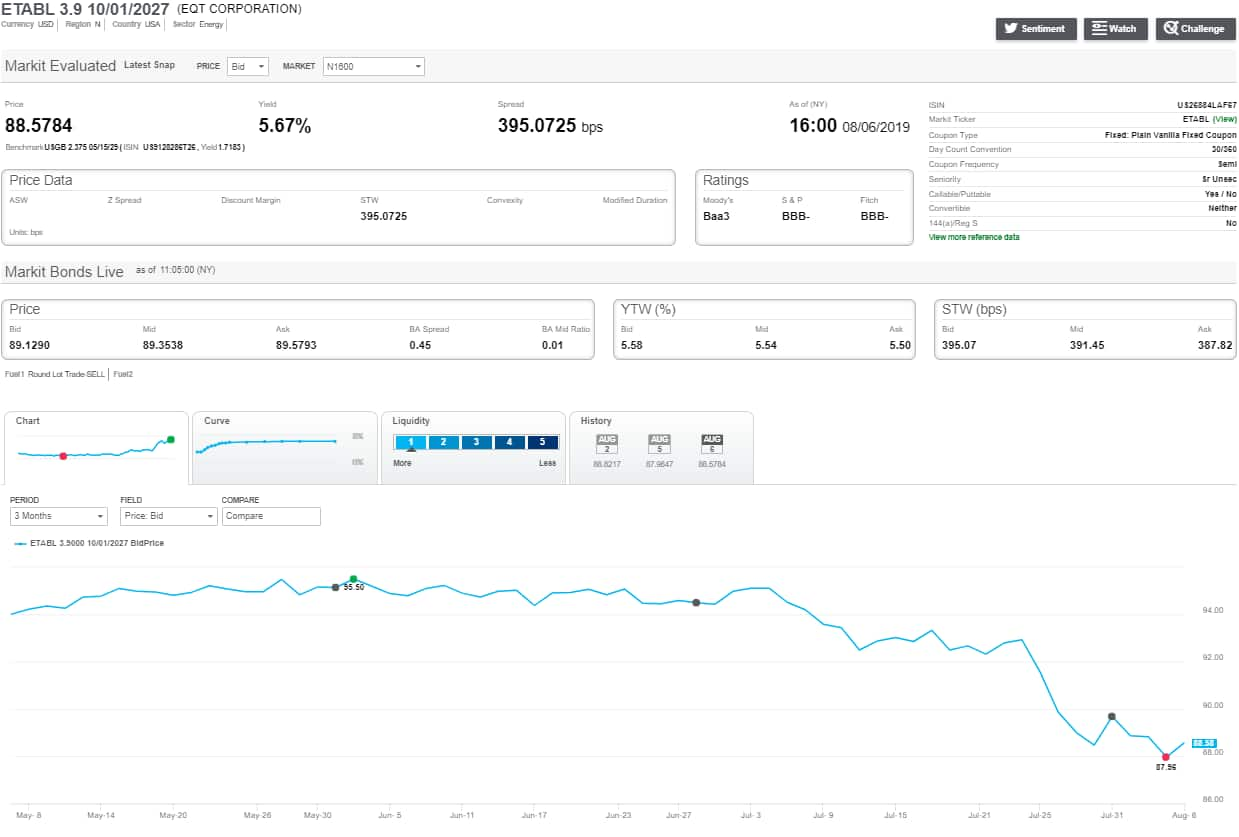

EQT Corporation 3.9% 10/01/27 (US26884LAF67)

- This bond decreased in price value by $5.08, from $94.35 to $89.27 (the bond continues to move downward in the month of August)

- This bond's credit spread widened by 82 basis points, from +270 to +352

- Other energy companies including EQM Midstream Partners, Apache, and Hess also saw their bonds decline in value over the month of July

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcorporate-bond-pricing-data-july-2019-recap.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcorporate-bond-pricing-data-july-2019-recap.html&text=Corporate+Bond+Pricing+Recap+for+July+2019+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcorporate-bond-pricing-data-july-2019-recap.html","enabled":true},{"name":"email","url":"?subject=Corporate Bond Pricing Recap for July 2019 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcorporate-bond-pricing-data-july-2019-recap.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Corporate+Bond+Pricing+Recap+for+July+2019+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcorporate-bond-pricing-data-july-2019-recap.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}