Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 13, 2025

Central bank policy seen as less supportive of US equity market returns as uncertainty over the inflation outlook persists

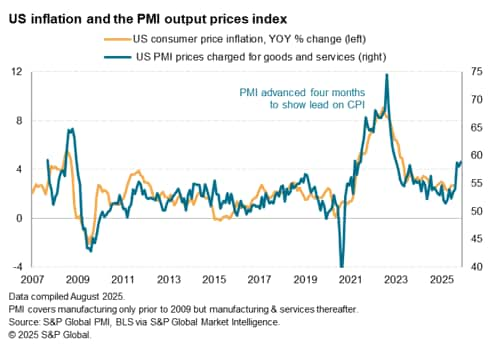

While the latest headline US CPI revealed that prices rose less than expected in July, US PMI Output Prices data continue to hint at the likelihood for further tariff-driven inflation in the coming months. Diminished hopes for central bank policy to be supportive of US equity market returns have certainly been reflected in the latest S&P Global Investment Manager Index (IMI) survey, with sector preferences notably shifting in tandem as well.

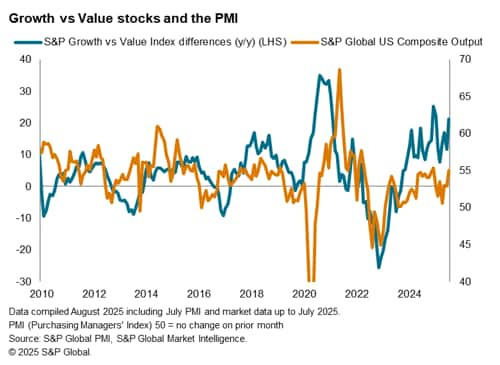

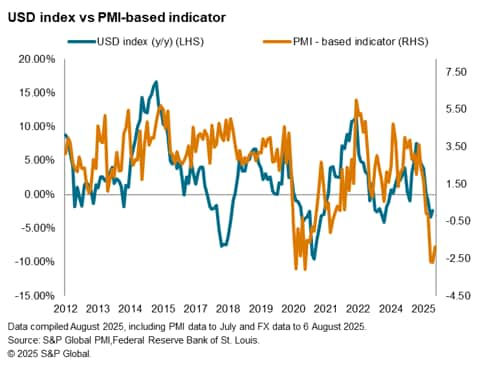

Overall, the latest US PMI data remained supportive of growth stocks outperforming in the immediate term, while our PMI-based indicator pointed to the possibility for some greenback weakness in August.

Inflation uncertainty still ahead?

The latest US Consumer Price Index (CPI) posted 2.7% year-on-year (y/y) in July, which is unchanged from June. Coming in below the market consensus, the newest set of inflation data enabled investors to breathe a sigh of relief as convictions strengthened for an imminent September interest rate cut by the US Federal Reserve. This was despite core CPI ticking noticeably higher in July. According to the latest CME FedWatch tool, the market has now almost fully priced in a rate cut as compared to an 86% conviction just prior to the release of the latest CPI data.

That said, the inclusion of the 2.7% print for July was merely in line with the trend preluded by the US PMI Output Prices data. Overall, the US PMI prices charged data, inclusive of both goods and services, are suggesting that US CPI may run close to 4% in the months to follow, according to historical comparisons. This is expected to be largely driven by higher US tariffs, as we have already seen with June and July CPI breakdowns. If it materialises, the elevated inflation trend could challenge further rate cuts even if we should see a move in September.

Monetary policy optimism evaporates

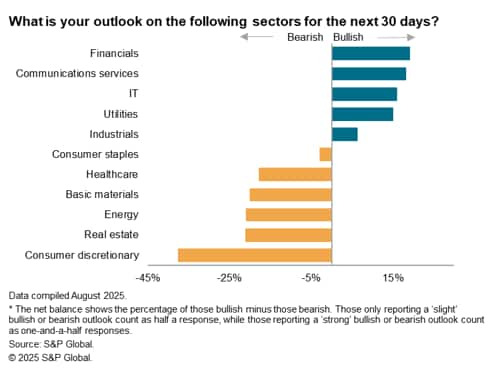

As it is, the latest S&P Global Investment Manager Index, based on data collected from US equity investors at the start of August, showed a visible easing of central bank policy from being a positive factor for US equity market returns in July to a now neutral factor in August. Conviction of additional interest rate cuts have weakened compared to a month ago, at least according to this measure of views from major money managers. Concurrently, concerns over the macro environment, both global and the US, heightened from last month on the back of trade uncertainty to reinforce a more risk-off attitude among investors midway through the third quarter of the year.

The resulting impact had been expectations for weaker near-term market performance with sector preferences notably also shifting in ways that are starting to reflect more defensive preferences. While financials, communication services and the tech sector retained the lead in the latest IMI survey, this was with reduction in bullish views for both financials and the IT sector. Instead, utilities had been one to gain favour, while consumer staples saw bearish sentiment ease from a month ago. Notably, the outlook for basic materials witnessed a visible change as investors turn from being bullish in July to bearish at the start of August.

One positive news is that the latest PMI data remain supportive of growth stocks, which typically excel during period of economic expansion, as opposed to value stocks. A simple comparison between the yearly differentials of the two equity indices and the S&P Global US Composite PMI Output data showed that the latter edged higher during the latest survey period to be supportive of better growth stock performance. That said, we again need to caveat the fact that the tariff-induced inventory-building boost to US growth in the first half of 2025 may reverse into the end of the year with the risk of payback. As such, we will continue to monitor the PMI data, with the next release being the flash PMI on August 21st, for insights into any changes in business conditions and the corresponding indications for equity market performance.

Signals of USD weakness in August

Finally, an update of our PMI-based indicator for gauging the USD index direction has shown a 'sell' signal for August based on PMI data released by August 6th. So far, this appears to be in the money with the USD index having drifted lower since last week. Meanwhile, a lookback at the 'buy' signal for the period between July and August had also yielded positive returns.

Access the Investment Manager Index press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcentral-bank-policy-seen-as-less-supportive-of-us-equity-market-returns-uncertainty-inflation-aug25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcentral-bank-policy-seen-as-less-supportive-of-us-equity-market-returns-uncertainty-inflation-aug25.html&text=Central+bank+policy+seen+as+less+supportive+of+US+equity+market+returns+as+uncertainty+over+the+inflation+outlook+persists+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcentral-bank-policy-seen-as-less-supportive-of-us-equity-market-returns-uncertainty-inflation-aug25.html","enabled":true},{"name":"email","url":"?subject=Central bank policy seen as less supportive of US equity market returns as uncertainty over the inflation outlook persists | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcentral-bank-policy-seen-as-less-supportive-of-us-equity-market-returns-uncertainty-inflation-aug25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Central+bank+policy+seen+as+less+supportive+of+US+equity+market+returns+as+uncertainty+over+the+inflation+outlook+persists+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcentral-bank-policy-seen-as-less-supportive-of-us-equity-market-returns-uncertainty-inflation-aug25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}