Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 30, 2020

Caixin PMI shows manufacturing rebound impeded by slumping exports

- Headline PMI drops to 49.4 in April, signalling a deterioration of manufacturing conditions

- Output rises further but new orders fall at faster rate, led by largest fall in export orders since 2008

- Factory employment shrinks while sentiment falls to four-month low

- Prices continue to decline

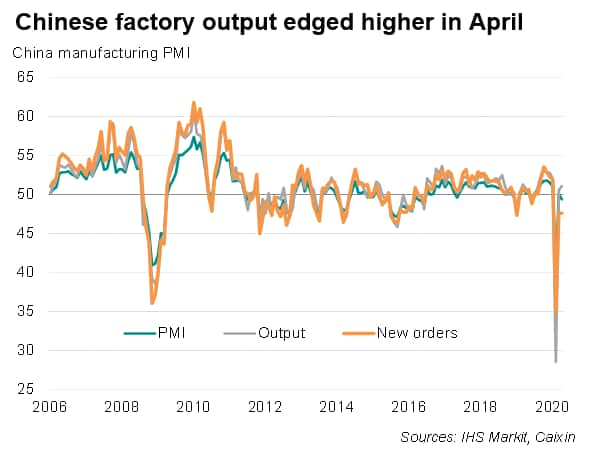

Caixin PMI data showed a further modest increase in Chinese manufacturing output during April, but the rise represents only another very marginal upturn in production after the record fall suffered in February. Limiting the sector's recovery was a re-intensification of the loss of export sales, which slumped to the greatest extent since 2008 amid worldwide measures to curb the spread of COVID-19 outbreak. Factory employment and purchasing activity both declined, while business confidence about the year ahead dropped to a four-month low, all of which bodes ill for the sector in coming months.

The survey highlights how, even with factories restarting operations and gradually returning to full capacity, the global downturn in demand is expected to limit the extent of recovery in China's manufacturing sector, with further output expansion likely to be driven largely by processing backlogs.

Weak start to second quarter

The Caixin headline manufacturing PMI* for mainland China, compiled by IHS Markit, fell from 50.1 in March to 49.4 in April, indicating that operating conditions of the sector had deteriorated from the prior month.

While factory production rose modestly after a survey record decline in February as increasing numbers of factories resumed work, growth mostly came from working through backlogs of previously placed orders, many of which had been placed prior to the COVID-19 lockdowns. Indeed, the increase in the amount of unprocessed orders slowed further, down from February's high.

*Data for Caixin China Manufacturing PMI survey were collected 7-22 April 2020.

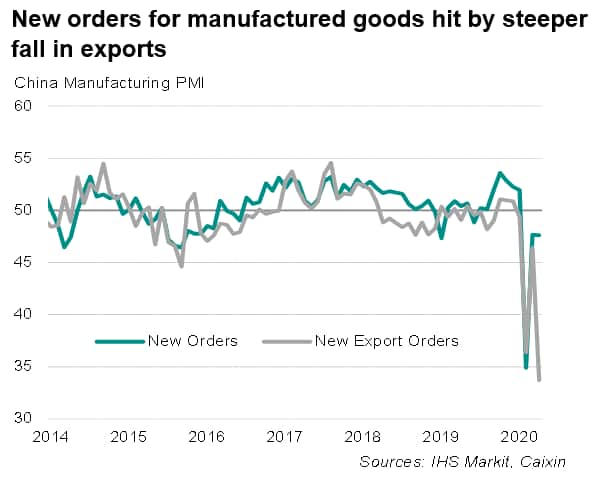

Inflows of new orders meanwhile continued to fall, down for a third successive month. Moreover, although not declining at anything like the rate seen in February, the latest drop in orders was among the largest seen over the past decade, linked in turn to the largest monthly drop in new export orders since December 2008 at the height of the global financial crisis (and the third largest decline in exports in the 16-year history of the survey).

The downturn in the sales trend came at a time where global demand is under great pressure due to lockdowns and other measures imposed in many countries around the world placing a choke on the normal functioning of economies.

Higher output was seen for producers of intermediate and investment goods, while the production of consumer goods fell. Smaller enterprises in particular continued to struggle to raise production.

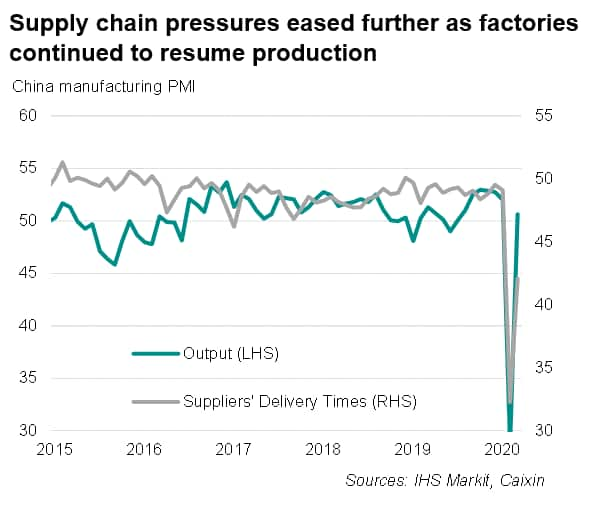

Easing pressure on supply chains

Supply chains remained under pressure at the start of the second quarter, but the rate at which delivery times lengthened slowed notably and was modest overall compared to the record number of delays seen in February. The resumption of work at factories helped to gradually restore distribution networks. That said, there continued to be reports of transportation issues and firms not yet operating at full capacity among respondents that reported longer delivery times.

Factory job market deteriorates

The weakening sales trend saw firms cut back on their staff numbers amid panel comments of layoffs. Overall factory employment fell for a fourth straight month in April. While not as steep as February's record, the pace of decline was among the fastest in recent years. Survey data showed the sharpest fall in employment from consumer goods producers, following by those making intermediate goods while manufacturers of investment products actually reported job creation.

Falling prices

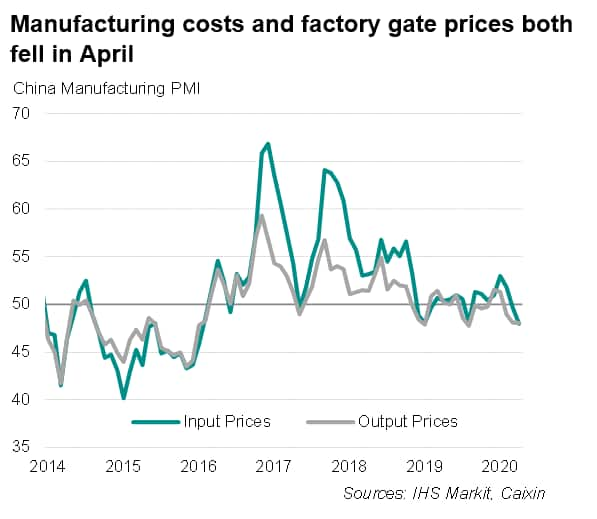

Prices charged for Chinese manufactured products fell for a third month in a row during April as firms reportedly offered discounts to boost sales. Some companies also passed on the savings from lower costs to customers. Average cost burdens fell for a second successive month, dropping at the sharpest rate since the start of 2016. Lower prices for raw materials such as oil, base metals, plastics and pork were widely reported as driving input prices down.

Download the latest PMI press releases here: https://www.markiteconomics.com/Public/Release/PressReleases

Bernard Aw, Principal Economist, IHS Markit

bernard.aw@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-shows-manufacturing-rebound-impeded-by-slumping-exports-April2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-shows-manufacturing-rebound-impeded-by-slumping-exports-April2020.html&text=Caixin+PMI+shows+manufacturing+rebound+impeded+by+slumping+exports+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-shows-manufacturing-rebound-impeded-by-slumping-exports-April2020.html","enabled":true},{"name":"email","url":"?subject=Caixin PMI shows manufacturing rebound impeded by slumping exports | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-shows-manufacturing-rebound-impeded-by-slumping-exports-April2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Caixin+PMI+shows+manufacturing+rebound+impeded+by+slumping+exports+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-shows-manufacturing-rebound-impeded-by-slumping-exports-April2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}