Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 10, 2025

Broad-based deterioration in trade in October

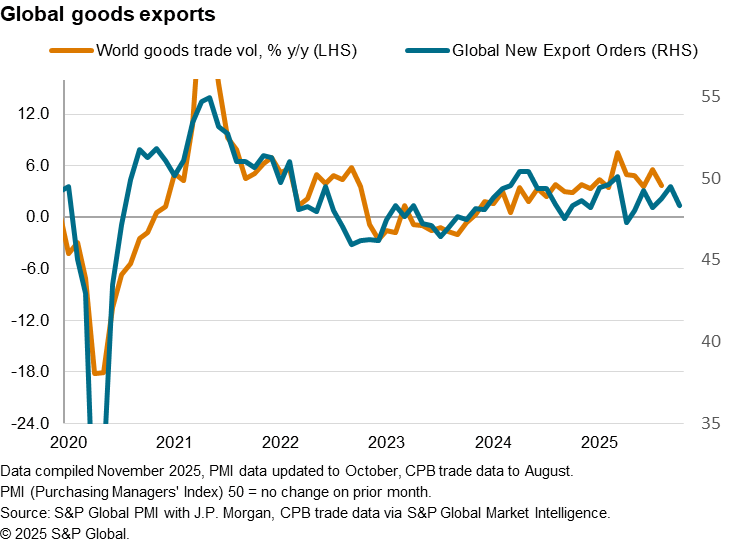

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade further contracted at the start of the final quarter of 2025. Moreover, the degree of decline deepened. The seasonally adjusted Global PMI New Export Orders Index, sponsored by J.P.Morgan and compiled by S&P Global, fell to 48.5 in October from 49.7 in September. The latest reading marked an extension of the period of trade contraction that commenced in April.

Manufacturing trade contraction deepens while fall in exchange of services renews

The decline in trade activity was broad-based by sector, with the manufacturing sector recording a faster rate of deterioration. Posting below the 50.0 neutral mark for the seventh month running, the seasonally adjusted global manufacturing New Export Orders Index indicated a continued contraction in demand for goods, with the latest reading marking the fastest fall in three months.

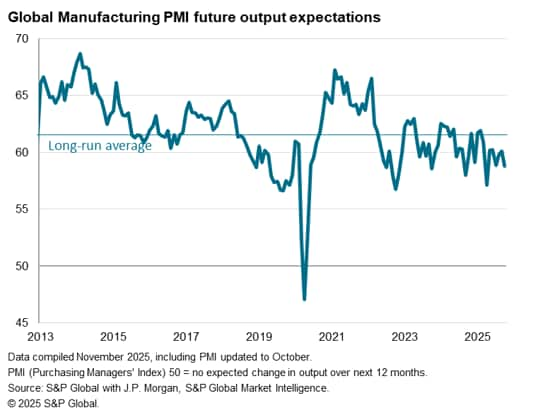

The downturn in manufacturing exports took place against a backdrop of sustained growth in the goods producing sector. The global manufacturing sector saw another modest expansion in production, driven primarily by rising domestic demand. In cases such as the US, the latest rise in output was also seen attributed to inventory building, with notable risks of fading momentum in the coming months. Overall, the goods trade climate remained subdued, with potential weakness also reinforced by a loss of confidence among goods producers in October. Optimism regarding output in the year ahead sank to the lowest since April, when widespread US tariffs were first announced. Among the economies tracked with the lowest future output expectations measured against its long-run averages were Canada and mainland China, both having seen worrisome headlines regarding trade with the US in October. Concerns over trade relations with the US have also affected the neighbouring economies of mainland China and Canada. For instance, various North Asian economies also saw lower output expectation indices compared with their long-run as jitters over the outlook for US-China trade dampened sentiment for manufacturers. While some of these concerns are likely to ease into the end of the year as a trade truce was achieved at the end of October, the notable drop in confidence continued to paint a subdued picture for the manufacturing sector.

Services exports meanwhile fell in October after having briefly stabilised at the end of the third quarter. That said, the decline in services trade was only marginal, with the pace of reduction matching the year-to-date average in October.

Detailed sector PMI revealed that export growth was led by various service-related sectors with Insurance, Healthcare Services and Software & Services in the lead. The weakest performers were meanwhile a mix of Metals & Mining, Real Estate and Resources, all of which recorded sharp declines in export business.

New export business declines across both developed and emerging markets

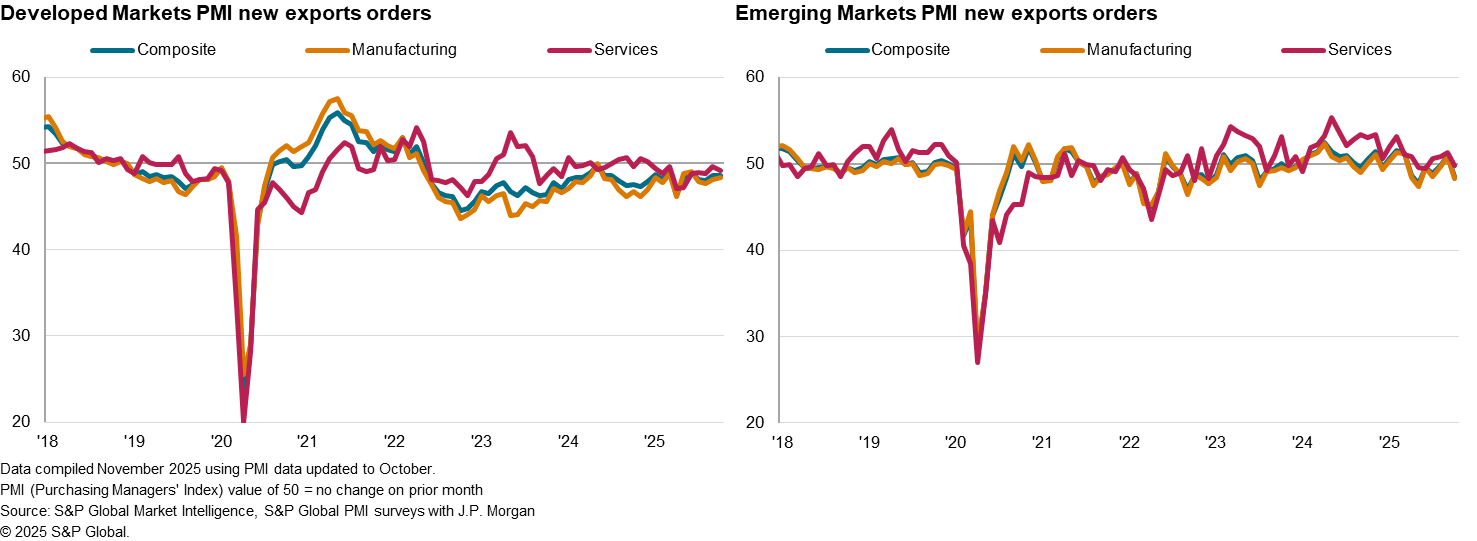

Regionally, the contraction in new export business broadened to also include emerging markets in October while developed market remained in modest contraction.

Fresh reductions in both manufacturing and services new export orders led to the latest downturn in trade activity across emerging markets. Absent the brief improvement in September, new export orders would have fallen continuously since April. The latest downturn also represented a fading of the front-loading effect that had helped emerging market exporters since around the mid-year. The latest reading reflected the sharpest contraction in new export business in five months.

Developed markets as a whole continued to post lower new export business in October, extending the sequence of contraction that began in June 2022. The overall rate of reduction remained unchanged from September, as a faster drop in the service sector was offset by an easing of the downturn for manufacturers.

India leads the expansion in goods trade followed by Russia

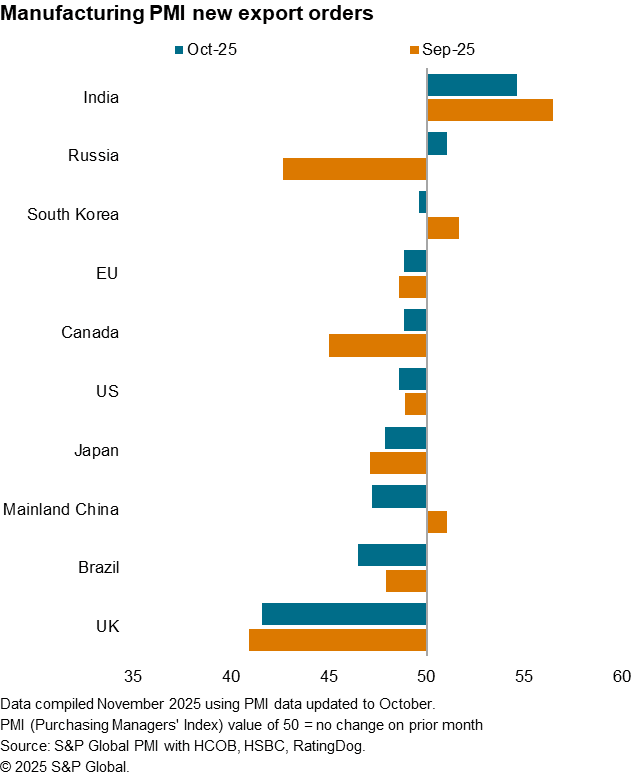

The number of top ten trading economies recording higher goods exports lowered to just two in October, down from three in September, with a change in the mix as well.

India continued to take the lead despite the rate of manufacturing new export orders growth decelerating to a ten-month low. But, while South Korea and mainland China had joined India in expansion in September, both fell back into decline in October. Russia, in contrast, reported higher manufacturing new export orders for the first time in three months.

The UK meanwhile recorded the sharpest downturn in goods trade again among the top ten trading economies, albeit with the rate of decline softening since the September low, due in part to the restarting of auto production across supply chains following cyber-attacks. Brazil also saw a marked decline in goods export orders as panellists cited the US as a key source of demand weakness.

Japan also recorded a moderate decline in trade activity, affected by trade uncertainties, with more modest reductions in goods new export orders were meanwhile seen in the remaining economies.

Access the press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbroadbased-deterioration-in-trade-in-october-nov25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbroadbased-deterioration-in-trade-in-october-nov25.html&text=Broad-based+deterioration+in+trade+in+October+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbroadbased-deterioration-in-trade-in-october-nov25.html","enabled":true},{"name":"email","url":"?subject=Broad-based deterioration in trade in October | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbroadbased-deterioration-in-trade-in-october-nov25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Broad-based+deterioration+in+trade+in+October+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbroadbased-deterioration-in-trade-in-october-nov25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}