Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 11, 2025

Household financial disparity grows in the aftermath of the COVID-19 pandemic, CSI data shows

Consumer survey data from S&P Global highlight a wide and growing divergence between the financial wellbeing of the lowest income and wealthiest households in the UK.

Measuring wellbeing

The Consumer Sentiment Index survey tracks key metrics among UK households on a monthly basis, with the data series dating back to early-2009. The most recent monthly datasets have shown some encouraging signs of recovery, with the headline index reaching one of its highest levels recorded in the survey. However, a closer examination of the underlying data reveals markedly divergent trends by income group, particularly since the pandemic and throughout the ongoing cost of living crisis.

One of the questions included in the CSI questionnaire asks respondents to compare their household's financial situation to that of the previous month. While the tracker has generally been relatively elevated in recent months compared to the survey's long-run average, further analysis reveals significant divergences in financial wellbeing based on household income levels.

The data breaks downs households into five different income tiers:

• less than £15,000 per year

• £15,001 to £23,000 per year

• £23,001 to £34,500 per year

• £34,501 to £57,750 per year

• £57,751 or more per year.

Individuals in the higher income tiers generally report more positive responses than their counterparts in all other income brackets, but the disparity between the highest income tier and the other brackets has widened in recent years.

This note will specifically examine the increasing gap between the highest and lowest income brackets.

Growing divergence between higher and lower income households since the pandemic

The COVID-19 pandemic introduced substantial shocks to households' financial wellbeing in the early months. All income brackets reported a marked deterioration in their financial situations in 2020, a trend that not only persisted but deepened over the following years amid the cost-of-living crisis with the notable exception of the highest income bracket, where the experience has been more mixed.

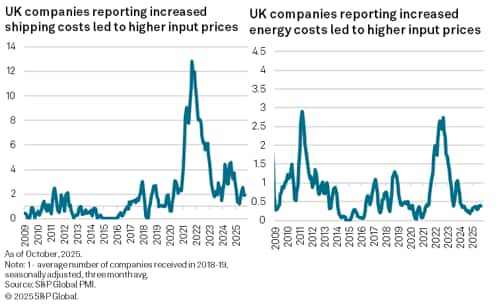

Since the pandemic, households have faced mounting pressure from rising costs of essentials such as food, energy, and housing. Energy prices, in particular, have undergone extreme fluctuations, largely driven by the Ukraine-Russia conflict. Furthermore, supply chain disruptions, including shipping challenges in the Red Sea, have compounded shortages and elevated costs for essential goods.

The repercussions of soaring energy costs and supply-side challenges on input prices are captured in S&P Global Panel Comments Trackers data, which provide qualitative insights from PMI survey contributors around the globe.

The peak of this inflation crisis in the UK was experienced in late 2022, when inflation soared to a 41-year high of 11.1%, significantly surpassing the Bank of England's target of 2%. This period coincided with households reporting the most severe decline in monthly financial wellbeing on record in October 2022, with the seasonally adjusted headline index plunging to 26.9.

Notably, the gap between the highest and lowest earners at this time was relatively narrow compared to historical averages.

The central bank reacted by tightening its monetary policy with a series of interest rate hikes. However, as inflation began to subside, this shift coincided with an expanding divide between the highest and lowest earning households. Indeed, high-earning households have consistently outperformed all other income brackets during this period.

Wealthy households bounce back, but lower income households struggle

As a result, differences in financial wellbeing among households based on income have become more pronounced in recent years. The chasm between the highest and lowest earners reached its zenith in June 2024, just before the General Election. At that juncture, the Bank of England's policy rate had risen to a high of 5.25%, occurring just one month prior to the central bank's first rate cut, which was followed by a series of further reductions.

Higher income households have demonstrated a more robust recovery from the economic repercussions of the pandemic and the ongoing cost of living crisis, as illustrated by the chart below, which plots the shifts in financial wellbeing among the highest and lowest income tiers since 2009, based on yearly averages. For the years 2024 and 2025 (data available up to October), the highest earning households have reported noteworthy improvements in their financial circumstances. This trend underscores the resilience of affluent households as they navigate the economic landscape, achieving performance levels not previously seen in the series' history.

Meanwhile, lower income households displayed some signs of recovery in 2023 and 2024; however, they are experiencing greater financial pressures again in 2025.

Outlook

The CSI data suggest that the disparity between higher and lower earning households is set to endure, with affluent households displaying relatively higher optimism regarding their financial wellbeing outlook. In contrast, lower income households are bracing for further declines in their financial health.

The upcoming Autumn Budget will be pivotal in shaping the financial landscape for households in the year ahead. Adjustments to the National Minimum Wage and National Insurance contributions, alongside evolving tax implications, are fostering an environment of uncertainty for both consumers and businesses.

Moreover, it will be crucial to assess the measures the Chancellor may implement to support households, particularly as the winter months loom.

Access the October CSI press release here.

The next CSI release is scheduled for 17th November.

Maryam Baluch, Economist, S&P Global Market Intelligence

Tel: +44 1344 327 213

maryam.baluch@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhousehold-financial-disparity-grows-in-the-aftermath-of-the-covid19-pandemic-csi-data-shows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhousehold-financial-disparity-grows-in-the-aftermath-of-the-covid19-pandemic-csi-data-shows.html&text=Household+financial+disparity+grows+in+the+aftermath+of+the+COVID-19+pandemic%2c+CSI+data+shows+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhousehold-financial-disparity-grows-in-the-aftermath-of-the-covid19-pandemic-csi-data-shows.html","enabled":true},{"name":"email","url":"?subject=Household financial disparity grows in the aftermath of the COVID-19 pandemic, CSI data shows | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhousehold-financial-disparity-grows-in-the-aftermath-of-the-covid19-pandemic-csi-data-shows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Household+financial+disparity+grows+in+the+aftermath+of+the+COVID-19+pandemic%2c+CSI+data+shows+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhousehold-financial-disparity-grows-in-the-aftermath-of-the-covid19-pandemic-csi-data-shows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}