Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 11, 2025

Brazil bucks EM manufacturing trends as regional neighbours show resilience

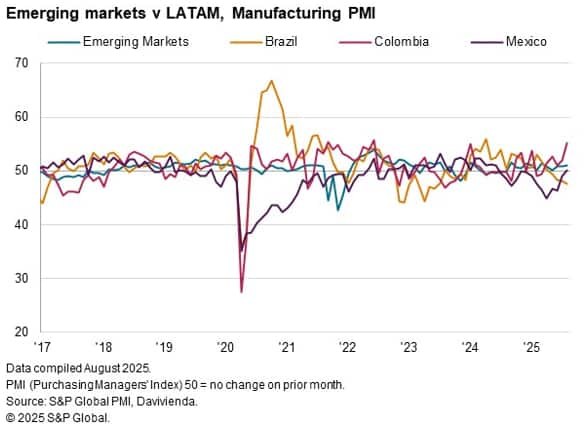

Emerging market manufacturing conditions continued their upward trajectory in August, marking the third consecutive month of improvement as strengthening new orders growth underpinned a renewed rise in production. However, this positive trend masked significant divergences between economies, notably within Latin America, where manufacturing performance varied considerably.

Whilst Colombia experienced the strongest upturn in factory output in over three years, driven by robust demand and client stock-building activities, Brazil and Mexico reported continued production declines.

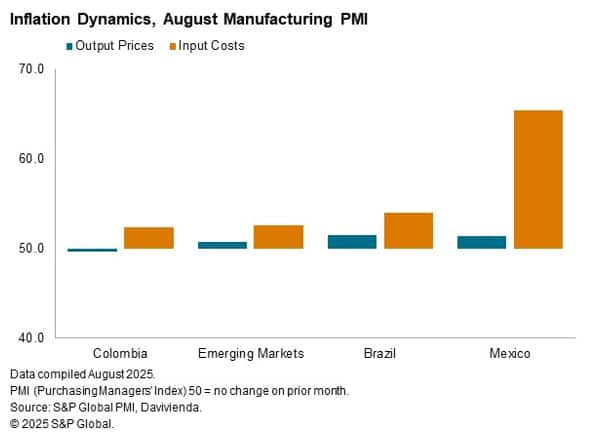

The regional picture was further complicated by mounting cost pressures and margin compression, as manufacturers across the three LATAM economies covered by PMI surveys grappled with input price inflation that outpaced their ability to raise selling prices.

Manufacturing conditions improve further across emerging markets

The S&P Global PMI® survey data revealed a third successive monthly improvement in manufacturing conditions across emerging markets, as a pick-up in new order growth aided a renewed expansion in production volumes during August. Across Latin America, however, the output picture remained mixed, with a sharp upturn in Colombia contrasting starkly with continued declines in both Brazil and Mexico.

Mexican goods producers nevertheless reported a slower decline in production and noted the first expansion in order book volumes for over a year. In contrast, demand for Brazilian manufactured goods deteriorated at the fastest pace since April 2023, reflecting subdued client confidence and the adverse impact of US tariff policies.

Colombia, meanwhile, experienced the strongest upturn in factory orders for 19 months, which prompted the steepest increase in output for over three years. Monitored companies attributed this performance to positive demand trends and stock-building efforts amongst clients, which resulted in considerably larger order sizes.

Regarding international trade, both Brazil and Mexico reported contractions in export sales that exceeded the emerging market average.

PMI price gauges point to significant margin compression

Whilst rates of input cost inflation moderated across all three Latin American nations for which PMI data are available, only Colombia recorded an increase that was below the emerging market average. Selling prices rose in both Brazil and Mexico, whilst Colombian manufacturers implemented price discounts.

Particularly noteworthy was Mexico, where the Output Charges Index stood more than 14 index points below the corresponding input price measure, indicating that manufacturers absorbed the majority of their additional cost burdens. Companies cited US tariff policies and unfavourable exchange rates as key drivers of higher expenses.

Colombian goods producers reported that competitive market conditions and easing cost pressures enabled price reductions in August. The decline was marginal overall, but ended a 14-month sequence of charge inflation.

Business sentiment fades across the region, but remains positive

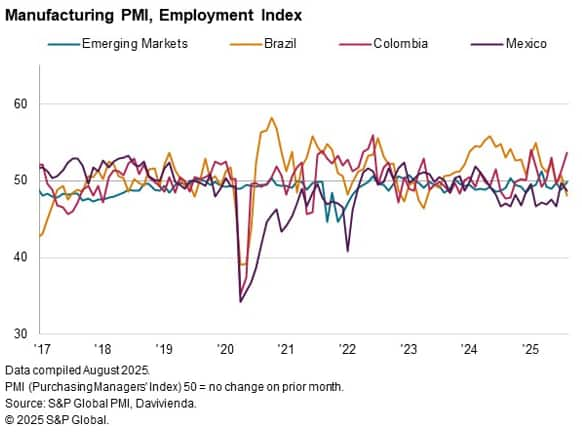

In contrast to strengthening business optimism at the broader emerging markets level, confidence weakened across all three Latin American economies. The most pronounced deterioration occurred in Mexico, where the PMI Future Output Index fell by nearly seven points as firms expressed growing concerns about competitive pressures and US tariffs. Concurrently, factories in Mexico reduced payroll numbers for the sixteenth consecutive month in August.

Whilst confidence levels in Mexico remained well below historical trends, sentiment in both Brazil and Colombia exceeded the emerging markets average. Brazilian manufacturers anticipated that new product launches, capital investment and machinery acquisitions would coincide with a demand recovery and thereby support output growth. However, following job creation in July, companies reported reduced headcounts in August amid cost-control initiatives.

In Colombia, business diversification, expanded client bases and projects pending approval underpinned greater optimism. This translated into job creation during August, with employment rising at the fastest pace since the beginning of the year.

Manufacturing conditions signal distinct central bank responses

The divergent manufacturing trajectories across Latin America present nuanced implications for monetary policy and economic growth prospects.

Colombia's robust performance suggests manufacturing is gaining meaningful momentum, which could support GDP in the coming quarters. This strength may lead to a cautious monetary policy tone, particularly given the chance of emerging inflationary pressures from demand growth. S&P Global Market Intelligence forecasts a stable near-term policy rate, before it is cut to 8.75% by the end of 2025.

Conversely, Brazil's deteriorating manufacturing conditions point to mounting economic headwinds that could necessitate more accommodative monetary policy to support growth. The persistent weakness in Brazilian manufacturing suggests GDP growth may remain subdued in the near term, but still-high inflation will likely hinder any interest rate cut in 2025.

Mexico's mixed signals - with production declining but new orders expanding - indicate the economy may be at an inflection point. However, the significant compression on margins and ongoing contraction in employment suggest GDP will likely remain constrained until manufacturers can restore pricing power and confidence improves. On monetary policy, we expect the central bank to continue cutting the policy rate.

Colombia tops SOI rankings

Colombia's investment landscape is characterised by an economy gradually diversifying away from primary commodities, with the service sector performing strongly (driven by a tourism boom), large investment in infrastructure and growing focus on renewable energy that offers significantly potential. Colombia's overall SOI score in 2025 (59.9 of 100) ranked higher than Brazil and Mexico, in large part explained by its positive average performance of the institutional quality pillar score (67.6 of 100) and strong performance (74.4 of 100) in the logistics efficiency pillar score.

By contrast, Mexico's overall SOI score has been on a steady decline since 2015, a change largely driven by a decline in the institutional quality score, from 58.8 (of 100) in 2015 to 52.1 (of 100) in 2025. Looking ahead, Mexico faces significant challenges, including increasing labour costs and an informal labour market that represents over half of total employment. Although the impact of US tariffs on exports and ongoing global economic uncertainties can further strain the manufacturing sector, we assess that Mexican exports will maintain preferential access to the US market following the scheduled review of the USMCA in 2026.

Brazil's overall SOI score in 2025 (57.6 of 100) is largely driven by slightly above average performance in the market potential pillar score. Overall, Brazil's performance over time has demonstrated stagnation and Brazil faces challenges as trade policy puts additional pressure on the textile and agriculture sectors. However, the sizeable potential offered by new offshore oil (estimated at 30 billion of barrels) and its pioneering position in renewables would likely result in future improvement in the score.

Access the global PMI press releases.

Pollyanna De Lima, Principal Economist, S&P Global Market Intelligence

Tel: +44 1491 461 075

Cassandra Pagán, Senior Principal Analyst, S&P Global Market Intelligence

Tel: +31 2050 258 78

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrazil-bucks-em-manufacturing-trends-as-regional-neighbours-show-resilience-Sep24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrazil-bucks-em-manufacturing-trends-as-regional-neighbours-show-resilience-Sep24.html&text=Brazil+bucks+EM+manufacturing+trends+as+regional+neighbours+show+resilience+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrazil-bucks-em-manufacturing-trends-as-regional-neighbours-show-resilience-Sep24.html","enabled":true},{"name":"email","url":"?subject=Brazil bucks EM manufacturing trends as regional neighbours show resilience | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrazil-bucks-em-manufacturing-trends-as-regional-neighbours-show-resilience-Sep24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brazil+bucks+EM+manufacturing+trends+as+regional+neighbours+show+resilience+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrazil-bucks-em-manufacturing-trends-as-regional-neighbours-show-resilience-Sep24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}