Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 28, 2022

APAC Electronics Industry Expansion Moderates Amidst Pricing Pressures

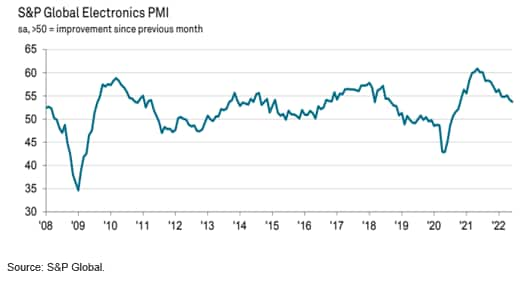

The latest S&P Global Electronics PMI survey shows that expansion in the electronics sector is continuing, albeit growth momentum has gradually moderated during the first half of 2022, with new orders having slowed. The global electronics industry continues to struggle with protracted supplier delivery times and pricing pressures for critical materials, although supplier delivery times have shown gradual improvement in recent months.

APAC electronics exports remain strong in first half of 2022

The global electronics industry has shown positive expansion since mid-2020, as the COVID-19 pandemic has driven strong demand for consumer electronics for remote working and home entertainment. However, the pace of expansion has shown some moderation in the first half of 2022. Nevertheless, electronics exports have continued to show strong growth in a number of major APAC electronics manufacturing hubs during the first half of 2022.

South Korea's exports of information and communications technology (ICT) goods grew by 18.9 percent year-on-year (y/) to USD 123 billion in the first six months of 2022, accounting for 35% of total South Korean exports. South Korean exports of semiconductors rose by 21% y/y, reaching USD 70 billion. In Japan, exports of semiconductors rose by 18.7% y/y in the first six months of 2022.

Taiwan's exports of electronics products rose by 15% y/y in June. Information and communication technology product new orders in June showed buoyant growth, rising by 22 percent y/y to USD 17 billion.

Southeast Asian economies also recorded strong growth in electronics exports. In Malaysia, exports of electrical and electronics products rose by 32% y/y during the first six months of 2022, helped by strong demand from the US. Vietnam also recorded buoyant electronics exports, with exports of phones and components rising by 16.4% y/y in the first six months of 2022, reaching a total of USD 29.2 billion.

India has also become a significant exporter of electronics products, with total electronics goods exports for the previous fiscal year 2021-22 up 42% y/y to USD 12.4 billion. India's Ministry of Electronics and Information Technology has set out a five-year roadmap to boost India's annual electronics exports to USD 120 billion by 2026, with the domestic market for electronics products targeted to reach USD 180 billion by 2026.

Pace of global electronics expansion moderates

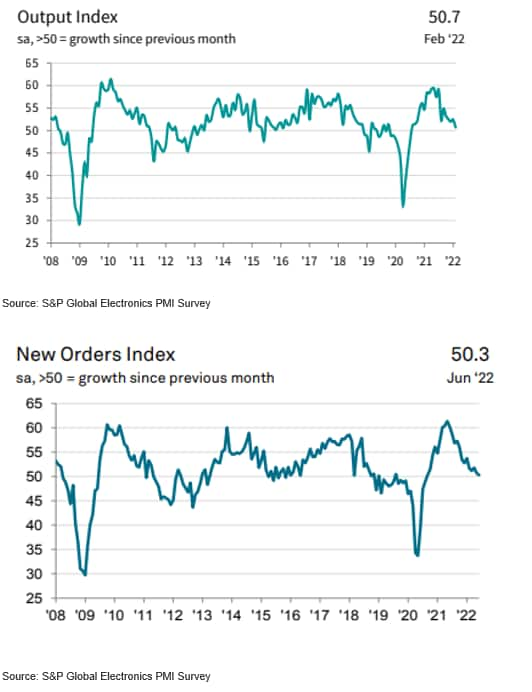

The global electronics manufacturing industry continued to show expansion in June 2022, although the pace of growth has gradually moderated. The headline S&P Global Electronics PMI fell to 53.7 in June, reaching its lowest level for 20 months. The latest survey results continued to show positive expansionary conditions for global electronics producers, though slowdowns in both output and new orders growth weighed on the pace of expansion.

The June survey data signaled a further slowdown in output growth at global electronics producers, with the Electronics PMI Output sub-index moderating to 50.3, just slightly above the neutral mark. New orders also fell to 50.3, marginally above the 50.0 mark that indicates the threshold between expansion and contraction.

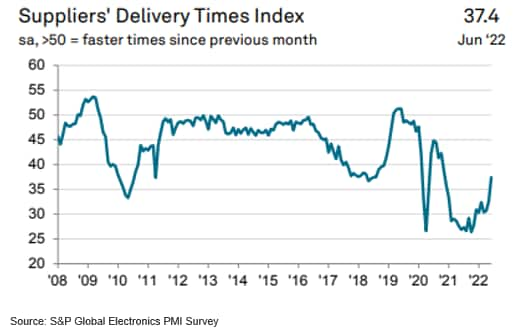

There were continuing pressures on global electronics supply chains during June, as signaled by the seasonally adjusted Suppliers' Delivery Times Index posting 37.4, still far below the 50.0 no-change mark. Supplier delivery times continued to be very protracted for the electronics industry. Raw material shortages and issues with transport were often cited by survey respondents, with companies also commenting on continued disruptions in China and strikes by workers in their supply chains.

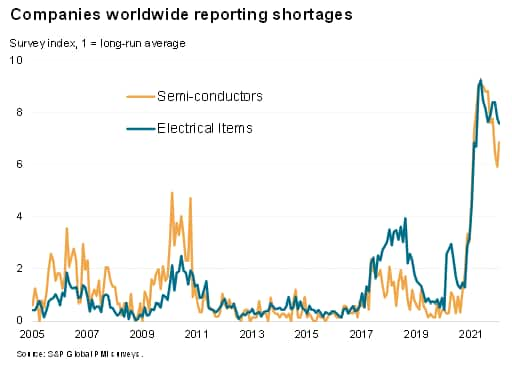

Industry supply shortages for the semiconductors and electrical products industries remained far above their long-run average, although these shortages showed some signs of easing in recent months.

Inflation pressures remain severe

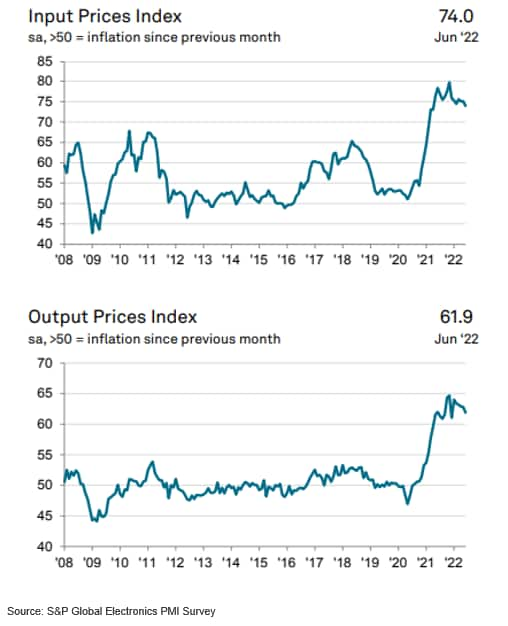

Global electronics manufacturers continue to face intense cost pressures, according to June survey data. Increases in international raw material prices and rising supplier fees were commonly mentioned reasons for sustained inflationary pressures. Overall, input costs rose at one of the steepest rates in the series history, with the Input Prices PMI sub-index at 74.0 in June, albeit having eased slightly from recent peaks.

Due to continued high input pricing pressures, many companies have at least partially passed on costs to their clients. The Output Prices PMI sub-index recorded 61.9 in June, still signaling very high output price pressures compared to the survey's history in the past decade.

Electronics outlook

The near-term outlook for the APAC electronics industry is for continued expansion, as signaled by the most recent S&P Global Electronics PMI Survey. Lengthy production backlogs for some key electronics products, notably semiconductors, will be an important factor supporting electronics output during the second half of 2022. However, growth momentum has been moderating in recent months. Slowing growth momentum in the key markets of the US and EU are also expected to act as a drag on electronics new orders during the second half of 2022.

The impact of the COVID-19 pandemic has accelerated the pace of digital transformation due to the global shift to working remotely, which has boosted demand for electronic devices such as computers, printers and mobile phones. The easing of lockdowns in many countries has also triggered a rebound in consumer spending, helping to boost demand for a wide range of consumer electronics. Spending on consumer electronics has also been boosted by fiscal stimulus measures in many OECD countries that have provided significant pandemic relief payments to support households in many large economies, including the US, UK, Japan and Australia. Meanwhile the rebound in global demand for autos during 2021 after the slump during the first half of 2020, has boosted demand for auto electronics, albeit contributing to intensifying supply-side problems related to semiconductors shortages.

The medium-term economic outlook is also supportive for the electronics industry, with sustained strong world economic growth forecast over 2022-2024. With shortages of semiconductors disrupting manufacturing supply chains in 2021, the importance of having domestic electronics production capacity for critical electronics components has become a national priority for major industrial nations, including the US, EU and China. For the US and EU, reducing reliance on Asian semiconductors production has become a key strategic priority over the next decade. India is also trying to establish a commercial semiconductors manufacturing sector, to reduce its heavy reliance on imported semiconductors.

A key risk of concern to many governments is excessive global vulnerability of manufacturing supply chains to semiconductors supply from South Korea and Taiwan, which are major electronics production hubs but also potential geopolitical flashpoints in the Asia-Pacific region. Military tensions in the Taiwan Strait and South China Sea have escalated since 2021, highlighting these vulnerabilities.

The outlook for electronics demand is also supported by major technological developments, including 5G rollout over the next five years, which will drive demand for 5G mobile phones. Demand for industrial electronics is also expected to grow rapidly over the medium term, helped by Industry 4.0, as industrial automation and the Internet of Things boosts rapidly growth in demand for industrial electronics. Competition amongst leading technology nations in strategic electronics production has also intensified. Consequently, strategic global competition amongst the world's leading high-technology nations is also likely to play a greater role in reshaping the global electronics industry landscape over the next decade.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-electronics-industry-expansion-moderates-amidst-pricing-pressures-Jul22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-electronics-industry-expansion-moderates-amidst-pricing-pressures-Jul22.html&text=APAC+Electronics+Industry+Expansion+Moderates+Amidst+Pricing+Pressures+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-electronics-industry-expansion-moderates-amidst-pricing-pressures-Jul22.html","enabled":true},{"name":"email","url":"?subject=APAC Electronics Industry Expansion Moderates Amidst Pricing Pressures | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-electronics-industry-expansion-moderates-amidst-pricing-pressures-Jul22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=APAC+Electronics+Industry+Expansion+Moderates+Amidst+Pricing+Pressures+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-electronics-industry-expansion-moderates-amidst-pricing-pressures-Jul22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}