Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 26, 2022

Week Ahead Economic Preview: Week of 25 July 2022

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

A busy week sees the US Federal Open Market Committee (FOMC) meeting with markets predicting at least a 75-basis point hike. A plethora of US economic data will also be released including second quarter GDP, which could well show the US to already be in recession. Eurozone GDP data are also updated and are likely to show growth losing momentum ahead of a likely downturn in the third quarter.

The Fed's FOMC meeting is set to dominate headlines this week with a 100-basis point hike on the table (though our Fed-watchers expect a 75bp rise). Inflation approaching double-digits has prompted the US central bank to take a tougher stance. However, the US could already be in a technical recession. Q2 GDP data, released Thursday, are expected to show a modest gain but our nowcast model points to a 1.8% contraction, on the back of a 1.6% decline in Q1. The Fed meeting also comes hard on the heels of flash PMIs, which pointed to heightened downturn risks for the US and Europe, with economic activity contracting in the US and eurozone in July. While the survey price gauges remained elevated, price pressures also showed signs of easing, which could lead to less aggressive policy trajectory.

Meanwhile, the US housing market has entered uncertain waters, with mortgage rates surging amid rate hikes and increased uncertainty. The US house Price Index - released Tuesday - will be another marker for the diary.

In Europe, sentiment data for the Eurozone are accompanied by GDP data for Q2. This follows the ECB rate hike of 50 basis points - the first increase in more than a decade. Like the FOMC, the ECB has been late in tackling surging inflation and risks tightening policy into a downturn. The latest GDP data will therefore help reveal the extent to which growth has been impacted by the energy shock, material scarcities, COVID-19, price pressures and the Ukraine war. We expect growth to have slowed, with flash PMIs pointing to a renewed downturn in the third quarter.

Finally, in the APAC region, Hong Kong SAR's central bank policy meeting and South Korean GDP are notable events. Retail sales, unemployment and consumer confidence data will reveal also how Japan has fared at the end of Q2.

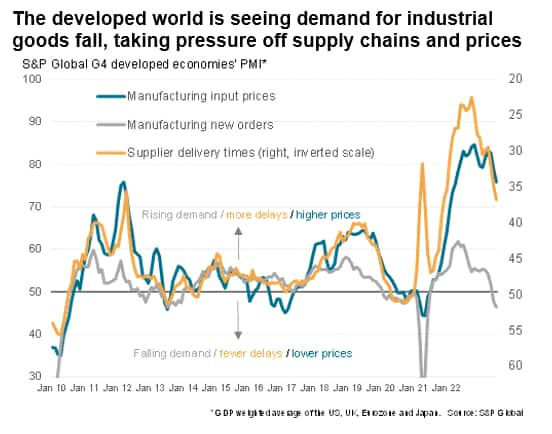

Industrial price pressures ease

While July's flash PMI data brought disappointing news on economic growth trajectories. The surveys signalled heightened recession risks in the US and Europe as output across four largest developed economies (the 'G4') fell for the first time since the pandemic lockdowns of early-2020. However, the surveys brought better news on inflation. In particular, supplier delivery times - which measure the time is takes suppliers to provide inputs to factories - showed the lowest incidence of delays in the developed world since November 2020. While this alleviation of supply chain pressure unfortunately stems primarily from a drop in demand for inputs by factories, many of which are now starting to grow concerned over high inventory levels, the flip side is the good news on how price pressures have eased. With demand falling and supply improving, pricing power is shifting away from the seller to the buyer. Industrial input prices consequently rose across the G4 in July at the slowest rate for 15 months.

Final PMI survey data, due out in early August, will clarify the global demand and supply picture further, and in particular reveal how businesses (and exporters) in mainland China are coping with ongoing COVID-19 containment measures. It will also be important to watch the service sector price gauges, as these tend to be more heavily influences by wages. Encouragingly, flash PMI data also hinted at cooling in service sector cost growth.

Key diary events

<span/>Monday 25 July

Singapore Inflation (Jun)

Germany ifo Business Climate (Jul)

Poland Unemployment rate (Jun)

Taiwan Industrial Production (Jun, Retail Sales (Jun)

Hong Kong Balance of Trade (Jun)

Brazil Current Account (Apr)

US Chicago Fed National Activity Index (Jun), Dallas Fed Manufacturing Index (Jul)

Japan BOJ monetary minutes (Jul)

Tuesday 26 July

South Korea GDP Growth Rate (Q2)

Ireland Consumer Confidence (Jul)

Singapore Industrial production (Jun)

United States House Price Index (May), Consumer confidence (Jul)

South Korea Consumer Confidence (Jul)

Wednesday 27 Jul

Australia Inflation Rate (Q2)

China Industrial profits (Jun)

Taiwan Consumer Confidence (Jul)

Japan Coincident Index Final (May)

Germany GfK Consumer Confidence (Aug)

France Consumer confidence (Jul)

Italy Business Confidence (Jul)

United States Durable goods (Jun), Interest Rate Decision

Russia Unemployment rate (Jun), GDP (Jun)

South Korea GDP (Q2)

Thursday 28 Jul

Japan Foreign Bond Investment (Jul)

Australia Retail Sales (Jun)

Hong Kong Interest Rate Decision

Netherland's Business Confidence (Jul)

Eurozone Consumer Confidence (Jul)

Germany Inflation (Jul)

United States GDP (Q2), jobless claims (Jul), Core PCE prices (Q2)

Friday 29 Jul

South Korea industrial production (Jun)

Japan Unemployment (Jun), Retail Sales (Jun), Consumer Confidence (Jul)

Singapore Unemployment rate (Q2), Business Confidence (Q2)

Thailand Industrial Production (Jun)

France GDP (Q2) Inflation (Jul)

Spain GDP (Q2), Inflation (Jul), Current account (Jul)

Germany Unemployment (Jul), GDP flash (Q2)

Italy GDP (Q2), Inflation (Jul), PPI (Jun)

United Kingdom Mortgage approvals (Jun)

Eurozone GDP (Q2), Inflation (Jul)

Canada GDP (May)

United States Core PCE Price Index (Jun), Michigan Consumer Sentiment (Jul)

What to watch

Americas: US Fed FOMC, Q2 GDP data, sentiment and housing data, Canada GDP

The US takes centre stage with the Fed FOMC meeting on Wednesday and GDP data on Thursday. A 75, or even 100, basis point hike is widely anticipated from the FOMC meeting, with another 50- or 75-point rise expected in September after inflation hit its highest for over 40 years (9.1%). However, the Fed tightening is causing concerns amid signs of weakening economic growth, with flash PMI data pointing to a steeping economic downturn. GDP data for Q2 will meanwhile reveal whether the US has already entered a technical recession after the first quarter's 1.6% contraction. Our nowcast model points to a 1.8% annualised rate of decline in Q2 against the consensus of a modest rise. Any further weakening of the economic growth picture alongside the elevated inflation readings will inevitably fuel stagflation fears but could lead to a reassessment of how aggressive the Fed's tightening is likely to be.

The week also sees a number of updates on the US housing market, over which concerns are growing in relation to rising mortgage rates.

Europe: Eurozone GDP, Germany Inflation, GDP and Ifo Business Climate. France and Italy Q2 GDP data.

GDP readings for Germany are out on Friday. The latest flash PMI data pointed to a downturn in economic in July after a weakening growth picture in the second quarter. We forecast GDP to expand by around 0.5% in Q2, but all eyes are focused on the dataflow to assess downturn risks in Q3.

France and Italy Q2 GDP figures will be also scrutinised on Friday, especially in Italy following Mario Draghi's resignation as prime minister. Also watch out for updated business and consumer sentiment data from the EU, with recent data showing households to be the gloomiest on record.

For the UK, the focus will be on mortgage lending.

Asia-Pacific: South Korea Q2 GDP, Hong Kong Interest rate decision, Japan and Australia Retail sales

South Korea will also report Q2 GDP readings in the coming week. Like many regions, growth is expected to ease while consumer prices continue to rise sharply. There is also a wealth of data on the Japanese economy to be released, including CPI, retail sales and industrial production, which come on the heels of flash PMI data signalled a renewed weakening of the economic picture as the rebound from Omicron fades.

Special report

Vietnam Economy - Rajiv Biswas

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-july-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-july-2022.html&text=Week+Ahead+Economic+Preview%3a+Week+of+25+July+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-july-2022.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 25 July 2022 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-july-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+25+July+2022+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-july-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}