Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 25, 2019

A tale of two countries

Argentina and Turkey are firmly established as miscreants in emerging market credit. Both sovereigns have political and economic frailties that place them in the highly vulnerable bracket.

But scale is important in credit assessment, and it should be noted that Argentina's transgressions are of a different order altogether. Few countries can match its serial defaults and its frequent flirtations with economic disaster. The latest episode is all too familiar. President Macri was elected in 2015 only a year after a credit event was triggered on Argentina's CDS during Cristina Kirchner's disastrous regime. Macri promised a more stable, conventional economic policy but he has failed to combat sky high inflation and currency volatility. The latest misstep is the introduction of price controls, a policy redolent of Peronist regimes, including Kirchner's.

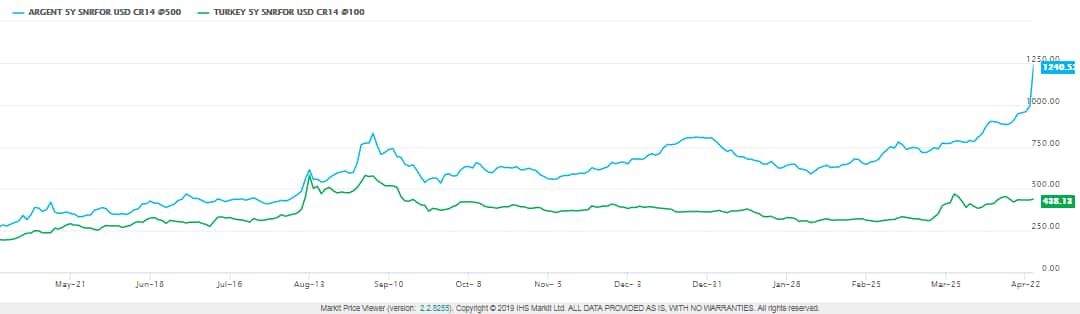

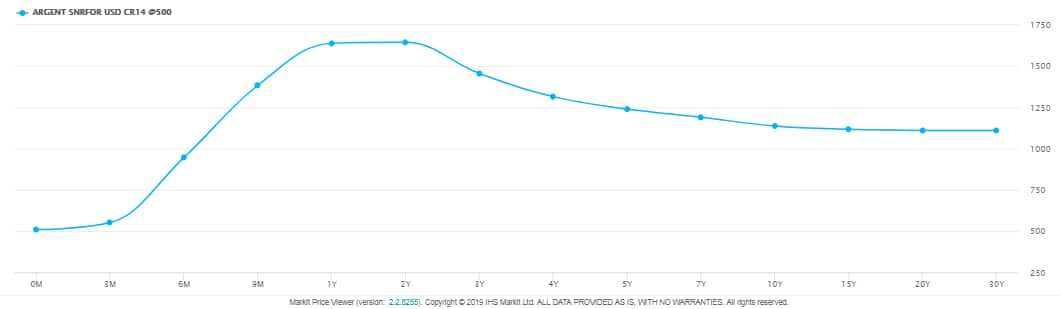

But the real fear of the markets is the return of Kirchner, who is riding high in the polls ahead of the election in October. This could induce Macri into a more confrontational approach with the IMF and raise serious concerns about Argentina's creditworthiness. The sovereign's five-year CDS spreads have more than doubled since the beginning of the year and are now quoted at 1393bps (in practice quoted upfront at 28.5 points). The CDS curve is inverted from two years and the sovereign is moving towards the realm of distressed investors.

Turkey is not quite at that level yet, but its problems are still serious. Its policymakers' credibility took a battering last year when they refused to raise rates during a currency crisis. The central bank eventually raised rates sharply but its dwindling reserves have caused concern. This was heightened this week when figures showed a significant drop in reserves and the central bank dropped language on "further monetary tightening." Like Argentina, Turkey suffers from high inflation (Turkey's annual rate is at 20% compared to Argentina's 55%) so it raises doubts about how the bank will achieve its objective of price stability.

Turkey's five year CDS is trading at 462bps, which is 100bps wider than where it started the year. Contagion to the broader emerging market has been limited, which will be encouraging to some. But more volatility in both sovereigns is likely, and the risk of an appreciating dollar could prove be even more destabilising for emerging market credit.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-tale-of-two-countries.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-tale-of-two-countries.html&text=A+tale+of+two+countries+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-tale-of-two-countries.html","enabled":true},{"name":"email","url":"?subject=A tale of two countries | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-tale-of-two-countries.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=A+tale+of+two+countries+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fa-tale-of-two-countries.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}