Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 29, 2018

Managing the liquidity risk regulation wave: SEC 22e-4 and beyond

Few topics have received more focus—or generated more controversy on a global scale—than liquidity risk reform. Both the U.S. Securities and Exchange Commission (SEC) and the International Organization of Securities Commissions (IOSCO) advocate developing a holistic liquidity risk management framework.

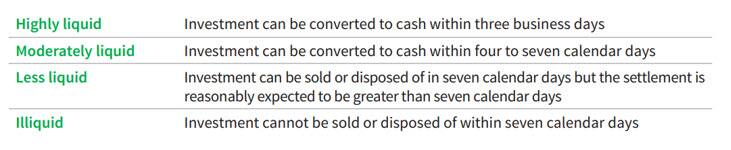

Under the SEC rule, registered open-end management investment companies, including ETFs, must adopt a written liquidity risk management framework, approved by the fund’s board of directors. In addition, they must collect and ultimately report on liquidity risk by categorizing holdings on a time-classified basis (now whether these classifications will be publically available depends on the outcome of the latest proposal as of March 14th 2018):

The Board of the International Organization of Securities Commissions (IOSCO) has pursued a consultation process in which it looked at examples of best practices used by international regulators and asset managers. In its final report, Recommendations for Liquidity Risk Management for Collective Investment Schemes, it asserts that effective liquidity risk management is important to safeguard the interests and fair treatment of investors and maintain the order and vigor of collective investment schemes (CIS) and markets. It also explores liquidity risk management tools that aim to pass on transaction costs to redeeming investors or restrict access, to prevent a situation where remaining investors are left with a less liquid portfolio with higher risk exposure. More recently, the European Systemic Risk Board (ESRB) has drawn further attention to liquidity issues and published its own set of recommendations around systemic risks related to fund liquidity.

Critics of the original SEC rule proposals contended the rules were too cumbersome or that they implied a level of precision that doesn’t exist. Subsequent discussions within the industry and the revised final rule have addressed some of these concerns. Controversy aside, we see the IOSCO report as evidence that increased attention to liquidity risk may spread reforms globally. The notion of regulating liquidity risk management is no longer a question of if, but when and how. In the interim, leadership firms are moving forward, adopting best practices and preparing for the full reporting requirements.

Read more in our whitepaper, Assessing Liquidity, Why Quality Data Matters in the Fixed Income Space:

Read the WhitepaperS&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fManaging-the-liquidity-risk-regulation-wave.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fManaging-the-liquidity-risk-regulation-wave.html&text=Managing+the+liquidity+risk+regulation+wave%3a+SEC+22e-4+and+beyond","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fManaging-the-liquidity-risk-regulation-wave.html","enabled":true},{"name":"email","url":"?subject=Managing the liquidity risk regulation wave: SEC 22e-4 and beyond&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fManaging-the-liquidity-risk-regulation-wave.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Managing+the+liquidity+risk+regulation+wave%3a+SEC+22e-4+and+beyond http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fManaging-the-liquidity-risk-regulation-wave.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}