Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 30, 2015

US GDP data confirm economic slowdown at year end

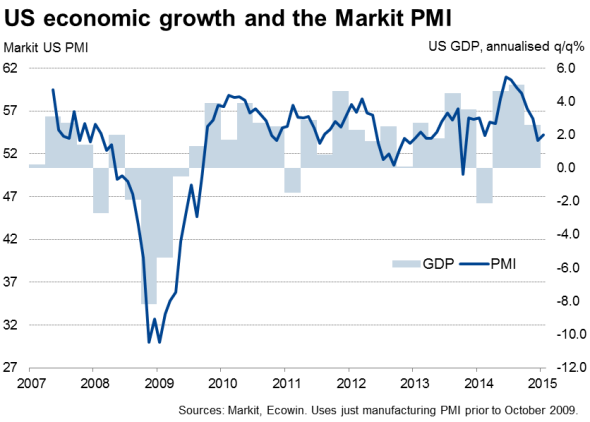

The pace of US economic growth slowed sharply at the end of last year, easing more than economists had generally expected. However, the data were in line with recent Markit PMI survey evidence, which also points to the rate of expansion slowing further in the first quarter of 2015.

Growth rate halves

Gross domestic product rose at an annualised rate of 2.6% in the final quarter of 2014, according to official data from the Commerce Department, down from 5.0% in the third quarter and below market expectations of 3.0%. That equates to a 0.7% quarterly rise, down from 1.2% in the third quarter.

The fourth quarter expansion means the US economy grew 2.4% over 2014 as a whole, up from 2.2% in 2013.

The economy is also showing more signs of lopsided growth, being too reliant on the consumer. Consumer spending rose at an annualised rate of 4.3% in the fourth quarter but business investment fell at a pace of 1.9%. While the rise in consumer spending was the fastest since the first quarter of 2006, the falling business investment was the biggest since the second quarter of 2009. Ideally, a sustainable economic upturn requires business spending to be rising alongside consumer expenditure. That said, the investment data tend to be subject to large revisions, so we should treat the latest numbers with due caution.

Importantly, while disappointing relative to the surging pace seen in the summer, the rate of growth remained strong enough to generate impressive job creation, with the fourth quarter seeing the largest rise in non-farm payrolls since 1999, pushing the unemployment rate down to a six-and-a-half year low of 5.6% in December.

Fed's patience to be tested

Fed officials consequently left policy guidance unchanged at their January meeting, noting 'patience' is still warranted and leaving markets to expect the first hike in interest rates to take place no sooner than June. However, the FOMC will be watching the data flow carefully in the lead up to its next meeting in March, and the latest numbers suggest that we could see the Fed thinking about pushing back its first rate hikes into late-2015, and even early-2016.

While Markit's Flash PMI survey data signalled a further robust expansion of private sector business activity in January, the latest reading was the second weakest for 11 months and points to GDP growth sliding to 2.0% in the first quarter. Companies also reported the weakest monthly increase in new orders since the recession, suggesting the pace of economic growth could weaken even further in February.

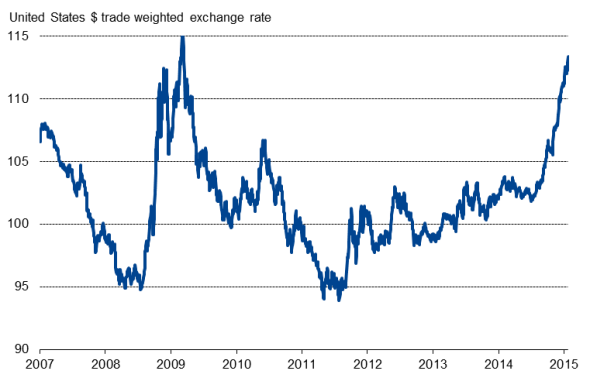

Orders are being hit in part by the Greenback's strength, which is hitting competitiveness in overseas markets. The impact is already being seen in companies' earnings. Companies as diverse as Caterpillar, Pfizer and P&G have all cited the rising dollar as a headwind to their 2015 earnings guidance.

The survey evidence of a slowdown in order book growth alongside the recent corporate earnings warnings will no doubt encourage the Fed to be even more patient in timing the first rate hike, especially as inflation has slipped to just 0.8% (its lowest since 2009) and wage growth has dipped to a meagre 1.7%.

Upside and downside risks to outlook

There are signs, however, that economic growth could start to pick up again in coming months. Consumer confidence rose to its highest since August 2007 in January, according to the Conference Board, most likely buoyed by the boost to spending power from lower oil costs and the recent slide in inflation. The announcement of full-scale QE by the ECB should also help boost business and consumer confidence in Europe, which remains a major export market for the US.

On the other hand, escalating tensions with Russia and the potential for another flare-up of the euro area debt crisis following the anti-austerity Syriza party's success in the Greek elections remain key risks to the global economic outlook.

Exchange rate

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-Economics-US-GDP-data-confirm-economic-slowdown-at-year-end.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-Economics-US-GDP-data-confirm-economic-slowdown-at-year-end.html&text=US+GDP+data+confirm+economic+slowdown+at+year+end","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-Economics-US-GDP-data-confirm-economic-slowdown-at-year-end.html","enabled":true},{"name":"email","url":"?subject=US GDP data confirm economic slowdown at year end&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-Economics-US-GDP-data-confirm-economic-slowdown-at-year-end.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+GDP+data+confirm+economic+slowdown+at+year+end http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-Economics-US-GDP-data-confirm-economic-slowdown-at-year-end.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}