Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 30, 2015

Signs of economy healing as Spanish GDP upturn confirms growth spurt

Spain's economy is enjoying its strongest growth for seven years, boosted by broad-based expansions across manufacturing and services. The country is enjoying rising exports and surging consumer spending, the latter buoyed by falling prices.

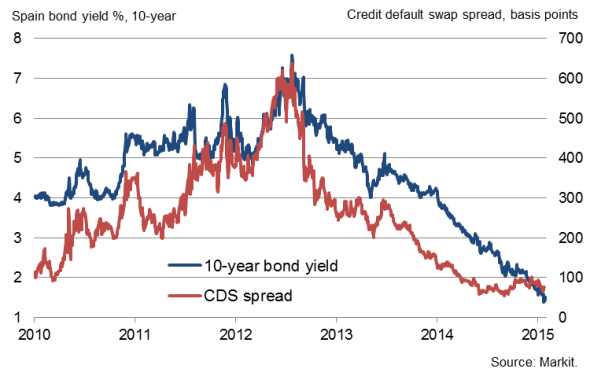

The news helped drive a further reduction in Spain's borrowing costs as, despite rising political tensions in the region resulting from the Greek elections, markets continue to applaud Spain's progress.

Gross domestic product rose 0.7% in the final quarter of 2014, up from 0.5% in the third quarter. GDP has risen continually since mid-2013 with the recovery gaining momentum throughout last year. GDP stood 2.0% higher than a year ago in the fourth quarter as a result.

The recovery had been signalled in advance by increasingly buoyant PMI survey data throughout much of last year, although the most recent survey data suggest that the pace of expansion may have cooled slightly.

The GDP report gave no breakdown, but PMI survey data indicate strong growth across both manufacturing and services over the second half of last year. The former has been buoyed in particular by rising exports, boosted in turn by productivity improvements alongside the weaker euro.

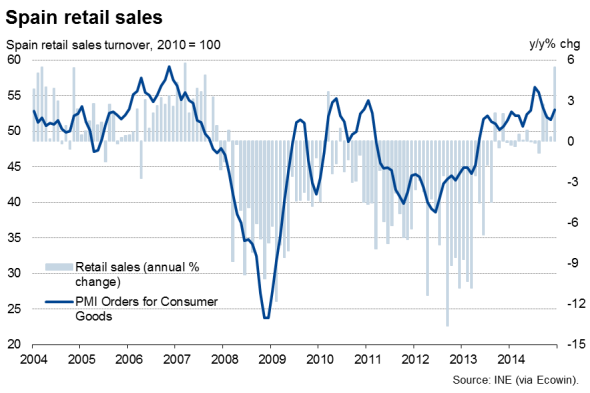

It also looks like the consumer played a major role in the economy's better performance late last year. Retail sales rose 5.4% on a year ago in December, the largest annual increase since March 2007.

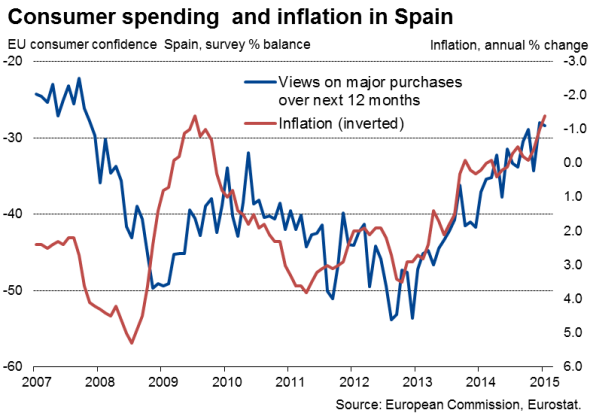

The surge in consumer spending calls into question the worry about deflation in the euro area. Consumer prices fell 1.4% on a year in Spain (contributing to a 0.6% fall across the eurozone as a whole in January).

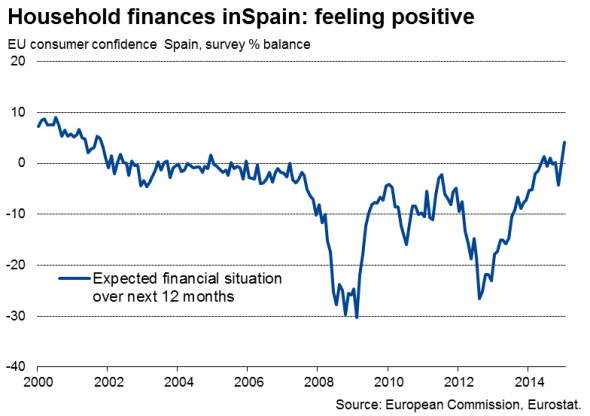

The fear is that the prospect of even lower prices in the future will cause households to delay purchases. However, data so far suggest that households are enjoying the ability to spend, taking advantage of lower prices. Consumer confidence survey data form the European Commission shows that households views on their intentions to make major purchases have risen to post-crisis highs in recent months. Views on their financial situation over the next 12 months have also hit the highest since 2001.

The upturn in consumer confidence, the additional stimulus from the ECB's QE purchases and lower energy bills arising from the oil price rout all give good grounds to believe that Spain's economy will continue to prosper in 2015. The key worry is political instability, the risk of which has been raised after the Greek elections, but the credit markets are not pricing in any contagion from Greece at the moment.

The yield on ten-year Spanish debt fell to a near-all-time low of 1.462%, according to Markit's data, and the spread on credit default swaps (the cost of insuring Spanish debt against default) remains far lower than during the 2012 crisis.

Bond market

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-Economics-Signs-of-economy-healing-as-Spanish-GDP-upturn-confirms-growth-spurt.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-Economics-Signs-of-economy-healing-as-Spanish-GDP-upturn-confirms-growth-spurt.html&text=Signs+of+economy+healing+as+Spanish+GDP+upturn+confirms+growth+spurt","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-Economics-Signs-of-economy-healing-as-Spanish-GDP-upturn-confirms-growth-spurt.html","enabled":true},{"name":"email","url":"?subject=Signs of economy healing as Spanish GDP upturn confirms growth spurt&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-Economics-Signs-of-economy-healing-as-Spanish-GDP-upturn-confirms-growth-spurt.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Signs+of+economy+healing+as+Spanish+GDP+upturn+confirms+growth+spurt http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-Economics-Signs-of-economy-healing-as-Spanish-GDP-upturn-confirms-growth-spurt.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}