Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 27, 2014

European investors look west for returns

The US' continuing economic strength against the backdrop of European uncertainty has seen European investors add to their US exposure at a record rate.

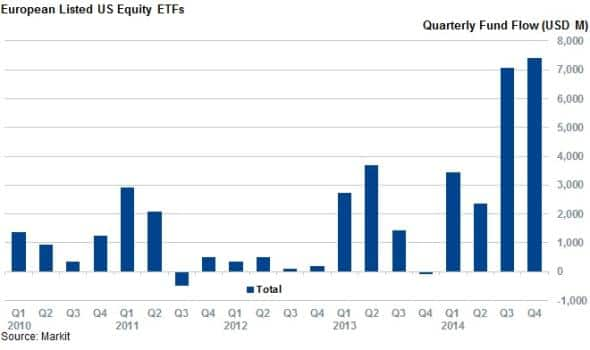

- European listed US Equity ETFs are on track for their best quarterly inflows after seeing over $4.2bn of new funds

- Large cap broad market funds have taken the majority of inflows with the iShares S&P 500 - B UCITS ETF seeing $2.36bn of inflows

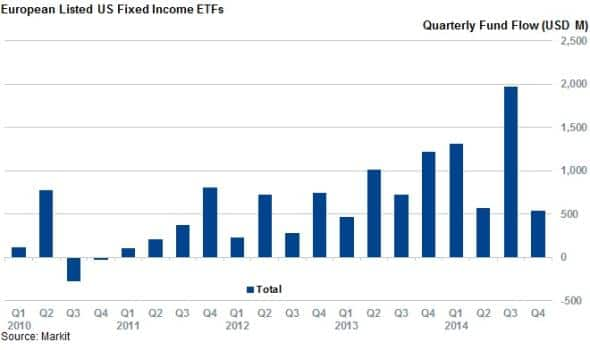

- Fixed income funds have not proved as popular

The US's economic recovery went from strength to strength over the last week as the country grew at a better than expected 3.9% annualised rate in the third quarter. Also encouraging was the fact that consumer spending was revised up from the preliminary readings, indicating strong momentum coming into the last three months of the year. This positive news pushed equities to new all-time highs with the S&P 500 erasing the losses it saw over the opening weeks of October.

This strong growth marks a significant contrast to the situation in Europe, where the eurozone has experienced flat growth over the last few years. This trend looks set to continue in the near term as the European Commission recently cut its forecast for the region's growth in the coming year.

This lacklustre growth has seen the region's currencies trail the dollar which has boosted returns for European investors investing in dollar-denominated assets. This development, combined with relative weakness in the region's stock market has seen European based US investments largely outperform domestic ones over the last seven weeks.

European investors head east

This phenomenon has not gone unnoticed by investors as European listed US exposed funds have seen over $7.2bn of inflows since the start of October. This strong appetite for US exposure comes at the heels of a record breaking third quarter where the 198 European listed US equity funds saw a record high $7.1bn of inflows.

Investor haven't been particularly selective about their US exposure over the last few weeks, as Large Cap funds have seen the majority of inflows over the quarter with over 90% of inflows. In fact, nine of the ten funds which have led inflows this quarter track the S&P 500 index with the iShares S&P 500-B UCITS ETF leading the inflow pack.

Fixed income less popular

Interestingly while the last quarter also saw record inflows towards US exposed fixed income funds, European investors have not been as eager to invest in the asset class in the closing months of 2014 as the 62 European listed US fixed income ETFs have seen only a quarter of the inflows seen in the last quarter.

Funds which track US government debt have seen outflows over the quarter with short dates treasury funds seeing outflows led by the iShares $ Treasury Bond 1-3yr UCIT and PIMCO US Dollar Short Maturity ETF both seeing large outflows.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112014-Equities-European-investors-look-west-for-returns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112014-Equities-European-investors-look-west-for-returns.html&text=European+investors+look+west+for+returns","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112014-Equities-European-investors-look-west-for-returns.html","enabled":true},{"name":"email","url":"?subject=European investors look west for returns&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112014-Equities-European-investors-look-west-for-returns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+investors+look+west+for+returns http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27112014-Equities-European-investors-look-west-for-returns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}