Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 27, 2017

Snap lockup can't come soon enough for shorts

The quantity of Snap shares in lending programs has fallen significantly in the last few weeks despite insatiable demand from short sellers, which has driven the fees earned from lending shares to astronomical levels

- Snap inventory in lending programs has fallen by 13% in the last month

- Lenders pulling their Snap inventory despite being able to charge over 50%

- Short demand for Snap shares has remained unwavering despite the fees

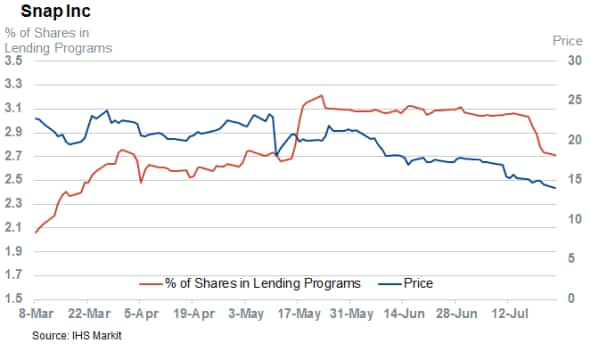

Snap’s lockup expiry can’t come soon enough for short sellers – the company’s long suffering investors who bought shares immediately following the IPO have started to sell off and restrict their shares. The number of Snap shares in lending programs peaked at 36.8 million, or 3.1% of all outstanding shares, three weeks ago. And the ensuing selloff that pushed Snap shares below their IPO price coincided with a 13% reduction in the number of shares available for short sellers.

Whether or not this reduction is driven by a change of heart by Snap’s initial backers remains to be seen. But the astronomically high lending fees commanded by Snap make it quite unlikely that lenders are restricting their inventory on purely moral ground. In fact, long-only investors stand to earn roughly $1,600 daily for every $1 million of Snap shares they manage to lend at the current market rate.

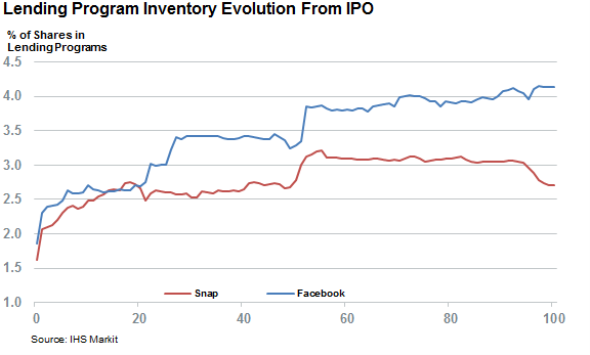

The sudden reduction in the lending inventory so soon after Snap’s IPO is relatively uncommon. Facebook shares experienced a similar trend in the weeks immediately following its IPO: early investors didn’t experience any buyer’s remorse, however, as the number of Facebook shares in on loan continued to climb steadily higher in subsequent months. Snap shares have had a much tougher time convincing long-only investors to get onboard. Its lending program availability has remained flat around 3% of total shares for the last three months.

This weekend’s lockup expiry will surely see more shares trickle through to lending programs, but the fact that Snap’s early backers are starting to have second thoughts underscores the challenges the company faces since listing back in March.

Walking away from fees

The recent reduction in inventory is starting to have a material impact on the cost to borrow Snap shares. The fee needed to borrow them has climbed to levels seldom seen in the securities lending market. Snap shares are now commanding annualized fees of more than 60% in the securities lending market. This latest fee is by far and away the highest level seen since the company’s trading debut.

Short sellers not giving up

Short sellers haven’t been put off by the extortionate cost to borrow Snap shares, and lendable shares have continued to be consumed over the last few weeks. The fact that more than 95% of the short inventory is out on loan means it would be near impossible for shorts to raise their Snap exposure as there is simply no way to source shares at the moment.

The overall short interest has declined by 10% from the highs over the last few weeks, but this is has been driven by the previously mentioned supply constraint rather than a change of heart from bearish investor.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072017-Equities-Snap-lockup-can-t-come-soon-enough-for-shorts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072017-Equities-Snap-lockup-can-t-come-soon-enough-for-shorts.html&text=Snap+lockup+can%27t+come+soon+enough+for+shorts","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072017-Equities-Snap-lockup-can-t-come-soon-enough-for-shorts.html","enabled":true},{"name":"email","url":"?subject=Snap lockup can't come soon enough for shorts&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072017-Equities-Snap-lockup-can-t-come-soon-enough-for-shorts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Snap+lockup+can%27t+come+soon+enough+for+shorts http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072017-Equities-Snap-lockup-can-t-come-soon-enough-for-shorts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}