Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 25, 2016

Beware of European yield traps

Dividends at commodity firms have proved more resilient than their embattled shares. But this trend is starting to unravel as businesses curtail payments to preserve cash; causing the number of yield traps to multiply.

- 246 shares in Europe now trading with a lower forward dividend yield than trailing 12 month

- Average forward yields across Europe now at 2.9%, 10bps less than the trailing yield

- Recent price falls at Norwegian LPG shippers raise yields to even loftier heights

Always looking ahead

Hindsight is often a frustrating filter to look through, but investors lured by high historical yields would do well to take heed of stocks reaching far above norms. The recent sell-off seen across European shares has been driving trailing dividend yields to attractive levels, especially since many companies were hesitant to cut payments in the wake of the recent share price collapse. Yield thirsty investors need to beware however as companies are starting to reassess dividends as economic uncertainty prevails.

Just this week BHP carved 74% from its dividend, joining others such as Anglo American, Glencore and most notably rival Rio Tinto - which had previously committed to maintaining its progressive dividend policy. These firms join the 246 constituents of the Markit Developed Europe universe set to pay a lower dividend in the coming 12 months than that paid in the previous 12.

This means that the average one year forward dividend yield across the Markit Developed Europe universe covered by Markit Dividend Forecastingwill come in at 2.89%, according to the most recent estimate. This compares to an average trailing yield of 2.97% across the same group of shares.

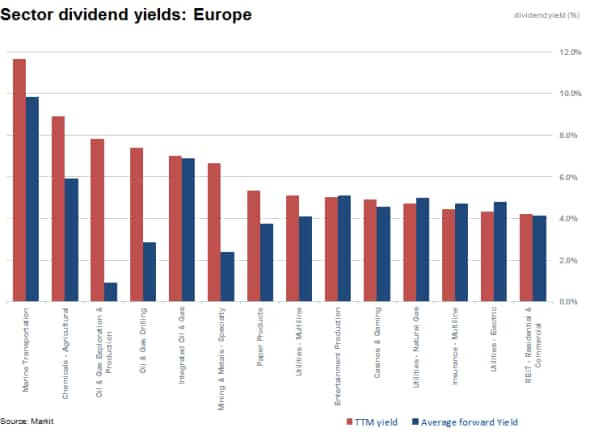

The biggest yield disconnect (forward versus trailing basis) are expected in the oil & gas and mining & material sectors. Both are set to see their yields fall by over 60% in the coming 12 months, compared to their trailing 12 month dividend yields. This will see their yields fall in line with that of the rest of the market with oil and gas set to yield 2.9%, and while that of the materials sector will come in at 2.4% on average.

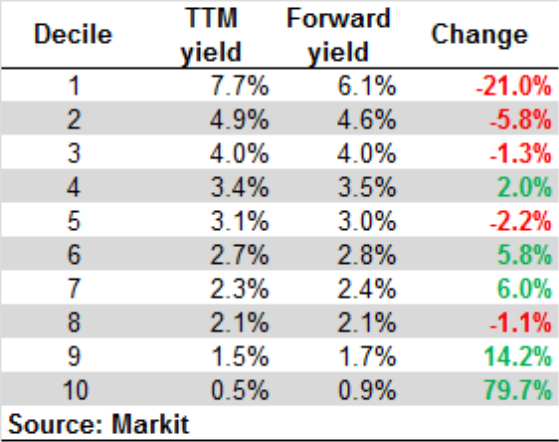

Research SignalsTTM Dividend Yield factor*, are those most prone to disappoint investors going forward as these firms are set to see their dividend yield fall by 20% in the coming 12 months.

In contrast, the shares with the most meagre trailing twelve month yields are actually expected to see their average yield increase by 80%.

Norwegian LPG Shippers rising yields

The Marine Transportation sector in Europe is expected to largely buck the trend of declining yields however with two Norwegian LPG shippers BW and Avance set to be the only two firms in the region to yield more than 20% in the coming 12 months, according to our latest dividend forecast. Recent share price weakness has caused yields to spike even higher across the two firms.

* TTM Dividend Yield is defined as the trailing 12-month dividends per share for a stock divided by its trading price. Markit ranks this factor in descending order.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-Equities-Beware-of-European-yield-traps.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-Equities-Beware-of-European-yield-traps.html&text=Beware+of+European+yield+traps","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-Equities-Beware-of-European-yield-traps.html","enabled":true},{"name":"email","url":"?subject=Beware of European yield traps&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-Equities-Beware-of-European-yield-traps.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Beware+of+European+yield+traps http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022016-Equities-Beware-of-European-yield-traps.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}