Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 24, 2017

Japan Flash Manufacturing PMI shows solid start to fourth quarter

The Japanese manufacturing economy started the fourth quarter on a positive note and expanded at a solid pace in October, according to the latest Flash PMI data. At the same time, cost pressures intensified suggesting that inflation may pick up in coming months.

The headline Nikkei Flash Japan Manufacturing PMI came in at 52.5 in October, slightly lower than September's reading of 52.9, but nonetheless signalled a further robust improvement in the health of the sector.

Strengthening client demand, in both domestic and international markets, continued to act as a key source of growth. Although new orders grew at a slower rate than September, the pace of expansion remained solid and similar to the average seen so far this year.

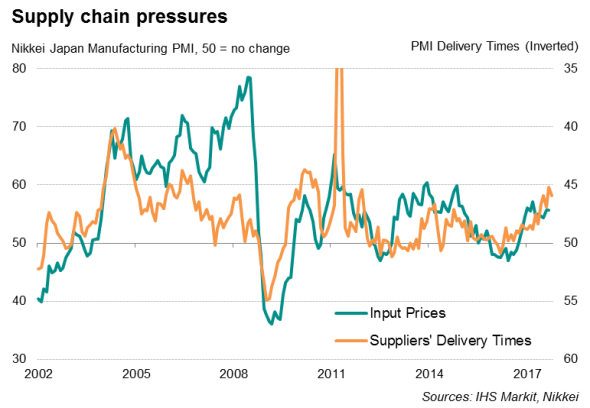

Supply chain pressures point to higher prices

Firms continued to suffer from supply chain delays in October, with average delivery times lengthening markedly at the start of the fourth quarter. Vendor performance has remained under pressure as demand for inputs continued to outstrip supply. Such delays are often accompanied by higher prices as pricing power shifts to suppliers. The recent spate of lengthening delivery times therefore suggests that inflationary pressures are building in Japan.

The latest PMI survey showed that average input costs rose at the same rate as that seen in September, to signal a further sharp rise in cost burdens. Rising global commodity prices, especially for industrial metals and energy, as well as supplier price hikes have been key drivers of input cost inflation.

Despite greater cost burdens, companies generally absorbed the bulk of the higher input prices and raised their charges at a comparatively weaker pace. Notably, average charges for Japanese goods rose only marginally and at a rate well below that seen for input costs, pointing towards an ongoing squeeze on profit margins. This situation is untenable in the medium term, which suggests that higher manufacturing costs are likely to feed through to consumer prices, which will be welcome news for the Bank of Japan.

Optimism softens slightly

PMI data illustrated the possibility that output growth could wane in coming months, especially when euphoria over Olympics Games-related demand starts to fade. The Flash PMI data showed that business confidence about the year ahead was the least upbeat for 11 months, contrasting with an uptick in optimism in the previous month.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102017-economics-japan-flash-manufacturing-pmi-shows-solid-start-to-fourth-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102017-economics-japan-flash-manufacturing-pmi-shows-solid-start-to-fourth-quarter.html&text=Japan+Flash+Manufacturing+PMI+shows+solid+start+to+fourth+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102017-economics-japan-flash-manufacturing-pmi-shows-solid-start-to-fourth-quarter.html","enabled":true},{"name":"email","url":"?subject=Japan Flash Manufacturing PMI shows solid start to fourth quarter&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102017-economics-japan-flash-manufacturing-pmi-shows-solid-start-to-fourth-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+Flash+Manufacturing+PMI+shows+solid+start+to+fourth+quarter http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102017-economics-japan-flash-manufacturing-pmi-shows-solid-start-to-fourth-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}