Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 23, 2017

Dramatic shift in UK household interest rate expectations

The most recent IHS Markit UK Household Finance Index (HFI) reported a dramatic shift in interest rate expectations among UK households, with over 40% expecting a rate rise before 2018, up from 12% in September.

The response was not a surprise, following the recent guidance and rhetoric emanating from the Bank of England. Rising public expectations are in line with the market consensus of a move by the Bank as soon as November, with inflation looking set to head above 3%. That said, policymakers face a quandary over price pressures versus weak economic growth.

Rate hike expectations move towards the near-term

A clear majority (80%) of households noted that they anticipate a rise in interest rates in the next 12 months, if not sooner. Furthermore, October's HFI survey data revealed that nearly half of UK households forecast a rise before 2018.

The HFI findings also signalled that the current squeeze on household finances began to ease. That said, the improvement was partly fuelled by rising unsecured credit availability, enabling households to increase spending in the face of rising inflation. Any increase in interest rates would raise repayments on unsecured debt, adding an extra burden on already-fragile budgets.

Inflation set to accelerate above 3%

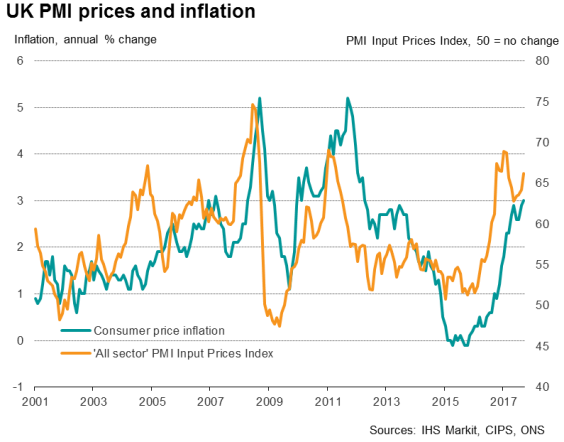

The most recent UK PMI data for input prices signalled an uptick in already-sharp price pressures in September. UK firms reported the steepest rise in input costs since February, commonly linked to more expensive imports and the weak pound. Higher costs were often passed on to customers, according to the PMI survey, leading to the largest monthly rise in prices charged for goods and services since April. This suggests that consumer price inflation could rise above 3% in the coming months.

With price pressures on the up, 78% of analysts polled by Bloomberg* in October predicted a rate hike in November's meeting of the Bank's Monetary Policy Committee (MPC), with analysts expecting the Bank to react to signs of higher inflation.

Rate rise likely despite muted growth

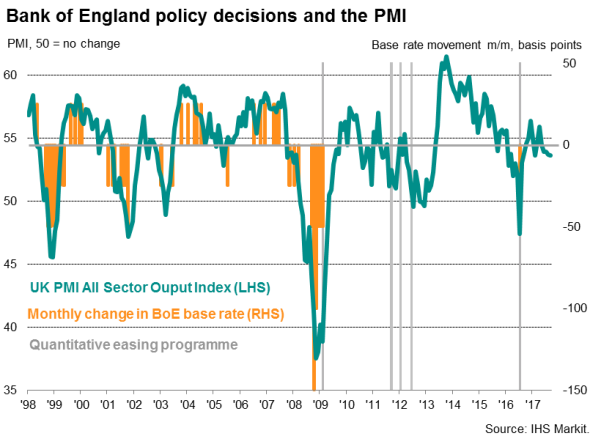

Expectations of a hike in interest rates have been raised despite weak economic growth. The UK 'all sector' PMI Output Index - a closely watched economic indicator - was at 53.6 in September, the joint-lowest since August 2016. Historically, a figure of over 55 would give a signal of an interest rate hike, so the latest data indicated that the strength of economic growth is currently well below that usually associated with rate rise territory. The latest available GDP data (for Q2) corroborated this picture of subdued growth, currently at just 0.3% quarter-on-quarter.

The most recent data thereby places the Bank of England in a difficult scenario. On the one hand, low rates continue to stimulate the economy in a period of uncertainty and muted growth. On the other, as the public's expectations build and inflationary pressures continue to erode household budgets, the MPC's reaction will be close to call.

*https://www.bloomberg.com/news/articles/2017-10-20/boe-s-november-rate-hike-isn-t-set-in-stone-after-crunch-week

Sam Teague | Economist, IHS Markit

Tel: +44 14 9146 1018

sam.teague@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102017-Economics-Dramatic-shift-in-UK-household-interest-rate-expectations.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102017-Economics-Dramatic-shift-in-UK-household-interest-rate-expectations.html&text=Dramatic+shift+in+UK+household+interest+rate+expectations","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102017-Economics-Dramatic-shift-in-UK-household-interest-rate-expectations.html","enabled":true},{"name":"email","url":"?subject=Dramatic shift in UK household interest rate expectations&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102017-Economics-Dramatic-shift-in-UK-household-interest-rate-expectations.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Dramatic+shift+in+UK+household+interest+rate+expectations http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102017-Economics-Dramatic-shift-in-UK-household-interest-rate-expectations.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}