Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 24, 2015

Dim sum bond returns beat western peers

After a slow start the year, offshore renminbi bond issuance has picked up, with renminbi-denominated corporate bond returns now outperforming their western counterparts.

- Offshore RMB corporates yield 73bps over USD corporates, significantly tighter than the 298bps three months ago

- Investment grade offshore RMB bonds have returned 413bps over US investment grade ytd

- 94% of the iBoxx Offshore RMB Corporates Index marked with the top two liquidity ratings

The offshore renminbi (RMB) bond market has started to pick up over the last few months after a slow start to the year. Large corporates such as American manufacturer Caterpillar and New Zealand based dairy company Fonterra sparked life into the primary market with jumbo issuances over the past week.

From an issuer's standpoint, lower borrowing costs in the west discouraged primary issuance in dim sum bonds at the 2015, as funding was cheaper (on a currency swap basis) in non RMB terms. Volatility in Chinese rates was also a cause for concern, but falling funding costs in RMB and the recent volatility in western sovereign bond markets has made conditions for issuing dim sum bonds more attractive.

Yields tighten

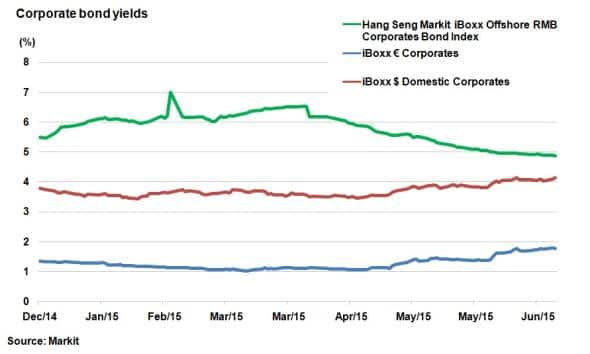

Just like Chinese equities, offshore renminbi corporate bonds have performed well in the secondary market year to date (ytd). Offshore RMB corporate bonds, as represented by the Hang Seng Markit iBoxx Offshore RMB Corporates Bond Index, have seen yields tighten from over 6% in January to below 5% as of latest count. This rally has coincided with the selloff in euro and dollar denominated, sending their yields higher.

The disconnect between the Chinese and western bond markets is highlighted by the tightening in the basis between the yield on the offshore RMB corporate bonds and USD domestic corporate bonds, represented by the Markit iBoxx $ Domestic Corporates index. Over the last three months the basis has fallen from 298bps to 73bps, making the RMB market much more attractive to companies with large operations in China which would usually issue debt in US dollars.

Total returns

Investor appetite

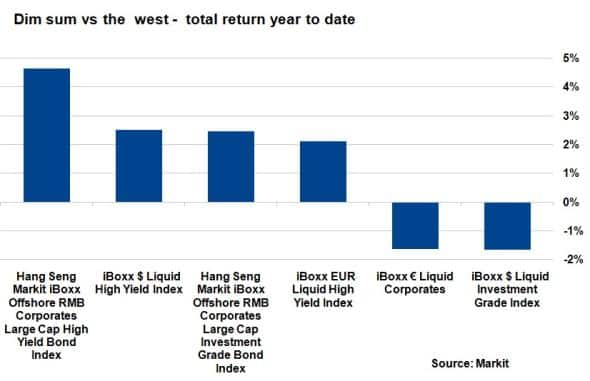

From an investor's perspective, dim sum bonds present an attractive proposition as corporate yields are higher than those seen in USD or euro denominated corporate bonds. The selloff in the western bond markets hit corporate bond returns, with investment grade corporates issued in euros and USD turning negative on a total return basis.

Conversely, offshore RMB corporate bonds have remained resilient, returning 2.48% ytd, according to the Hang Seng Markit iBoxx Offshore RMB Corporates Large Cap High Yield Bond Index. This marks a return of 413bps over USD investment grade corporates.

Dim sum bonds' outperformance also holds true in the relatively better performing high yield part of the bond market, where the Markit iBoxx $ Liquid High Yield Index and the Markit iBoxx EUR Liquid High Yield Index have managed to stay in positive territory for the year with respective 2.41% and 2.14% total returns. The Markit Hang Seng Markit iBoxx Offshore RMB Corporates Large Cap High Yield Bond Index has returned 2% over the strong returns delivered by these indexes.

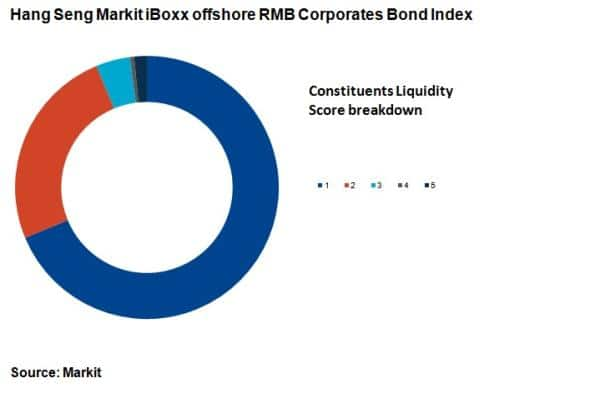

A common investor concern is the lack of liquidity in Asian bond markets, but the constituents of the Hang Seng Markit iBoxx Offshore RMB Corporates Bond Index prove otherwise.

69% of the index's constituents are marked with a liquidity score of 1; the highest rank (5 being the lowest) based on market depth, bid/offer spread, maturity and shadow liquidity, according to Markit's bond pricing service. A further 94% of the index's constituents fall within the top two rankings.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24062015-Credit-Dim-sum-bond-returns-beat-western-peers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24062015-Credit-Dim-sum-bond-returns-beat-western-peers.html&text=Dim+sum+bond+returns+beat+western+peers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24062015-Credit-Dim-sum-bond-returns-beat-western-peers.html","enabled":true},{"name":"email","url":"?subject=Dim sum bond returns beat western peers&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24062015-Credit-Dim-sum-bond-returns-beat-western-peers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Dim+sum+bond+returns+beat+western+peers http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24062015-Credit-Dim-sum-bond-returns-beat-western-peers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}