Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 23, 2014

Who wants to bet against France?

Despite the recent downbeat market, short sellers have not shown much appetite to increase their positions in French shares.

- Average short interest across French constituents of the Stoxx 600 index has fallen below the overall index average in July

- The most heavily shorted companies have seen shorts cover a third of their positions since the start of the year

- This is not universal however with Cgg seeing large increase in short interest since the start of the year

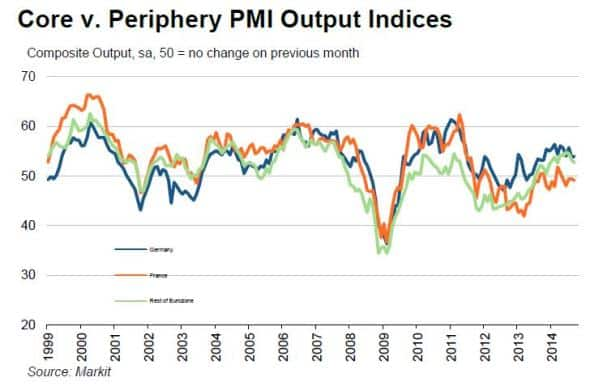

The latest batch of Flash PMI readings has seen France yet again trail the rest of Europe in terms of composite output growth, with surveyed companies indicating a fifth straight monthly decline in output. This weak growth has seen the country scrap its budget deficit target for both the current and coming year. On the equities side, investors seem to be weary of the recent spate of low growth, with the country’s CAC 40 index underperforming the Stoxx 600 index over the last couple of months. Perversely, the European Central Bank’s recent willingness to loosen monetary policy seems to have lifted the CAC as it’s rebounded by 6% from the recent lows in August.

This propensity for central bank intervention seems to have reduced the appetite for short sellers in recent months.

Shorts cover

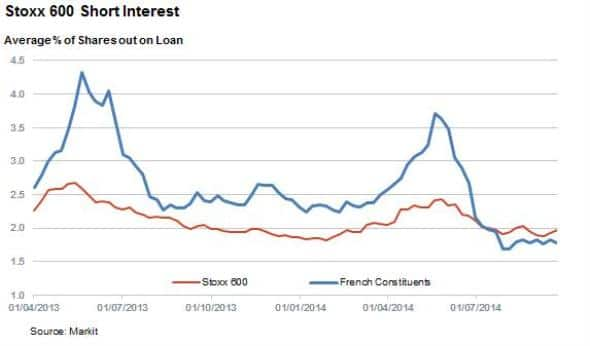

Appetite to short French stocks has fallen in the last few months, while that of shorting European companies has grown. The average percentage of shares out on loan across the 82 French constituents of the Stoxx 600 index has fallen by a quarter since the start of the year and hovers near recent lows. The overall appetite for short selling across Europe, as measured by the average percentage of shares out on loan across the overall Stoxx 600 has increased slightly since the start of the year, ticking up 6% since January.

This recent bout of covering, against the run of play, has seen the average short interest across French constituents fall below the index average for the first time in over a year.

Most shorted lead the covering

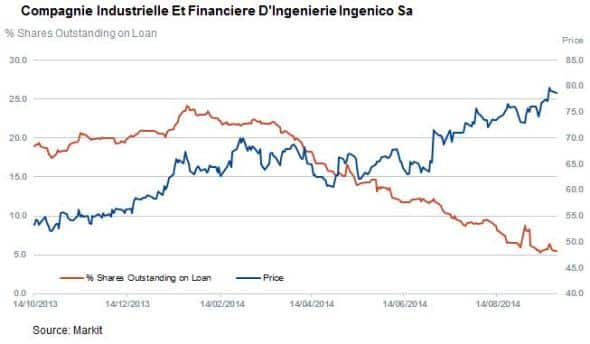

As to what is behind the covering, we see that the most shorted companies are driving the activity. Average demand to borrow across the ten most shorted companies has fallen by over a third since the start of the year.

Leading the covering is Ingenico which has seen shorts close out 75% of their positions as the company posted better than expected results. This has made the firm a painful short as shares, which were the most shorted French constituent at the start of the year, have advanced by 33% since the start of the year.

Implicit or explicit, the hand of government has been behind some of this short covering with carmaker Peugeot seeing the proportion of its shares out on loan fall by 85% as it announced a €3 billion recapitalisation led by the French government.

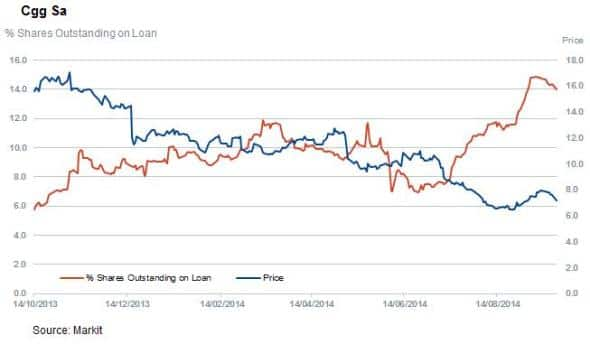

This covering is not universal however as four of the companies in amongst the top ten most shorted have seen an increase in short interest since the start of the year.

Chief amongst these is geological mapping frim Cgg, which has seen short interest climb by 50% in year to date to 14% as it announced a fall in demand for its services.

Essilorm, Orpea and Edenred have also joined the ten most shorted after seeing increases in shorting activity.

Simon Colvin | Associate Director, IHS Markit

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092014-Equities-Who-wants-to-bet-against-France.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092014-Equities-Who-wants-to-bet-against-France.html&text=Who+wants+to+bet+against+France%3f","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092014-Equities-Who-wants-to-bet-against-France.html","enabled":true},{"name":"email","url":"?subject=Who wants to bet against France?&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092014-Equities-Who-wants-to-bet-against-France.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Who+wants+to+bet+against+France%3f http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092014-Equities-Who-wants-to-bet-against-France.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}