Short sellers profit from recent IPOs

2013 was a vintage year for IPOs. An analysis of newly floated stocks three months after listing highlights that the companies with the highest short interest have underperformed their less shorted peers by over 20% on average.

- 2013 witnessed 222 IPOs – the most since 2000

- The nine most borrowed stocks, three months following float, have fallen by over 30%

- Heavily shorted Fairway Group is the worst performing IPO of 2013

2013 was the most active year for IPO’s since 2000. 222 companies went public and raised over $55bn. Short sellers have been able to consistently uncover underperforming shares.

Due to the nature of securities lending market, we have analysed the crop of IPO shares three months after their trading debut to ensure that newly listed shares have time to make their way to securities lending programs. Taking a medium term approach to our analysis isolates price swings initially following float.

Most shorted underperform

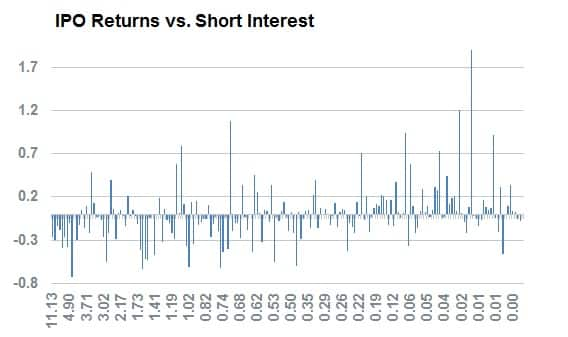

The returns of the most shorted stocks were vastly worse than the least shorted companies. The chart below shows the short interest on the x axis and the following return of the security on the y axis measured from three months after the IPO date to the week ending Thursday April 17th.

The fact that the stocks which saw the worst negative return on average have congregated to the left of the chart highlights that short sellers have been able to successfully uncover underperforming shares. In fact, the 57 companies with more than 1% of shares outstanding on loan fell by an average of 11.26% while the 69 least shorted companies (short interest less than 0.25%) returned an average of 12.23%.

The average return for all companies in the observation universe was -0.51%.

Note that every one of the nine companies heavily targeted by short sellers three months on from listing saw its shares fall from the observation point to last Thursday. The average fall in share price seen by these companies is a very significant 31% over the observation period.

Highlights

Retailer Fairway Group takes top honours as the worst performing IPO. The grocery chain has seen shorts continue to build positions with current demand to borrow sitting at an all-time high 10.7% of shares outstanding.

Twitter, arguable the most heavily anticipated listing of the year saw huge a surge in short interest after its share price increased from $45 after the first day to trading to $75 in December, the start of the observation period. Short interest has continued to climb as the social media company’s shares retreated by over a third from its December highs.

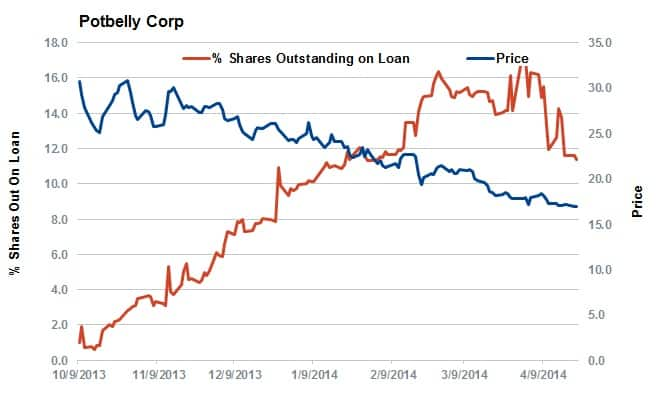

Potbelly has seen short interest steadily rise as its share price has continued to fall. Since January Potbelly has declined by about 30% and remains a highly shorted stock.

Short sellers jumped on TCS shortly after the IPO and were proved right after the price hit a high of $46.61 in late December. Since the price has fallen to $31.6 but short interest still remains high.

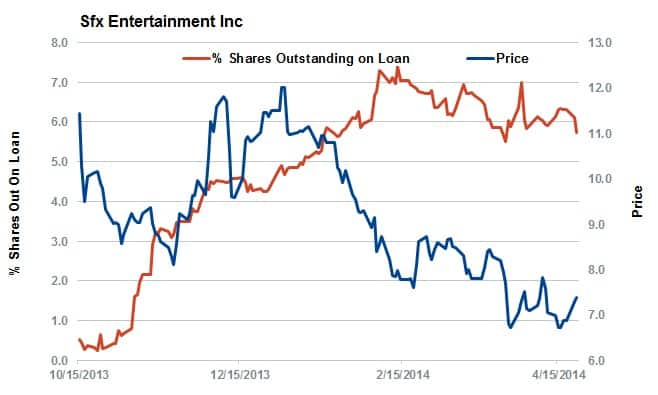

SFX Entertainment had volatile first few months of trading. Shorts have steadily increased and many think that electronic dance music may be more of a fad than a trend.

Andrew Laird | Analyst, IHS Markit