Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 22, 2014

Apple pulls short sellers to watch market

As Apple gets ready to enter the watch market, we have seen short interest in its potential competitors surge over the last few months.

- Swatch Group has seen shorts quadruple since the start of the year

- In the low end of the market, both Movado and Fossil have seen shorts surge

- Conversely Japanese firms have not seen much shorting in the last few weeks

Apple's expected entry into the wearable technology market has had many forecasting a major disruption to the current watch ecosystem. While the concept of a smart watch has been around for several years now, industry analysts are expecting Apple, with its track record of balancing technological design challenges and large hordes of loyal followers, to provide the type of momentum needed to make this product category mainstream.

While early technological specs seem to indicate that users of the Apple watch would still need to compromise on such things as battery life and connectivity, it still provides a credible competitor to several aspects of the watch market; mainly mid-tier and sports products.

As a result, many of the established watch industry participants now see high short interest in the wake of Apple's latest announcement.

Swatch heavily shorted

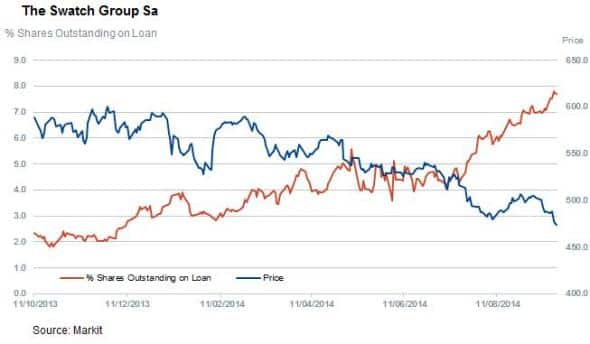

Swatch, the Swiss timepiece conglomerate with a heavy luxury tilt has seen shorts build up over the last few months and now sees the highest proportion of its shares out on loan in over a year. While a proportion of the increased shorting activity was probably driven by the speculation of Apple's entry into the watch market, investors are also likely to be reacting to the weakening Asian market.

Swatch generated 56% of its revenue from the region last year and the recent Chinese crackdown on government excesses has seen the company miss both its profit and revenue expectations in its last earnings release. Current demand to borrow sits at 8% of shares outstanding, up from 2% at the start of the year.

The company's Asian headwinds were also echoed by fellow luxury peer Richmond, which recently saw its share dive in the wake of weak sales figures. Shorts have also multiplied their positions in Richmond since the start of the year, jumping five fold to 2.5% of shares outstanding

Shorts active at the low end

The general consensus in the wake of Apple's product launch was that few Richmond or Swatch customers, many of whom spend over $10,000 per timepiece, would trade their luxury automatic timepieces for a touchscreen phone accessory that needs to be charged on a daily basis. The same can't be said for companies at the low end of the market and several of the players in this space have seen increased shorting activity in the last few weeks.

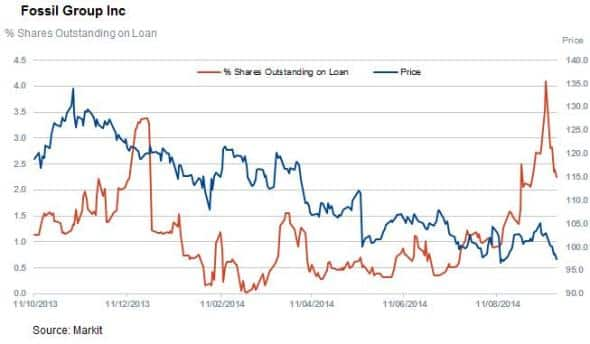

Fossil Group saw the largest surge in demand to borrow with shorts jumping from 0.5% to 4% of shares outstanding in the last few weeks. While this demand to borrow seems to have abated somewhat in the last few days, it still represents a large hike from levels seen earlier in the year.

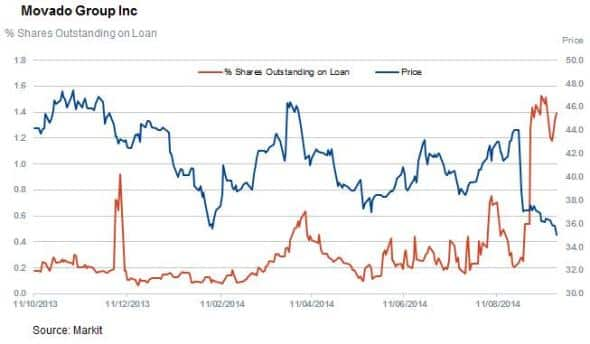

Movado, which offers many fashion brand watches in its product offering, has also seen a jump in short interest in the last few weeks. This also coincides with another weak earnings announcement which has sent the firm's shares down by 22% in the last month.

Japan largely immune

Interestingly, the two listed Japanese watchmakers have not seen much of a jump in short interest with both Citizen and Seiko seeing flat demand to borrow in the last few weeks.

Struggling growth market

Shorts have become more active in the watch space in the last few months, while this does not seem to be entirely driven by the prospects of Apple entering the industry; a new deep pocketed competitor has the prospect of disrupting the current watch industry at a time when a weakening Chinese market has seen the industry struggle for growth.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092014-apple-pulls-short-sellers-to-watch-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092014-apple-pulls-short-sellers-to-watch-market.html&text=Apple+pulls+short+sellers+to+watch+market","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092014-apple-pulls-short-sellers-to-watch-market.html","enabled":true},{"name":"email","url":"?subject=Apple pulls short sellers to watch market&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092014-apple-pulls-short-sellers-to-watch-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Apple+pulls+short+sellers+to+watch+market http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22092014-apple-pulls-short-sellers-to-watch-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}