Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 22, 2015

ECB comments halt bond selloff

The ECB has reiterated its commitment to QE, halting the bond selloff, while Ukraine's woes worsen as corporates struggle to repay debt.

- ECB rhetoric has temporarily halted the slide in European sovereign bond prices

- Russia's 5-yr CDS spread has tightened below 300bps; the first time since November 2014

- Loan ETFs experienced a sharp surge in inflows of $376m in April; the highest in a year

Europe

A senior member of the ECB, Benoit Coeure, said this week that the bank would front load its QE purchases ahead of reduced liquidity during the summer months. The statement quashed speculation that the ECB would end QE early amid better than expected growth and inflation expectations.

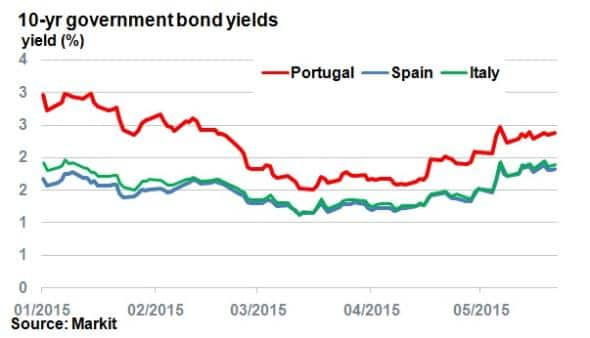

As a result of the statement, the euro fell against the US dollar and European stock markets rallied. The comment came just as European sovereign bond yields experienced a sharp rise over the past month, erasing any QE attributed gains. 10-yr periphery bond yields halted, with Italy yielding 1.89% and Spain 1.81%. Portugal also managed to sell six month debt at negative yield for the first time on record.

Across Europe, Russia's recovery gained traction as its 5-yr CDS spreads tightened below 300bps for the first time since November 2014. The recovery is in stark contrast to its neighbour Ukraine, whose credit trajectory diverged in February as troubles deepened. CDS spreads continue to imply a default probability above 95%.

Sovereign troubles have also spilled over into the corporate sector. Metinvest, a Ukrainian steel firm, technically defaulted on its corporate debt this week as it failed to repay principle on its 2015 US dollar bond. Its other US dollar bonds, a 2017 and a 2018, continue to trade at 58.5 and 56 on a cash basis to par respectively according to Markit's bond pricing service.

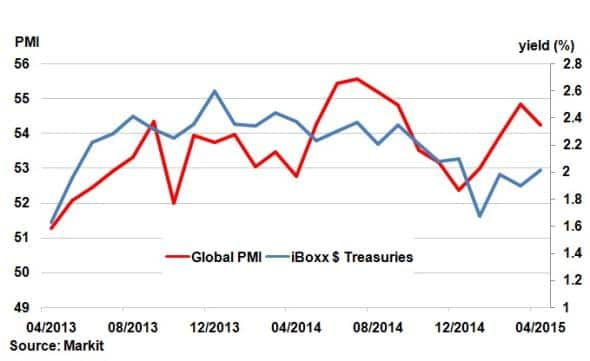

Treasury bond yields and the global macroeconomic environment hold a close relationship. Comparing the annual yield on the Markit iBoxx $ Treasuries index and Markit's Global PMI composite finds that the uptick in the PMI level this year from 53.0 to 54.3 has been met by an increase in yields from 1.68% to 2.02%.

This trend can be seen holding over the past few years, which have seen treasury yields rising as global PMI levels increased and vice versa.

Loan ETFs

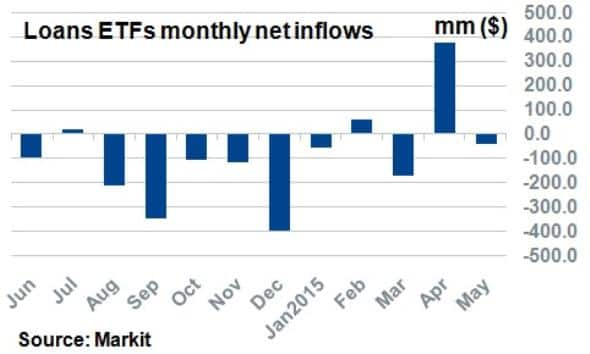

ETFs tracing indices compromised of leveraged loans experienced their best month of inflows since March 2014, with $376m of inflows in April. The increased demand came as investors rushed to less interest rate sensitive assets that are negatively correlated to sovereign and corporate bonds.

The largest leveraged loan ETF, the PowerShares Senior Loan Portfolio ETF, has outperformed the largest investment grade corporates ETF, the iShares iBoxx $ Investment Grade Corporate ETF by over 3% in April. That trend has since cooled off which has seen invertors take some profits off the recent trade, with leveraged loan funds seeing outflows in the last three weeks.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052015-credit-ecb-comments-halt-bond-selloff.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052015-credit-ecb-comments-halt-bond-selloff.html&text=ECB+comments+halt+bond+selloff","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052015-credit-ecb-comments-halt-bond-selloff.html","enabled":true},{"name":"email","url":"?subject=ECB comments halt bond selloff&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052015-credit-ecb-comments-halt-bond-selloff.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ECB+comments+halt+bond+selloff http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22052015-credit-ecb-comments-halt-bond-selloff.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}