Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 21, 2015

US HY rebounds but risky end remains stuck

Credit risk among the US high yield market has fallen in October, but the riskiest part of the quality spectrum is continuing to see spreads widen.

- The Markit iBoxx USD Liquid High Yield index has seen its index spread tighten 53bps so far this month

- CCC sub-index has seen the opposite with its spread 27bps wider so far this month.

- The divergence is not necessarily driven by sector exposure, rather credit quality.

Investor appetite for US high yield bonds has returned after a brief pause this summer. ETFs tracking US high yield bonds have seen $3.53bn of inflows so far this month, a sharp rebound from the $1.2bn of outflows seen in August and September.

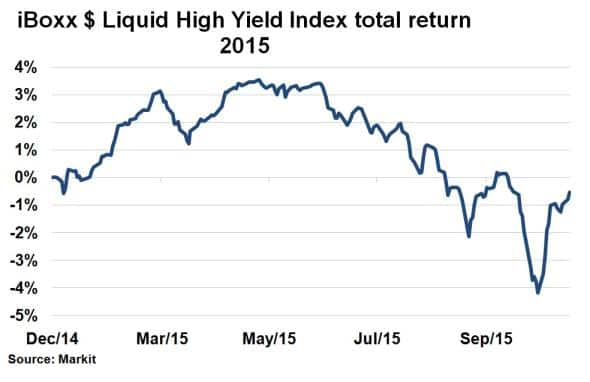

Waning volatility and fears over commodity prices have seen US HY bond returns rebound. The Markit iBoxx USD Liquid High Yield (HYG) index has returned 3.19% so far this month and is now just 53bps off positive total return territory. Much of these returns were driven by shifting risk perceptions. The index spread over benchmark rates is 35bps tighter this month as calmer markets have helped diminish credit risk. However, certain areas of the US HY market have fared better than others, presenting risks.

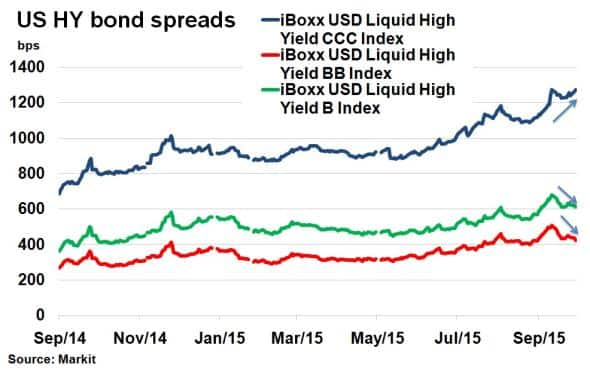

Splitting the US HY sector into ratings reveals more about the drivers of the recent HY rally. The higher rated credits that have seen much spread compression. BB and B rated bonds, as represented by the Markit iBoxx USD Liquid High Yield BB index and the Markit iBoxx USD Liquid High Yield B index have seen spreads tighten 70bps and 55bps, respectively. Conversely, the iBoxx USD Liquid High Yield CCC index has seen its bond spread widen 27bps during the same period. It is the first time in the past year such a divergence between the indices has occurred, showcasing a flight to quality even within the HY market.

Breakdown

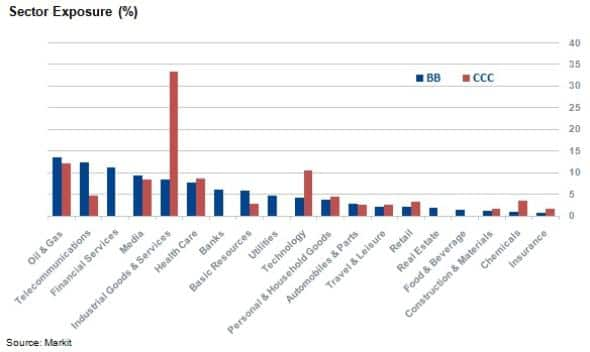

In terms of share, BB and B rated bonds make up the bulk of the US HY market and are the main drivers of returns. While the CCC market is smaller, its influence cannot be overlooked as it represents the riskiest end of the market and has the likeliest impact on default rates.

Of the 106 constituents of the iBoxx USD Liquid High Yield CCC index, 59 (or 56%) are considered to be in "distressed" territory, having a bond spread greater than 1,000bps. Of them, 31 spawn from the two industries that have been the most volatile over the past few months, Oil & Gas and Basic Materials. But it is worth noting that in terms of index weight, both BB and B have a similar exposure to these sectors. Rather the divergence in CCC is down to poorer credit quality, of which many happen to be highly leveraged shale producers like Energy XXI Gulf Coast Inc, EXCO Resources Inc and Comstock Resources Inc.

With US HY issuance drying up over the past few months and spreads continuing to widen, the environment presents challenging times for CCC issuers. The fragmented HY market poses risks none more than the potential to spill over further up the quality spectrum.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102015-Credit-US-HY-rebounds-but-risky-end-remains-stuck.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102015-Credit-US-HY-rebounds-but-risky-end-remains-stuck.html&text=US+HY+rebounds+but+risky+end+remains+stuck","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102015-Credit-US-HY-rebounds-but-risky-end-remains-stuck.html","enabled":true},{"name":"email","url":"?subject=US HY rebounds but risky end remains stuck&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102015-Credit-US-HY-rebounds-but-risky-end-remains-stuck.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+HY+rebounds+but+risky+end+remains+stuck http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102015-Credit-US-HY-rebounds-but-risky-end-remains-stuck.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}